Good morning, it's Paul & Jack here with Tuesday's SCVR.

I mystery shopped TGI Fridays again last night, and will be interviewing Hostmore (LON:MORE) (I hold) management late this afternoon, which should be interesting. So a busy day ahead.

EDIT: Here is my audio interview with Hostmore CEO & CFO.

Mello Trusts & Funds Show - free! Today at 2pm. More details here. Some interesting speakers, looks good.

Agenda -

Paul's Section:

Sanderson Design (LON:SDG) (I hold) - a positive trading update for FY 1/2022. Profit guidance is raised 13%. That makes the PER only 11.4, which is clearly too cheap. We should see a decent recovery in share price now. Nice strong balance sheet too. Benefiting from UK customers on-shoring production to SDG's UK factories, after Brexit & global supply chain problems. Licensing strong, and US sales good growth. Lots to like here, the turnaround under excellent CEO Lisa Montague continues.

Gattaca (LON:GATC) - a horrible profit warning, now saying FY 7/2022 will only be breakeven (similar to H1). The staffing group has taken on loads more sales staff, who have not yet delivered increased sales. I don't have any confidence in management or forecasts, so it's no longer of any interest to me.

Brickability (LON:BRCK) - a positive trading update, saying FY 3/2022 will be ahead of expectations. Cenkos helpfully publish updated forecasts. This looks a good, growing (lots of acquisitions) group, at a reasonable valuation. Bear in mind cyclicality though, and possible one-off boost from high timber selling prices.

Hotel Chocolat (LON:HOTC) - "marginally ahead" of expectations trading update for H1. The shares are expensive, on a punchy rating, but decent growth, internationally too, could justify the high price maybe?

Blancco Technology (LON:BLTG) - a positive trading update, ahead of expectations, but no figures provided. No broker research available. I don't like the aggressive accounting, and in the past, it's generated little genuine profits or cashflows.

Jack's Section:

Henry Boot (LON:BOOT) - ahead of expectations update for the financial year. Conservatively-run, with family shareholdings, and has been around for more than a century. So it has proven its resilience in what can be a turbulent construction and homebuilding sector. Growth initiatives are in place so if conditions remain favourable then perhaps it can break through that 300p barrier.

Anexo (LON:ANX) - significantly ahead update with a sustained recovery leading to record levels of vehicles on the road. The group has grown since listing in 2018 and looks cheap on a forecast PER basis so could well rerate, but I’m not a fan of the business model and it’s very possible that regulation at some point reduces the profit potential.

Ramsdens Holdings (LON:RFX) - operations are recovering, although the exact timing on the foreign exchange business remains uncertain. Solid balance sheet though, and if you expect the group to fully recover in the medium term and execute on the growth plan, then the share price is not demanding.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section

Sanderson Design (LON:SDG) (I hold)

153p (at close, yesterday) - mkt cap £109m

Sanderson Design Group PLC (AIM: SDG), the luxury interior design and furnishings group, announces a trading update in respect of the year ending 31 January 2022…

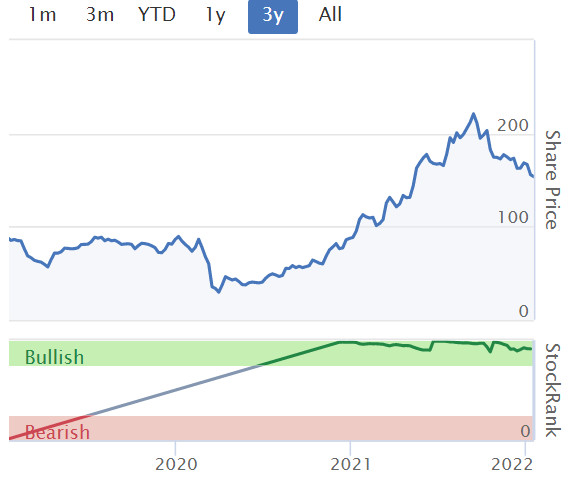

The share price here has followed the same pattern as many other small caps - a big bull run in 2020/2021, then drifting down since Sept 2021. The big difficulty with this, is whether the selling is just short-termist, uninformed traders, banking profits, or getting bored, or using a stop loss, or whether it’s informed sellers who know the company isn’t trading well? This is the quandary we have with everything at the moment.

