Good morning, and welcome to Tuesday's SCVR, written by Paul & extra sections from Jack, since it's too busy for me to handle everything on my own.

Inflation & interest rates again

What an interesting discussion yesterday about the risk of inflation returning. Everyone seems to be commenting on that at the moment, I saw a very good article in the Telegraph this morning on the same topic, and thought to myself, oh dear I hope the Stockopedia subscribers don't think I plagiarised it. That's unavoidable though, when you're covering current topical themes. I remember a city broker friend once wrongly accusing Graham of plagiarising his blog, because they both happened to comment on bond yields on the same day! I had to gently intervene and point out that nobody had ownership of any macro topic, and we're far too busy to read other peoples' blogs, when we're frantically trying to prepare content to a deadline for our own! We're all friends again now, I'm pleased to say.

I enjoy thinking about macro topics, but just for the avoidance of doubt, see myself as an enthusiastic amateur on that topic, not any kind of opinion leader! It's interesting trying to work out how the world around us works, especially at times like this, when strange stuff like QE is happening. Also, I feel having a general overview of macro economics is vital to put share prices into context - are they cheap, or expensive? That depends on what's likely to happen next to the economy.

Russell Napier

My thanks go to subscriber Michael Prince who added a comment yesterday pointing us towards a podcast by Grant Williams, called The End Game Ep.5 - Russell Napier (you can find it by searching for the title or the name, on whatever podcast system you use). I was gripped by this long podcast, and concluded that Russell Napier is a brilliant commentator/economist.

I also found a more recent podcast from MoneyWeek where Merryn Somerset-Webb interviewed him badly - constantly interrupting & talking over the end of his sentences. Pity, as she's usually very good, but should have just kept quiet to let the interviewee speak, who after all, knows a lot more than she does, and has more interesting things to say. Pity, as she usually talks sense, and I normally respect what she has to say.

Indeed, as interviewer Grant Williams above noted at the end of his own podcast, when you get a great guest on, you should just shut up & let them talk! Merryn needs to take note. It's a key thing I always do in my CEO interviews - never interrupt, just let them talk. People appreciate that so much, and I always get favourable feedback from listeners. Tamzin is the same in her interviews - never interrupting. It just makes for a more pleasing listening experience, and after all, an interview is about the interviewee, not the interviewer trying to demonstrate how clever they are!

It's different maybe when dealing with some slippery politician that's trying to dodge the questions though. But personally I stopped waking up to the Today Programme on my clock/radio a long time ago, as I found the journalists so obnoxious. What could be worse than waking up to some people rowing about politics? It starts the day off with a headache.

Anyway, Russell Napier's stuff makes a lot of sense, so well worth seeking out. He's one of several commentators who have previously been relaxed about inflation not being a threat, now changing their minds, and saying we're entering a period of higher inflation. That matters a lot, as it could be bad news for shares on high PERs., and could be seriously bad news for bonds, as yields could rise (thus pushing down capital values). If inflation rises a lot, and stays high, then of course property values would also probably fall, depending on what interest rates do.

A key question being whether Govts will be able/willing to keep interest rates below inflation? Stephanie Kelton (MMT supporter) says interest rates can be anything the Govt wants, whereas Russell Napier points out some flaws in her arguments. Fascinating stuff!

OK, on to some small cap news...

Timing - I've started early, so will keep writing until I get tired. Update at 13:09 - time for lunch now. I'll be back later to look at WJG, and possible some others. Update at 17:02 - today's report is now finished.

Agenda - this is what caught our eyes today -

Jack's Section:

Henry Boot (LON:BOOT) - Trading update

Aptitude Software (LON:APTD) - Trading update

Paul's Section:

Cambridge Cognition Holdings (LON:COG) (I hold) - Trading update, board change & notice of results

Quartix Holdings (LON:QTX) - Substantial Director sale in secondary placing at 401p

Superdry (LON:SDRY) - Half-year Report

Watkin Jones (LON:WJG) (I hold) - Full year results

.

