Good morning!

I've had a quick look at the sparkling interim figures from JD Sports Fashion (LON:JD.) - it just shows that, even in tough conditions, the best companies can still deliver good figures. The numbers benefit from an acquisition in the USA. The narrative talks about further international expansion, including in the biggest potential market, the USA - which could be exciting. It looks very impressive, apart from the now loss-making outdoors division - affected by the hot summer (not many people buying outdoor coats for hiking, etc). Worth a closer look, when I have more time. Although I am uneasy about a highly profitable retailer distributing other brands' stock - there's the potential risk of big brands squeezing JD's profits at some point.

Here are some late comments from Monday's announcements. More people will see them if I put them into today's report (I wrote these comments below last night. They're brief, because I'm concentrating my energies more on companies which interest me.

Brady (LON:BRY)

A trading & risk management software company.

Interim results (6m to 30 Jun 2018) look poor (loss-making), but it expects a better H2. With 95% visibility on 2018 revenues, that seems well underpinned.

Balance sheet looks quite weak, but software companies get paid up-front, so can often operate fine with a weak balance sheet.

With such a poor track record, it's difficult to understand why this company is valued at anything like the current market cap of £55m (at 66p per share). Maybe the client relationships would be attractive to an acquirer?

The narrative talks about a 3 year turnaround plan. It doesn't interest me. Why pay up-front for a turnaround that hasn't yet delivered profitability?

Luceco (LON:LUCE)

Poor H1 results, but a more positive outlook for H2;

The Group's outlook remains unchanged from the July 2018 Trading Update. The second half of 2018 is anticipated to be a stronger period than the first six months with a return to profitability expected.

Although UK consumer confidence remains fragile the Group has moved into the third quarter with: a 30% increase in the UK Retail order book, lower commodity prices, better selling prices and a more favourable currency position as a result of the hedging actions taken at the beginning of the year and improving currency markets.

Consequently, the Group is well positioned to deliver year-on-year adjusted operating profit growth in the second half of the year.

It's not the sort of company that interests me at all.

UP Global Sourcing Holdings (LON:UPGS)

An in line update. Profit is well down on last year, but as expected.

Not a very good company, in my opinion.

Maintel Holdings (LON:MAI)

Interim results - this telecoms company might be worth a closer look. H1 profit is down slightly against LY, but the outlook comments sound upbeat.

Valuation looks modest, with a low PER and decent dividend yield.

I don't understand this sector, so don't invest in it usually, so it's not for me. Readers might want to have a look into it though, as it looks superficially attractive at first glance.

Belvoir Lettings (LON:BLV)

Share price: 108p (unchanged today, at 08:33)

No. shares: 34.9m

Market cap: £37.7m

Belvoir Lettings PLC (AIM: BLV), the UK's largest property franchise, is pleased to announce interim results for the six months ended 30 June 2018.

This is quite an interesting little company, which mainly operates residential property lettings offices, through a franchise model. There's some ancillary income from property sales & mortgage broking.

Notable features are that it's been growing in recent years, and has a high dividend yield. The shares are quite illiquid, with a wide spread, so it's not one to trade in & out of.

- H1 revenue up 19% to £6.1m

- Adjusted profit also up 19% to £2.43m

- Statutory PBT is up 66% to £2.87m, but this benefits from a one-off £800k boost, from reducing a provision for contingent consideration. Therefore, the adjusted number above is the right one to use when valuing the share

- H1 figures benefit from an acquisition on 13 July 2017 - which didn't contribute at all to H1 last year, but delivered a full 6m trading in H1 this year

- Interim dividend flat at 3.4p

- Good cashflow

- Weak balance sheet, with negative NTAV

- Contingent consideration creditor of £4,155k is in current liabilities - so investors need to confirm how the company is going to pay this? Cash or shares? If cash, where will they get it from? e.g. increased borrowings?

Outlook - trading in line with full year management expectations. Why do they say management expectations, and not market expectations?

H2 has made a promising start.

