Good morning, Paul here.

Estimated time of completion today is 13:00 - I have to escape from London, so need to get this out of the way & then catch a train back to the south coast.

Update at 11:41 - today's report is now finished.

Murgitroyd (LON:MUR)

Share price: 675p (unchanged today, at 08:06)

No. shares: 9.0m

Market cap: £60.8m

Possible offer for the company

It sounds as if news of this possible bid might have leaked out. With the share price zooming up, to the level of the possible bid, at 675p, then there's no premium price at all now.

Discussions with Sovereign are at an advanced stage with due diligence enquiries complete. The Board confirms that, should Sovereign or an entity controlled by Sovereign announce a firm intention to make an offer pursuant to Rule 2.7 of the Code on the above terms, the Board's current intention is to recommend that Murgitroyd shareholders accept the offer.

Shareholders would be entitled to ask why the Directors want to sell the company at the current share price? A bid premium of c.30-40% is more normal.

On 17 Sept 2019 the company announced quite good results for FY 05/2019, with basic EPS up 11.9% to 33.2p. Therefore this deal values the company (patent attorneys) at 20.3 times earnings - that looks a full price to me.

Although the chart does make you wonder if a bit of insider dealer might have been going on, with regards to the bid approach?

accesso Technology (LON:ACSO)

Share price: 675p (down 15% today, at 08:18)

No. shares: 27.6m

Market cap: £186.3m

Update on the formal sale process

accesso Technology Group plc (AIM: ASCO), the premier technology solutions provider to leisure, entertainment, hospitality, attractions and cultural markets, provides the following update on its announced formal sale process (the "Formal Sale Process") under the City Code on Takeovers and Mergers (the "Code").

It's clear that nobody really knows how to value this company. The share price peaked at almost 3000p in Sep 2018, valuing it then at c. £828m. It's since lost almost 78% in price. The announcement of a formal sale process starting, in Jul 2019, following a number of unsolicited bid approaches, saw the share price spike up 60%, from 690p to 1105p, and we've since seen the bid premium disappear again.

The upshot is that interested parties have not offered enough to tempt management;

The Company and its advisers have now received refreshed indications of interest from a number of the interested parties, none of which are at a level that the Board feels offers sufficient value to shareholders.

The Board and its advisers are continuing to engage in discussions with certain of these parties to determine whether an offer for the Company can be delivered at a value that the Board considers is attractive to shareholders.

The problem with this, is that the announcement today doesn't disclose what level the bid interest is at. I feel this is absolutely key information which shareholders are entitled to be told. It's not right that the Directors alone (plus presumably their advisers) know what the company is worth (i.e. what bidders were prepared to pay) but shareholders are not being told this information.

Since we have not been told what price bidding interest is at, it's virtually impossible to value this share. The fundamentals are difficult to interpret too, because so much is being capitalised into development spend on the balance sheet.

On balance, I feel that, given the length of time that the company has been up for sale, the lack of an acceptable offer feels rather bearish.

On the upside case, you can now buy the same company almost 80% cheaper than at the top of the bull market last year.

Personally, I would want to see more evidence of positive cashflows before taking an interest here.

dotDigital (LON:DOTD)

Share price: 95.5p (up 5% today, at 08:49)

No. shares: 297.4m

Market cap: £284.0m

dotdigital Group plc (AIM: DOTD), a leading cross-channel marketing automation platform, announces final audited results for the year ended 30 June 2019 with strong growth in revenue and profit driven by the Group's organic growth strategy and the addition of omni-channel functionality.

I'm impressed with these numbers, and I think it's worth readers taking a closer look at this company.

The key number is this;

Adjusted EPS from continuing operations grew by 33% to 3.88p (2018: 2.91p); ahead of market expectations

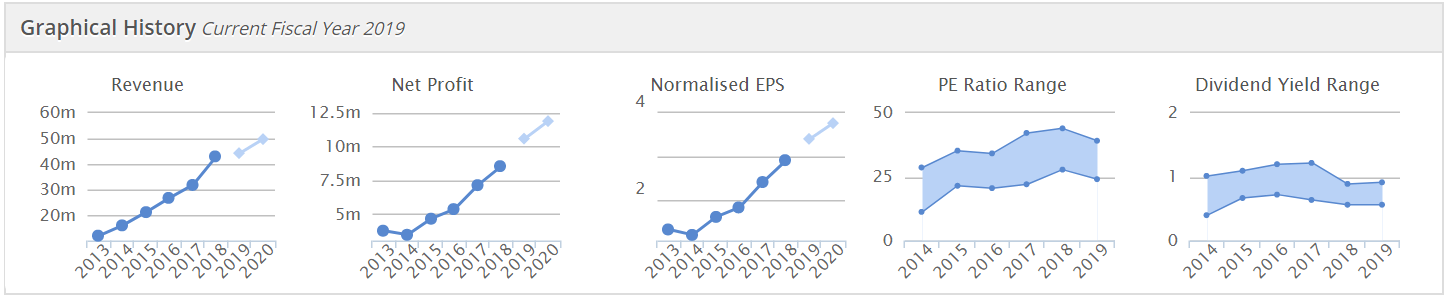

With the share price currently at 95.5p (at 08:53, and ticking up gradually) that's a PER of 24.6 - not cheap, but acceptable value, given the excellent track record of growth, combined with a strong balance sheet. Look at this for a track record;