Jack’s section

Henry Boot (LON:BOOT)

Share price: 277.65 (+7.2%)

Shares in issue: 133,181,537

Market cap: £370m

Henry Boot (LON:BOOT) acquires land, obtains planning permission, develops sites, and maintains its property investment portfolio.

It’s a family affair, with a couple of Boots and family trusts popping up in the Major Shareholders list. Chairman Jamie Boot has been with the company since 1979 and has run all four of the group’s main operating subsidiaries during his career. Director Dealings have been mixed over the past year, but it’s interesting to note the most recent spate of buying activity at 241-247p.

The group qualifies for the Benjamin Graham Defensive Investor Screen, a Bargain screen that looks for reasonably priced earnings growth, along with dividend growth, manageable debt, and solid liquidity ratios. Glancing at some of the quick checks on the StockReport, BOOT comfortably passes some Quality checks including an F-Score of 5, a Z-score of 8 or so, a net cash position. There is a small pension deficit to bear in mind - about £36m at the last interim date - but the liquidity ratios and free cash flow generation look pretty solid.

Top line and profit growth has faltered at BOOT and, while margins and returns on capital appear reasonably solid, it is worth noting that the direction of travel across all of these metrics has been down since 2017. However, with a Quality Rank of 85, this is a contrarian stock, so is likely worth monitoring for a rebound in construction.

The update reads well: “The Group has ended the year materially ahead of the Board's revised expectations for 2020, due primarily to land disposals and a resilient performance from the development, construction and house building businesses, in Henry Boot's target industrial and residential markets.”

Net cash is level at c.£27m, just under 10% of yesterday’s market cap, and promisingly BOOT has also “generated significant levels of cash which has allowed for reinvestment within the Group's focused three long-term key markets: industrial & logistics, residential and urban development.”

Activity has been steadily increasing and government guidelines have allowed BOOT to continue serving its customers over lockdown.

Conclusion

This is a reassuring update from BOOT, in which the company has managed to maintain its robust balance sheet and also invest in strategic growth opportunities. As a longer term quality hold with a potential sector rerating on the cards, it is worth investigating in more detail. The family orientation suggests a shareholder-minded culture - an important consideration in times of uncertainty.

The group has strong forward sales and a growing store of opportunities. The one blot is the more general decline in revenue and profits since 2017. While the group is materially ahead, this is based on much-reduced expectations.

Note the date of incorporation was back in November 1919, though - so that alongside the net cash balance sheet and improving prospects does suggest BOOT can ride out Covid and ultimately benefit from a recovery.

.

Aptitude Software (LON:APTD)

Share price: 594p (+9.96%)

Shares in issue: 56,428,967

Market cap: £335m

Aptitude Software (LON:APTD) provides financial management software applications to large global businesses. The software is developed on the Aptitude technology platform, which facilitates the processing of business event-driven transactions and calculations.

Its products add value by taking data from complex systems, typically with unique and siloed data sources across multiple business entities, to create a unified view of finance. Recurring revenue is growing, and it’s a capital-light, cash-generative SaaS business model with around $40m of net cash on the balance sheet.

It’s high quality stuff, and as you might expect, Aptitude now attracts some premium relative valuation metrics:

With some share price momentum and potential earnings upgrades, it has all the makings of another High Flyer tech stock.

