Good morning, it's Paul here.

Just to get you started today, I reviewed 8 companies last night, which was clearing some of the backlog from earlier this week.

Then I'll look at Friday's RNSs once I've had a lie-in, and a full english at my favourite local Turkish cafe here in north London!

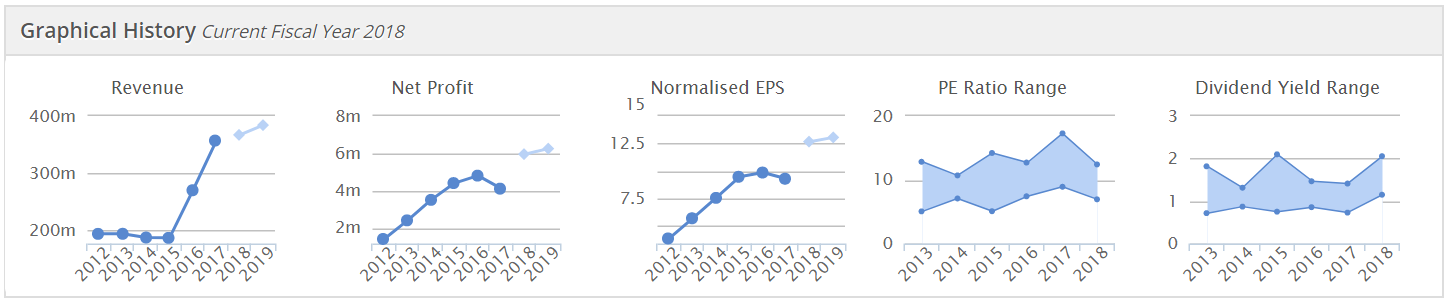

Ideagen (LON:IDEA)

Share price: 150p

No. shares: 219.2m

Market cap: £328.8m

Ideagen PLC (AIM: IDEA), a leading supplier of Integrated Risk Management (IRM) software to highly regulated industries, announces its unaudited interim results for the six months ended 31 October 2018.

These numbers were published on Tuesday this week (22 Jan 2019), and have been well-received by the market, with a good bounce in the share price from a recent low of c.119p, to 150p now.

I met the Exec Chairman both at Mello Chiswick, and also privately for a working lunch, in late Dec 2018. I wrote up my thoughts afterwards, here. I've just re-read those notes, to refresh my memory.

Interim results - key points;

- Good revenue growth of 22%, to £21m

- Organic revenue growth is strong, at 8% (the rest has come from acquisitions)

- Recurring revenues now 67% of the total. This is expected to grow to 74% by 2020, as the group transitions more to a SaaS model

- Adjusted profit before tax up 17% to to £4.8m - note the strong profit margin of nearly 23% of revenues (if you accept the adjustments)

- Net debt of £1.3m - a very good position for an acquisitive group. I'll look at the balance sheet more closely below

Positive-sounding operational review (I won't repeat it here). 95% customer retention rate stands out as very pleasing.

Current trading & outlook - sounds fine;

First half performance in line with market expectations and outlook strong for second half...

Current trading is in line with market expectations and the acquisitions made in H1 are performing well.

The IRM market continues to grow and our success in winning new business together with our levels of recurring revenue and repeat business from our 4,000 strong customer base provides the Board with confidence in the outlook for this year and beyond.

What's IRM? It stands for "integrated risk management".

Balance sheet - net assets of £71.7m, is top heavy with intangibles of £91.1m, due to all the acquisitions that have been made.

Therefore, NTAV is negative, at -£19.4m, which I'm not keen on.

As I mentioned yesterday, with another software group, Tribal (LON:TRB) , the nature of the software sector is that customers pay up-front, which is reflected in the deferred income creditor. This allows businesses to operate in a perfectly satisfactory way, with favourable cashflow, despite having (on paper) a weak balance sheet.

Cash generation - looks OK to me. There is a large amortisation charge to the P&L, which I am perfectly happy to ignore. Cash generated from operations was £5.2m in H1, and of that, £1.3m was capitalised into development costs.

Note there was a £20m equity raise in the period, and £24.3m went out to fund acquisition(s).

Forecasts - there's a recent FinnCap note available. It's pencilled in 4.8p adj EPS for FY 04/2019. It sounds from the positive outlook as if that number should be hit. Note that IDEA has a long-term track record of hitting, or beating forecasts.

