Good morning, it's Paul here!

Hopefully I'll do a better job of reporting on today's news than earlier this week. The volume has overwhelmed me a bit this week, but I'll get cracking.

Fevertree Drinks (LON:FEVR)

Share price: 2769p (up 6.6% today, at 09:17)

No. shares: 116.1m

Market cap: £3,215m

Just to mention this mid to larger cap, in passing, as it's such an interesting situation - the maker of posh tonic water & other premium mixer drinks.

Shareholders can breath a sigh of relief this morning - with a positive trading update. Growth in the UK has been strong, at 52%, and international growth also looks to be taking off well.

Reflecting the continued strong performance in the second half, the Board expects that the outcome for the full year will be comfortably ahead of the Board's expectations...

We're not seeing many trading updates like that at the moment.

The £3.2bn market cap may look like madness, but not if it continues growing this strongly. Revenues may be relatively modest, but its operating profit margin is very high.

The forward PER isn't as bonkers as it's been in the past, either. Stockopedia is showing consensus of 49.2p for 2018. "Comfortably ahead" possibly means 52-53p, at a guess, making the 2018 PER about 53.

Fro 2019, I imagine forecasts will be increased - I'm inclined to pencil in 60-70p EPS. That equates to a PER of between 40-46 - high, but not outrageous for a growth company that is performing very well.

My feeling is that growth company shares now resemble playing Russian Roulette. The slightest disappointment, and you wake up to an instant 50% loss. Whereas, as we've seen today, an out-performance update has only added 7% to the share price. That doesn't seem terribly good risk:reward to me.

Flybe (LON:FLYB)

Share price: 4.6p (down 28% today)

No. shares: 216.7m

Market cap: £10.0m

Overview of offer to shareholders

This clarification type statement seems to be telling Flybe shareholders that the game is up, and that the derisory offer of 1p per share from a consortium including Virgin & Stobart, is the only option.

This sentence sounds crucial to me;

The sale to Connect Airways of Flybe's trading subsidiaries is expected to complete by the longstop date of 22 February 2019. This will not require shareholder approval.

You would normally expect selling off the entire business for virtually nothing to require shareholder approval. However, I think I'm right in saying that in situations of imminent financial collapse, Directors can waive this requirement. Could any readers more familiar with M&A either confirm, or correct me on this point. Thanks in advance.

So the way today's RNS sets things out, even if shareholders vote against the 1p takeover bid, it won't matter - because the shareholder vote is not to approve the sale of the business, it's to approve the 1p bid for what will by then just be a cash shell.

The only hope for FLYB shareholders, is if a higher competing bid appears, although it looks to be getting late in the day for that.

My opinion - with the share price at 4.6p, and the most likely outcome being a 1p bid, then the logical thing to do would seem to be selling out now, at 4.6p, instead of taking the imminent 82% loss to 1p.

There again, anything could happen. Maybe shareholders feel that they've lost so much already, that they don't really care about the tiny, remaining scrap of value?

What a sad end for shareholders. However, at least the sale to the consortium guarantees the future of the business, and the many jobs. Flybe is a very important airline for connecting regional airports in the UK, which without it, might even have to close. So in the big picture, the promised £100m investment into Flybe by the new owners should be welcomed.

Inland Homes (LON:INL)

Share price: 54.8p (down 3% today)

No. shares: 207.4m

Market cap: £113.7m

Inland Homes (AIM: INL) ("Inland Homes", the "Group" or the "Company"), the leading brownfield developer, housebuilder and partnership housing company with a focus on the south and south east of England, provides the following update ahead of its Interim Results for the six months ended 31 December 2018, which will be announced on 7 March 2019.

- Much bigger banking facility agreed with HSBC (£65m) to replace £20m Barclays facility

- Planning permission imminent for a large brownfield scheme of 1,853 plots

- Short term Brexit uncertainty

- Other developments in progress (there's more detail in the RNS, if you're interested)

My opinion - where's the long-term shareholder value creation? Answer, there doesn't seem to have really been any! Take a look at the long-term chart - the share price went down a lot in the financial crisis, and has basically taken 12 years to get back to where it was in 2007, at the start.