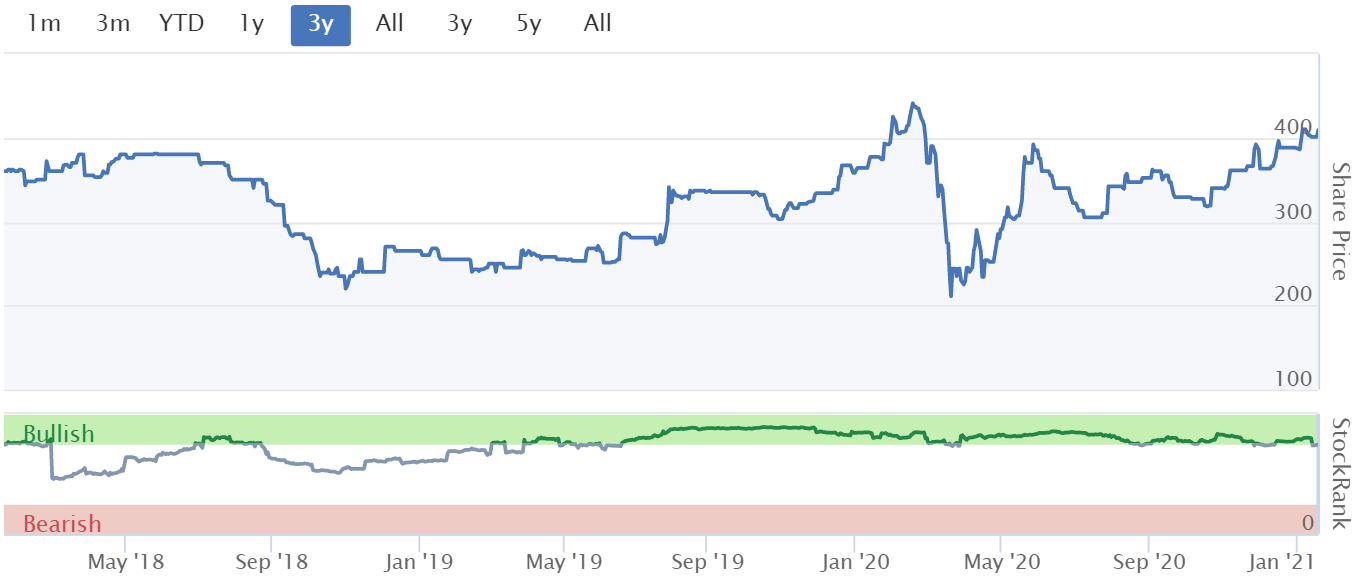

Note the Momentum Rank is up 16 places over the past 30 days, the shares are up this morning, and the overall StockRank is steadily improving.

Aptitude reports that a strong final quarter's new business performance “provides the business with greater revenue visibility for 2021.”

Annual Recurring Revenue was up 11% in the year to £31.2m, driven by new customer wins and the expansion of existing relationships. There’s £44.8m of cash on the balance sheet (up from £33m), with no loans. That net cash position brings the group’s enterprise value below the £300m mark.

The final quarter saw a particularly strong performance in the North American technology and insurance sectors. Key developments include:

- A new multi-year SaaS agreements with two North American insurers; and

- A new business SaaS agreement with a leading global medical technology company for its Revenue Management and Lease Accounting Engine products, “further demonstrating the value realisable by clients of using more than one of the Group's tightly integrated and complementary applications.”

These new business successes have been complemented by the increasing use of Aptitude’s applications by existing clients including one of the largest North American telecommunications companies and a European financial services organisation.

Conclusion

The improved revenue visibility and encouraging quarterly trajectory into the new year is clearly a positive and has been received warmly by the market.

Interestingly, Aptitude says that these successes “have strengthened the demand for implementation services from Aptitude Software and its partner network,” so it looks like the success is spurring further opportunities. Services revenue for the coming year is now anticipated to be slightly ahead of earlier expectations.

Looking forward, growth initiatives include:

- Continued development of the partner network; and

- The launch of Aptitude Accounting Hub and Aptitude Insurance Calculation Engine as SaaS-offerings, designed to capitalise on the “accelerated move to cloud experienced in 2020.”

The direction of travel here is firmly positive, but the share price has also gone up by about 50% over the past couple of weeks.

As with a lot of growing, net cash tech stocks, it’s a premium relative valuation - but we are really paying for all discounted future cash flows, so if a company like Aptitude on a forecast PE of 45.4x can continue to grow ahead of the market for many years, then such a premium can be justified.