BLV is expecting c.20% of letting agents to exit the market due to tough conditions & regulations. That seems a good opportunity for it to grow market share. That's an interesting theme more generally at the moment. Sectors which are struggling will have winners & losers. Every participant that goes bust, frees up more market share for stronger competitors.

Stockopedia shows consensus forecast at 11.6p for 2018, giving a PER of 9.3 - that looks about right to me, considering that there's a fair bit of debt on the balance sheet.

My opinion - an interesting small growth company. Over the last 5 years, the share price hasn't really gone anywhere though - although shareholders would have collected in plenty of dividend income over that time.

I'm not comfortable with the high dividend payouts, combined with a weak, indebted balance sheet. That's not a good combination. I'd rather see divis reduced, and the balance sheet strengthen over time. But I'm not a shareholder, so my opinion doesn't matter!

Overall, to me it looks priced about right. Quite an interesting little company, but it's not likely to shoot the lights out in terms of share price - I think there are probably better opportunities elsewhere.

Private property lettings is not an area I want exposure to. Rents are far too high for many low income renters, and this is a political hot potato. The trend seems to be towards Government action to clamp down on lettings, and I imagine that would continue.

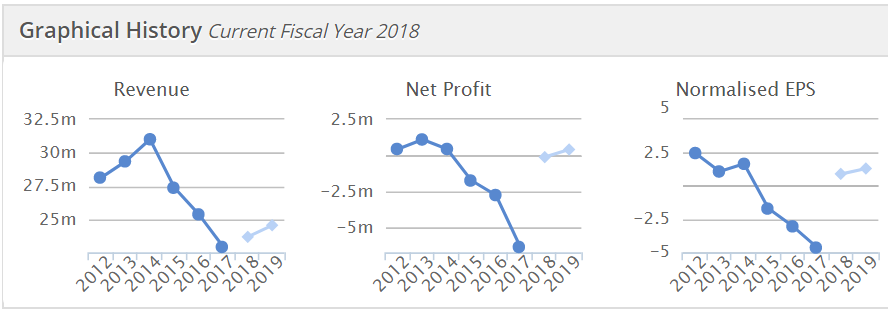

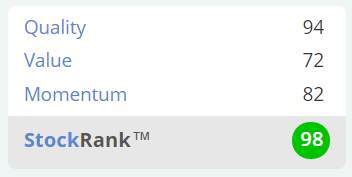

Stockopedia's algorithms love BLV - it's ranked as a "Super Stock", together with a cracking StockRank. So maybe there's a bigger opportunity here than I've realised?

NB. Please remember that StockRanks are not guaranteed to find winners (nothing is). However, the system is now statistically proven, over 5 years, to produce market-beating returns for a basket of stocks. Hence why I take notice of StockRanks as part of my research process on all shares.

Incidentally, nobody at Stockopedia has ever put any pressure on me, or even asked me, to back the StockRank system. Indeed for the first year or so, I held back from saying anything much about it, as I wanted to wait and see what the track record was like. I'm happy to back it now, because it works.

SimplyBiz (LON:SBIZ)

Share price: 185.5p (up 4.8% today, at 10:12)

No. shares: 76.5m

Market cap: 141.9m

SimplyBiz (AIM: SBIZ), the leading independent provider of compliance and business services to financial advisers and financial institutions in the UK, today announces its unaudited results for the six months ended 30 June 2018.

Recap - SimplyBiz floated on AIM in April 2018. It appeared at the Mello Derby investor show shortly afterwards - I recall hearing plenty of favourable comments about SimplyBiz, from successful investor friends at Mello. So it's been vaguely on my radar ever since, as a possible future purchase.

SCVR coverage on the company to date, has been;

16 Mar 2018- Graham briefed us on the company, just before it floated.

17 July 2018 - Graham wrote a section here, commenting on its in line with expectations trading update.

Interim results - announced today look good to me, at first glance.

