Good morning!

First of all, apologies - I had a very early night last night, and forgot to put up today's placeholder article (I have an alarm set for 21:30 on my mobile to remind me, but was already asleep by then yesterday).

Please note in the header the companies that I shall be looking at today. There's room for 1 or 2 more, so please feel free to leave requests in the comments below. Preferably for something interesting, not just an in line update. Oh and no financials, resources sector, pharma, property, or blue sky please, as I don't usually cover those (we have to whittle it down to a manageable number of stocks somehow).

Crypto-currencies

I see that Bitcoin is now down more than 40% from its recent highs, priced at $11,400 at the time of writing. Ripple is also plummeting, down 30% to $121 at the moment. Mind you, these things are so volatile, that they could even end the day up! That's why I've given up trying to trade them on IG, as even if I get the direction right, I'm invariably stopped out, due to the extreme volatility.

The spread betting companies must be having a field day with crypto-currencies, so it might well be worth looking at buying shares in that sector, if you can tolerate the regulatory risk? They've certainly made plenty of money out of me, that's for sure! It's true to say that whenever I step outside of my sphere of competence, the results are miserably poor.

Is the (so-called) crypto-currency meltdown underway? Quite possibly. I think this bubble is highly likely to blow up in 2018, due to there being so many obvious signs of the bubble being at or near its peak.

I've made no secret of my views on this - the valuations, running into many billions for things that are totally worthless, is complete nonsense. It's a speculative mania which ticks all the boxes warned about in books like Galbraith's (see picture below). This book is a terrific (and pleasingly short) & enjoyable read. I bet you'll say, "That's Bitcoin!" repeatedly, as you read this book, published in 1990. Galbraith's tone is dripping with disdain for foolish speculators, which is most enjoyable & amusing to read. It's a pity he's not around to pour scorn on Bitcoin.

Warren Buffett ("It will definitely come to a bad ending") and Charlie Munger ("total insanity ... avoid it like the plague") have made their views on Bitcoin & others crystal clear, and it doesn't usually pay to think you know better than them.

I love it when fans of Bitcoin tell me that I don't understand it. That's because such statements are one of the key confirmation points for a speculative mania - it usually has to be something new, and technologically advanced, in order to attract a bubble-like valuation.

A historical perspective is essential for any financial market participants, in my view. This is because nothing new ever really happens in markets. It's all been done before, just under different guises. I forget who it was who said that nothing ever changes with markets, because they are driven by human emotions - which of course never change.

Whilst we're on the subject of historical books, this one is my all-time favourite - written under a pseudonym in 1923, by a notorious trader (Jesse Livermore), who made & lost vast sums as a stock market trader. His eventual suicide in no way detracts from this remarkable autobiographical story & market trading wisdom in this book. I must re-read it (for the 4th or 5th time) actually, now it's been retrieved from my bookshelf.

I've mentioned it before here, but we're gaining new readers all the time, so they might not have seen my previous references to this outstanding book.

Right, I'd better write something about small caps now.

Van Elle Holdings (LON:VANL)

Share price: 88p (down 8.7% today, at 10:19)

No. shares: 80.0m

Market cap: £70.4m

Van Elle, the geotechnical engineering contractor offering a wide range of ground engineering techniques and services to customers in a variety of UK construction end markets, notes yesterday's announcement relating to Carillion plc ("Carillion") and comments as follows...

Its exposure to Carillion looks quite small, at £1.6m - being the total outstanding debt and work-in-progress. Note that the market has knocked about £6.1m off Van Elle's market cap today. An over-reaction perhaps, or possibly that this could be the thin end of the wedge?

The current financial year (04/2018) contains £2.5m of anticipated revenues related to Carillion. Van Elle doesn't yet know what will happen with these contracts.

My opinion - it seems pretty obvious that the contracts previously run by Carillion will in future be run by somebody else. So the only issue is what sort of delay there might be in resumption of contracts, if they stop at all. On the TV news last night, a Government spokesman seemed to be suggesting that contracts would continue without disruption, being managed by the Official Receiver's agents, instead of by Carillion.

