Good morning subscribers! It's Paul here.

Many thanks to the silent majority, who gave yesterday's SCVR a robust seal of approval, reflecting my 6 hours' intense hard work, from 7am to 1pm, of a seasonally high 97 thumbs up! Thank you, it's much appreciated.

It really shouldn't matter, but like my friend who went to weight-watchers, being rewarded with a worthless gold star really pleased him, even though we laughed afterwards about how ridiculous it is.

Now that SCVRs are part of your subscriptions, I've realised that I should work harder & earlier, to hopefully find a format that everyone likes, or at least can cope with. Please bear with me, whilst I try out a few ideas.

Initial review of RNS

(please note I won't be updating this section. New sections will appear below, so nobody has to go back and re-read parts of the article)

JD Sports Fashion

Strong results, from this rare bright spot in retailing. Far too big for me to review in detail here, at £5bn mkt cap.

- A big acquisition (Finish Line, USA) has helped boost revenues to £4.7bn for 52 weeks to 2 Feb 2019

- Adj EPS of 28.44p is up 13% on last year, and is 2.7% ahead of broker consensus forecast of 27.7p

- Share price has gone ballistic since recent 318p low on 20 Dec 2018. It's up 67% since then, to 532p. Well done holders! PER is 18.7 - looks about right, given strong performance

- Strong balance sheet, with £125.2m net cash

My view - what a lovely business! No current trading stats, as company (rightly) says these would be meaningless due to change in timing of Easter.

... However, we are pleased with the continued underlying positive performance of the Group and are excited by the major developments ahead.

That's it from me on JD today, I won't be adding any more detail below, as it's a large cap. I just wanted to have a quick look, for comparative purposes.

Flowtech Fluidpower (LON:FLO)

2 announcements (results, and separate trading update) today.

Company says its 2018 results are in line with expectations. Debt increased on acquisitions.

There's a short video results presentation, a nice touch.

Q1 update says in line with expectations overall. Smallest division is struggling, but larger ones doing OK.

I quite like this group, so will write up a full section below, later today. Even though results are only in line with expectations, I want to dig into the balance sheet & cashflows in a bit more detail. The PER is low, and dividend yield high, hence my interest in digging a bit deeper, later on.

Card Factory (LON:CARD)

Final results for y/e 31 Jan 2019 look to be in line with expectations. Actually, adj EPS looks a little ahead, at 17.6p vs 17.3p forecast.

This is a very resilient High Street business, with terrific profit margins. Although profit slightly down, I see this as a survivor long-term. Very attractive divi yield.

I'll write up a full section below, later - as I think this company is worth considering, for dependable divis.

Kainos (LON:KNOS)

Trading update for y/e 31 Mar 2019 is in line with expectations.

I don't have any particular insights on this group, so am not planning on looking in more detail. The trading update doesn't really say much anyway.

Telit Communications (LON:TCM)

2018 results are out. I've found plenty of red flags in its previous results, so will have a rummage through these figures later.

Main Report

I'll do the more detailed (old format) sections below on things which most interested me in the above initial skim of the RNS before 8am, plus anything else that pops up.

Card Factory (LON:CARD)

Share price: 178p (up 0.5% today, at 08:15)

No. shares: 341.5m

Market cap: £607.9m

Card Factory, the UK's leading specialist retailer of greeting cards, dressings and gifts, announces its preliminary results for the year ended 31 January 2019 ('FY19').

This company seems to me to be a much better business than many investors realise. Key features are;

- Very high profit margins

- Flat LFL sales, despite retailing doom & gloom (there was a solid trading update on 10 Jan 2019)

- Highly cash generative, and paying out big divis

That's why I'm taking a closer look at the numbers today. The company's last guidance (in Jan 2019) was for £89-91m underlying EBITDA. Actual adjusted EBITDA has come in towards the low end of that (tight) range, at £89.4m. That's down 4.9% on prior year, a respectable result in very tough conditions for retailers.

I like the fact that CARD is able to very accurately predict its results, with accurate guidance. That's the sign of a resilient business, and good management. In contrast, fashion retailers are often subject to much larger variations in performance, especially if they get the product wrong (e.g. recently Bon Marche & Quiz are good examples of that). There isn't much risk in greetings cards & associated gifts. Plus the gross margins are massive on greetings cards.