The current year PER is now 31.3 - that strikes me as a punchy rating. Although the group's excellent track record of making good acquisitions, arguably justifies a premium price.

FY 04/2020 rises to 5.8p forecast adj EPS, dropping the PER to 25.9 - still rather punchy for my liking.

My opinion - much though I like management here, and respect their achievements in creating terrific long-term shareholder value, the valuation seems too rich for me to consider getting involved.

Sanderson (LON:SND)

Share price: 94.5p

No. shares: 60.0m

Market cap: £56.7m

Sanderson Group plc ('Sanderson' or 'the Group'), the specialist provider of digital technology solutions, innovative software and managed services for the retail, wholesale, supply chain logistics, food and drink processing and manufacturing market sectors...

I very much liked the good results, and lowly valuation, when reporting here in late Nov 2018, on this software group's results for FY 09/2018.

Its update on Tue this week is also positive;

"Following strong, above target results for the year ended 30 September 2018, the Group has made a good start to the current financial year ending 30 September 2019.

At the end of the first quarter, to 31 December 2018,Group revenue and profit are approximately 20% ahead of the comparable prior year period reflecting organic growth and an additional two months contribution from the acquisition of the Anisa Group, which was completed in November 2017.

Sales order intake levels in the first quarter have also been encouraging with an increased number of new customers gained compared with the prior year period.

The order book has grown, providing a good level of confidence going into the second quarter of the financial year.

Cash sounds fine;

... positive net cash position of £3.38 million as of 21 January 2019

I'm not madly keen on the balance sheet here either, which also has negative NTAV, and a small pension deficit.

Outlook comments - sound a little cautious about Brexit, and the retail sector. But focusing on digital retailing, seems to be paying off.

Manufacturing sector is seeing protracted sales cycles.

Dividends - total for the year up 13% to 3.0p, giving a worthwhile yield of 3.2%

Valuation - current year forecast EPS is 8.1p - so the PER is only 11.7 - that seems very reasonable. Although forecast earnings growth is fairly modest.

My opinion - the figures look attractive to me. This software group makes good margins, has a decent growth track record, yet is valued on a modest PER - I'm not really sure why. Do any readers have any insights into why the market is not prepared to give this company a rating that reflects its good performance?

NCC (LON:NCC)

Share price: 127p (down 31% yesterday, at market close)

No. shares: 277.8m

Market cap: £352.8m

Half year results to 30 Nov 2018

Searching our archive, I don't seem to have ever reported on this company. Graham did a write-up almost 2 years ago,here, funnily enough on a profit warning that knocked 44% off the share price. He didn't seem madly enamoured by the company at the time.

Moving on to today's news which has hit the share price by 31%, let's find out what's gone wrong this time.

NCC Group plc (LSE: NCC, "NCC Group" or "the Group"), the leading independent global cyber security and risk mitigation expert, has reported its half year results for the six months to 30 November 2018.

Hmm, I don't really know where to start with this, as there's a lot of detail in the RNS today, but it doesn't mean a lot to me, as I don't know anything about the company.

Let's cut to the chase. In outlook it says;

We now expect to deliver full year adjusted EBIT of around £34m. while our longer term growth prospects remain excellent."

Clearly this must be below expectations, otherwise the share price wouldn't have fallen 31% today.

I cannot find any broker updates today. An old broker note from 26 Sep 2018 suggests that adj PBT for FY 05/2019 should be c.£33.7m. That's odd, as the £34m figure mentioned today for EBIT (same as PBT, except for interest charges, which were £0.8m in H1), looks to be in the same ballpark.

My opinion - apologies, but I'm abandoning this one. It looks far too complicated for me to want to spend loads of time trying to understand the business model, and what's gone wrong.

If there was some broker research available to guide me, then I could make some sense of it, but at the moment there isn't.

In any case, the balance sheet is a deal-breaker for me. NAV is £208.5m, less £239.3m intangibles, gives a negative NTAV of -£30.8m.