In this case, we’ve got nothing to worry about, as the business is doing well, so it’s been uninformed selling taking the share price down -

…following a strong performance from the Company's manufacturing and licensing operations.

Whilst Group revenues for the year are expected to be only slightly ahead of Board expectations at approximately £112.0 million (FY 2021: £93.8m), the Group's profitability is expected to be significantly ahead owing to the operational gearing effect of recent manufacturing sales and additional, higher margin, licensing income.

This following bit is interesting, particularly because it mentions UK manufacturing benefiting from Brexit, due to on-shoring back to the UK. Let’s hope we see a lot more of this, generally - I think it’s been a foolish mistake that the West has become so dependent on supply chains from China - an increasingly hostile and aggressive totalitarian dictatorship, remember.

The Group's manufacturing operations have continued to benefit from very strong order books. Third party sales are expected to be up approximately 33% in the year compared with the prior year, in part reflecting the attraction of onshore UK production for UK customers following Brexit and COVID-19 related global supply chain issues, along with strongly growing international sales. Both of the Group's manufacturing sites, wallpaper printing in Loughborough and fabric printing in Lancaster, performed well.

Licensing - strong performance from licensing. I don’t understand this following point about IFRS 15 -

This performance reflects the recognition of accelerated income under IFRS15 along with robust sales from existing licensees, notably NEXT's Morris & Co. womenswear and the core categories of window coverings and bedding.

Profit guidance - top marks for clarity here, well done SDG (and your advisers) -

As a result of the above, the Board expects adjusted profit before tax of at least £12.0 million for the year ending 31 January 2022 (FY 2021: £7.1m).

Net cash - has further strengthened, but we’re not told how much. Oh yes, of course that’s because the year end hasn’t happened yet, being 31 January 2022! I was initially thinking about 31 Dec year ends, which is not the case with SDG.

The Company's balance sheet has further strengthened during the second half of the year. The net cash position at 31 January 2022 is expected to show an improvement on the £15.4 million, excluding leases, as at 31 July 2021.

Importantly, a growing cash pile means the group is financially secure, and has options re bolt on acquisitions and/or increased divis.

Valuation - I’ve not seen any updated broker research yet. An old note from Progressive (dated 11 Nov 2021, and very useful for background info on the company) shows £10.6m forecast adj PBT for FY 1/2022.

The company says today actual will be at least £12.0m, so that’s a £1.4m, or 13% profit beat - very good.

Adding 13% onto the previous 11.8p forecast EPS arrives at 13.4p EPS

At 153p per share, divided by my estimate of 13.4p EPS, the PER is only 11.4 - that’s too cheap, and I see maybe 50% upside on that price (230p/share).

My opinion - it strikes me as being the wrong price - clearly too cheap. Unless you think profits are likely to go down, then a PER of 11.4 seems inappropriate. I would have thought a PER of 15-20 would make more sense, given the turnaround underway, strong balance sheet, and value of the unique, large, and historic design catalogue.

I wouldn’t be surprised if the company attracts a takeover bid, given the under-valuation currently.

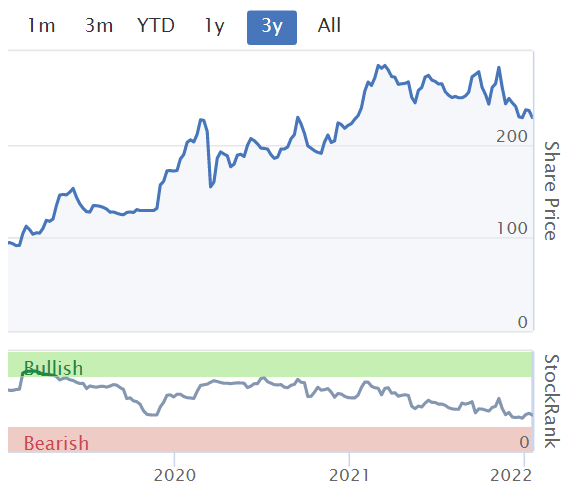

Stockopedia's computers like it too, and this high StockRank could rise further, once increased broker forecasts, and a recovering share price feed through into the value and momentum scores -

.

