Good morning! Graham and Roland here with today's report.

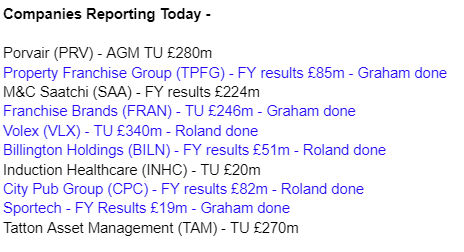

This report is now finished - 10.20am. Have a great day!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Graham's Section

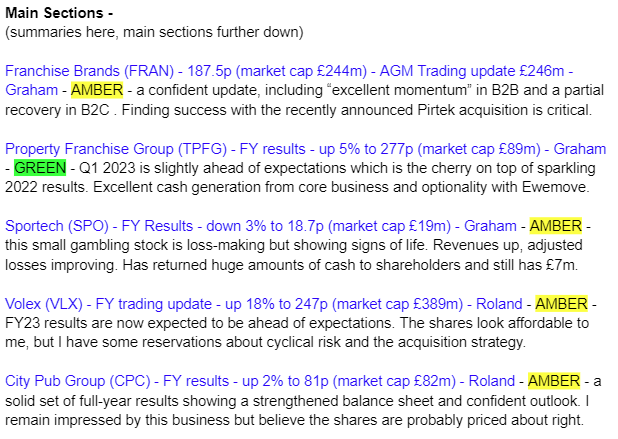

Franchise Brands (LON:FRAN)

- Share price: 187.5p (pre-market)

- Market cap: £244m

We already looked at this one two weeks ago - with the remarkable news that it was making a £200m acquisition, funded by £110m of new equity.

Today we have an AGM trading update. I don’t see many new numbers here; but there is lots of reassurance for shareholders that the overall group continues to trade well:

…the excellent momentum in the B2B Division that was a feature of 2022 has continued. Metro Rod experienced strong growth in system sales, achieving record levels in Q1. The integration of Filta UK within this division continues with the combined objectives of improving customer service and reducing costs in the medium term. The defensive, mainly essential services provided by this division have proved resilient despite the current macro-economic uncertainties.

Other points:

Filta in North America performed “robustly” in Q1

Car paintwork repair company Chipsaway has seen a recovery in franchisee recruitment, but “the loss of franchisees in 2022 and increased overheads generally have impacted income in Q1 2023”.

Acquisition of Pirtek Europe (hydraulic hose repair and replacement company) will complete on 21st April, subject to shareholder approval.

Overall, it has been a “good start” to 2023.

Graham’s view

There’s little reason for me to change my opinion on this one, following this update.

I continue like many aspects of this stock and I agree that that Pirtek deal has the potential to be a huge success for the company and its shareholders, if the planned synergies and opportunities from the deal materialise.

I’m going to stay neutral for the same reasons that I did last time. Firstly, it looks like they may have paid a heavy multiple for Pirtek. And secondly, the level of debt and equity dilution that’s involved is significant and in my mind will be difficult to justify. But let’s see if they can in fact justify it with continued financial success.

Long-term shareholders have done very well here and I certainly wouldn’t want to short this one:

Property Franchise (LON:TPFG)

- Share price: 277p (+5%)

- Market cap: £89m

Today we have full-year results from “the UK’s largest property franchisor”. We covered the corresponding trading update here, in February.

Let’s review some of the key bullet points:

13% total revenue growth to £27m

8% like-for-like total revenue growth (even stronger than the 7% reported in the trading update)

Management service fees (“royalties”) up 5% like-for-like, up 8% overall to £16m.

The adjusted operating margin is 41%, up from 40% last year - this is a high-quality business!

PBT increases 38% to £8.8m, and is matched by £8.2m of free cash flow.

The company borrowed £12.5m from Barclays to help fund the £24m acquisition of Hunters in early 2021.

Of this borrowing, £7.5m was a term loan, repayable over four years. Thanks to the free cash flow generated, this loan has now been repaid. Very nice!

They have moved from a net debt position (£2.7m) to a net cash position (£1.7m), while also paying a nice divi (yield currently c. 5%).

Q1 Trading and Outlook

Q1 is “slightly ahead of management’s expectations with regards to both revenue and profitability”.

The residential market “is expected to align with that of 2019 as we move through the year”.

And rental inflation continues to be a strong theme in 2023, being driven by “a lack of stock, unprecedented demand, and rising mortgage costs”.

It’s important to understand the sales vs. lettings mix for these businesses. In 2022, lettings were responsible for 47% of TPFG’s total revenues, and 55% of its high-quality royalty income.

The number of tenanted properties managed by TPFG only increased by 2,000 (to 76,000), but revenues were also boosted by the rental inflation mentioned above.