The 3-year chart below seems to show a rather accident-prone business;

Joules (LON:JOUL)

Share price: 260p

No. shares: 87.8m

Market cap: £228.3m

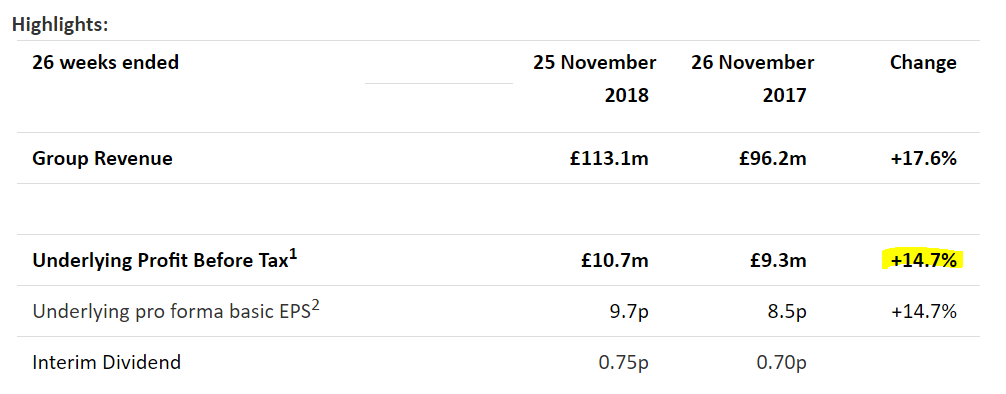

These figures cover the 26 weeks to 25 Nov 2018, for this distinctive, niche fashion brand.

I commented favourably on its recent Christmas trading update, here on 8 Jan 2019. This is a good company, which is growing, has a solid niche & attractive brand, and is selling a high proportion online. So it ticks the right boxes.

General moan about badly worded trading updates

Although as usual with this company, I was exasperated with the muddled & ambiguous wording of its trading updates. Joules seems determined to make my job needlessly difficult! Investors have so many updates to read, every day, that there's really no excuse for companies repeatedly publishing updates that lack of clarity, and cause confusion.

If it helps, I will happily engage with PRs, and companies, and give them a shopping list of what investors like me want to be told in trading updates. I did this recently, and it worked very well. For the company concerned (I won't name it, and it wasn't Joules), they took on board my suggestions, and issued a much-improved update, which provided clear & specific facts & figures, instead of the previous ambiguous waffle.

Sometimes, maybe the problem might be that too many people get involved in wording trading updates? By the time the Directors, broker, and PR have all edited a document, it can lose its overall coherence.

Interim results - the highlights section looks really good. Given that we know how tough fashion retailing conditions are, to be posting increased profits right now is very impressive;

This is a stand-out point from the narrative;

International revenue increased by 64.2% and now represents 15.8% of Group revenue

We've seen before that, when online fashion companies (Asos and BooHoo spring to mind) crack the international growth, then the shares seriously re-rated upwards. Therefore, I think this is an important potential upside catalyst for Joules - although its product is much more niche than Asos or BooHoo, so the upside may not be quite so big.

Current trading/ outlook - looks good;

The Board reiterates its confidence in achieving full year 2019 Underlying PBT in line with its expectations

Valuation - considering how the competition are struggling, Joules really does deserve a premium price, given its out-performance.

This is not a demanding valuation, and in normal circumstances, I think would be a good bit higher;

eCommerce is doing really well, and has grown rapidly to 46.5% of total retail sales. That's very impressive, and means the business overall should not be blighted by the slowdown in physical retail.

Expanding the physical stores is happening at a great time - when there are plenty of good sites available, with excellent deals available from desperate landlords. It's difficult to think of better conditions for a successful brand to be expanding, which might seem an odd thing to say, but the deals available should mean new shop openings are highly profitable from day 1.

Balance sheet - is good. Solid. No issues here.

Cashflow - is very good, especially the operating cashflow. Note that H1 is the seasonally stronger part of the year.

My opinion - I'm really warming to this share, and feel that I should probably have some in my portfolio at some point - maybe once the macro picture has settled down (if it ever does!)

Fashion business, or any entrepreneurial business really, can often come unstuck when it grows too large, and has to become more corporate. That can kill off the business in some cases, or badly damage it anyway, as the magic from the founder's skills & brand creativity becomes diluted, or disappears altogether. Superdry (LON:SDRY) seems a good recent example of that. Private eCommerce fashion company MissGuided is a more spectacular, disastrous example of this happening - which I reported on here on 8 Jan 2019.