These are the key numbers (with my comments);

- Revenue up 3.3% to £436.0m

- Gross margin works out at 67.4% - one of the highest in the retail sector

- LFL sales basically flat, at -0.1% - this is a good outcome, since High Street footfall is declining in many towns. So CARD has successfully made up the shortfall with additional sales - I like that a lot

- Underlying EBITDA of £89.4m is resilient, and within forecast range, but it's still going down (by 4.9% vs prior year), which is not good

- If you don't like EBITDA, then focus on underlying profit before tax, down 7.3% to £74.6m

- My favourite measure is underlying EPS, as it's easy to work out PER & divi cover from this measure, which is down 7.1% to 17.6p. This gives a PER of 10.1 - that's lowish, but it should be low, because earnings are falling

Dividends - flat at 9.3p per share - giving a yield of 5.2%. However, the company also pays out special divis - as you can see from this Stockopedia page, special divis have been very generous in recent years. The divis are the main reason to buy this share. Adding in the 5p special divi paid in Dec 2018, the yield rises to a very pleasing 8.0%. I think that level of payout looks sustainable too, which is unusual for such a high yield.

Another special divi is mentioned today as being in the pipeline for interim results later this year.

Store roll out - is continuing, with 51 net new stores opened in the year. Total is now 972. Lots of smallish shops. Taking a simple average (which won't be completely accurate, but gives us a rough idea), that means revenues per store of £449k, and EBITDA per store (approximates to cashflow, for retail businesses) of £92k.

Actually, the per store figures would be a good deal higher than £92k, because that figure takes into account all the head office costs too. So each of those small Card Factory stores you see, is on average making a profit of over £100k p.a.. Not bad!

Wages costs are rising (up 7.9%, but that will include new stores), but store occupancy costs are rising less (up 4.3%). Rents will on average be falling, on lease renewals, which helps to offset cost increases on other things;

We continue to target improvements in our overall rent roll as we reach break points or expiries on existing leases and expect cash savings of c£0.4m in FY20.

Balance sheet - net debt is a little higher than I would like, but has come down vs last year. It's £141.3m at 31 Jan 2019 (2018: £161.3m). That it can reduce debt, whilst paying out huge divis, and opening new stores, shows just what a cash cow this business continues to be.

Overall, the balance sheet is weak, with negative NTAV of -£92.4m. Normally that would be a deal-breaker for me, but it's acceptable here because the business is so cash generative. Also remember that retailers don't usually have much in receivables, and sell goods for cash, hence a weaker balance sheet is tolerable, providing cashflows remain strong.

Outlook - this bit is very interesting, as it goes against what most of us probably imagined to be the case;

The greetings card market remains resilient and robust with encouraging trends amongst younger customers who are buying more cards...

...Whilst the new financial year is just two months old, we are satisfied with the start we have made and are particularly pleased with the record seasonal performances from Valentine's Day and Mother's Day.

... As previously stated, EBITDA for the forthcoming year is anticipated to be broadly flat year-on-year (excluding the impact of IFRS 16) as we anticipate another challenging consumer environment due to external factors.

That all sounds fairly encouraging, given known macro headwinds for retailers.

My opinion - as you've probably gathered, I like this share. The company has a strong niche, and is trading robustly in tough markets. It's paying out an 8% (sustainable) yield, so I think this is a very good share for income seekers to consider.

I could see this share re-rating at some point, maybe onto a more appropriate PER of say 12-13, giving about 20-30% upside on the current share price, potentially. In the meantime, the bumper divis will be flowing to shareholders.

It may seem an unlikely share to be positive about, but the numbers do the talking here, and I think it's definitely worth a thumbs up from me. I don't currently hold any directly, but do have a tiny indirect stake through a share club of which I am a member.

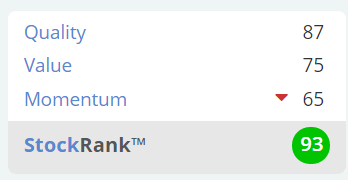

Stockopedia's computers agree, with a "Super Stock" classification, and very high StockRank (these are not infallible remember, but are statistically proven when used in a portfolio approach);

Flowtech Fluidpower (LON:FLO)

Share price: 118.5p (down 3% today, at 11:12)

No. shares: 60.9m

Market cap: £72.2m

Flowtech Fluidpower plc (AIM: FLO), the leading specialist supplier of technical fluid power components and services announces its preliminary unaudited results for the year ended 31 December 2018. Audited results for this period are expected to be available later in April.

This group is growing primarily through acquisitions.

- Revenue is up 42% to £111.1m

- Profit before tax up 14.6% to £6.92m - a considerably lower increase than the revenue increase, indicating lower margins in 2018 than in 2017

- EPS down from 9.69p in 2017, to 8.34p in 2018. This is due to there being a higher tax charge % in 2018, and from the issue of new shares during 2018

- Net debt up from £14.9m to £19.9m - I'll check to see if that looks problematic or not

Dividends - strikingly high, considering this acquisitive group is increasing its bank debt. I don't feel it's appropriate to be paying out such high divis, given the debt on the balance sheet. 6.07p total divis for the year is a yield of 5.1% - in my opinion that's not a safe yield, given the balance sheet weakness & debt.