I think it's safest to assume that the £1.6m of bad debts might need to be written off. From my experience working for an insolvency practitioner in the 1990s, there had to be a strict break between pre-receivership, and post-receivership debts. Anything pre-receivership could not be legally paid. Although this situation might be different, I don't know.

These numbers are small relative to Van Elle's market cap, and I would be inclined to buy the dip, if I liked this company. Having just done some checks, my view is that Van Elle has a strong balance sheet, and is strongly profitable. Therefore it should be able to easily cope with the sort of numbers mentioned in today's RNS, without any threat whatsoever to the company's solvency.

Therefore, providing nothing else comes out of the woodwork, based on today's announcement, Van Elle shareholders can relax. This is a relatively modest, one-off hit to earnings & the balance sheet, that should not do any long-term damage to the company.

IG Design (LON:IGR)

Share price: 394.5p (up 3.4% today, at 10:42)

No. shares: 63.3m

Market cap: £249.7m

IG Design Group plc, one of the world's leading designers, innovators and manufacturers of gift packaging, greetings, stationery, creative play products and giftware, announces an update for the third quarter, which covers the Group's Christmas trading period to 31 December 2017.

The company has a 31 March year end, as implied above.

I'm surprised the share price hasn't risen more today, because it's a positive, better than expected update today;

... All regions are on track to achieve year on year revenue and profit growth and we are therefore pleased to upgrade the Group's full year performance with diluted earnings per share1 expected to be ahead of current market expectations and delivering strong year-on-year growth.

Other points;

- Strong cash conversion

- 03/2019 and beyond should benefit from lower US tax charges (note that from the last interim results, USA produced 42.6% of total group profits - see note 2 of interim figures to 30 Sep 2017 )

Outlook - positive, but wording is fairly bland/generic;

We are very well placed to continue to create sustainable value for our shareholders through organic growth and will also continue to seek compelling acquisition opportunities underpinned by an ever-strengthening balance sheet and a long track record of proven performance."

I take slight issue with the "ever-strengthening balance sheet" comment, because it's not really a strong balance sheet, and the group relies on bank borrowings to fund some of its working capital. I think a better form of wording would have been to say that the balance sheet is improving. This doesn't really matter though, as the company is trading strongly, so can easily support bank borrowings. I wouldn't want to see them making any big acquisitions with additional debt though - it would be better to do equity fundraisings for say half (or more) of the cost of any future acquisitions.

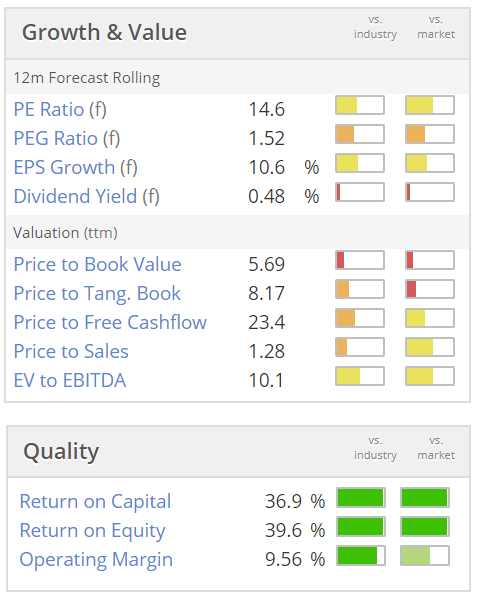

Valuation - these figures are as of last night, so performance will be better than this. In an expensive market, this looks good value, for a decent growth company that's performing well;

There's an absolutely lovely progression of key performance measures, as you can see below. This has been reflected in a higher PER range, shown in graph 4 below - some of which is down to IGR performing well, but some is due to a general bull market re-rating of practically everything;

My opinion - this share gets a firm thumbs up from me.

This share has been a long-standing favourite here, although sadly I baulked at the relatively high valuation some time ago, and sold mine very prematurely, missing out on a nice rise since. Never mind, can't win 'em all.