Gattaca (LON:GATC)

96p (down 31% at 08:32) - mkt cap £31m

Bad luck to holders here, hit today with a nasty profit warning.

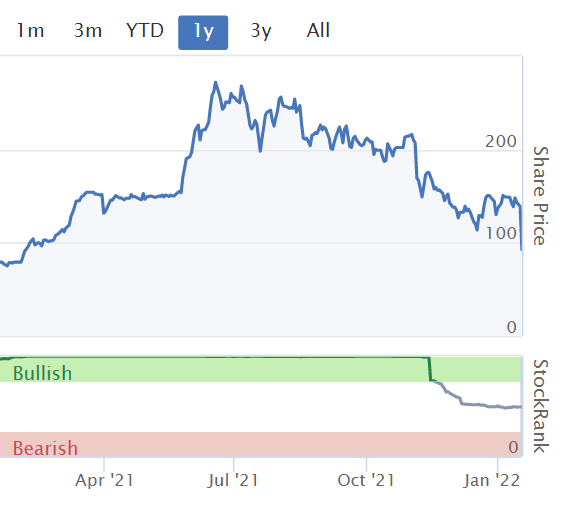

There’s an interesting discussion below in the reader comments - that the weak share price at GATC, was indicating things were not going well. There again, as we saw above with SDG, a weak share price in recent months did not indicate anything at all there, it was just general market drift, despite the company trading well.

This is the main difficulty we face - share prices do not necessarily reflect how a company is trading. Sometimes they do, and sometimes they don’t.

Also, even when share prices do reflect the fundamentals, they often overshoot up or down.

It’s particularly tricky at the moment, with so much uncertainty, and there’s no easy answer. If investing was easy, we’d all be billionaires!

Gattaca plc, the specialist Engineering and Technology recruitment solutions business, provides the following trading update.

Following a review by the Board of the outlook for the business for its financial year ending 31 July 2022 ("FY22"), it now anticipates the Company's continuing underlying profit before tax will be significantly below market expectations. This is driven by delayed recovery in our contract business where the improvement in our customer's demand has been slower than expected we now foresee a lower growth rate in the second half of the financial year.

Revised profit guidance - it’s only going to achieve breakeven for FY 7/2022 - that’s appalling! Previous broker forecast was £6.0m profit. This is in buoyant markets - other staffing companies are doing well - look at how many times Jack has updated us positively on Robert Walters (LON:RWA) for example.

… with continuing underlying profit before tax for its financial year ending 31 July 2022 to be around breakeven.

What’s gone wrong? A large increase in costs (UK sales headcount up 24% since Jan 2021), combined with inadequate sales growth.

Revised forecasts - I don’t have any confidence in management, or forecasts, given this huge profit miss announced today.

For the record though, FY 7/2023 is now 13.7p, and FY 7/2024 is 20.6p, but how realistic are those forecasts, given that this year has now been slashed to just breakeven?

My opinion - the forecast numbers previously looked quite attractive for GATC, but now it’s clear the company is performing so badly, I don’t have any confidence in management or forecasts, so won’t be investing. This was a near-miss for me, as I almost bought back in on recent weakness.

On the plus side, its last balance sheet was sound, with NTAV of £26.4m, so there are no solvency or dilution issues.

How is it that other staffing companies are doing so well, in a favourable market, yet GATC is not making any money at all? The only conclusion is that the business isn’t much good as things currently stand, so the bears such as BnB were right.

It may recover from here, which would make sense given that new sales staff would take time to build up leads & contract wins.

It’s important to put emotions aside, and think about the fundamentals, when hit by a profit warning. I find an emotional response to immediately buy more on a profit warning, is nearly always a mistake. Sometimes just ditching them, and walking away, can be a good way to avoid further bad news, and the vortex of anxiety and mental energy that gets sucked into the often protracted recovery (if there is one at all) from poorly performing shares.

That’s a decision everyone has to make for themselves.