What founders need to do, is to step aside into the creative & marketing, brand, side of the business, and bring in professional management to do everything else. Hence why I really like that Joules seems to have gone down this route;

Colin Porter joined as COO in 2010 and became CEO in September 2015, with Tom Joule focusing on the creative side of the business in his capacity as Chief Brand Officer

It's often a very difficult balancing act, finding the right people who can work together - respecting the founder's vision on brand & product, whilst also introducing proper discipline over how the business is managed, which is usually lacking in smaller companies. Growth is very difficult to manage.

The danger with any fashion business, is that the designers & buyers screw up the fashions, and destroy the brand credibility. My feeling on this, is that Joules has such a distinctive look, that this is probably a lower risk than with most.

Thank you to the readers who commented on the product when I last wrote about Joules, which was very helpful. People mentioned how hard-wearing the product is, hence making customers more tolerant of high prices. I really must do a store visit, and properly look at the product. Although the prices are way above what I would normally pay for clothing. Maybe I need to refocus, and buy better quality stuff, instead of filling my cupboards with Primark stuff?

Looking at the prices on Joules' website, I think a knitted hat, or scarf, might fit my budget.

Incidentally, before we leave the EU (if we ever do), then hopefully we can learn from the French how to properly tie a scarf, instead of doing that ridiculous noose arrangement that Brits tend to think is the only option. Here's a nice, short video explaining some better, French-style, scarf tying options.

So yes, a big thumbs up from me for JOUL shares. At some point, I'll be buying some. I see this as a good long-term winner. I'm not confident enough to do so yet, though.

Bullet points from now on, to get through as many companies as I can.

Empresaria (LON:EMR)

66p - trading update on 23 Jan 2019 - relates to calendar 2018.

The Board is pleased to advise that the Group has delivered profit in line with current market expectations for the financial year ended 31 December 2018.

The Group is expected to deliver a 4% increase in both net fee income and adjusted profit before tax against the prior year. This profit represents another historic high level for the Group.

Due to the mix of profit across brands with different non-controlling interests, diluted adjusted earnings per share is now expected to be slightly lower than the prior year.

Updated forecasts - Research Tree is doing me proud today! There's an update, showing the following revised EPS forecasts;

2018: 12.0p (down 5.5%)

2019: 12.2p (down 6.2%)

With the share price only 66.5p, the PER here is ultra-low, at just 5.5

My opinion - the update goes on to say that there has been some regulatory disruption in Germany & Japan, but that's now sorted.

This staffing group has a good international spread of operations, which has insulated it from country-specific problems.

Some central, business development costs are being increased. That could put a short term brake on profits growth.

I talked through the debt position with management a few months ago, and came away reassured. It's funding a debtor book of high quality customers, so it's really revolving credit, not a particular concern, providing the group remains profitable & cash generative. Management seem pretty switched on.

The valuation looks attractive to me, for a group with a sound track record;

An interesting aside with Empresaria, is that it has multi-branded operations. Therefore, if it needed to downsize, the disposals would be easy to implement.

The share price looks over-sold to me.

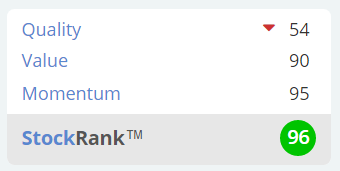

Mission Marketing (LON:TMMG)

Trading update for calendar 2018.

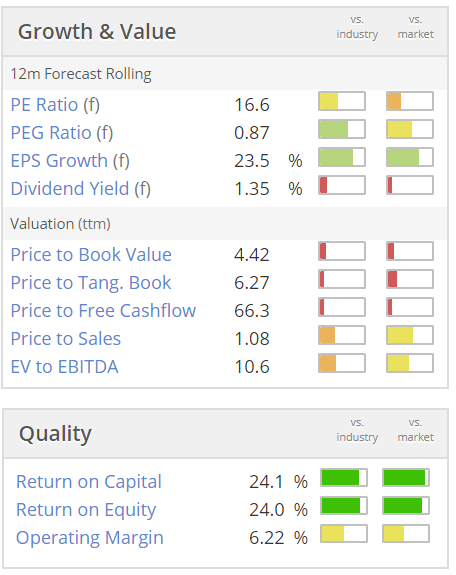

A good update, for a share that seems to have a perennially low PER;

2018 finished strongly, as anticipated, and results for the year are expected to be in line with market expectations. We expect revenue to be over 10% ahead of last year, reflecting core growth of c5% and the first contribution from our 2018 acquisition, krow Communications.