Based on today's announcement, and fairly attractive valuation, I think this looks a decent GARP share, and I'm tempted to revisit it in my portfolio. Another leg up looks possible. Although I would caution that the market as a whole for UK small caps feels a bit wobbly at the moment. Many momentum shares seem to be pausing, or selling off, even after issuing positive updates. That makes me a little wary of opening any new long positions at the moment. Although such negative market sentiment can sometimes provide good buying opportunities in the best quality companies.

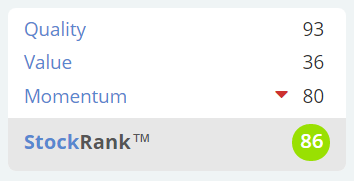

Based on its performance in recent years, I would certainly regard IGR as a high quality share. So does Stockopedia - note the 93 quality score below. So a QARP stock, by the looks of it;

Premier Technical Services (LON:PTSG)

Share price: 183p (up 2.8% today)

No. shares: 104.5m

Market cap: £191.2m

Premier Technical Services Group PLC ("PTSG" or the "Group"), the niche specialist services provider, is pleased to announce that its results for the year ended 31 December 2017 are anticipated to be in line with the Board's expectations.

Good stuff.

Outlook comments are better still;

In addition, the Board expects that the results for the year ended 31 December 2018 will be materially ahead of current market forecasts. This reflects the strength of the Group's order book and successful integration, and ongoing progress at its recently acquired businesses.

That's a strikingly good announcement, given that 2018 has only just started. It's very unusual to see management being so bullish at the start of a year. Normally people tend to play it safe, and wait until out-performance is comfortably in the bag, before announcing positive

More detail is given on acquisitions, which sounds as if they're going very well. That's very pleasing, since this is a buy & build business. Hence evidence that they are good at making, and integrating acquisitions, is a big plus.

Carillion insolvency - negligible impact expected.

Healthy pipeline of potential acquisitions.

My opinion - the CEO here is like a machine - reeling off facts & figures, and seemingly very much on top of the detail, as well as the overview - which is very impressive, and exactly what I look for at entrepreneurial businesses like this.

On the downside, I do have an ongoing concern about high debtors on the balance sheet, the explanation for which I didn't find terribly convincing (it's high margin work, so we don't get paid quickly).

Stockopedia shows consensus EPS forecast for 2018 at 9.9p. Based on today's update I would estimate that 12p+ is probably more realistic. That would put the shares on a 2018 PER of 15.3 or below. That looks quite attractive for a group which seems to be establishing a good track record.

On paper it looks very good. Personally I'd like to see receivables (debtors) come down to a more reasonable level, before being comfortable enough to buy any. Although that reticence has cost me money, since the share price performance in 2017 was strong.

Note that the shareholder base is very concentrated. The largest 2 shareholders are the CEO & Chairman. Hawk is Bob Morton:

Overall, it looks interesting, and if things continue to go well, I imagine Directors might reduce their shareholdings in secondary placings. This is likely to be a stock that institutions may want to buy, and the only source of stock would be from the Directors. It would be good to see liquidity improve, as it's a thinly traded share, due to the concentrated shareholdings shown above.

GYM (LON:GYM)

Share price: 230.5p (up 1.5% today, at 13:46)

No. shares: 128.3m

Market cap: £295.7m

The Gym Group plc ("the Company" or "TGG"), the fast growing, nationwide operator of 129 low cost gyms, announces a pre-close trading update for the year ended 31 December 2017.

This is a roll-out, and quite a fast one;

Site numbers expanded by 44% to 128 at year end (2016: 89) with 21 organic openings and 18 sites acquired from Lifestyle Fitness.

Lots of detail on various KPIs, and operational stuff, is given. The only comment that really matters to investors is this bit;

In light of the progress made, the Company anticipates its results will be in line with market expectations for earnings in 2017.

Outlook - sounds confident;

Following another strong performance, the Company has created an excellent platform for the coming year. The business is in great shape to achieve the substantial growth in profitability included in its 2018 plans, as it benefits from the significant expansion of the past 2 years.

It plans to open 15-20 new gyms in 2018.