The way I look at things is this, when a profit warning happens:

If the problems are temporary, caused by external factors, and fixable, then I’ll usually sit tight, wait for a few weeks for the price to settle, and to consider my options carefully over time, and then maybe buy more.

If problems are something inherently wrong with the business model/management, then I should probably sell (but often fail to do so, due to stubbornness).

Anyway, it’s your money, so your choice as to what to do. But this clearly is not a very good business as things stand.

.

.

Brickability (LON:BRCK)

102p (up 4% at 09:26) - mkt cap £304m

Brickability Group plc (AIM: BRCK), the leading construction materials distributor, today announces the following update on trading for the financial year ended 31 March 2022.

For background, I’ve just read Jack’s review in Dec 2021 of interim results to 9/2021. The figures look good, and there’s been a rapid pace of expansion through acquisitions.

Note that equity was raised to fund some acquisitions, so the share count has risen from 230m in 2020 to 299m now, 30% more shares. Hence profit growth needs to be adjusted down by 30%, or easier to value the share on EPS numbers, which already take into account dilution.

Revised guidance - today we get a positive update, with EBITDA guidance being raised -

Following the release of the interims results for the six months ended 30 September 2021, the Group has continued to deliver a strong performance across all of its business divisions.

As a result, the Brickability Board is pleased to announce that it now expects to report an adjusted EBITDA* of a least £32 million for the full year to 31 March 2022, ahead of current market expectations.

Unfortunately, there’s no footnote to explain what previous market expectations were, which is annoying, as it wastes our time having to look it up. Plus we have to work out what EPS is, in order to value the share. It's so frustrating that companies are told by their brokers to use EBITDA as the key profit measure, when it's generally not the figure many private investors want to see - most of us are interested primarily in EPS, although I can't speak for everyone of course.

Many thanks to Cenkos, for publishing an update on Research Tree, which explains this is a 13% increase in profit guidance.

At least some of the out-performance has been driven by BRCK’s timber merchant business, benefiting from much higher selling prices we’ve seen in that sector (also confirmed by James Latham (LON:LTHM) ). How long will this boost last though, I wonder, before prices normalise when supply chains catch up with demand? So should we be treating some of BRCK’s increased profits as a temporary one-off boost?

Cenkos is estimating 8.3p EPS for FY 3/2022, which should be reliable, as it’s mostly in the bag by now. That’s a PER of 12.2 - seems modest, although this sector won’t attract premium valuations generally.

Outlook - this sounds positive -

Taylor Maxwell and the other businesses acquired by the Group during the current year have continued to perform well and the sustained positive momentum and optimism within the UK housebuilding sector is reflected in the Group's forward order book levels, with demand for the Group's product offering building throughout this year and expected to continue into the new financial year.

Balance sheet - checking back to the last interims, BRCK’s balance sheet is modest, at NTAV of £19m. Also note it is unusual, in holding very little inventories - since the business uses mostly a drop-shipping model, I believe. That greatly reduces the need for working capital, which looks good, providing the manufacturers don’t decide to by-pass BRCK and sell direct to the end customers - probably the biggest single risk with BRCK’s business model.

My opinion - the numbers look good. Strong profit growth, ahead of expectations, and a reasonable valuation.

It’s up to you to assess what the future prospects are. We just review the figures here.

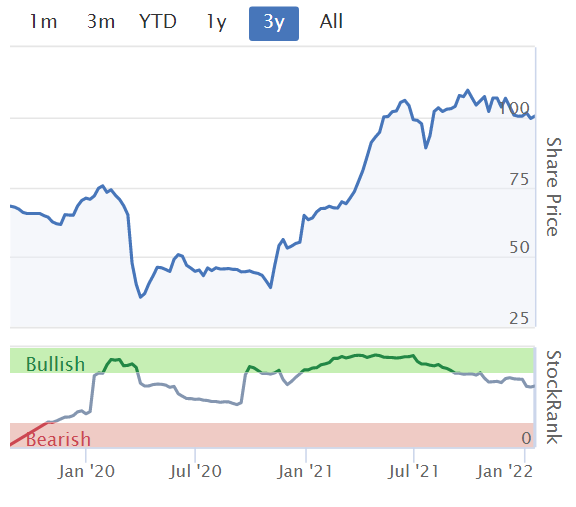

Note how this share has been resilient in recent months - an encouraging sign - when many other small caps drifted down.

