Good morning, it's Paul here.

Firstly, please accept my apologies for the break in coverage last week. Things are back on track now, so we'll have full coverage this week. Hopefully I'll also be able to recap on one or two interesting things from last week too.

Today I'll be reporting on results or trading updates from: DotDigital, Koovs, NWF, and Kromek.

dotDigital (LON:DOTD)

Share price: 97.0p (up 1.0% today, at 08:15)

No. shares: 295.8m

Market cap: £286.9m

AGM statement (trading update) - this company calls itself;

... the leading provider of intuitive software as a service ("SaaS") and managed services to digital marketing professionals through the 'dotmailer' platform

This share has been a long-standing favourite of mine here over the past 5 years, but (stupidly) I've always baulked at the high valuation - even when it was 17p per share! It just goes to show, that good companies grow into, and soon overtake an apparently high valuation.

The company has a 30 June year end, so today's update covers the bulk of H1 06/2018.

"The Group has seen the positive trading momentum highlighted in the 2017 preliminary results continue into the first half of the new financial year.

This progress is in line with management expectations and is driven by strong international sales and growing demand for dotmailer in the ecommerce market...

Sounds good.

Note that the company spent about half its cash pile recently, buying a group of companies called Comapi for £11m. This is a messaging software company, which seems to be in the process of being integrated into DOTD's existing software.

My opinion - this seems a quality outfit, which hasn't put a foot wrong. The market has rewarded that with a multibagger share price over the last 6 years.

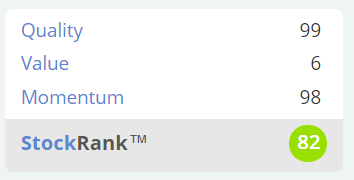

The StockRank sums it up very clearly - quality & momentum, but pricey;

The interesting thing here is that bulls could argue that DOTD is only scratching the surface of its potential markets. More detail is given in today's announcement about the "Connectors" between DOTD's dotmailer platform, and ecommerce leaders such as Shopify, and Magento (which are widely used platforms for ecommerce sites).

Another impressive trait of DOTD is that its growth is self-funded, so the share count has only increased marginally in the last 5 or 6 years, despite profits soaring. That's mightily impressive. It also has very high profit margins. There's an awful lot to like about this company. It's tempting, even at the current forward PER of 28.5

Koovs (LON:KOOV)

Share price: 16.25p (down 39.8% today, at 09:13)

No. shares: 175.4m

Market cap: £28.5m

Koovs plc (AIM: KOOV), ("Koovs" or the "Company") the fashion-forward business focused on the young Indian e-commerce market, today announces its interim results for the six months to 30 September 2017.

These figures are absolutely dire. To clarify that, the figures are always dire from Koovs, but the one saving grace in the past has been rapid revenue growth. The stock market will often give rapidly growing companies the benefit of the doubt over losses & cash burn, if top line growth is soaring.

What's so shocking about today's results from Koovs, is that revenue growth has completely stopped. Here are a few numbers for H1;

- Revenue £3.9m, down 1.1% on H1 PY (remember that this is meant to be a rapid growth stock)

- Gross profit minus £12k - so they're basically selling clothes for the cost of manufacture

- Overheads £7.7m

- Operating loss £7.7m (remember these are just 6 months figures)

Looking at the balance sheet, there is cash of £5.6m, plus bank deposits of £3.7m, so the company probably has enough cash to last until spring 2018 by my reckoning.

Receivables looks very high, at £7.6m - that's almost a year's revenues sitting in receivables. Seems odd.

There is also "loans & borrowings" of £6.9m, so the net cash figure is minimal. This £6.9m is the convertible (at 40p) 6% loan notes.

The narrative is just delusional nonsense, so best ignored. Businesses that don't have a viable business model always try to sprinkle glitter over things by steering investors towards meaningless KPIs.

Outlook comments - clearly not good, as there's not enough cash to drive growth through marketing. Note also that "sales" here are not the same as "revenues";

With modest additional marketing spend, the important month of November delivered a significant year on year improvement across key metrics, with Sales up by 17% to 1.7m and website traffic up 43%.

However, marketing expenditure is currently significantly down due to the ongoing funding requirements of the Group, which the Company expects to affect FY18 sales overall.

Additional marketing expenditure is conditional upon the timing of closure of the funding programme announced in July 2017, which the Company continues to expect to close shortly.

It's stating the obvious, but a funding round from July which hasn't closed by December, suggests that funders are not too keen to inject more cash. Why would they, since that cash is already earmarked for total destruction.

My opinion - the business model at Koovs has been all wrong since the start. The central overheads are far too large, sales are too small (and not even growing any more), gross margin is nil. Plus there's very little cash left.

It might survive, if funders are prepared to throw more money at it. The existing equity is worth nothing though, on any rational basis.

In my experience, successful eCommerce businesses tend to start small, operate on a shoestring by a driven founder CEO, and keep costs low as they grow. Then after a few years, growth becomes self-funding, and accelerates. Koovs has tried to put the cart before the horse - escalating its central overhead far too high, before it's generated any decent sales momentum.

