Good morning, it's Paul here.

Today's report is a mixture of backlog from yesterday, and reports published today. Some was written last night, and some today, so that's why it might sound a bit confusing in places.

Sosandar (LON:SOS)

Share price: 37.0p (up 8.8% today)

No. shares: 116.2m

Market cap: £43.0m

(this is my largest personal shareholding)

My main focus on Weds morning will be interim results from Sosandar (LON:SOS) (which is my largest personal shareholding). We already know from the 10 October 2018 trading update what to expect, in terms of H1 revenues (£1.84m, organic growth of a stunning 407% Y-on-Y), and an excellent gross margin of 55%.

However, it's the most recent outlook & current trading comments which will be key. I'm anticipating strong current trading, for 2 reasons;

1) In the last update, it said that September 2018 had seen record sales. That is when new season autumn/winter stock hits the website. So if the initial sales are strong, then you can be sure of a successful season overall (to early January), because the product designs have hit the nail on the head. Fashion retail is mainly about the product. This tiny company is producing better womenswear ranges than Marks & Spencer. Think about that for a moment.

EDIT: results confirmed in the narrative, that October was a new consecutive record sales month. As you would expect for a rapid growth company. End of edit.

2) I monitor the Sosandar website every day. A lot of "new in" styles are selling out (in some sizes) within days of hitting the website - which augurs well for current trading. Social media followers are small, but growing fast on the key ones - Instagram & Facebook.

I wrote the above last night.

For anyone interested, here is my initial take on the interim results this morning. More later;

Figures and current trading are in line with management expectations. I queried on a phone call this morning if management and market (i.e. house broker forecast) expectations are the same thing? Yes they are.

In my opinion, they should beat the full year (FY 03/2019) revenue forecast of £3.9m (Shore Capital), because Oct-Dec is a huge seasonal peak in womenswear. EDIT: Shore Capital has today upgraded revenue forecast for this year by 6% to £4.15m. That still looks conservative to me. Shore has also increased its admin costs forecast from £5.6m to £5.8m, which overall leaves the forecast loss for this year unchanged at £3.5m.

Forecast for next year (ending 03/2020) is revenue of £9.5m, and a loss of £1.6m.

Then 03/2021 the forecast revenue is £19.5m, and a maiden profit of £2.1m. I'm working on the basis that this is just the start, of what could become a very much larger business longer term.

H1 revenue is already £1.84m, which included quieter summer months when it was too hot.

So broker forecast implies only £2.06m revs in H2, which is crazily low given that Oct-Dec should show a massive uplift. By my calculations, revenues should be £4.5m to £5m for the full year. At 55% margins, that's excellent operational gearing. Then you're probably looking at £10m+ next year, and breakeven-ish.

Roll the numbers forwards, with triple-digit % revenue growth, and 55% gross margins, and you arrive at startling profitability in 2-3 years. There's no guarantee that will happen of course, but the company is off to an excellent start (it's only been trading for 2 years, remember).

Very encouraging commentary today from Sosandar, including positive noises about sales of current season styles. That augurs very well for peak seasonal trading this autumn/winter.

Gross margin of 55% is astonishingly high for such a small business.

When it IPO'd, I questioned management on how realistic it was to target £3m revenues this year (original forecast), which looked a tall order. They said they were confident it could be done. Now we're heading for a substantial beat against the original forecasts.

It's all going extremely well. I'm glad they did £3m placing now, as it removes any concerns about running out of cash.

I don't think there's much more to add about Sosandar. I've had a quick chat with management this morning, and I'm happy with everything.

The numbers & commentary in today's RNS are self-explanatory, and well worth reading. In my view this stock is likely to be a multi-bagger, taking a long-term view. It's all about backing a highly competent, experienced, and hard-working management team.

Firstly, here are some additional company updates from yesterday:

Bonmarche Holdings (LON:BON)

Share price: 84p (up 3% yesterday)

No. shares: 50.0m

Market cap: £42.0m

Bonmarché is one of the UK's largest women's value retailers, focused on selling stylish, affordable, quality clothing and accessories in a wide range of sizes, via its own store portfolio and online.