- Revenue up 13.7% to £24.2m for H1 - the bulk of which (8.6%) came from an acquisition (Landmark Surveyors), the balance is organic growth

- Adjusted profit before tax up 60.8% to £4.5m - a very impressive increase. Also note the very high profit margin of 18.6%

- Adjusted EPS up 61.7% to 4.68p

As an aside, I'm normally happy with adjusted performance figures, providing the adjustments are reasonable. It's fine to adjust out amortisation of acquired intangibles, because those are meaningless book entries when it comes to actually valuing a company.

As Graham has pointed out before, the statutory (i.e. not adjusted) numbers can be useful in assessing whether acquisitions have added value or not, over the long term. Although that's a secondary consideration for me. I don't really care whether a business has grown organically, or through acquisition. It's current performance & outlook that matters to me, and I don't want arbitrary intangibles & their amortisation muddying the valuation waters. So I always strip out acquired intangibles from the balance sheet, and also the related amortisation from the P&L.

Finance costs are unusually high, which is a one-off, as debt was repaid as part of the IPO. The adjusted profit figure removes £1.3m of exceptional finance costs. In future, finance costs should be very low, because debt has now been repaid. The H1 figures include about 3-4 months when the group was still highly geared, pre-IPO, so are not representative of the future.

Dividends - this is reassuring;

Maiden interim dividend of 0.98p per share, in respect of the nine months trading to 31 December, post IPO, as per the stated intention in the admission document

A high margin business like this should have the capacity to pay much bigger dividends in the future.

Outlook - sounds fine, and clearly worded;

Since the end of the period, trading has continued in line with the Board's expectations, and we remain on track to deliver on market expectations for the full year.

Valuation - what are market expectations then? It's helpful when RNSs include a footnote, telling us what market expectations are. The next best thing is a broker update note published on Research Tree, which I'm pleased to report is available in this case, from the house broker.

Incidentally, if you're a serious investor, and do not already have a Research Tree subscription, then you're crazy! Post MiFIF II, I find it a vital source of research information for private investors (I have never had any commercial relationship with RT by the way, for the more suspicious-minded amongst you).

Adjusted ESP forecast for 2018, is 10.5p. So at 185.5p share price, that's a 2018 PER of 17.7 - seem reasonable for a high margin, growing company, in an interesting niche, with recurring revenues.

Forecasts beyond this year are obviously less certain, but rise to 12.9p in 2019, and 15.0p in 2020. That would bring the 2020 PER down to 12.4 if forecasts are achieved.

Balance sheet - looks adequate, rather than strong.

NTAV is sllightly negative, at -£535k. That's not a concern for a business with no capex requirements, and which receives recurring cashflow from customers.

One oddity is that it has cash of £10.7m, simultaneously with having £10.0m in borrowings. Why would this be? Note 11 indicates that the company drew down £10.1m from a new £15.0m Revolving Credit Facility in April 2018.

I think the question needs to be asked, as to why the company doesn't pay off the loan, to save on interest charges, using its cash pile of roughly the same amount? Maybe the cash was at an unusually high spike as at 30 June 2018? I can't think of any other reason why this company would have a loan and cash simultaneously. There doesn't seem to be any issue with large creditors needing to be paid imminently.

It would be useful to have some clarity on this, I've put a call into the company's advisers, and am awaiting a call back. I'll insert here what the explanation is, if/when they get back to me.

** UPDATE - telecon with SimplyBiz CFO, Gareth Hague **

My thanks go to Instinctif Partners for putting me in touch with the Group CFO of SimplyBiz today, who was happy to answer my questions about the cash/debt situation.