.

.

Hotel Chocolat (LON:HOTC)

518p (up 1.6%, at 11:22) - mkt cap £711m

Hotel Chocolat Group plc, a premium British chocolatier and omni-channel retailer, today announces a trading update for the 13-week period ("Q2") and the 26-week period ("H1") ended 26 December 2021.

Good revenue growth -

Total Group revenue for H1 has been strong, increasing 40% compared to the prior year, and by 56% compared to the equivalent period in the financial year ended 28 June 2020 ("FY20"), the last equivalent period prior to the impact of Covid-19

Note that HOTC is international, with particularly impressive growth in USA +128%, and Japan (JV) +131%

Outlook - given the high rating, is this good enough? -

Trading throughout the period has been encouraging and the Board now expects trading to be marginally ahead of management's expectations for the current financial year.

Diary date - 2 March 2022, for Interims (6m ended 26 Dec 2021)

Growth drivers - lots of activities underway -

"All of our six growth drivers are behind the acceleration in sales:

Velvetiser in-home drinks system,

VIP Loyalty rewards, and Digital,

whilst the USA,

Global Wholesale,

and the Japan joint venture

are finding the formula for sustained growth, and our UK domestic market still has huge potential.

Forecasts - many thanks to Liberum for crunching the numbers, as follows:

FY 6/2022: 11.8p EPS, PER of 44

FY 6/2023: 14.1p EPS, PER of 37

FY 6/2024: 18.2p EPS, PER of 28

Punchy ratings, but given the international appeal of the brand, and some recurring revenues from subscriptions, you can justify this rating. Providing nothing goes wrong of course.

My opinion - it’s worth considering as a long-term investment, if you can stomach the high rating.

.

.

Blancco Technology (LON:BLTG)

232p (up 4% at 12:40) - mkt cap £175m

Blancco Technology Group PLC (AIM: BLTG, "Blancco", the "Company" or the "Group"), the industry standard in data erasure and mobile lifecycle solutions, is pleased to provide the following trading update for the six months ended 31 December 2021 ("H1 FY22").

Full Year Results expected to be above expectations, driven primarily by increasing industry tailwinds of sustainability and governance

Strong revenue growth in H1 (no figures provided), above expectations.

New business won in H1, and further strengthened pipeline.

Upbeat-sounding outlook comments.

Profits - up, but no specific numbers -

The operational gearing inherent within the business, combined with continued cost savings, have resulted in anticipated operating margins for H1 FY22 increasing significantly. As a result, adjusted operating profit, adjusted EBITDA and cash are all expected to be comfortably above the board's expectations.

My opinion - neutral, as I can’t find any broker notes, so am not able to flesh out the narrative with numbers.

Looking back at the last full year results to FY 6/2021, the accounting looks aggressive to me, with little genuine profit, after share-based payments and amortisation of acquired intangibles are included (adj operating profit £2.3m, real operating profit £1.8m).

Half of the cashflow was spent on development spend last year.

As the company says, operational gearing could make the figures look a lot better, but I certainly wouldn’t come anywhere near a valuation of £175m based on the track record so far.

.

.

Henry Boot (LON:BOOT)

Share price: 279.5p (pre-open)

Shares in issue: 133,319,228

Market cap: £372.6m

This is a conservatively run construction group that has been operating for well over a century now. The founding family remains involved which suggests it may have a slightly different culture to some other developers out there as the family continues to own stock.

It’s got a respectable dividend track record, maintaining some form of payment to shareholders in the aftermath of 2007/8 and Covid, so could be a good longer term holding.

The share price has struggled to break through 300p in the past but the group has growth initiatives in place and current momentum is good so that could certainly change at some point, although it does suggest a degree of patience might be required.

Trading statement for the year to 31 December 2021

We've had a good year ahead of expectations, operating in strong markets and also making very encouraging progress against our recently declared medium term strategic targets.

There’s been an uplift in industrial & logistics capital values (both in completed retained developments and existing investments) alongside a strong performance from the strategic land business.