It doesn't make sense to me, for a group which is growing by acquisition, funded from fresh equity issues & debt, to be paying big dividends. It seems like giving with one hand, and taking away with the other. Surely it would make more sense to pay a token divi during the rapid growth phase, then become a big divi payer once the group is mature?

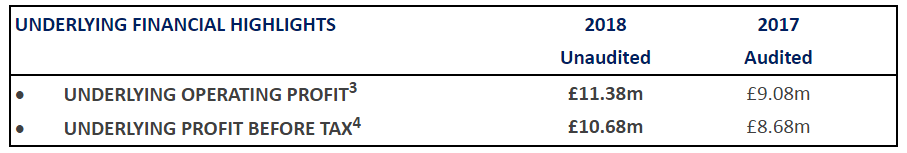

Underlying results - the group also presents higher, alternative version of profits, as follows;

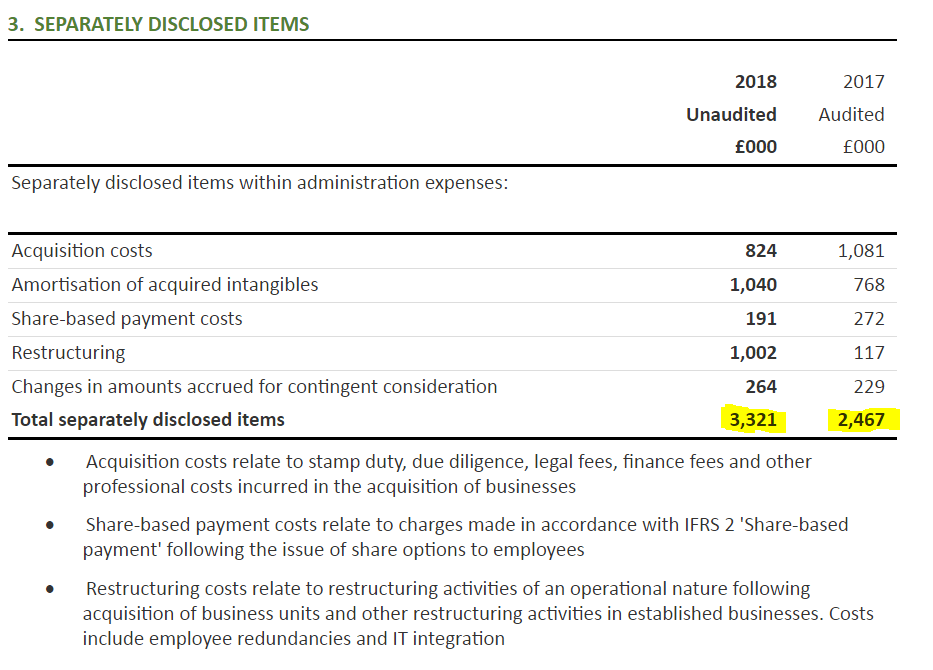

Note 3 gives us a breakdown of the adjustments;

I suppose a case can be made that these are not underlying costs, although they're quite material in aggregate. The danger with acquisitive groups, is that "restructuring", and "acquisition" costs can become soft codes within the accounts department, and all sorts of odds & ends can end up dumped within these categories.

I recently read a very interesting shorting dossier on Premier Technical Services (LON:PTSG) (in which I have a small short position), which gave very interesting examples of how profit can be boosted within acquisitive groups. That really put me off the whole idea of buying shares which rely on multiple acquisitions. I'm not saying there's anything wrong, just that the risk that their might be something wrong, is increased at groups where lots of acquisitions are made.

On the plus side, it's worth noting that FLO's Chairman, Malcolm Diamond, seemed to do a good job at Trifast (LON:TRI) which more than 10-bagged from the lows of 2009, partly driven by a series of apparently good acquisitions. So I imagine his experience is helping steer the management of FLO away from the pitfalls of an acquisitive strategy, perhaps?

Balance sheet - NAV is £87.4m. Being an acquisitive group, intangible assets (mainly goodwill) are high, at £70.6m. That leaves NTAV at £16.8m - still positive, as the group has sensibly raised some equity as well as debt, to fund acquisitions.

Working capital looks OK, with a current ratio of 1.40 - for this type of business, I'm generally happy with anything over about 1.30. This also includes the bulk of its bank debt (in current liabilities), which makes the 1.4 current ratio more comfortable. For example, if you were to move the £18.1m bank debt into long term creditors, then then the current ratio would be very good, at 2.5.

