Good morning, it's Paul here - with my rather erratic reporting schedule - apologies - we get there in the end.

Monday's report is here.

Rightly or not, I reckon the premium bid for FOOT could be what we need, to highlight value amongst small caps. The trick is finding the ones that are under-priced, and avoiding the ones that are in permanent decline. If any of us could do that perfectly, we'd be billionaires! In truth, we're trying to predict the future, so it's educated guesswork.

I'll do my best, as your small caps guide. But please remember that I'll be right:wrong about 60:40 in a good year. 75:25 in an amazing year (e.g. 2017). And maybe 40:60 (or less?) in a bad year. So the onus is to figure things out for yourself. If I can help, by pointing out a wobbly balance sheet, etc., then I'll try.

Ultimately, your success comes from your own skill and luck (and genius!)!

Bonmarche Holdings (LON:BON)

Share price: 29.5p (down 20% here today, at market close)

No. shares: 50.0m

Market cap: £14.8m

Trading update (profit warning)

It's remarkable to see that this womenswear retailer has now lost about 90% of its share price since its series of profit warnings began, in Dec 2015.

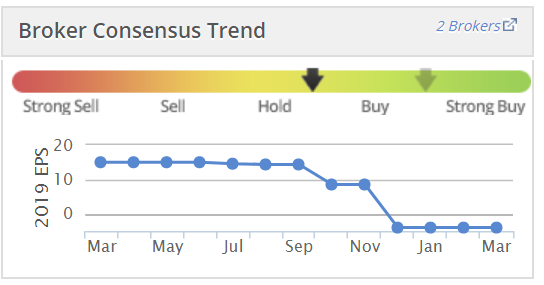

As you can see from the Stockopedia broker consensus graph, expectations for the current financial year (ending 31 Mar 2019) have collapsed, and this is before any downgrades resulting from today's profit warning have been taken into account;

My notes from the last trading update in Jan 2019 are here. I concluded then that there's little likelihood of the business recovering, and the divis would probably soon stop altogether. A slowly dying business, by the looks of it.

Current trading - is grim. When I last reported (in late Jan 2019) the company was expecting a loss for FY 03/2019 of around -£2m. Today things are looking much worse;

... However, trading since the beginning of March has been significantly weaker, reversing sales gains made in the previous months. In light of this, we now believe there is a likelihood of sales levels for the remainder of the month continuing to follow this trend, which would make the underlying PBT loss for the year greater than £4.0m.

Accordingly, we now estimate that the underlying PBT loss will be between £5.0m and £6.0m.

This reminds me of the recent profit warning from QUIZ (LON:QUIZ) . What worries me is that such a large deterioration in trading, during a quiet seasonal period at the end of the financial year, suggests that current trading must be horrendous. No figures are given on current LFL sales, but it must be negative, well into double digit percentages.

What's gone wrong? This is the explanation given, which doesn't cut the mustard with me;

We believe that the recent downturn in trading is a consequence of the demand for transitional ranges, between winter and spring, having been satisfied during January and February. Although sales of spring season stock benefitted from the spell of warm weather in late February, this is not yet a large enough part of the sales mix to compensate for the lower demand for transitional stock. Nevertheless, on the basis of this positive early reaction to the spring product, our expectation for FY20 remains unchanged.

The last sentence provides a glimmer of hope. I think the real reasons, are that High Street footfall is going down, and the product offering isn't good enough to attract enough sales. Also, BON doesn't sell enough online to compensate for falling conventional sales.

Cash position - sounds like BON needs to dip into its overdraft at the low point;

The Group's cash balance reaches its lowest point in the annual cycle at the end of March, when its bank facility is expected to be sufficient to meet liquidity requirements, even at the lowest end of the PBT range.

Other than this short term borrowing requirement at the year end, the Group expects to continue to operate with a positive net cash balance during FY20.

That's moderately encouraging, but remember that banks generally don't like lending to loss-making companies. Therefore I would not rely on bank facilities being available in future, when needed.