Boot’s key three markets are industrial & logistics, residential, and urban development. All have performed well and the group has invested £66m into new opportunities in these markets. Net debt of c£44m is ‘comfortably within the targeted operating gearing range of 10-20%’.

Hallam Land Management (HLM) is materially ahead of expectations, driven by strong demand from housebuilders for residential land. This division added over 1,000 acres to its landbank, capable of delivering 7,600 plots, and growing the total land bank to over 92,500 plots (2020: 88,700). The group has also submitted a planning application for 3,100 plots, commercial development, and a primary school in Bicester.

Henry Boot Developments (HBD) completed on developments with a Gross Development Value (GDV) of £298m (HBD share £68m, 2020: HBD share £58m) and continues to build up its committed development pipeline amid strong industrial occupier demand. The value of the investment portfolio has continued to grow following acquisitions and valuation gains ‘significantly ahead of expectations’.

Stonebridge Homes (SBH) completed on 120 units (2020: 115 units) in what Boot calls a buoyant housing market, achieving sales of 0.83 units per site per week (2020: 0.90). The land bank is up from 1,119 plots to 1,157 plots and provides 5.7 years of supply based on a one-year rolling forward sales forecast.

At the beginning of 2022, SBH has secured 68% of its annual delivery target of 204 units for 2022 and the strategic objective to grow this business to building 600 units per year is on track.

Henry Boot Construction has performed well and Banner Plant is trading above pre-CV-19 levels.

Outlook - good momentum, robust balance sheet, strong momentum across its operations and a good pipeline of opportunities.

Whilst market conditions remain supportive for the Group to deliver its short and medium-term targets, Henry Boot continues to monitor the shortage of materials and labour in the UK construction industry, in addition to increasing build costs. However, the business is currently managing these challenges effectively, with the added benefit of sales price increases.

Conclusion

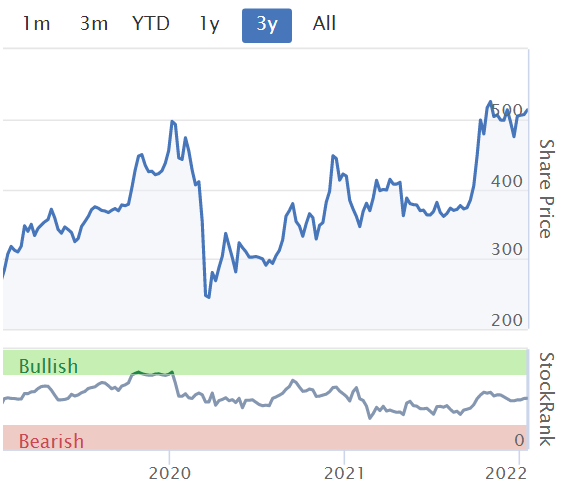

Seems to be a good update, and the valuation is hardly demanding here given a Quality Rank of 81. Mind you, a modest PE ratio is the norm here, so that might not change.

Nevertheless, Henry Boot strikes me as a dependable operator - it has been around for more than 130 years, after all.

It pays a dividend, but at 2.31%, it would hardly make up for a stalling share price... I like the company though. It seems like a safe pair of hands, and the price to tangible value of 1.12x is attractive.

It’s a cyclical industry, so if a recession hits then all bets are off for a while but I would think this is one company that would survive a downturn. The dividend track record suggests as much.

On the other hand, if conditions remain more favourable we could see a return to around 30p of earnings per share the group was previously generating and I’d back that 300p resistance level to fall at some point.

Anexo (LON:ANX)

Share price: 157.85p (+7.02%)

Shares in issue: 116,000,000

Market cap: £183.1m

Anexo is a specialist integrated credit hire and legal services provider. It provides replacement vehicles to consumers who have been involved in a non-fault accident but have no other access to a replacement vehicle. It then charges credit hire, rather than spot hire rates, and recovers the charges from the at-fault insurer.

Trading update for the year to 31 December 2021

The Board is pleased to announce that revenue growth has exceeded the Group's forecasts and that profit before tax will be significantly ahead of market expectations.