CEO comment:

It must be lovely to write up commentary for annual results when you have achievements like these to report:

We have delivered another strong set of record results in 2022. Particularly pleasing given the economic backdrop and contraction in residential sales transactions. In two years, we have grown group revenue almost 2.5 times, maintained recurring revenues at half of group revenue, doubled adjusted profit before tax and grown adjusted fully diluted earnings per share by two-thirds. We have also put ourselves back in a net cash position within eighteen months of our largest acquisition to date, Hunters, giving us a strong platform for future growth.

Graham's view

I’m particularly impressed with the growth at EweMove, which has doubled its territories covered in the last two years to 189.

This is a hybrid agent that puts a modern twist on traditional estate agency but without moving to the very cheap model employed by Purplebricks or Strike.

Ewemove is still quite small, so it remains to be seen what it can achieve at a larger scale. However, it does currently enjoy much higher ratings from customers than Purplebricks. Its rating against Strike is more even. Remember that Purplebricks was at one point valued at nearly one and a half billion pounds!

My overall view on TPFG remains very positive. It strikes me as a high-quality, cash-generative, shareholder-oriented company. The only thing they are missing is a share buyback, which I think could make sense at a sub-£100m market cap.

The shares may be held up currently by macro concerns. I think that TPFG is well-diversified between sales and lettings so that it can do reasonably well even in a poor sales market. But it may be fair to have some concerns about overpaying for this stock in a fragile housing market:

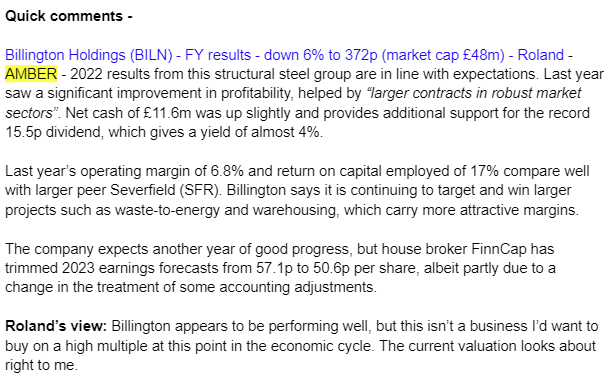

Sportech (LON:SPO)

- Share price: 18.7p (-3%)

- Market cap: £19m

It’s been a long time since we looked at this gambling share. The share price hasn’t done very well:

It returned money to shareholders in 2021, at 40p per share, after the sale of various assets.

Let’s quickly review the latest situation:

Revenues up 2% to £26m (previous year: £25.6m at constant currencies)

Gross profits up 11% to £14.2m (previous year: £12.8m at constant currencies)

Adjusted loss £0.1m (previous year: adjusted loss of £3.4m)

The company finished the year with cash of £7.4m, after paying a £7m dividend. It has returned lots of cash to shareholders, that’s for sure!

The group currently consists of a range of gaming venues in Connecticut, and also two digital businesses including one which offers lottery technology.

In sports betting at their US venues, they were very pleased with a handle of $98.7m in 2022 - this is the amount wagered by customers. The company then achieved a “hold” of 9.4%, i.e. that was the margin it achieved on bets. My understanding is that most bookies would be delighted with that number!

Comment by the Exec Chairman:

2022 Operational leverage was impressive, as modest revenue gains translated to impressive gross profit gains and a return to positive EBITDA during the year. We are reviewing various strategic options for the current business lines while evaluating online betting opportunities that leverage our brand, people and expertise. Cash position is strong and we will update the market regarding potential further shareholder capital returns ahead of the May AGM.

Outlook

Goals in 2023 include “materially” reducing the corporate cost base, evaluating a range of corporate/growth opportunities, and delivering “further capital returns to shareholders”.

Graham's view

I’m enthused by this company’s strong willingness to return cash to shareholders, which it has done repeatedly. Management claim that they are focused on the efficient use of cash and on accurately measuring their returns on capital deployed - I always like to hear this, especially when it’s true! Their words and actions do strike me as highly shareholder-oriented.

More study is required but this one strikes me as potentially interesting

Roland's Section

Volex (LON:VLX)

- Share price: 249p (+18% at 08.15)

- Market cap: £389m

Full year trading ahead of market expectations

This manufacturing group led by Nat Rothschild looks more reasonably priced than it has been over the last couple of years. Today’s trading update is ahead of expectations, so I wonder if we can expect the stock to regain some of its lost momentum.

Volex produces electrical cabling for commercial customers, including electric vehicles, medical equipment and other industrial markets. The group has been growing by acquisition as well as organically in recent years.

Today’s full-year trading update covers the 52 weeks ended 2 April 2023.

Main highlights: the company says that full-year results are now expected to be ahead of market expectations. These are helpfully included in the footnotes.

Here are the main highlights:

FY23 revenue: “at least $710m” (previous consensus $692.9m)

FY23 underlying operating profit: “at least $66 million” (previous consensus $62.9m)

Revenue is expected to be at least 15.5% higher than the prior year, with underlying operating profit at least 17.4% higher than last year.

Paul looked at the adjustments Volex uses in its underlying profits in November – they were fairly conventional, although I would subtract share-based payments charges, which were $2.6m in H1.