Has Inland paid massive dividends along the way? No - dividends have been modest, and not a patch on the enormous payouts by e.g. Persimmon (LON:PSN) .

Therefore the only conclusion I can come to, is that this company seems to exist mainly for the benefit of its staff & Directors. Although shareholders who timed their entry & exit well from 2013-2016 would have done well.

Looking at things more positively, the bombed out share price here might be providing an opportunity perhaps? The company seems to have a lot of projects in the pipeline. The current share price is well below NTAV - and there is development upside on NTAV. The EPRA NAV is between 95-102p. I'm not exactly sure what the basis for that is, but I think it might include some of the development upside. The current share price of 55p therefore looks low, relative to EPRA NAV - possibly because management has a poor track record, of failing to create long-term shareholder value? Plus they don't seem to have any skill in predicting market conditions - as this group was created just before the market crashed in 2008.

Worth a closer look, for sector experts, I would say. There might be value here. I imagine the housing market is likely to kick-start once the politicians have successfully sabotaged Brexit. So this could be an interesting time to look at housebuilding shares, for risk-tolerant investors.

SimplyBiz (LON:SBIZ)

Share price: 163p (up 8% today, at 10:10)

No. shares: 76.5m

Market cap: £124.7m

SimplyBiz (AIM: SBIZ), the leading independent provider of compliance and business services to financial advisers and financial institutions in the UK, today issues a pre-close trading update for the year ended 31 December 2018.

I like this easy-to-understand business model. It's an advisory service, on subscription (so good recurring revenues), on complex regulatory matters. It makes complete sense for clients to use an external adviser, as the regulations are so complex that specialists are needed.

Note that Peel Hunt was appointed as joint broker earlier this week - a precursor to a fundraising, possibly? Today it reports £6.4m of net cash on the balance sheet, which looks healthy. So any possible future fundraising would either be to fund acquisitions, or for a secondary placing of some of the Chairman's 40% stake, maybe. This is pure speculation on my part.

Trading in 2018 has been good;

The Group has performed strongly throughout the year, with trading in line with management expectations.

Outlook comments - sound positive;

One of the many positive factors of our business model is our recurring income and forward revenue visibility. This provides us with a great deal of confidence, and we enter 2019 full of optimism and in great shape for the year ahead.

"Our capital position and a highly-fragmented marketplace offer us ongoing opportunities to build out our service offering, reinforce the strength of our organic growth platform and pursue selective acquisitions.

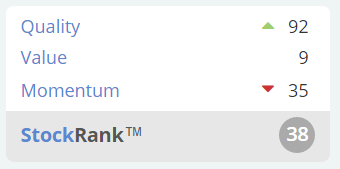

Valuation - this looks good value on a PER basis, especially considering that it traded well in 2018, and is forecast to grow EPS by a further 23% in 2019;

My opinion - I had a fairly detailed look at SBIZ when it reported interim figures here in Sept 2018. My view on it was positive, and included a chat with the CFO to clarify a couple of points. The share price, even after today's rise, is lower than it was back in Sept, and the valuation seems much more attractive now - as we're valuing it on 2019 forecasts now.

This is not a share I hold personally, but it's high on my watch list. It looks a decent business, with recurring revenues, and a profitable niche market. Growth is good, and divis are coming through. Therefore it gets a solid thumbs up from me.

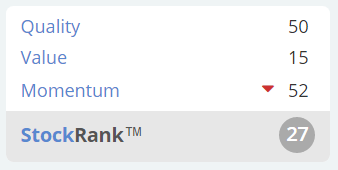

I'm not sure why the Stockopedia computers are so sceptical? The StockRank system is flashing a warning though, so it would need a deeper look into the numbers to be sure there's nothing wrong. The relatively short history as a listed company could possibly be marking it down?

EDIT: there's a useful updated broker note today, from Zeus, available on Research Tree.