The worst mistake was under-funding the start-up. If you're going to really go for it, in terms of growth & heavy start-up costs, then the cash required for 3+ years' cash burn needs to be raised up-front, plus a contingency reserve. Koovs has been struggling for cash since 2015, and its repeated funding rounds, are looking increasingly desperate.

Maybe it's time to just admit defeat, and let it fail? Or slash costs to the bone, and try again as a leaner, fitter business?

NWF (LON:NWF)

Share price: 165p (up 0.6% today, at 10:53)

No. shares: 48.7m

Market cap: £80.4m

NWF Group plc ("NWF" or "the Group"), the specialist agricultural and distribution business delivering feed, food and fuel across the UK, today announces a trading update for the half year ended 30 November 2017 and its notice of results date.

A simple, and clear update;

The Group reports that trading for the half year ended 30 November 2017 was ahead of the prior year and the Board remains confident of delivering its full year expectations.

Net debt was also lower than at 30 November 2016.

More divisional performance information is given, which I won't cover here.

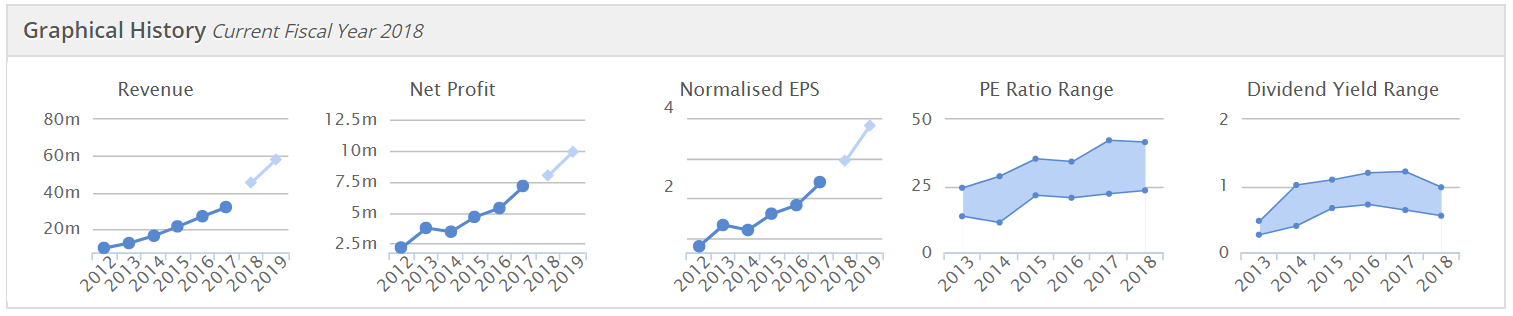

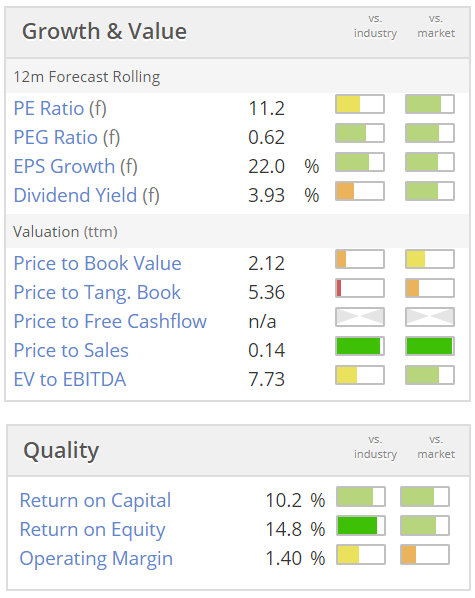

Valuation - the valuation is fairly low, as you would expect for a fairly boring, very low margin business;

Note that divis are fairly good, and there has been a nice progression with the divis rising 5-6% p.a. - which works well, after a few years' compounding has been allowed to happen.

My opinion - I always almost nod off when looking at this company, it's so boring.

That said, there seems to be a nice turnaround happening, with EPS heading for forecast of about 14.3p this year - well up on the previous 2 years' results.

The valuation seems undemanding, so it might be worth a closer look perhaps?

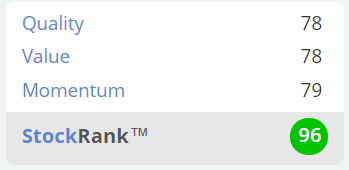

Note the excellent StockRank, which surprises me at being this high;

Kromek (LON:KMK)

Share price: 25.4p (down 5.8% today)

No. shares: 260.4m

Market cap: £66.1m

Kromek (AIM: KMK), a radiation detection technology company focusing on the medical, security screening and nuclear markets, announces its interim results for the six months ended 31 October 2017.

I'm trying to work out why this company is worth £66.1m, when it's reported pretty lame H1 figures today.

Revenue in H1 was only £4.8m, although that is up 27% on H1 LY.