Costs: Volex says that it has been able to increase gross margins and manage rising costs. As a result, underlying operating margin is expected to be 9.3%, compared to 9.1% last year.

Cash flow: operating cash flow is said to have improved in H2. After capex, dividends and acquisition payments totalling $46m, the company expects to report net debt ex-leases of c.$76m.

This is said to represent a multiple of 1.0x EBITDA, “comfortably below the Group’s target leverage corridor”.

FY24 Outlook: Volex says it has “strong momentum” into FY2024 and says that market share gains are helping to offset weaker demand in some markets, such as consumer electricals.

No specific guidance on the outlook for the year ahead is provided, but Volex remains committed to its five-year strategy to increase revenue to $1.2bn by the end of FY2027, aided by acquisitions.

Broker forecasts have consistently suggested another year of growth in 2023/24. Today’s update seems likely to reinforce this outlook:

Roland’s view

Volex appears to be performing well and in reasonably good financial health. The shares look reasonably valued to me and quality metrics look acceptable, if not outstanding.

My main concern with this business is that its desire for growth may mean that it makes acquisitions which add bulk to the group, but don’t necessarily move it up the value chain or deliver clear synergies with other parts of the business.

Despite this risk, my view on Volex is broadly positive. The current rating looks undemanding and I think the shares could perform well, if Volex can continue to improve its profitability and cash generation.

City Pub (LON:CPC)

- Share price 81p (+2% at 08.15)

- Market cap: £84m

“For the first time in 3 years, I am confident about crystallising enhancement of shareholder value. The Company is now in the best shape it's ever been in.” - Exec Chairman

This upmarket pub group is focused on London, the south of England, and Wales. Today’s results show a return to profitability and suggest the group is now positioned to resume its pre-pandemic growth trajectory.

Profit margins remain low, but unlike some of its larger listed rivals, City Pub is now carrying very little debt. This – plus the group’s premium positioning and freehold estate – suggests to me it could be a more attractive prospect for investors in this sector than some of its larger and more indebted rivals.

Let’s take a look.

Financial highlights:

Today’s results cover the 52 weeks ended 25 December 2022. As expected, they show a significant benefit from the removal of pandemic restrictions in place at times during 2021.

Revenue: +63% to £57.8m

Adjusted pre-tax profit up 280% to £3.8m

Operating margin: 2.5%

Reported net profit: +£1.1m (2021: loss of £2.9m)

2022 balance sheet net asset value: 91p per share

Company estate valuation NAV: 150p per share

Net debt: £4m

Net debt was reduced significantly last year with the help of £17m proceeds from disposals.

The company says that a March 2022 valuation of its estate gives a portfolio value of £160m, or 150p per share, but it’s not completely clear to me how this aligns with the balance sheet PP&E value of £99m and lease assets of £17.6m.

However, I’m confident that at current levels, the stock is trading below book value with minimal debt – an attractive position providing some margin of safety.

Dividend/buybacks: There was no dividend, as City Pub has opted to buyback shares instead. With the stock trading below its book value this makes sense and should be accretive to NAV.

Buybacks totalled c.1m shares totalling c.£0.83m last year. Further buybacks will be considered, but the board is keen to maintain “prudent gearing levels”. Sounds sensible enough to me.

Operational update: over the last year, City Pub says it has completed a refurbishment of its estate and concluded a number of disposals. This has left the group with a strengthened balance sheet and strengthened “premium estate”.

Executive Chairman Clive Watson, who is a 3% shareholder, is now confident the group is positioned to resume progress:

Our premium estate is now fully refurbished creating, together with the strengthened management team, a platform for expansion when the time is right.

Mr Watson says that trading was challenging last year due to rising costs and staff shortages. However, he says that the company has now weathered the storm and is positioned to “adopt a more ambitious approach”.

Outlook: trading during the first three months of 2023 is said to be “ahead of expectations”, with like-for-like sales versus 2022 up by over 13%.

The group’s investment in Mosaic Pub & Dining Group was increased to 48% in April, and management expects to take operational control in the next two months. This will give City Pubs an estate of over 50 pubs, its largest ever.

The outlook for the year appears confident, although no specific guidance is provided.

Prior to today, Stockopedia consensus forecasts suggested earnings could rise by 55% in 2023. My impression is that this remains a reasonable estimate.

Roland’s view

When I last looked at City Pubs in April 2022, I was cautious about the outlook and valuation for the business.

Today, the share price is unchanged but the outlook and balance sheet appear to be improved.

Forecasts for this year imply a further improvement in profitability, in addition to continued sales growth.

I’m cautiously optimistic that this business should be able to perform well from here. However, I’m not entirely convinced that the shares offer compelling value. While City Pubs is trading at a discount to book value, the pub trade is a low-margin business that’s very exposed to consumer spending and input costs.

On a P/E basis, the shares don’t look especially cheap to me, on 18x FY23 forecast earnings.

On balance, my feeling is that this looks a good business, but it’s probably priced about right at current levels.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.