Good morning!

There's a huge supply of announcements today. I have a dental appointment this afternoon but will come back and write a little more afterwards.

The list ended like this:

- Cenkos Securities (LON:CNKS)

- Judges Scientific (LON:JDG)

- Escape Hunt (LON:ESC)

- Flowtech Fluidpower (LON:FLO)

- Focusrite (LON:TUNE)

- City of London Investment (LON:CLIG)

Sorry for not getting around to Cloudcall (LON:CALL), but I think Paul is the expert in this share. He will be back later in the week. Perhaps he will have a chance to review it for us then.

Thanks!

Graham

Cenkos Securities (LON:CNKS)

- Share price: 92p (-7%)

- No. of shares: 55 million

- Market cap: £51 million

A few words on this Nomad/broker as it is one I have some familiarity with.

These are very poor results as profits have collapsed almost to nothing (£0.3 million).

But it is still profitable, although only just.

What I find impressive about Cenkos is that it has never made a loss in 13 years of history as public company.

This is due to compensation plans which very heavily reward results, and then are flexible to dry up when results deteriorate.

For example, in this H1 period, revenues collapsed by 38%. It's not a stretch to imagine that most businesses would suffer a loss if their revenues fell by 38% compared to the prior period.

Demonstrating the flexibility of employee pay, staff costs also fell in the period, by 32.5%. The banker bonuses were significantly reduced.

Drilling into the revenue streams, I see that every single one of Cenkos' activities saw reduced sales this period.

The largest revenue stream also saw the largest percentage fall: corporate finance fees are down 44%. This is a feast-and-famine type of business. It heavily depends on market conditions and on the earning power of the company's top investment bankers.

Nomad/broking fees were about flat, research fees were down 12% thanks to MiFID II, and execution fees were down 43% due to exceptional gains made last year.

Like most investment banks, the research and execution divisons are minor contributors to revenue. It's the corporate finance division that really matters.

Corporate finance fees are down by £9.3 million but when you consider that last year's results benefited from a £10.6 million boost from a single deal, it's not such a bad result. Total revenues are actually up 18% compared to the H1 period of two years ago.

Something else that has changed this year is that the company has included its net assets in its financial highlights.

It's nearly always a worthwhile exercise to see the subtle ways that presentation changes from year to year.

I wonder if the inclusion of net assets this year (in addition to cash) is meant to serve as a reminder to investors of the underlying value in the company. Net assets have reduced slightly but are still are hefty £26.3 million, while cash is £21.7 million. Very material in comparison to a £51 million market cap.

Outlook - there's never much visibility, and the "outlook" section doesn't even bother including a forward-looking statement. Instead, it merely says that the company has made "a good start to the year".

My view - this is not a "compounder" type of share and simply by virtue of what it does, it's never going to be a particularly high-quality investment.

That said, it does have a proven business model of never making a loss (although since I keep mentioning that, perhaps 2018 will be the year if finally falls into the red!)

When you combine the fact that it never makes a loss (so far) with the extremely strong balance sheet and its strong position as a Nomad/broker in the City, this is a stock I could be tempted to buy into again, at the right price. I would want it to be a "deep value" type of investment.

In the long-term, mid-sized banks like this typically end up merging with larger rivals. I expect that is how this story will end, though the time-frame is anyone's guess.

The StockRank is 78, including a Value Rank of 96. I would be cautious about assigning a P/E multiple to this share, however. Earnings can do almost anything at all from year to year.

Judges Scientific (LON:JDG)

- Share price: 2720p (+5%)

- No. of shares: 6.2 million

- Market cap: £169 million

This company is proving out the thesis that it is a long-term compounder. It invests in scientific instruments businesses, typically using a combination of reinvested earnings and debt.

Sparkling H1 results:

- revenues up 13% (5.7% organic)

- adjusted PBT up 50% to £6.6 million

- statutory PBT up 100% to £4.2 million

The cash generated from operations is £6.3 million, approximating the adjusted PBT figure rather than the statutory PBT figure.

The non-cash amortisation charge is £2.1 million, so that might have been expected. Though there are a lot of other ingredients to cash flow. too.

Outlook - ahead of FY 2018 expectations.

My view - this looks and feels like a business that is going to continue to compound earnings for investors. Today it reports a "return on total invested capital" of 24% on a trailing 12 month basis, up from 17% the prior year.

If it could continue to go at anything like these rates, it will produce fabulous wealth for shareholders.

Risks - the company itself says that:

Currency fluctuations and the ups and downs of government spending in various parts of the global market for our products continue to be the main factors influencing demand in the short term and causing it to oscillate around the long term positive trend driving the scientific sector.

I would go further than this and say that I personally would find it very difficult to appraise Judges' underlying scientific businesses (you can see a list of them here). There are too many of them to keep track of, for a start!

So I think you have to approach this as you would a fund or any other investment vehicle. It's about whether or not you buy into the concept of what it's doing, the management team, their approach and the overall risk levels.