My opinion - things are deteriorating rapidly here, and I think the company is close to a crisis. If current trends continue, then it's likely to go bust in 2020, in my view. Therefore, this share is now uninvestable for me.

I think it's likely to be carnage in 2019 & 2020, in terms of many retailers & restaurants going bust. The painful truth is that, because people are buying so much online now, there is far too much capacity. So the weakest formats have to disappear, to free up enough business for the survivors. I don't think BON is likely to survive this process. Unless it manages to pull off a drastic turnaround, which is clearly not happening.

NAHL (LON:NAH)

Share price: 102.5p (up 14.7% today, at market close)

No. shares: 46.2m

Market cap: £47.4m

NAHL, the leading UK marketing and services business focused on the UK consumer legal market, announces its Final Results for the year ended 31 December 2018.

I last looked at this personal injury claims group here in Jan 2019, after a mild profit warning.

The market seems to like the 2018 results published today. Or rather, the reduced profit versus last year is a little better than forecast (18.2p u/l EPS, versus 17.6p consensus forecast).

Outlook comments today seem a bit perkier too;

Whilst market pressures persist, trading during the early part of 2019 has improved.

We remain confident in our outlook for the remainder of the year.

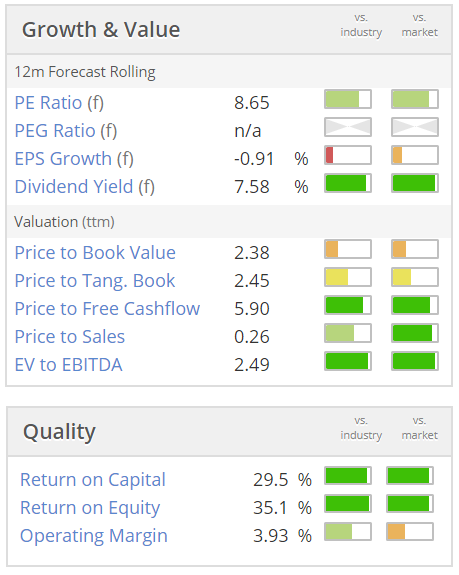

Valuation - this is a low PER & high yield stock, commensurate with the sector in which it operates, which historically has seen profitability & cashflows often prove flaky.

PER - at 102.5p and 18.2p u/l EPS, the 2018 PER is just 5.6

Divi yield - 8.9p total divis for 2018 (heavily down on 2017's 15.9p) gives a yield of 8.7%

Balance sheet - looks weak, with negative NTAV.

My opinion - it's a straightforward value share. The key question for investors is whether you think profits & divis are sustainable. Not much else matters.

Cash conversion isn't very good - quite a bit of profit ends up in increased working capital. That needs a close look, for anyone considering investing here.

Personally, I wouldn't go near this type of business as a potential investment, as I've seen so many go wrong. The geared balance sheet & rather poor cash conversion are further negatives. So definitely not one for me, but good luck to holders.

Note that the CFO has just spent £10k buying shares.

Also note that the chart is showing signs of improvement recently - one of an increasingly growing list of small cap shares that are bouncing from oversold conditions;

SCS (LON:SCS)

Share price: 225.5p (up 1.8% today, at market close)

No. shares: 40.0m

Market cap: £90.2m

ScS, one of the UK's largest retailers of upholstered furniture and floorings, is pleased to announce its interim results for the 26 weeks ended 26 January 2019.

SCS seems to have a very lop-sided financial year, in that almost all the profits are made in H2. Therefore there's not much in the way of meaningful analysis I can do on the H1 numbers. Other than to say, they look OK.

Full year outlook is more important;

The Group continues to deliver profitable growth whilst increasing its resilience. The Board is pleased with the Group's year to date trading, which is in line with its expectations.

For the 33 weeks ended 16 March 2019, the Group achieved like-for-like order intake growth of 2.9% and two-year like-for-like order intake growth of 4.6%.