Headline profit before tax** is expected to be over 20% higher than last year, at £9.4m, representing the eighth year of consecutive growth. Against a background of continuing uncertainty and challenges in our sector, we are particularly pleased with this progress.

Net debt - this is very pleasing, as rather too much debt has been the Achilles Heel of this group for many years. The position now looks much better - which is ideal, if we are heading for more difficult economic times, then getting debt down in advance makes a lot of sense;

... the net bank debt position at 31 December 2018 was £4.0m, slightly better than market expectations. The ratio of net bank debt to EBITDA consequently reduced to below x0.5, strengthening the balance sheet further and triggering another reduction in interest rates on the Group's debt facilities from this month to 1.25% over LIBOR.

My opinion - given the lowly valuation, this update comes across well.

The forward PER of only 6.4 looks great value. However, with possible storm clouds on the economic horizon, then marketing groups are going to be avoided by most investors - hence low valuations probably make sense.

If economic conditions turn out OK, then this share could have nice upside on it, it's very linked to the macro picture.

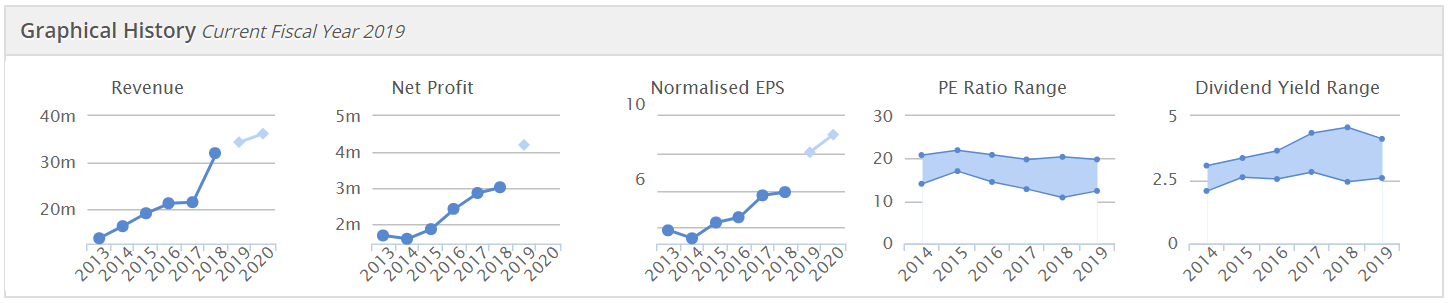

Stockopedia likes it a lot;

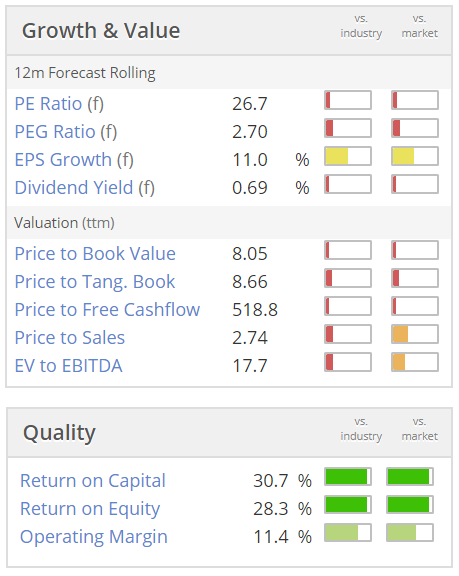

Hotel Chocolat (LON:HOTC)

295p - trading update, published on 23 Jan 2019;

Hotel Chocolat Group plc, a premium British chocolatier and omni-channel retailer, today announces the following trading update for the 13 weeks ended 30 December 2018.

- Total revenue up 15% - no LFLs given

- Opened 15 new stores in UK in H2, now has 117

- Trading in early 2019 continues to be in line with mgt expectations

- Strong Xmas trading

- Wholesale performed well - lower margin, but capex light

- TV documentary drove sales of chocolate liquor

- Loyalty scheme recruited 400k new members

- New York & Tokyo stores well received

My opinion - I'm not a fan, of their chocolate (which I found bland & ludicrously expensive for what it is), nor the shares - which also seem far too expensive, given the fairly pedestrian EPS growth - which incidentally, requires a lot of capex to achieve - e.g. expansion capex used up pretty much all the cashflow it generated last year.