Tribal (LON:TRB)

Share price: 80p (up 4% today, at 11:44)

No. shares: 196.1m

Market cap: £156.9m

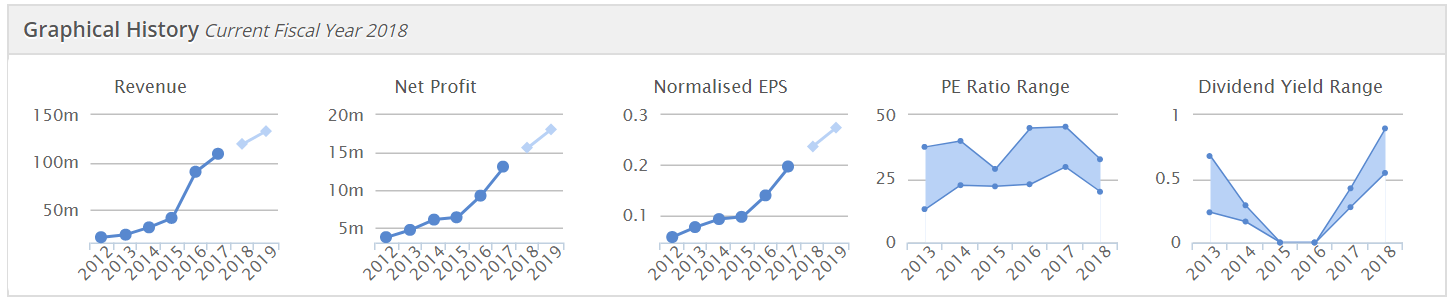

The wheels came off quite badly in late 2015, for this educational services business. It's staged a very good share price recovery since.

Today's update sounds good, I think?

The Group has continued the positive performance reported in the first half and the Board anticipates the EBITA for the full year to be materially ahead of expectations whilst revenues will be lower than last year, as expected.

Operating margins are anticipated to be higher compared to last year as a result of improved operating efficiency and good cost control.

As announced with the half year results, the full year results will include the impact to EBITA of IFRS15 revenue recognition which would otherwise have resulted in significantly higher profits.

Other points, which I'll summarise;

- Good sales progress in the UK

- Australian schools "challenging". Restructuring underway, £1m cost

- Efficiency gains & cost savings progressing in line with expectations

- Ooh, I don't like the sound of this;

The Group is in dispute with a platform software supplier regarding historic royalty payments. This may potentially lead to a material claim, in which case we will vigorously defend it. We will update as appropriate.

Cash position looks strong;

The Group's balance sheet has continued to strengthen, with no long-term debt and positive collections resulting in net cash above expectation. Net cash at 31 December 2018 was £20.0m (2017: £14.1m).

Bear in mind that the company receives a lot of cash up-front from its customers, in advance of services being provided. Therefore, whilst this cash balance is very good, don't run away with the idea that Tribal has a strong balance sheet, because it doesn't.

At 30 Jun 2018, it had NAV of £32.2m, less intangibles of £34.1m, gives NTAV slightly negative, at -£1.9m. However, this isn't a concern, since software companies often operate with favourable cashflow - getting money up-front from customers. Hence what would otherwise look a weak balance sheet, in other sectors, is absolutely fine in this sector.

You just have to be a bit careful when using Enterprise Value in valuing software companies, as the cash isn't really theirs, it's up-front money from customers. It's also worth trying to find out what seasonal movements there are in cash balances - as year ends are usually chosen to reflect a seasonal high point in cash.

Directorspeak - sounds pretty good;

"I am pleased with the improved profit performance for the year. Tribal has won significant new customers in a competitive market and has a good pipeline of future opportunities. The improvement in margin through effective cost management continues the programme implemented in 2016.

I look forward to continued momentum in 2019 and the years beyond."

Updated forecasts - from N+1 Singer, are available on Research Tree.

My opinion - this sounds a good update today, apart from the potential legal claim.

As regards valuation, on about 18-19 times 2019 forecast earnings, I'd say this looks priced about right. After the big market correction, I'm looking for bargains at the moment, not things that look fully priced, hence it doesn't really appeal to me.