The reasons the company has both a £10.7m positive cash balance, and £10m drawn down on its RCF bank facility are as follows;

- Management prudence at time of IPO in April 2018 - i.e. have plenty of cash on hand, so everything goes smoothly

- Adjustments to drawdown of RCF occur quarterly, so the first one was in July, after the interim period end

- Investment opportunities (i.e. smallish potential acquisitions) were simmering away over the summer, so the company wanted flexibility, of having ready access to cash

- If repayments are made on the RCF, then the bank charges non-utilisation fees. So the saving on interest charges from repayment is not that great

- The company may repay some of the RCF using surplus cash at the next review, in Oct 2018, if no acquisitions are imminent

- Debt to EBITDA is low, so the company has plenty of borrowing flexibility

- Very good relationship with Yorkshire Bank

I also asked the Group CFO about the cyclicality of cashflows. He said that revenues are typically smooth - most customers (IFAs) pay on a monthly direct debit, either at the end of each month for that month's services, or pays in the following month.

Outgoings are more cyclical, because staff bonuses are paid in H1. So H2 sees better cash conversion than H1.

There's very little concentration of client risk. Biggest client is about 1% of revenues. Clients typically pay between £250-750 per month, which is about 2% of client revenues. The service relieves them of regulatory worries, so is seen as money well-spent by most clients.

There are competitors offering similar services, but "we work hard for our fees".

I am completely satisfied with the explanations given. My thanks to Gareth Hague for taking the time to telephone me,

** End of Update **

My opinion - SimplyBiz looks good to me. The valuation seems fair, and I very much like the niche which this company serves. Increasingly complex regulation, in many sectors, has opened up opportunities for advisory businesses. It's money well-spent for small companies to pay a subscription, to have expert advice on complex matters, on hand. The alternative, of having to research complex areas yourself, makes me shudder with horror.

Overall then, I'm tempted to open a new position here at some point. Although given macro worries, I'm tending to add interesting companies to my watchlist, with a "buy the dips" mentality, rather than chasing it up in price.

SimplyBiz looks to me like a quality IPO, not something that was buffed up for sale, only to disappoint later - we've had far too many of those this year. So far so good, although it's still early days.

Two companies look as if they'll be leaving AIM shortly, in very different circumstances;

Produce Investments (LON:PIL) - a potato farmer. A recommended cash takeover bid, at 193p has been announced. This is a 35% premium. The price looks fair to me.

The announcement today says that being privately owned will be more suitable for the company. I couldn't agree more - it was always a misfit on the stock market.

Note that the StockRank is 96, and it's ranked a "Super Stock". This share has been cropping up on my value screens for some time now, but I just didn't want to own a potato grower. Just shows, sometimes the most mundane companies can have upside.

Apologies, something went funny with the formatting from this point, I'm trying to sort it out now.

OneView (LON:ONEV)

Down 81% today, on news of the shares de-listing.

I warned SCVR readers off this share twice in the past. So hopefully no readers here got caught out.

We have to be so careful when looking at the tiniest companies on AIM. De-listing is the end game for quite a lot of tiny, loss-making companies. This usually results in c.50% instant losses for shareholders, sometimes more, as in this case. Therefore there's one simple solution;

Don't buy junk like this in the first place!

Toople (LON:TOOP)

This is another micro cap "Sucker Stock", also with a StockRank of 3, which is down 47% today. The reason is a £2.2m placing at just 0.3p per share, a huge discount.

The modus operandi here seems quite cynical - excite the share price with contract win announcements (that's what caused the recent big spikes up in share price), then do a deeply discounted placing as quickly as possible.

Why do I mention this? To warn people that buying into supposedly good news, at a micro cap which doesn't have enough cash in the bank, is asking for trouble. Very often you'll get viciously diluted in a placing that you have no access to.

Again, it's easy to avoid junk like this, just by doing some very basic research. Or, to save time, just avoid shares with a low StockRank.

Unfortunately, the last 3 sections have just disappeared, arrgghh!

This is a very brief summary of what they said;

Midwich (LON:MIDW) - a bit too big for these reports now.

Good results, and outlook, but the valuation now looks very high. It's difficult to see any immediate upside from this valuation.

Cyanconnode Holdings (LON:CYAN) - terrible results, as usual. Admits it needs to raise more cash. Therefore uninvestable.

That's it from me.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.