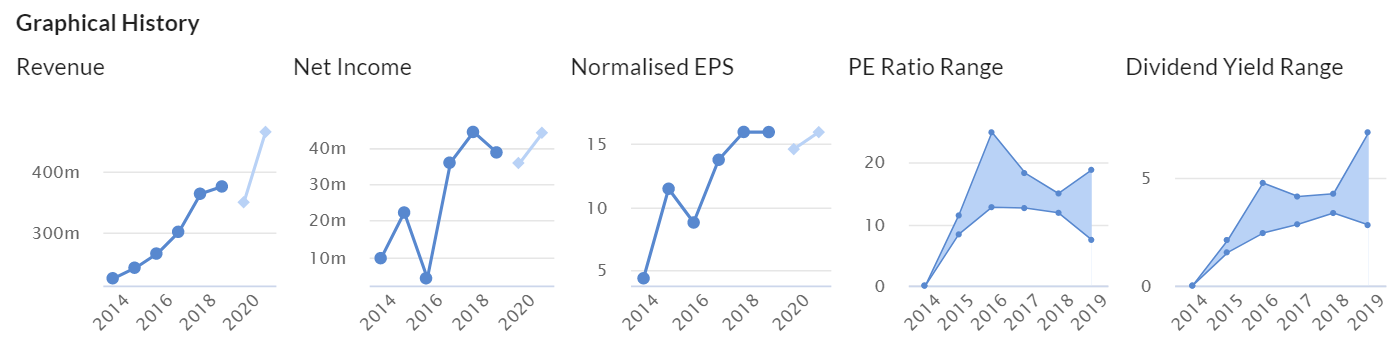

On that point though, Aptitude has actually struggled to generate the required rates of revenue growth and earnings growth.

That aside, the 2021 outlook is undeniably positive and this is a classic low-capital, cash-generative, recurring revenue software company. So it ticks a lot of boxes for a lot of people.

But at this price I would want to be sure there is plenty of runway for growth, as growth is what the present valuation demands, and broker forecasts are surprisingly lacklustre.

If these forecasts are simply behind the curve, then that could be an opportunity.

.

Paul's Section

Cambridge Cognition Holdings (LON:COG)

(I hold)

73.7p (up 9% at 08:20) - mkt cap £23m

An illiquid tiddler.

Cambridge Cognition Holdings plc (AIM: COG), which develops and markets digital solutions to assess brain health, is pleased to announce a positive trading update and notice of results for the year ended 31 December 2020, together with details of a forthcoming change to the Company's board.

This headline looks good -

Strong financial performance with growth in revenues of 34% and increase in order backlog of 96%

- Revenues up 34% to £6.74m

- Loss for the year narrowed to £(0.44)m (2019: £(2.9)m loss)

- Cash risen to £3.05m (end 2019: £0.9m)

Order intake - looks very good indeed -

The Company had a successful year in 2020, delivering significant growth in revenues from digital solutions for clinical trials by executing its strategy of increased focus on commercialisation. Order intake for the year closed at a record £12.70 million, up 158% on the previous year's order intake of £4.93 million.

This maintains the growth trajectory reported in the interim results. The contracted order backlog was £11.17 million at 31 December 2020 (£5.69 million at 31 December 2019) of which at least £6.0 million is expected to be recognised as revenue in 2021 subject to customer delivery schedules and COVID-19 impacts.

To put that into context, broker consensus was £7.2m revenues forecast for 2021. So having “at least” £6.0m of that already contracted for, looks very encouraging - i.e. a beat against forecast seems lined up for 2021. Finncap has this morning raised forecast revenue to £8.5m - hopefully still conservative)

Two large, one-off orders totalling £3.1m flatter the 2020 results, and may not be repeated. Nice transparency there, in revealing this to investors. The fact that the company got those big orders at all, is a positive to me.

Covid impact - delayed some orders, but also created opportunities.

Outlook -

The substantial contracted order backlog provides the Company with a solid foundation for 2021. While there remains some uncertainty relating to timing of customers' clinical trials due to the COVID-19 pandemic, the Company is well positioned for continued growth in the dynamic, expanding market for digital solutions for clinical trials.

CFO departure -

Nick Walters has resigned as CFO after 7 years.

Remains a Director until AGM in May 2021, so it sounds like an orderly handover, particularly as a new CFO has been appointed, Mick Holton -who seems to have relevant experience from “senior finance roles at Alliance Boots”.

