Good morning!

How are your portfolios doing at the moment? Mine has certainly taken a few hits.

The great thing about the sell-off, of course, is that it opens up all sorts of new buying opportunities.

I've been doing quite a lot of work on my watchlist, keeping it up to date and looking for those spots where a value opportunity may have opened up for a company that I previously liked, but wasn't willing to pay for.

Most recently, two such companies caught my eye: 888 (LON:888) and Gocompare.Com (LON:GOCO). I now have long positions in both of these.

This has been at the expense of my fixed income holdings. Bonds are now just 10% of my portfolio, with 3% cash and the rest in UK equities.

And if the FTSE stays around current levels (or gets cheaper), I'll continue to make that switch into equities. I imagine that I'll be 100% invested in equities if the FTSE gets back to the 6000 level.

The political uncertainty seems very extreme at the moment, and it could become even worse, but this makes for pleasant conditions in which to buy shares, in my opinion. When others are heading for the exits - that's when you get some good value. But you do need a long time horizon, so you won't be forced out of your position before the value shines through.

VFTSE - the UK's VIX

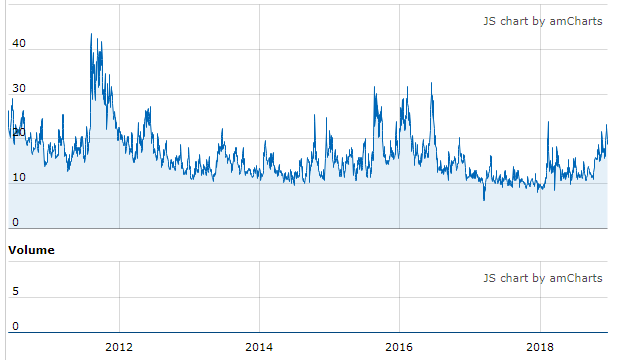

One of the barometers I keep an eye on is the UK's volatility index, with ticker code "VFTSE".

I got this chart off Euronext.com:

With a reading of 19, this shows that traders are pricing in above-average levels of volatility.

It could get much worse, however: peak readings have been seen at 30 in 2015/2016 and over 40 in 2011.

My interpretation is that we are still a long way from peak bearishness and peak fear, so it makes sense to keep some powder dry.

Ok, let's see what's on the newswire today:

- Bonmarche Holdings (LON:BON)

- Purplebricks (LON:PURP)

- RhythmOne (LON:RTHM)

- Koovs (LON:KOOV)

- Ocado (LON:OCDO)

- Titon Holdings (LON:TON)

- PZ Cussons (LON:PZC)

Bonmarche Holdings (LON:BON)

- Share price: 45.5p (-43.5%)

- No. of shares: 50 million

- Market cap: £23 million

Change to forecast for current financial year (FY19)

This is a nasty profit warning.

I've just been catching up on our previous commentary:

- Commentary by Paul (21 Nov 2018)

- Commentary by Me (27 Sep 2018)

Well done to Paul who said last month:

The slow start to autumn/winter season, and much higher inventories, suggests to me that there could be a profit warning in the next couple of months, as Xmas sales seem to be set up to disappoint.

For my own part, I described the company as "complacent" for planning to maintain the size of its estate, instead of shutting down marginal stores.

Today we learn that sales during Black Friday week were "extremely poor, particularly in the retail stores", and customer behaviour is not following any pattern previously experienced by the company.

Worse than that, there has been no recovery since Black Friday, "despite the application of extensive discounts".

Brexit is described as a significant factor, which I don't believe. Online clothing sales are doing very well and companies with a strong online proposition are doing fine.

Bonmarche's problem is that its online offering is still so undeveloped, compared to the size of its physical estate.

It also admits it has "no visibility" with respect to recovery, and is therefore pencilling in an underlying PBT loss of between £4 million and breakeven for the current financial year.

Its central assumption for LFL store sales is negative 12% in Q3 (Oct - Dec) and negative 1% in Q4 (Jan - March).

Balance sheet - the company says it won't run out of cash in the short-term. We've remarked previously that it has a solid balance sheet.

Dividend - the final dividend will need to be reviewed. Again kudos to Paul, who said last month: Whether it will remain cash generative enough to continue paying such generous divis, is doubtful.

My view

There have been some warning signs of deterioration, not least the sales miss in September which triggered my previous article.

Until now, however, there were "value"-based arguments that the company was still expected to be profitable, and so the shares were cheap. But trading needed to stop deteriorating. Obviously, that hasn't happened, and instead the deterioration has accelerated.

The CEO comment is spooky: she says that conditions are "unprecedented in our experience and are significantly worse even than during the recession of 2008/9."

What's changed? How could things be worse even than the recession of 2008/9, if the UK is not currently in recession?

Obviously, the answer is the internet.