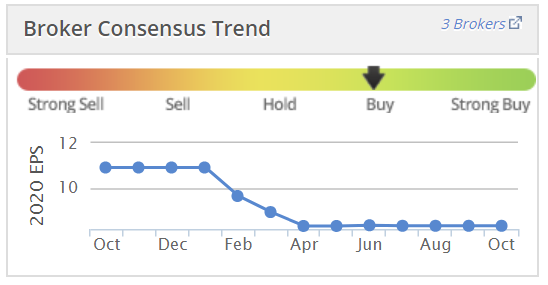

It looks like the 2020 EPS figure has been achieved in 2019 (note that it's a 30 June year end).

I've rummaged through the accounts, and flag up these points;

- Tax - R&D enhanced claim for tax credits of £2,327k, which has brought down the effective tax rate to almost zero - clearly that is a big help to EPS. Worth noting, as the company would be vulnerable if this generous tax benefit were to be curtailed by the UK Govt.

- Discontinued operations - made a £2.457m loss, which is excluded from the adjusted EPS figures. That's a reasonable accounting treatment, but is worth noting.

- Cash pile has reached £19.3m

- Very strong balance sheet, which gives the company scope to make more acquisitions, or improve its rather miserly dividends

- Heavy capitalisation of development spending onto the balance sheet, of £5.6m. This is much larger than the amortisation charge of £2.75m, boosting profits above cashflow by the difference, of £2.85m - again just something to note

- Strong recurring revenues is very positive

Broker updates - there are 2 useful broker updates, available on Research Tree. I've just had a quick look at both, and am feeling slightly smug that I spotted the boost to earnings from the lower tax charge!

It strikes me that both brokers covering DOTD are being quite modest with the forecasting for FY 06/20 and 06/21. So it's possible that DOTD could out-perform these forecasts maybe, given its excellent track record in the past.

My opinion - you've probably already gathered that I like this company.

The share price is probably about right for now, but I could see future upside from the cash pile being put to good use with another acquisition. Plus this also looks the type of company which might attract a takeover bid from a larger software group perhaps?

All in all, it gets a thumbs up from me.

Walker Greenbank (LON:WGB)

Share price: 74.5p (unchanged today, at 09:56)

No. shares: 71.0m

Market cap: £52.9m

Walker Greenbank PLC (AIM: WGB), the luxury interior design and furnishings group, announces its interim results for the six-month period ended 31 July 2019, which are in line with the Board's expectations.

That's a good format - putting the key information that results are in line with expectations, right at the top of the announcement. I wish all companies would do that, instead of burying, or omitting that key information.

There was an H1 trading update here, published on 6 Aug 2019, so that's why today's update hasn't moved the share price, as there don't seem to be any surprises.

The bar seems to have been lowered a fair bit for this year's full year expectations;

Licensing revenues benefited from a one-off boost, due to a change in accounting treatment. Although I note that the H1 TU said licensing would be up 25%, but is actually up 60%, so looks better than expected.

Cost-savings being implemented.

Current trading & outlook sound OK;

Trading in the first half of the year was in line with the Board's expectations and continues to reflect the challenges affecting the consumer sector both in the UK and internationally. We have made good progress with our strategy review and have begun taking steps to increase the focus of the business going forwards to drive sales and increase efficiency. At this stage of the year as we enter the autumn selling period, we continue to expect the full year out-turn to meet the Board's expectations.

Balance sheet - looks healthy.

Current ratio is strong, at 1.97, or 2.19 if you strip out the £2,589k current liability relating to IFRS 16, which I regard as spurious.

Pension deficit - has come down from £9.7m to £5.2m in the last 6 months. Although as we know, the accounting treatment of pension deficits is often divorced from reality, in terms of what recovery contributions are needed in cash terms (often much higher).

Note 11 discloses that cash contributions of £918k were made into the pension schemes in just 6 months, so it's quite a big outflow of cash.

We really do need a proper review of the accounting rules for company pension schemes, as to my mind they are materially understating the real world cash liabilities of pension schemes. We shouldn't need to hunt through the figures to ascertain the genuine picture.