Online Q&A session today at 12:30 -

Matthew Stork, Cambridge Cognition's CEO, will be hosting an online Q&A session regarding the latest developments with the Company at 12.30 p.m. GMT today. This session is open to all existing and prospective shareholders, and equity analysts. Those wishing to attend should email COG@investor-focus.co.uk for access details. Participants will have the opportunity to submit questions during the session, but questions are welcomed in advance and may be submitted to COG@investor-focus.co.uk.

My opinion - the track record of this company has been rather disappointing, since it floated in 2013. However, it looks to me as if things might be coming together nicely now.

The cash burn has stopped, so there shouldn’t be any need for another placing.

The order book is brimming, with out-performance for 2021 likely, given low forecasts.

It’s operating in a sexy sector - cloud-based medical (mental) testing, where it has decades of experience & data, so a niche that should be high margin and protected to some extent maybe? Maybe this could conceptually be another Bioventix (LON:BVXP) in the making? i.e. high margin, niche specialism, barriers to entry, etc.

Finncap has raised 2021 revenue forecast by 18% today, to £8.5m, which would result in a small profit. The gross margin is nearly 80%, so there is big operational gearing with this company - if sales really take off, then it could quickly become highly profitable, which in turn would trigger a big re-rating of the shares.

This is starting to look interesting. I’m sitting tight on my (smallish) position, as it looks as if things might be coming together at long last.

.

Quartix Holdings (LON:QTX)

401p (unchanged at 09:49) - mkt cap £192m

The CEO & family are selling almost 7.2m shares at 401p per share (no discount, indicating good demand from institutional buyers), raising £28.9m. Good luck to him, he's built up a very good company. That’s a whacking great sale, of 15% of the company, hence why I’m flagging it. On the upside, the family still retains 22.2% of the company.

The usual, ridiculous line is trotted out in the RNS saying that the sale is;

... in order to satisfy strong investor demand.

No it isn't! This is codswallop, and everyone knows it. The sale is happening because the seller wants to sell. Strong institutional demand is positive, in that it helps the sale happen at a decent price, but it’s not what drives the process.

Please can we consign this ridiculous phrase to the dustbin of history? All the RNS needs to say is this, my amended, more truthful version of it below;

Quartix, a leading supplier of vehicle tracking systems, announces that it has been informed by Andrew Walters, Chief Executive Officer, his wife and PCA, Dominie Walters, and A J Walters Trust, a trust established by Andrew Walters for the benefit of his family, and includes Andrew Walters and his wife as trustees (together the "Sellers") of the intention to sell an aggregate of 7,194,377 ordinary shares of 1 pence each ("Ordinary Shares") in the capital of Company (the "Placing Shares") at a price of 401 pence per Placing Share (the "Placing")in order to satisfy strong investor demand. There was strong institutional demand for these shares.

My opinion - I reviewed QTX’s last trading update here on 13 Jan 2021, concluding that it’s a nice company, but the valuation looks full. A large Director sale today rather reinforces that view.

.

.

Superdry (LON:SDRY)

201p (down 16%, at 11:43) - mkt cap £165m

Brand reset journey continues; robust balance sheet despite Covid-19 disruption …

Interim results for the 26-week period to 24 October 2020

“Brand reset” is just a slogan, there’s no evidence of any tangible progress in the figures, nor the outlook, in my opinion, being hard nosed about it. I like turnarounds, so am keeping an open mind on SDRY. However, I need facts, not aspirations to convince me.

My initial impression is that today’s interim numbers are nowhere near as bad as I was expecting. Although covering May-Oct 2020, the shops would have been open for most of that period, apart from the first few weeks.

.

- Sales are down, although in the circumstances (23.4)% isn’t a disaster by any means, and ties in exactly with the loss of 23% of trading days in the period.

- Strong eCommerce sales, +50%. This represented half of all retail sales - very encouraging indeed.

- Gross margin also well down, but again as I would expect - retailers have to clear stock at whatever price they can get for it, to clear the space for new ranges. So if trading is disrupted, that means more markdowns.

- Net cash looks healthy.