Unfortunately, I don't know what the catalyst might be for this to recover back to consistent profitability and therefore I would have zero interest in picking up the shares. It looks as if consumers have lost interest and it's simply unable to compete in the current environment. Web sales at 12% of total (most recent interim results) are too small to pick up the slack.

If there are any bulls out there, let's hear the counter-arguments please!

Purplebricks (LON:PURP)

- Share price: 135p (-10%)

- No. of shares: 303 million

- Market cap: £409 million

Much of the speculative air attached to this company's valuation has been sucked out of it over the past 18 months, which is only right in my opinion.

At the end of the day, it's not a technology company, there are no network effects and there is no moat, except for the cool brand name.

Which means that it should be trading at a normal valuation, in my view, rather than at the sort of valuation which would make Amazon (US:AMZN) blush!

In the UK market, where it has been active for 5-6 years, it has just achieved £8.4 million of H1 adjusted EBITDA, and has hybrid market share of 74% (flat against last year).

The UK market is "challenging" at a macro level, and as such Purplebricks now expects full-year revenue to be in the bottom half of the previous range (£165-175 million vs. previous range £165 - £185 million).

We also get some comments about industry dynamics. There has been "unprecedented investment by competitors in marketing and unsustainable reductions in fees charged".

Are reduced fees really unsustainable or are they are a permanent feature of this industry, I wonder?

Purplebricks sells its services on the basis that it undercuts the traditional estate agents. What's to stop someone else coming along and undercutting Purplebricks? Apart from its marketing budget, I don't think there is anything.

My view

I just don't understand why it's attractive to run this at a loss. The massive marketing budget (£39 million in the last six months) seems over-the-top versus the profitability that is likely to be achieved when it reaches peak market share.

Net cash is c. £90 million after investing in Germany and running losses in Australia and North America. Another worry is that the international expansion effort is far too premature, given that it hasn't exactly proven the business model in the UK yet.

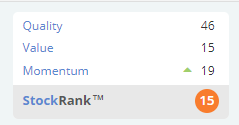

I could be wrong, but I still have the StockRank on my side for now:

RhythmOne (LON:RTHM)

- Share price: 184p (+4%)

- No. of shares: 78.6 million

- Market cap: £145 million

This is the company previously known as "Blinkx", an advertising business which suffered some negative publicity a few years back.

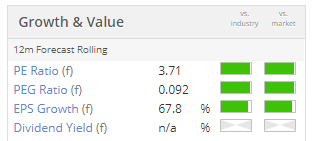

Just thought I'd mention it because some readers were commenting on it, and there is something funny going on with the P/E ratio!

Highlights from these results:

- revenue +53% to $175 million with the help of a big acquisition

- pre-tax loss $1.6 million (a reduction compared to last year)

- $10 million share buyback approved

Outlook

- Trading in line with consensus forecasts for revenue and adjusted EBITDA.

- More M&A in the works.

My view

This company's activities are incomprehensible to me, but perhaps some of you will be able to untangle it.

Koovs (LON:KOOV)

- Share price: 8p (-9%)

- No. of shares: 356 million

- Market cap: £28 million

Interim results six months ended 30 September 2018

This Indian version of ASOS (LON:ASC) has never quite lived up to its Western counterparts.

For a long while, it ran a negative gross margin, in addition to its big marketing budget.

As it was running out of cash again this year, however, it slashed its marketing budget and its inventory levels by almost 50% each.

As a conseqence, sales collapsed by 40% in H1 to just £2.1 million.

Funnily enough, this meant that pre-tax loss reduced, too! The pre-tax loss is £6.4 million.

Outlook

The company says there are "green shoots" now that stock levels and marketing activities have increased, thanks to its fundraising efforts.

My view

Way too speculative for me, I will give credit to the company that it has managed to find some really committed shareholders who have continued to pour money in.

One of these is India's largest retailer, which is going to be a cornerstone investor with a 29% equity stake. That does provide some reassurance of a sort.

If it takes off and reaches profitability then perhaps the effects of dilution can be overcome, but that isn't something I would want to bet on.

For example, Koovs has agreed to pay one of its huge advertising partners not with cash but with equity, every six months over the next four years. The amount of dilution which existing shareholders suffer will therefore be a function of the share price - this is not the sort of gamble which makes for a sleep-sound investment.