On all counts, this looks a pretty solid investment to me.

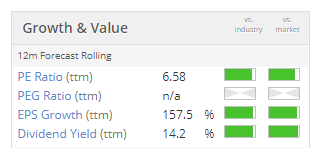

The JDG StockRank reminds us that quality must be paid for. It suggests that Judges could offer better-than-average prospects despite the elevated rating:

Escape Hunt (LON:ESC)

- Share price: 109.5p (unch.)

- No. of shares: 20 million

- Market cap: £22 million

As was expected, the H1 numbers aren't pretty from this escape room operator.

It has been listed since May 2017 and is growing from a very small base.

We have revenues of £800k and an adjusted EBITDA loss of £1.4 million.

Net cash is £6.4 million, down £4 million in six months.

I'm a bit concerned that the company might have listed too early in its development. It has spent £2.2 million on capex and also suffered a £1.8 million operating cash outflow. There's no getting away from the fact that it's still a very small company.

It does have the flexibility to decide how many further new sites it opens after the initial tranche. We will have to see how the newly opened sites perform.

At this stage, it looks very speculative to me.

Flowtech Fluidpower (LON:FLO)

- Share price: 121.5p (-28%)

- No. of shares: 61 million

- Market cap: £74 million

It's a sharp fall at this hydraulic/pneumatic products business.

It has traded at a "cheap" valuation and enjoyed a high StockRank for some time. Its most controversial (or interesting, depending on how you look at it) feature is its active acquisition strategy.

For example, these numbers show revenue up an amazing 65%. The price for this is equity dilution and a more than doubling of the debt load.

We also get a warning:

Whilst recent trading has remained positive, there are some signs, particularly in some engineering businesses, that growth may be softening. As such while we remain confident in the prospects for the future growth in both our markets, and the enhancement our coordinated activities will bring, we are cautious about prospects in the short term until clarity is achieved on the post - Brexit UK economy. Beyond this short-term view, the Board remains confident in the overall Group strategy being adopted."

I don't know if I really buy this. JDG reported great results today without any need to blame the macro picture.

We can compare and contrast the JDG and FLO acquisition strategies. JDG uses retained earnings to buy new businesses, using a modest amount of debt.

FLO, on the other hand, has increased its share count at a much faster rate and taken on a much bigger debt load, while earning inferior quality metrics (ROCE, ROE) compared to JDG. For these reasons alone, I am much more interested in JDG!

As far as FLO is concerned, the vagueness of today's warning probably hasn't helped the share price. There is no real explanation given, just a view that there are "signs" of softening growth for FY 2019.

For FY 2018, results are expected to be only "marginally below" market expectations, due to the delay and possible loss of a contract.

It doesn't sound like the company has run into any serious difficulties yet so if you were already bullish on the company and looking for an opportunity to buy, today could be that chance. Meanwhile, existing holders can justifiably feel bemused by today's aggressive share price reaction!

Focusrite (LON:TUNE)

- Share price: 409p (-9%)

- No. of shares: 58 million

- Market cap: £237 million

This developer of hardware and software products for the music industry has also seen a curious sell-off today.

I say "curious" because revenues for the year ending August 2018 are forecast in line with expectations, up 15% on a constant currency basis.

We knew that H2 would probably be slower than H1, due to the heavy weighting of sales around Christmas.

Perhaps this bit has spooked investors?

The business is well positioned to continue to grow as our strategy resonates with consumers throughout the world. However, we remain mindful and cautious of current major macro-economic factors in the US and UK/Europe, and will continue to watch them vigilantly as they unfold to assess how they could potentially affect our business

A reader has mentioned tariffs by the US on Focusrite's Chinese suppliers as a potential source of concern (though Focusrite is headquartered in the UK, as you'd expect).

It's another vague cautionary statement from a company. I don't like vague cautionary statements from companies, as you can probably tell by now!

Whether it is referring to tariffs, Brexit or something else, I don't know.

It's great that the company is keeping an eye on future developments which might affect the business.

For investors though, I think we need to do our best to avoid fear that doesn't have a specific justification - detailed information about a tariff that will increase the costs faced by a company, for example.

We need to avoid fear without justification and instead be "structurally bullish", to borrow wording from Nick Train.

In other words: the macro environment plays a role, but we shouldn't let macro fear influence our decisions too much. Instead we should align ourselves with the long-term growth of equity markets and in particular with the growth of good companies.

For what it's worth, I do think that Focusrite is a very good company. So in the absence of a specific reason to be fearful, I'd be optimistic for its prospects.

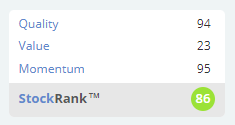

I'm not the only one who thinks so. As such, there's still quite a lot of positive sentiment baked in to the share price (these metrics are from last night):

City of London Investment (LON:CLIG)

- Share price: 407.5p (0.6%)

- No. of shares: 27 million

- Market cap: £109 million

I've written positively about this institutional asset manager before and this appears to be another fine set of results (released yesterday).