Underlying profit - this figure of £(10.6)m loss looks too good to be true. Consider this;

Underlying loss before tax of £(10.6)m driven by trading disruption, net of cost saving actions (£13.5m) and government support (£12.3m), and is after the impact of reduced depreciation arising from prior impairments and the utilisation of the onerous lease provision (net £31.6m benefit).

The item that stands out for me is the last one. If I’m reading that right, then it sounds like a £31.6m onerous lease provision has been released into the P&L, which would boost profit by that amount. Hence doesn’t that mean the underlying profits are £(10.6)m + £(31.6)m = £(42.2)m in H1? This is a key point which needs clarifying.

Cash position - is good, and has improved further since the period end -

As at 9 January net cash is £54.8m, and our refinanced ABL facility undrawn. Net cash remained positive throughout 2020.

That’s encouraging, but I don’t think this is sustainable, because;

Favourable working capital movements flatter cash - both inventories & receivables are well down on a year earlier, which makes sense given reduced revenues. However, trade payables is sharply up - when it should also be down in line with reduced inventories. This is clear evidence that the company is stretching its trade creditors, in order to maximise cash. At some stage working capital will have to normalise, and that’s when the company would need to use its borrowing facilities. Plus remember that we need to factor in another 6 months of heavy trading losses, in H2.

Can wholesale customers pay their bills? There must be a risk of future bad debts lurking in the receivables book.

Hence my conclusion is that the underlying cash position, once working capital normalises, is not good. Not an immediate concern though. Longer term, I reckon SDRY is likely to need to do a placing to rebuild cash when trading normalises.

I think it can get through the covid crisis, into mid-2021 without going bust.

Outlook - confirms that there’s no immediate liquidity problem (providing lenders co-operate by loosening covenants, which seems to be happening);

In the balance of the year we anticipate:

· Prolonged store closures and subdued footfall in early 2021 to negatively impact revenues year-on-year, even after considering the six weeks of lockdown in late FY20. These shortfalls will be partially offset by rent waivers and furlough support.

· Given the elevated levels of clearance activity throughout the 2020 calendar year, and as we adopt a more balanced promotional stance in 2021, Ecommerce growth will decelerate in Q4 21.

· Wholesale revenues to end the year broadly in line with current market expectations.

The Company's liquidity remains strong with net cash of £54.8m at 9 January 2021, through continued cash preservation measures, including accessing government support initiatives across the UK and internationally, reduction and rephasing of stock intake, rent deferrals and associated Covid-19 waivers, rigorous cost control and cash management. Consequently, we currently expect to remain in a net cash position for the remainder of FY21.

We continue to have a total of over £130m of available liquidity at hand. Our £70m Asset Backed Lending Facility remains available, having not been used in the year to date, and is currently still undrawn. Given the continued volatility caused by Covid-19, we have agreed with our existing lenders to reprofile the profit related covenant tests for the period ended April 2022.

Going concern notes are essential reading. Covenant headroom sounds tight-

Under the reverse stress test, which management considers to be more than a remote possibility, liquidity headroom remains adequate, though the covenants would be under pressure over the 12 month going concern period in this scenario. Consequently, they are most sensitive to the macroeconomic recovery and performance over the next 12 months, since all covenants are on a trailing 12 month basis.

In conclusion, there’s a material uncertainty over going concern - not good at all. This share should be seen as high risk for this reason.

The Group directors noted that the risks set out above indicate that a material uncertainty exists and may cast significant doubt on the Group's ability to continue as a going concern and, therefore, that it may be unable to realise its assets and discharge its liabilities in the normal course of business.

The material uncertainty relates to:

• the duration and impact of the second-wave of national lockdowns and subsequent recovery in consumer demand, and the Group's ability to capture this in future trading; and,

• the ability of the Group to meet its covenants from debt providers

This uncertainty relates specifically to the covenant tests over the 12 month going concern period; the Group directors have assessed the liquidity requirements of the group under these downside scenarios and believe them to be adequate.

In practice, lenders are usually accommodating. However, it does raise the question, with lending facilities currently undrawn, why would lenders want to take on the risk of seeing the company start drawing down those borrowings? Especially if poor trading continues. Trade creditors are currently taking the strain, and at some point that is likely to shift to the bank.