Ocado (LON:OCDO)

- Share price: 806.4p (+1.6%)

- No. of shares: 698 million

- Market cap: £5,617 million

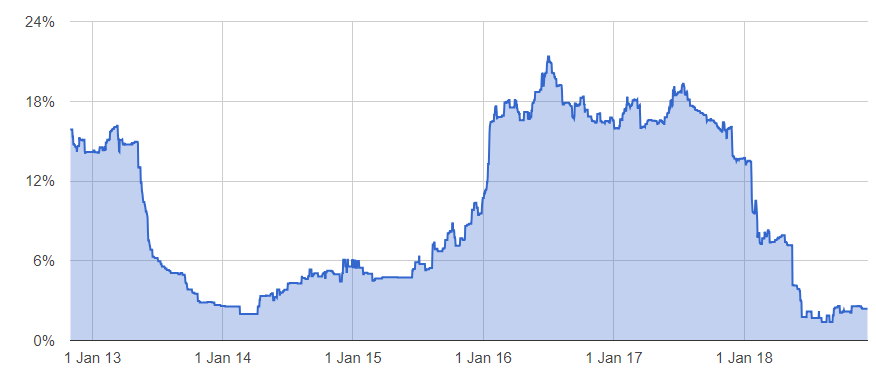

Without wishing to be too graphic, the shorters have been bludgeoned to death by Ocado.

Recorded short interest is now a measly 2.4%, down from a peak of 21% in 2016:

(Source: shorttracker.co.uk)

Today's update sees Q4 retail revenue in line with expectations, +12%.

Will it ever make much money? I don't know. It's forecast to make another small loss next year, on £1.8 billion of revenue.

Logistics is a tricky sector - I don't invest in it. But I do try to maintain some understanding of big-picture trends.

At the recent Mello London event, for example, I attended a talk by Supermarket Income REIT (LON:SUPR). As the name suggests, this is a REIT which owns the land used by major stores like Tesco, Sainsbury, etc.

This presentation gave me a new perspective on physical supermarkets: that their use as e-fulfillment centres, and the nature of the grocery industry with expiring goods, means that it will be difficult to replace them (in contrast, it's very easy to replace a local bookstore with an e-fulfillment warehouse).

On that basis, the grocery industry as a whole might not be quite as scary for investors as it has seemed to be, in recent years.

But the £5.6 billion valuation attached to Ocado does seem rather overcooked with a forward price/sales ratio of >3x, and sales growing at only about 12-13%.

Titon Holdings (LON:TON)

- Share price: 175.5p (-2.5%)

- No. of shares: 11.1 million

- Market cap: £19 million

Preliminary announcement year ended 30 Sep 2018

Titon Holdings Plc ("Titon", the "Group" or the "Company"), a leading international manufacturer and supplier of ventilation systems, and window and door hardware, is pleased to announce its preliminary results for the year ended 30 September 2018.

I also attended a talk by this company at a Mello conference this year.

Titon has been listed for a couple of decades and overall, it has a good track record of profits and dividends. The share price has made excellent progress in recent years and yet the forecast P/E ratio is merely 9x.

If I had to summarise my concerns, I would describe them as follows:

- Korean operations - no ability to look into them from this part of the world

- No evidence of any real intellectual property

- Looks to benefit from building regulations and legislation - I prefer companies where the growth driver is real customer demand.

Having said all of that, there is no denying that it has been a solid performer, has net cash, and is also churning out an acceptable ROCE of c. 15%.

Outlook

"...provided that Brexit doesn't negatively impact the UK economy we expect another year of growth in revenue and profits for Titon in line with market expectations."

My view

Likely to be of interest to those who dig around in cheap micro-caps. Doesn't quite pass my filters but could be worth researching in greater detail.

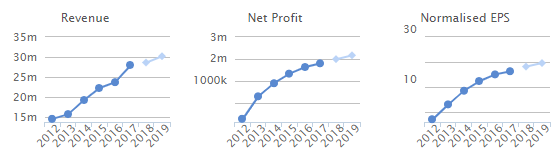

Making great progress over the years:

PZ Cussons (LON:PZC)

- Share price: 210p (-6.5%)

- No. of shares: 429 million

- Market cap: £900 million

PZ Cussons Plc announces its trading update in respect of the half year to 30 November 2018.

This is the consumer brands house which includes Carex, Imperial Leather, St Tropez, Mamador, etc.

As is often the case, Nigeria is a tough trading environment (weak currency and political uncertainty) while Europe and Asia are ok.

Outlook

The consumer is "under pressure in all of the markets in which we operate", and the full-year result will depend on macro conditions in Nigeria.

My view

An unpleasant update. 37% of revenue was derived from Africa last year, 90% of which was from Nigeria, and the exposure to that country is a definite concern. Thanks to the situation in Nigeria, group operating profit has been moving backwards.

At the same time, I think the group as a whole includes some terrific brands, and it has wide geographic exposure beyond Africa.

Net debt is reducing; it was last reported at £165 million (May 2018). That could be paid off in a couple of years, if the company wanted to.

The shares have had a major de-rating in recent years:

This could end up in my portfolio during my next buying spree. Definitely worth looking into.

All done for today folks, thanks for dropping by, and for your comments!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.