Valuation - this is a successful roll-out, so earnings are in a strong upward trend, as new sites come online and boost profits. Consensus seems to be about 7.5p for 2017, and 9.0p+ for 2018, and similar increases in subsequent years.

As we're already in 2018, it makes sense to value this share on about 25 times 9.0p, which is 225p. That's within spitting distance of the current share price of 230p, so it looks priced about right.

My opinion - I like this company. It's a good business model. Whilst there are competitors, the monthly fee is so low that once people are in the habit of using The Gym that's local to them, they're very unlikely to switch to a competitor.

The shares aren't cheap, but you have almost guaranteed increases in profitability coming through, from a self-funded roll-out. I see little scope for anything serious going wrong with this straightforward business model.

Longer term, once it has saturated the market, then there should be decent divis to come through. Overall, a thumbs up from me, although I don't really see much immediate upside on the share price, so won't be buying any personally for now. It's going on the watch list.

JD Sports Fashion (LON:JD.)

Share price: 388.5p (up 6.3% today)

No. shares: 973.2m

Market cap: £3,780.9m

This is a well-known retailer of sports fashion, and outdoor brands.

The company has had a good Christmas;

We are very pleased to report that the positive levels of performance announced in our Interim Results statement have continued through the second half, including the key Christmas period.

Like for like store sales in the second half to date across the Group's combined Sports and Outdoor fascias, including those in Europe, have been maintained at approximately 3% with additional sales growth arising from both material growth in online trade and continuing overseas space expansion.

The performance is particularly encouraging when considered against the challenging comparatives provided by the significant levels of sales increases achieved in each of the last three years.

That sounds really good. I very much like that this company specifically sets out store LFLs, separate to online growth. Whereas many other retailers are obscuring weak store LFLs by combining them with strong online growth into a single LFL number. I'm increasingly coming round to the view that we need an accounting standard on LFL reporting, as the bases used by retailers are so widely divergent - making it very difficult to compare performance between companies.

Profit out-performance - how about this for excellent reporting;

We are now confident that our headline Group profit before tax for the year ended 3 February 2018 will reach around 300m. Prior to this announcement the range of market expectations was 270m to 295m.

As I always say, why can't all companies report clearly, and specifically, like this?! Advisers (many of whom read my reports) please take note.

My opinion - I'm not a big fan of retailers that sell other peoples' brands. The worry here is that the big brands might decide, at some point, to sell direct to the public, as opposed to through JD Sports. That's probably why the valuation is relatively modest, despite the company performing well - doubts over the long-term sustainability of profits. For now though, everything seems fine.

WANdisco (LON:WAND)

Share price: 780p (down 6.0% today, at 14:58)

No. shares: 42.8m

Market cap: £333.8m

This is a highly specialised software company, which claims to have world-leading data management expertise. It updates us today on performance for calendar year 2017.

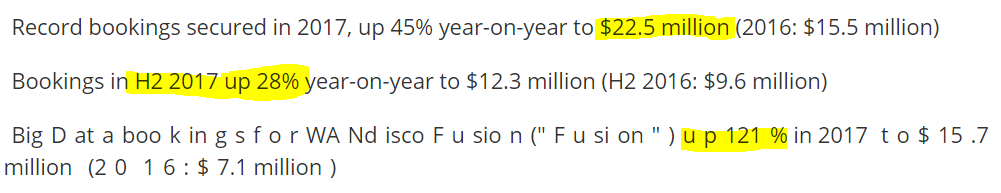

The company likes to report bookings (i.e. orders), but this is not to be confused with revenues, which will be lower.

Those figures don't seem to reconcile, so there must be some overlap. It's striking how small these numbers are, for a company valued at £334m.

Cash - was replenished with a placing, and now stands at $27.4m, less $4m debt (why?!)

In the past though, cash burn was prodigious, so I'm not sure how long the latest fundraise will last. There's unlikely to be any need to raise fresh funds this year anyway.

Contract wins - excitement over contract wins is what has propelled the shares price into the valuation stratosphere. A record $4.32m contract, and another for $4.1m are mentioned. Note that some contracts are sold through IBM - white labelling WANdisco's product - impressive. If the trickle of contract wins turns into a bigger flow, then things could get interesting.