Funds under management are up 10% (USD) or 8% (GBP), depending on how you measure it. Revenues also improve by 8%.

The Chairman is leaving after 12 years on the Board, and reflects on progress during his tenure.

As far as shareholders are concerned, they have made a total return of 377% over this time period.

And unless I've made an error, that works out at an annual compound return of 13.9%. Very good indeed!

He attributes the company's success to a) the investment methodology, b) efficient operations and c) fair treatment of staff.

The emerging markets closed-end fund (CEF) is still the core strategy. It under-performed its benchmark index during the year, but CLIG says the strategy remains "very profitable and viable", and is proud of the long-term record.

According to the Strategic Report, the strategy suffered during the year from an underweight position to the IT sector. IT is now worth a massive 28% of the emerging markets index, "the largest EM Sector index weight for at least 20 years".

I have been warning for some time now that I think the NASDAQ and shares around the world classified as SaaS/fintech/Internet of Things are overvalued. So I would back up CLIG's view that the strong performance and heavy weighting of IT is due for some mean-reversion.

Outlook - the company is heavily exposed to the political-economic tremors in Argentina, Turkey, China, etc.

In contrast to how other companies and directors might describe these conditions, this Chairman doesn't spread fear unnecessarily. He notes that there are various problems faced by these countries, and then leaves it up to shareholders to decide if CLIG is too scary/risky for us. Perfect!

At City of London I believe we are well placed other than if there were a general downturn in markets worldwide and even then our flexible cost structure will stand us in good stead.

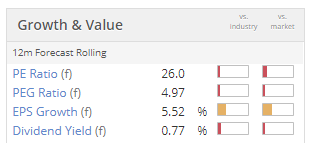

The risk of the shares is reduced by a nice cash pile. See how it has grown:

The company says it has been looking for acquisition opportunities for 10 years! But it hasn't found any, due to "egos, investment performance, costs and culture differences".

That deserves praise: it has resisted the urge to do a bad deal. No deal is often better than a bad deal, after all, or so they say. For CLIG shareholders, no deal means that surplus capital will probably get distributed to them.

The CEO is retiring in December 2019. In a remarkable act of transparency, he has announced the intention to sell 500,000 shares at each of 450p, 475p and 500p. Highly commendable.

His departure and the Chairman's sound like they are being handled very professionally and smoothly.

My opinion

I was impressed by this company the first time I looked at it, and I'm impressed by it again.

It's a shame that the Chairman & CEO are leaving, but I'm inclined to trust that their successors will maintain the culture.

What I really like is their lack of pretense and willingness to ignore standard corporate practice. The CEO doesn't bother with FuM targets because they "imply / encourage growth", which leads to risk-taking and errors in conditions when growth is impossible.

He also doesn't want for the company to be big just for the sake of it: he prefers to have a greater number of small units. I like this sort of unorthodox approach. Hopefully the new management team will maintain this tradition.

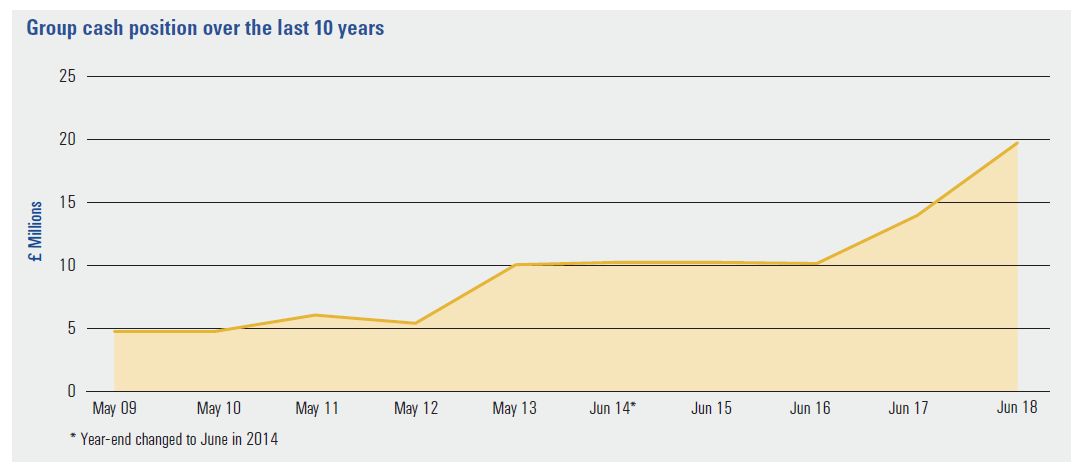

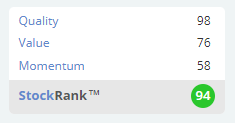

This share has a StockRank of 94 and an EV/EBITDA ratio of 7x (according to Stocko). A very interesting proposition!

That's all for now, thanks for dropping by!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.