Rightly or wrongly, I see this retail format as being gimmicky, and probably not having long-term longevity. Why? Because the product is all fur coat & no knickers, in my view. Fancy packaging & a nice shop format, but when I spent £10 on 3 small chocolate bars, it tasted like it could have come from the pound shop. I should probably test out more of the product, to make sure. Sooner or later though, consumers wise up to product that isn't as premium as it's made out to be.

It would be interesting to ask more widely to people we know (and readers here) - what do you think of the Hotel Chocolat product? Am I being unfair? Are my uncouth, unsophisticated palate & low-brow style preferences betraying me? I'm genuinely interested what readers think of the product & brand. Could there be an opportunity here, perhaps? I'm just mindful of how Thorntons lost brand credibility in the chocolate sector, trying to pretend to be premium, until people wised up.

This valuation seems too high to me, even after recent falls. A forward PER of 27, for just 11% earnings growth (driven by new stores, which cost a lot of capex). How does this valuation make sense? Is the brand really worth this sort of premium? Nice quality scores though. Of the companies I'm looking at today, Joules (LON:JOUL) strikes me as a much better, and better value, brand roll-out, than Hotel Chocolat. (I hold shares in neither, just to clarify)

Midwich (LON:MIDW)

560p - A positive trading update from this audiovisual products distributor.

The Group's trading momentum continued in the second half of the year, with encouraging growth seen across all of the Group's divisions. Additionally, all of the acquisitions made in 2017 performed either in line with or ahead of the Board's expectations and continue to benefit from being part of the Group.

Consequently, the Board now expects to report revenue for 2018 in excess of £570 million, representing growth of approximately 20 per cent over the prior year (20 per cent at constant currency). The Group has delivered revenue growth whilst continuing to improve gross margins in line with the Board's expectations. Cash generation was also strong and the cash conversion rate for the year was ahead of the prior year.

As a result of this strong performance, the Board now anticipates reporting adjusted profit before tax for 2018 to be slightly ahead of its previous expectations.

It's not a sector that interests me.

Priced at 19 times earnings, and with very little tangible book value supporting the price, I wouldn't want to explore this share idea any further.

dotDigital (LON:DOTD)

78p - this update doesn't look madly exciting. Organic growth was fairly modest at 15%.

- Adjusted EBITDA in line with market expectations for the 6 months to 31 Dec 2018.

- Comapi struggled due to several retail clients going bust.

- Plenty of cash, at £16.6m - more acquisitions likely perhaps?

My opinion - valuation of 19 times forward earnings looks quite reasonable for a tech, growth company. Trouble is, its growth has slowed to an unexciting rate.

This has historically been a very good company. So if management can accelerate organic growth, then the shares could re-rate upwards. There's also the chance that a highly rated partner (like Shopify or Magento) might buy DotDigital perhaps? I learned at the Cloudcall (LON:CALL) CMD recently, that good third-party software add-ons are very valuable to bigger software companies, as they make the bigger company's clients more sticky, hence increasing their lifetime value.

I think this one's worth adding to my watchlist.

Tribal (LON:TRB)

Share price: 72.4p (down 9.4% at 14:41)

No. shares: 196.1m

Market cap: £142.0m

I reviewed this education software/services company's latest trading update yesterday, here. It contained a warning of a dispute with a software provider, over royalties, which could "potentially lead to a material claim" against Tribal.

Today we hear that this claim could be very serious;

... yesterday evening received a letter of claim from lawyers acting for a provider of a software platform on which a number of the Company's material products are based. The letter claims that Tribal Education Limited has failed to account properly for royalties under the terms of a Value Added Reseller Agreement dated 1 April 2000 and has breached the terms of that agreement.

Whilst no specific amount is claimed the letter of claim estimates the losses at between £15 million and £30 million. These claims date back over a period of more than 18 years during which the Group has regularly made royalty payments and the Board does not consider the claims to be justified.

The Board intends to defend these claims vigorously.

My opinion - I'm amazed the share price hasn't fallen more than it has (almost 10% at the time of writing). Legal action is one of the worst type of uncertainties for private shareholders. We have no way of knowing what the risk of a substantial payout could be. Costs alone could also be substantial.