Outlook - strong pipeline;

We have begun 2018 with a strong new business pipeline across multiple industry verticals, not only through our partnership with IBM, but also via our other channel partners, as we maximise our routes to market. With the proceeds of the recent placing we have the resources to capitalise on the opportunity in front of us."

My opinion - I had a nicely profitable punt on this early last year, after spotting an RNS that sounded like a game-changer. However, since then the share price has risen very considerably, and looks very rich to me now.

It's still a very small, heavily loss-making company, so not really my cup of tea, at a £334m market cap. That said, I do sense that they've got an interesting product, so will keep half an eye on it in future.

Right, let's look at a couple of shares that readers have requested, even though these are outside my usual areas of focus.

Innovaderma (LON:IDP)

Share price: 227.4p (down 14.1% today, at 15:22)

No. shares: 14.38m

Market cap: £32.7m

InnovaDerma (LSE: IDP), a UK developer of life sciences, beauty and personal care products, is pleased to provide a trading update for the six months ended 31 December 2017.

Checking the archive, I don't seem to have ever looked at this one. The name put me off, as it sounds like a pharma, which is a sector I usually avoid. Graham seems to find the company interesting, as he wrote about it 4 times last year. So I shall get acquainted by reading Graham's articles now. It has a 30 June year end.

Right, I'm back, having been briefed by Graham's reports on the company. Kudos to Graham, as he called it perfectly - being bullish at 152p-160p in the spring of 2017, then cooling on the company once it has risen 92% to 292p by Oct 2017. Graham spotted some mixed product reviews, and was sceptical about the company seemingly pebble-dashing its marketplace with too many new product launches.

Key points from today's H1 update;

H1 revenue up 31% (constant currency) to £4.2m.

H2 weighting expected (Jan-Jun 2018), as in previous years;

As in prior years and as stated at the time of the final results in September, the Company expects revenue and profit growth to be strongly weighted to the second half. This reflects the momentum created in the first half as peak tanning season approaches.

In addition, entry into new markets together with new product launches such as Roots, Charles + Lee, StevieK Cosmetics and Prolong are expected to feed through to substantial revenue and profit growth in the second half of the year.

Graham speculated in a previous report here that the H2 weighting of the business might be due to increased demand for the company's fake tanning lotions in the spring/summer, when all that white skin (or blue, if you're in Scotland!!) is revealed by lighter spring/summer clothing. That seems to be correct.

Even so, the company has quite a mountain to climb in H2. Stockopedia shows broker consensus revenues for this year of £13.8m. Yet it only achieved £4.2m revenue in H1. So H2 needs to see a 129% increase on H1, to meet forecast. That seems a tall order to me. Having said that, I've checked last year's figures, and the uplift in revenues from H1 to H2 was 178%. So that puts a different perspective on things. Maybe this year's forecasts are not so ambitious, after all?

Outlook - sounds confident;

The Board remains confident in meeting market expectations for the current financial year and has much greater revenue visibility for the second half than in prior years.

My opinion - this is the first time I've looked at this share, and cannot say that I'm minded to look any deeper. For a £33m market cap, I'd want to see a much more established profits track record. That said, the top line growth here does look interesting.

The links that Graham put up of online reviews of the company's products looked worrisome. I put a lot of store on online reviews. Whilst you expect to see some malicious reviews, e.g. from competitors, there were far too many negative reviews for the Skinny Tan product, suggesting that it's not a very good product. Maybe I should try some out, and post pictures online for you?? lol! As a friend of mine says, a brown beer belly is much better than a white beer belly!!

If you really like this company, and think its products are the bees knees, then this might be a good entry point perhaps? Personally, I think competitors Creightons (LON:CRL) and Swallowfield (LON:SWL) (in which I hold a long position) look a bit more established, and better value for money based on the historic numbers. Whereas IDP seems to be offering the potential of faster growth, but is earlier stage in terms of profits.

Sorry, I've run out of time & energy, so will leave it there for today.

See you in the morning!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.