My opinion - I don’t like it. There’s not any evidence that the brand reset is working. If it were, then the company would be telling us about it!

There’s no guidance given for the full year, again reinforcing that things are clearly not going well.

I like the shift to online though, that’s encouraging.

The figures confirm to me that this business is going to probably need recapitalising when the crisis is over, and working capital normalises.

A key issue is what happens if/when business rates kick back in? It’s difficult to see how SDRY can become genuinely profitable again, without something stellar happening on product.

Looking at its website, who is SDRY trying to sell clothing to? The models seem young, so a yoof market. But anecdotally, a lot of the customers are pot-bellied middle-aged men, so my friends tell me. So how does it make sense to have models that look about 17 years old?

Overall then, I maintain my sceptical stance. That said, online growth is good, and the mkt cap of £165m could be seen as cheap, if the brand can return to former glories. How likely is that though? Lease liabilities are still a millstone, despite some renegotiation.

Going concern & bank facilities are an area of risk.

Note how the indiscriminate vaccine-related surge in late 2020 has mostly, and rapidly evaporated here.

.

.

Watkin Jones (LON:WJG)

(I hold)

203p (up 9%, at 16:22) - mkt cap £520m

This is a niche developer of build to rent, and student accommodation.

For background, I reported here on 6 Nov 2020 on its trading update for FY 09/2020. At the time I liked the look of it, but questioned how we should value it.

Diary date - 4 Feb 2021, 16:00 - investor presentation, details here.

Watkin Jones plc (AIM:WJG), the UK's leading developer and manager of residential for rent with a focus on the build to rent ('BtR') and purpose built student accommodation ('PBSA') sectors, announces its annual results for the year ended 30 September 2020 ('FY20').

Adj operating profit has come in at £51.7m (a bit above guidance given on 6 Nov 2020, at £48-50m)

It’s striking from the highlights table, how little WJG seems to have been impacted by covid/lockdown, with the various profit measures only down about 7-9% on LY (last year).

Dividends - down 12% at 7.35p, a useful yield of 3.6% - not bad in a year when many companies cancelled divis.

Net cash strong, at £94.8m

Exceptional costs of £20.5m (cladding & covid), previously announced, so nothing new there.

Outlook comments sound positive -

"COVID-19 undoubtedly caused delays to investment activity in the period, however I am pleased to report that the resumption in forward sales that we have seen, coupled with the increase in the number of student beds for delivery in FY21 and the scheduled completion of four BtR developments, should see Watkin Jones return to growth in the coming year, assuming there is no further significant disruption to our activities. We are pleased with our progress in growing our BtR and PBSA development pipelines and remain very confident in the long term prospects for these markets.

Results presentation slides can be viewed on the company’s website here.

There’s also an audio/visual presentation, click on “audio” on this page. Very helpful, thank you to the company for providing this for PIs.

Commissioned research is available here.

Balance sheet - is strong, with NTAV of £154.5m, and holding substantial net cash of £94.8m.

My opinion - I’m warming to this share, and bought a starter size position late last year. Even though I’m not entirely sure how to value it. If we use PER, then that’s 206p/ 14.7p adj EPS = 14.0, which seems reasonable. It looks as if earnings are sustainable, since we’re given chapter & verse in the commentary about the development pipeline.

I very much like the business model here. WJG forward-sells its building projects to investors. Then bags a lucrative development profit of 21.4% gross margin, on completion of each project. There's a project nearby to where I live, in Bournemouth, so I'm hoping they'll do a public viewing when it opens, which looks imminent. It's remarkable how quickly large buildings go up these days.

WJG has demonstrated in 2020 that the business model is robust, even in a highly disrupted year.

It gets a thumbs up from me. It's the type of share that I'm happy to now keep my small-medium sized position for years to come, collect in the divis, and possibly add to it on market dips. Build to rent seems a very good thing to be doing, as we clearly need much more plentiful, reasonably-priced, good quality accommodation for people to rent.

.

.

That's all for today. See you in the morning!

Regards, Paul & Jack.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.