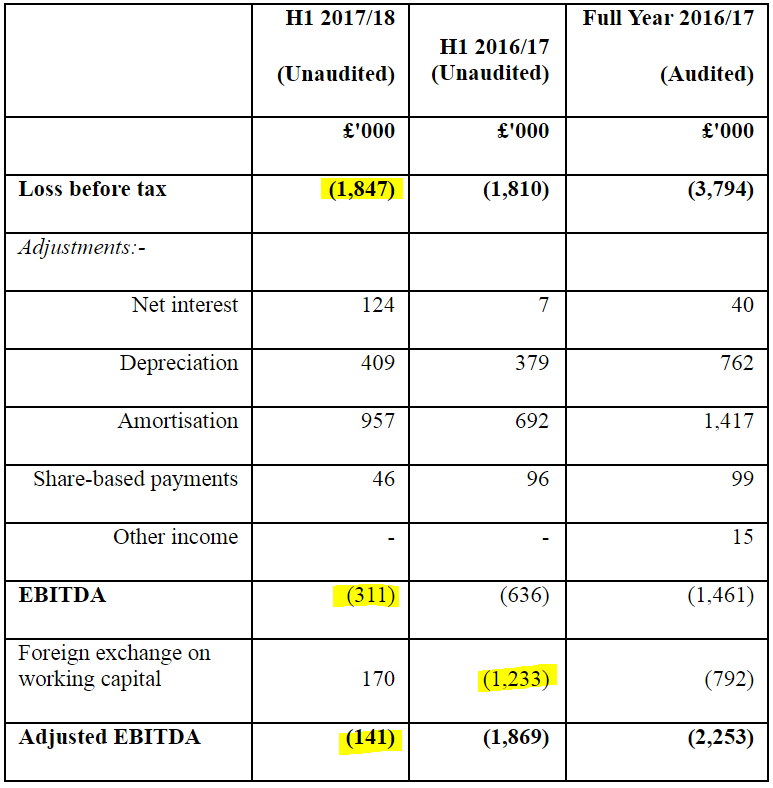

It's still loss-making on all measures - take your pick which profit measure you prefer from the below options;

Note also the big forex movements on working capital.

Balance sheet - looks very strong, after a big equity fundraise last year. So it has £15.0m cash in the bank, plus £1.25m long term cash deposits. On the other side, there is a £3.0m borrowings figure, which is unusual (to hold cash, and debt at the same time).

Debtors looks very high too, so that's worth checking out.

Jam tomorrow companies are a bit more tolerable if they have plenty of cash in the bank, as this one does.

Outlook

Kromek entered the second half of 2017/18 well-positioned to deliver revenue growth for the full year and achieving EBITDA breakeven in-line with market expectations. This expectation is underpinned by good visibility of revenues with a significant proportion under signed contract.

The Group continues to benefit from its customers commercially launching next-generation CZT-based products and from the increasing adoption of CZT-based technology across its target markets. TheGroup's products continue to gain traction in all its business segments and Kromek is strengthening its relationships with existing customers as well as enhancing its reputation among potential customers. As a result of this, combined with a strengthened order book and improved revenue visibility, the Board looks to the future with confidence.

My opinion - it's too much of a jam tomorrow share for me. Sometimes jam tomorrow shares do work, but it's fairly rare, and usually takes a lot longer than originally planned. So why pay a premium for an outcome that tends to be unlikely?

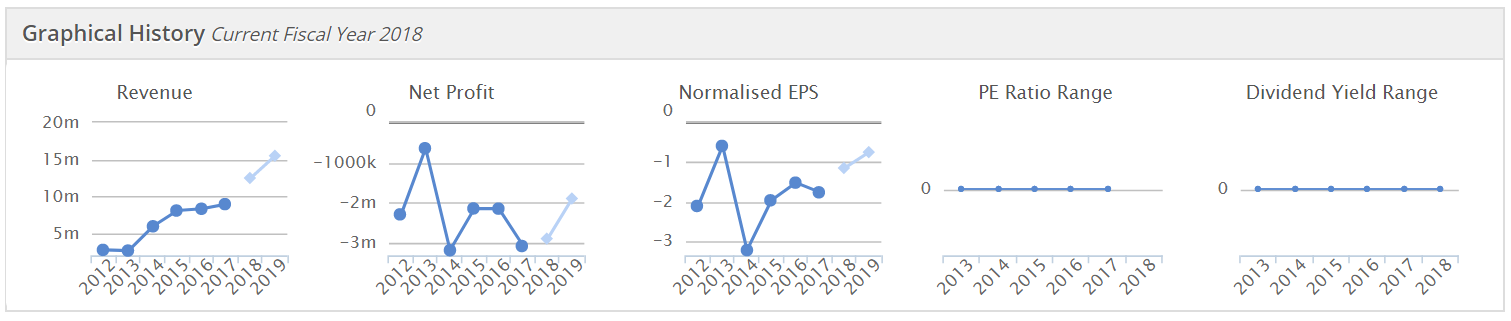

I would want to see a much better progression than the one in the charts below. Kromek seems resolutely mired in the red, despite its rising revenues. As for the PER and dividend yield graphs below - it looks like someone needs to fetch a defibrillator to get things moving here!

Perhaps Kromek's time will come at some point in the future, but that's not something I want to gamble on, especially not at a £66m market cap.

All done for today. See you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.