Our focus on providing excellent choice, value and quality for our customers, coupled with our commitment to delivering against our strategic priorities, continues to prove successful. The retail market continues to suffer in the midst of the uncertain economic and political environment. We therefore expect the trading environment to continue to remain challenging in the short to medium term, although the Board is confident that the Group is well positioned to maximise opportunities as they arise.

It sounds as if SCS is holding its own, in a tough market. Although how tough is it really? I think companies are expected to say that things are tough, but are they really? In out-of-town centres such as the ones SCS operates from, they look pretty healthy to me. I think the problems are more in town centres, from falling footfall, less so for big ticket items from retail parks.

Recent results from DFS Furniture (LON:DFS) looked reasonable too, so this sector is probably seeing reasonably decent conditions.

Balance sheet & cashflow statements both look very good. Note that the huge cash pile is boosted by customer deposits (paying cash, before SCS has to pay its supplier to have the sofa made - an attractive business model).

My opinion - as mentioned before, I like this share for its cashflows, decent balance sheet, and attractive dividend yield. That the company seems to be sailing along, serenely, when may other retailers are struggling, shows that it has an attractive niche.

SCS gets a thumbs up from me, and from the Stockopedia computers too, which award it a flawless StockRank of 99, and "Super Stock" classification.

There's plenty of green on the growth & value section too;

The bumper divis here look sustainable. Along with Shoe Zone (LON:SHOE) , I see SCS as a somewhat unlikely hero, but both seem to be trading very well in difficult markets. Both look good candidates for a shortlist of shares to include in an income portfolio, e.g. a mature SIPP.

Focusrite (LON:TUNE) - a solid trading update is out today. The share price has only moved up 1.4% to 524p, because it's only an in line update - is that good enough for a stock on a forward PER of 28?

Outlook comments sound positive;

"We are pleased with the outcome for the half year with profit and cash having grown and revenue, in line with our expectations, slightly ahead of the record half year in 2018. We remain very watchful of macroeconomic and political factors that affect our business, most notably import tariffs in the US and Brexit uncertainty, but have in place strategies to deal with any significant changes to the status quo.

The strength of our new product pipeline gives us confidence going forward and we already have several important launches planned during this year and the next."

All of which is nice, but in a stock market that has heavily sold off most growth companies, I'm scratching my head a bit as to why this one has been impervious? Is risk:reward good enough at the current valuation? Not for me it, it isn't. Forecast profit growth is negligible, which is not good enough to justify a fwd PER of 28. I would want to see exceeding expectations trading updates.

Judges Scientific (LON:JDG) - this share has recovered really well, since a wobbly patch in 2016. Results out today for 2018 look excellent. I very much like that JDG has funded numerous acquisitions from its own cashflows, with only a short term need for bank debt. An excellent business model, similar to Tracsis (LON:TRCS) .

Given strong results, and reasonably positive outlook comments, the share price still looks quite reasonable. It gets a thumbs up from me.

Bloomsbury Publishing (LON:BMY) - in line trading update for y/e 28 Feb 2019. The valuation looks about right to me. Note the very high StockRank of 96.

Zotefoams (LON:ZTF) - impressive 2018 results. Strong start to 2019. New capacity coming on stream.

The share price has been very strong of late, so I wonder if the upside might now be priced-in already? It would need forecasts to be raised further, to justify the current price, in my view.

Note that its cashflows show a lot being absorbed in growing working capital, and heavy expansion capex.

Tribal (LON:TRB) - 2018 results look good on an adjusted basis. The big problem here is a large legal claim against them, of £15-30m. That's highly material, so makes it too risky for me.

Elecosoft (LON:ELCO) - an interesting software company. I don't have time to look at the figures in depth today, but the headlines look good. Worth a closer look, when time permits. Readers might want to take a look. I've held this share in the past, and liked it previously.

Bango (LON:BGO) - unimpressive figures - small revenues, and still loss-making. The bull case here rests on the company having built a payments platform, which has huge capacity for exponential growth. The idea is that huge growth (with little to no increase in overheads) would then transform it into a highly profitable business.

Since I have no way to assess the likelihood of success, then it's impossible for me to value, or invest in this.

All done. Sorry it was late.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.