Anexo notes a ‘sustained recovery in its core business following the easing of the second national lockdown in March 2021’, with the number of vehicles on the road in its credit hire division (EDGE) peaking at record c2,500 in December 2021. The number of vehicles on the road currently stands at 2,300.

This has been helped by a strong motorcycle courier market, the withdrawal of competition due to Covid and the Civil Liability Act (May 2021), as well as the MCE deal announced on 25 November last year.

The group’s legal division, Bond Turner, has benefitted from the gradual reopening of courts. This trend is expected to continue.

Final Results for the year ended 31 December 2021 will be announced on 11 May 2022.

Conclusion

This is a new company to me. The things that stand out on the StockReport are:

- Growing revenue and profits,

- Strong margins and returns on capital (excluding the Covid period),

- Low Piotroski F-Score of 3, and

- Poor cash conversion, with the company very often free cash flow negative.

So signs of growth, but not a clean bill of health.

The cash conversion is likely explained by the business model, although I’m no expert in this regard. Anexo tends to spend its cash on more trade receivables (ie. the funding of new claims). Roland took a more detailed look here - it’s well worth a read, as are the comments as a gauge of sentiment.

The group says it has benefitted from the new Liability Act, which is a positive, but it also shows that regulatory risk is there in future. I’m not sure about the quality or stability of the profit opportunity here. It seems like the whole thing is focused on exploiting a loophole, at least in spirit, in order to hire out cars at high rates.

It’s still below pre-Covid levels and trading is strong, so the shares may well rerate from that modest earnings multiple, but I’m not comfortable with the business model.

Ramsdens Holdings (LON:RFX)

Share price: 164p (-1.5%)

Shares in issue: 31,393,207

Market cap: £51.5m

Annual results for the year to 30 September 2021

- Revenue of £40.7m,

- Gross profit of £22.3m (gross margin of 54.8%),

- Profit before tax of £0.6m,

- Net assets up sightly to £36.1m,

- Net cash of £13m,

- Final dividend of 1.2p declared.

For some reason, the group is comparing the 12 months of FY21 with the preceding eighteen month financial period. Ramsdens says this is because the two twelve month periods are not comparable due to Covid impacts. But I’m not sure how comparing a 12M period to an 18M period fixes that.

The profit before tax figure is aided by £1.6m of government support in the year, including £1.5m of furlough money.

Foreign exchange volumes were significantly impacted in Summer 2021, more so than in the prior summer, with foreign currency income approximately £10m lower than pre pandemic levels.

The investment in online retail jewellery has led to online sales more than doubling year on year.

Q1 update (October to December 2021)

- In store retail jewellery revenue up more than 30%,

- Online retail jewellery up more than 70%,

- Foreign currency volumes were c40% of pre-pandemic levels, up nearly 200% year-on-year,

- Pawnbroking loan book has from £5.9m in December 2020 to £6.8m in December 2021,

- The weight of the gold purchased from customers was approximately 80% of pre pandemic levels and was up c50% on October to December 2020.

The group's balance sheet and liquidity remain strong with cash of approximately £13m at the period end. This will enable further investment in new and relocated stores, as well as jewellery retail operations.

Conclusion

I’m slightly puzzled by the layout of these results, but Ramsdens remains a sensible, modestly valued small cap (assuming you expect a full recovery to FY19 levels of trading).

We’re still not back to normal operations here, but there is progress, and the group has a net cash position along with good control over costs so far.

I would view any further delay to FX volumes as a temporary setback and, taking FY19 EPS of 21.4p as the most recent ‘normal’ figure, think the shares look reasonable value at 7.8x FY19 earnings. Whether or not that’s how the market would react to further international travel disruption is another matter.

As with Henry Boot, it’s a stock that may well have so far frustrated holders.

It does seem as though Ramsdens offers superior growth potential though, with rising cash-backed earnings (on a 5Y compound annual growth rate in excess of 20%). So there is perhaps scope for a rerating of this company in a way that probably does not apply to Henry Boot.

I’d say it’s fairly valued for now given the near term uncertainty. In the medium term though, I expect operations to get back to normal and for the company to be growing via self-funded investment, so it probably is worth spending a bit more time on Ramsdens.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.