For me, this would make my decision very easy - I would have sold on the opening bell today, had I held this stock. I see it an uninvestable now, until this potentially very large legal dispute is resolved.

Bonmarche Holdings (LON:BON)

Share price: 38p (up 2.7% today, at 14:53)

No. shares: 50.0m

Market cap: £19.0m

Graham covered the awful profit warning from this womenswear chain here on 13 Dec 2018, his article nicely summarised the main points.

Today's update is for Q3 of the financial year, and year to date. The year end is 31 Mar 2019.

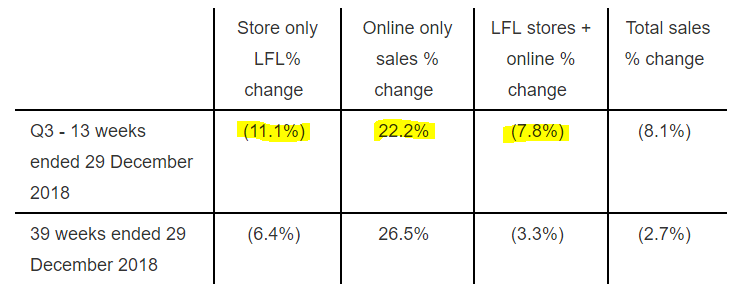

The information is very well presented, clearly showing the stores, and online, both separately and combined. We need this information, so retailers which deliberately obscure it, are being very unhelpful, and usually they do that in an attempt to bury, or delay, bad news.

The problem with BON is that its shops are seeing a steep decline in sales (partly due to lower footfall), but worsened by a poor autumn/winter product range.

Whilst its online sales are up decently, the 22.2% Q3 increase in online sales has only recouped about 30% of the decline in store sales - hence overall sales are still down -7.8% on a like-for-like basis. That's very bad, because of course the stores costs are largely fixed, causing an operationally geared fall in profits. Meanwhile growing online sales is positive, but costs there are more variable.

As I've mentioned before, the only fashion retailers worth considering, are ones where the online offering is at least 30%+ of total sales, and growing strongly. The best one is Next (LON:NXT) - where online growth is at least offsetting decline in store sales. Other ones worth considering, which are doing well online, are £JOUL and possibly Superdry (LON:SDRY) .

I currently don't hold any of those shares, even though I can see some appeal to them all.

Back to BON. It gives more detail, as follows;

December's announcement included an update on trading during October, November and early December 2018. A slight improvement in footfall towards the end of the month resulted in the store LFL sales figure being marginally better than the negative 12%, which together with an approximate negative 1% LFL for Q4, represented the mid-point of the underlying PBT range given.

Online sales continued to grow strongly during the period, albeit at a lower rate than in the first half of the year.

Gross margin during the period remained in line with revised forecasts and were below last year due to additional discounting and expected exchange rate headwinds.

Profit guidance - previously we were told to expect a full year result of between breakeven, and a loss of -£4m. Therefore today's mention of the mid-point, seems to be suggesting an outcome of a loss of -£2m.

Cash - reassurance that they have enough to get through the low point of the year, at end March.

Winter stock is clearing well.

Current trading is in line.

My opinion - it's loss-making now, so doesn't interest me, at any share price really.

The future long-term looks grim - continuing falls in store sales, whilst costs (especially wages) continue increasing.

However, the good news is that BON has short leases - the average should now be down to just 3 years. Therefore it will be able to shrink the store estate down in size quite quickly. Or, retain stores if landlords drop the rent enough to make them viable.

As the store estate shrinks, it will also have to shrink central costs too.

The focus on growing online sales is crucial, although BON has not grown this anywhere near enough - online was only 12% of total sales, as reported in the last interims. The company therefore has a huge mountain to climb, to get online sales up to where they need to be, to ensure long-term survival of the business.

We're probably nearing the end of the dividends. This year is forecast to be cut more than half. If business doesn't improve (and why would it?) then dividends will need to be abolished altogether, to conserve cash.

Overall, I can see why some people might be tempted in by the £19m market cap, but to me this looks like a slowly dying business. It's very difficult to see what would change, to enable this company to prosper in future. It's more likely to limp on for a few more years, gradually down-sizing the store estate. The best hope is that competitors go bust before BON, thus increasing its market share. If that can be combined with drastically reduced rents, then it could still be around for some time to come. I just don't see any prospect of significant shareholder value being created.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.