So I don't think there are any concerns here, re solvency.

Broker update - is available on Research Tree. It focuses on what management is doing to drive operational improvements & efficiencies.

Forecasts are left unchanged. Adjusted EPS figures are used by the house broker, which are;

2018 actual: 14.7p - PER of 8.1

2019 forecast: 16.5p - PER of 7.2

Those certainly look attractively cheap, if you're happy to use the adjusted EPS figures. I'm a little uneasy with the size & type of the adjustments.

This sounds OK - it's in line, which is really all that matters;

Group Trading remains in line with expectations. Revenue during the first three months of the current year increased by 14%, of which 4% was organic, with the balance representing acquisitive growth from a full period of trading for Beaumanor Engineering and Derek Lane & Co. which were acquired on 18 March 2018.

Both the Flowtechnology and PMC divisions traded well and have continued to do so in early April. The smaller Process division, which is involved in larger order activities, saw a reduction in sales against the comparative quarter, however a return to growth in Q2 is expected.

Some of the other commentary in this update might have rattled a few investors, as it sounds like there are internal management problems that need sorting out.

My opinion - I like various aspects of the figures here - low PER, big divi yield (even if it probably shouldn't be quite so high). Also the management focus on reducing working capital (and hence debt) is music to my ears.

On balance, if the company manages to avoid any banana skins re Brexit uncertainty, possible economic slowdown, etc, then it could pan out quite well. On the downside, there is risk - only today we had a profit warning from construction group Galliford Try (LON:GFRD) . If that spreads, then it could possibly cause problems for FLO perhaps?

This share could go either way - if it delivers a strong performance in 2019, then I could see this share re-rate to something like 150-200p. However, I can't shake off the hunch that it might have another profit warning in it, later this year, if the macro picture deteriorates. On balance then, I'm inclined to watch from the sidelines for now.

Telit Communications (LON:TCM)

Share price: 165.6p (down 2.6% today, at 12:50)

No. shares: 131.7m

Market cap: £218.1m

Year end results - for 2018

I've had a quick skim of these figures, however there's not really any point in analysing the 2018 numbers, because Telit's automotive division was sold post year end.

Note 3 (going concern) says that bank financing has been paid off, from the proceeds of the sale of the automotive division on 27 Feb 2019.

Note 7 gives details of this disposal. The full $105m in cash due, seems to have now been received by Telit. I know there was some investor scepticism over whether the $38.5m vendor loan (deferred consideration effectively) would be received, but Telit says this was received on 15 Apr 2019.

My view - there was a good bear case, given the many red flags at this company. However, selling the automotive division seems to have saved the day.

The 2018 figures are irrelevant now that the automotive division has been sold. It will be interesting to look at the 2019 interim figures later this year, to see how viable (or not) the remaining business is?

Given the history & track record of red flags here, I wouldn't go near it on the long side.

Discoverie (LON:DSCV)

Share price: 417p (up 0.2% today, at 15:13)

No. shares: 73.4m

Market cap: £306.1m

Curiosity got the better of me, on seeing this unfamiliar company name crop up on the RNS this morning. Turns out that it's the new name for ACAL.

discoverIE Group plc (LSE: DSCV, "discoverIE" or the "Group"), a leading international designer, manufacturer and supplier of customised electronics to industry, today issues a trading update for the year ended 31 March 2019 ahead of announcing its full year results on 4 June 2019.

Various positive statistics are given, but the crux is that it's an in line update, so reassuring, rather than exciting;

Trading in the fourth quarter continued strongly and the Group expects to deliver full year earnings in line with the Board's expectations...

Good cash generation is noteworthy;

Cash generation in the fourth quarter has been good with net debt at the year end lower than expected resulting in a Group gearing ratio4 of 1.8x

Placing & acquisitions - two further announcements detail a £29m gross (£28m net) placing at 400p, a 3.85% price discount, 10% dilution to existing shareholders. The terms look fair, apart from the ridiculous £1m in fees - money for old rope, as usual, for city firms!

The 2 smallish acquisitions are costing £15.9m, so the balance of funds raised is for debt reduction, taking it down from 1.8x EBITDA to 1.5x EBITDA.

My opinion - browsing the StockReport here, I'm struck by the good progression in profitability in the last few years. The valuation looks about right to me.

Stockopedia likes it, with a "High Flyer" classification, and a decent StockRank of 76.

Could be worthy of a closer look, perhaps?

That's me done for today. Thank you for all the gold stars!!! I hope people like today's format experiment, which I think works better than yesterday's.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.