In the real world, it has net cash of £922k. I don't see the IFRS 16 figure of £8.7m additional debt as being real world debt, so I'm ignoring it. Apparently this is what banks & institutional investors are doing too. If you hear otherwise, please let me know.

Overall, is passes my balance sheet testing with flying colours.

My opinion - this is a good share, I think. It has a sound balance sheet, and seems to be trading alright, given that its markets are weaker.

I see value in its catalogue of designs, and the evidence to back that up, is decent licensing revenues.

The share looks cheap, but the big unknown is what's likely to happen to earnings? Nobody knows, in a nutshell.

For investors prepared to take a long-term view, then this share should be fine, I think. There's always the risk of a profit warning though, if macro conditions worsen.

It looks the type of share that could attract a bid from overseas.

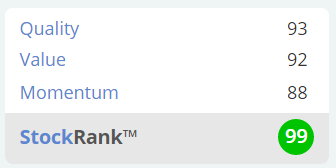

Stockopedia likes it a lot;

Driver (LON:DRV)

Share price: 53p (up 3% today, at 10:42)

No. shares: 52.2m

Market cap: £27.7m

Driver Group plc (AIM: DRV), the leading global professional services consultancy to the construction and engineering industries, providing multi-disciplinary consultancy services including expert witness, claims and dispute resolution services, today announces the following operational update on its activities.

This company has a 30 Sept year end. So this is a full year update, as follows;

Driver Group has performed well during the second half of 2018/19 and, as a result, expects to report underlying* PBT for the financial year of approximately £3m (H1: £0.8m), after incurring one-off costs amounting to £0.4m which were incurred as part of a rationalisation of its cost base.

That's a bit ambiguous. The way I read it, it seems to be saying that underlying profit is £3.4m, but it's not clear whether the £0.4m one-off costs are exceptional or not? I can't see any broker updates today.

Looking back to a broker note from Jun 2019, it was predicting £3.3m adjusted PBT, so I think this result today looks about what was expected. Hence not particularly price sensitive, other than being reassuring.

Looking at last year's accounts, it made £4.0m underlying profit, with a staggering £1.1m share based payment charge consuming more than a quarter of that.

Hence, despite the jaunty-sounding update today, the reality is that profit this year is well down on last year, due to the poor H1 this year.

Net cash - this sounds encouraging, for a group valued at only £28m;

Period-end net cash balances were approximately £5m after funding dividend and share buyback payments during the year.

Outlook comments sound upbeat.

Balance sheet - looks very strong, but with a very large receivables balance, which is an amber flag.

My opinion - it's good to see a company promise an improved H2 performance, and actually deliver, which is what seems to have happened here.

There's an unusually strong balance sheet, providing all those receivables actually turn into cash in due course.

This share is not really the type of thing that gets me interested, but it might be worth a look, possibly for readers who do look at this sector? I vaguely recall that there might have been a flurry of takeover bids for consultancy companies like this, a little while back?

Brady (LON:BRY)

Share price: 9.35p (up 36% today, at 11:20)

No. shares: 83.4m

Market cap: £7.8m

This is a very lucky escape for Brady shareholders, as the position here looked terminal.

Getting an exit at 10p per share is a good result, in the circumstances, as the company looked to be heading for insolvency, admitting recently that it needed a large cash injection to continue.

The buyer is Matthew Peacock of Hanover Investments. His comments in today's announcement are quite interesting;

"We are pleased to be announcing this recommended cash offer for Brady plc. While Brady enjoys an enviable market position, we believe that the public market is unable to deliver the operational support and funding Brady requires to fulfil its potential.

Hanover has successfully turned around several software businesses in a similar state of development, and stands ready with the expertise and capital to drive growth and deliver best in class products and services to Brady's customers."

I agree with his sentiments that the public markets are not suitable for struggling smaller companies.

You might remember Hanover Investors as being the outfit that built up & then almost destroyed Regenesis, now called Blancco Technology (LON:BLTG) . They turned up at almost every private investor event that was held, talking up how great the company was. Directors sold multiple £ millions of shares near the top in 2014, then it went horribly wrong, with a series of profit warnings & a collapsing share price. To be fair though, Blancco seems to be recovering somewhat at the moment.

If I held Brady shares, I'd ditch them now, in the market for 9.2p. It's not worth taking the risk that the deal falls through, given the precarious state of Brady's finances.

It's a dismal end for Brady as a listed company. The signs were there all along - capitalising a ton of costs, no genuine cashflow, etc., as we've discussed here several times before.

I remember interviewing the former CEO of Brady, a few years ago, and one of the reader questions was whether he should resign & hand over to someone else! I asked the question, and there was a long pause. I thought he had hung up. But he then gave a calm & measured reply. A few weeks later, he did resign. I felt guilty over that, but soon got over it.

The chart shows how quickly Brady shares unravelled;

That's it for today. See you again in the morning!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.