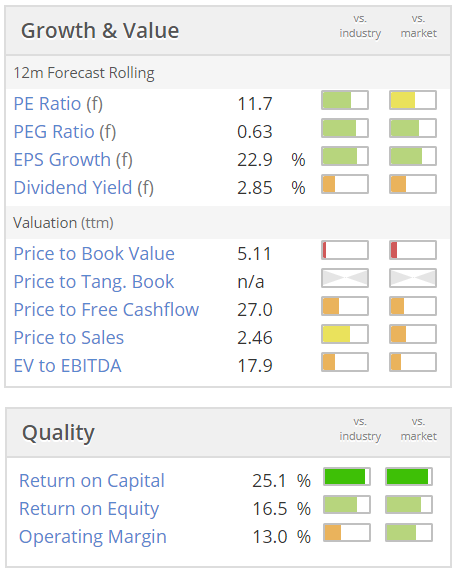

Quixant (LON:QXT)

Share price: 282p (down 18.7% today, at 11:51)

No. shares: 66.4m

Market cap: £187.2m

Quixant (AIM: QXT), a leading provider of innovative, highly engineered technology products principally to the global gaming industry, is pleased to provide the following update on trading for the year ended 31 December 2018.

As with so many growth companies, this share has now fallen considerably from its peak last year (c.486p in Sep 2018) - that's down 42% to 282p at the time of writing.

Today we get a mild profit warning;

Overall, Group revenues are expected to be c. $115m, slightly lower than current market forecasts of $120m, predominantly as a result of the decline in gaming monitors, leading to adjusted profit before tax also being slightly lower than market expectations of $18.98m.

Net cash at 31 December 2018 was approximately $9.9m.

Broker forecasts - have only been trimmed today by -6% for 2018 earnings, and -5% for 2019 - so no great shakes. I wonder if the -19% share price fall today, following on from a previous softening of the share price, might be overdone, and resulted in an attractive entry point?

Converting into sterling, we have:

Forecast 2018: 17.8p giving a PER of 15.8

Forecast 2019: 20.5p giving a PER of 13.8

The 2019 PER looks quite attractive, for a group which has delivered very good profits growth in recent years, with very little dilution from new shares.

I wonder if it might have taken on too much debt, to fund acquisitions?

I've looked back at the most recent interim balance sheet, and it looks fine to me. There's a little debt, but that was more than outweighed by cash. Net cash has since grown to $9.9m at end Dec 2018. Therefore it gets a tick in the box from me, with a strong balance sheet. No worries there at all.

Directorspeak/ outlook;

"I am pleased that our core gaming platforms business has continued to perform strongly, growing revenues and market share in what has proved to be a challenging year for the global gaming industry.

We continue to see a robust market for gaming monitors and, after having made the strategic decision to reduce our exposure to low margin business, I anticipate our monitor business will return to growth with improved margins in the future.

"During the year we have made some senior hires and formed divisional boards, to reflect the growth in the Group's business in recent years. I am confident we are well positioned to deliver on the significant market opportunity in both gaming and other markets and continue our track record of strong, profitable growth."

My opinion - the profit outcome for 2018 is only slightly up on 2017. So if we are now regarding this as a mature business, with little profit growth in future, then the current valuation of 15.8 times 2018 earnings, might even be a bit too high still.

However, if the company achieves its 2019 forecasts, which is a 15% rise in EPS, then the PER would drop to 13.8, and would in my view be attractive at that point. The outlook comments sound confident, so there's probably a good chance that the company might achieve its 2019 figures.

Taking into account its strong balance sheet, with net cash, this looks a fairly good proposition.

The forecast dividend yield is only 1.2%. I imagine the company is likely to make more acquisitions, using its growing cash pile.

Overall then, this gets a thumbs up from me. It looks worthy of doing some deeper research.

Stockopedia's view? This shows a very high quality score, but poor value. Although note that the value score could well improve after today's sharp fall in share price, coming on the back of only small downgrades to forecast earnings. So I think we can perhaps anticipate that the StockRank might start to improve from here, possibly?

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.