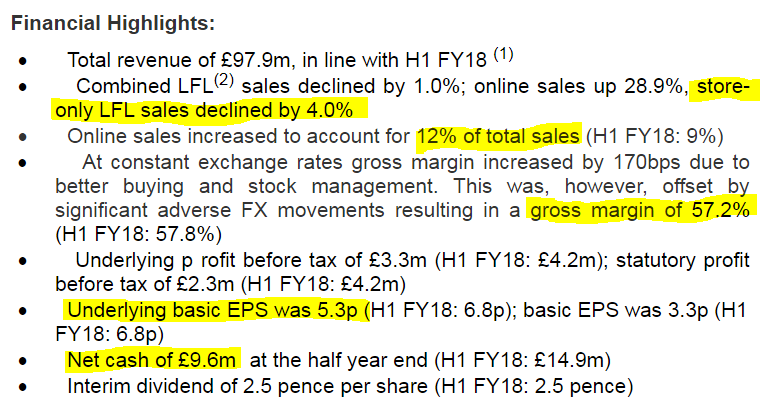

Here are the financial highlights, with my commentary on the yellow items below;

I like the disclosure of store LFL sales, online, and the blended total. That's useful information, in a good format, which I hope become the norm for other retailers reporting.

Online sales at only 12% of the total, is much too low, in my opinion. Although it is growing. The best retailers should be achieving nearer to half their sales online.

Store revenues down 4% LFL is not good, because as we know, many store costs are rising (especially staff wages). The key to retailers surviving, is cost flexibility - in particular property leases being short, hence allowing the retailer to walk away from loss-making, over-rented sites. BON is in a favourable position;

Following the major restructuring of the store estate in 2012, including the rebasing of rents, we have continued to maintain a tight control over property costs.

Twenty four stores had lease renewals or rent reviews completed during the period, for which we secured an average rent reduction of 15% plus an incentive with a cash equivalent value of £13k.

The average term to expiry (or the next break) is 3.6 years, which therefore allows us to retain flexibility across the store estate.

The worry for most retailers, is that over time, store sales gradually reduce, to a point where ultimately hardly any stores might end up being viable. What happens then?

Gross margin of 57.2%, despite forex headwinds, is good.

Seasonality - last year H1 & H2 were about the same for profits. Therefore achieving underlying EPS of 5.3p in H1 suggests that it might do c.10p EPS for the full year, ending 31 Mar 2019. That's above the 8.5p broker consensus forecast shown on Stockopedia.

Outlook - the company helpfully gives profit guidance for the full year (I so wish all companies would do this, it would make life much easier for investors);

Whilst online sales have continued to show strong year on year growth, as reported, store LFLs have remained weak, and traditional autumn/winter categories have had a slow start to the season. Providing that sales during the key Black Friday through to Christmas trading period meet expectations, the Board maintains the guidance published in September, being that the underlying PBT for the Group for FY19 will be approximately £5.5m.

(by my calculations, £5.5m adj PBT equates to about 9.0p EPS)

A slow start to the autumn/winter season is bad news. That suggests the product ranges have not sufficiently appealed to customers, which usually leads to a slow Xmas season & increased discounting, hence lower margins, to clear slow-moving lines. Therefore I imagine the next trading update is likely to be subdued.

This is reinforced by a much higher inventories figure of £28.2m at 29 Sept 2018, up from £23.5m a year earlier - which suggests there could be a lot of slow-moving stock in the shops.

Net cash - of £9.6m is healthy, but down quite a bit on a year earlier (£14.9m) - increased inventories looks to be the main culprit.

Balance sheet - is healthy, so no solvency issues.

Cash generation - is still good. Remember that retailers have quite large depreciation charges, so add that back, and EBITDA is not bad.

Dividends - the interim divi of 2.5p is maintained. The forecast yield of 9.5% is telling us that the market thinks the big divis are not likely to continue for much longer.

My opinion - although profits are down, as noted above, the company should deliver about 9.0p EPS for FY 03/2019. I make that a PER of 9.3 - not bad considering the balance sheet is also strong, with net cash.

The big problem here, as with almost all retailers, is the direction of travel. Store costs are rising, which need to be offset with rent reductions. BON looks OK in that regard. However, store LFL sales are likely to keep falling, relentlessly. This is a terrible headwind for retailers, as more business leaks away to online competition. BON's 12% of total sales online just isn't enough, although it is rising.

The slow start to autumn/winter season, and much higher inventories, suggests to me that there could be a profit warning in the next couple of months, as Xmas sales seem to be set up to disappoint.

BON is likely to be a survivor on the High Street, as it's still decently cash generative, and has sound finances. So its best hope is to pick up business from competitors going bust. If that can be combined with ditching loss-making shops on lease expiry, and canny negotiation on new, cheap & short leases, then I could see BON continuing to exist.

Whether it will remain cash generative enough to continue paying such generous divis, is doubtful.

Overall, I cannot see why anyone would want to buy this share in preference to the much higher quality, but only slightly more expensive (on a PER basis) shares in Next (LON:NXT) .

IMImobile (LON:IMO)

Share price: 291p (down 0.7% yesterday)

No. shares: 65.3m

Market cap: £190.0m

IMImobile PLC, a cloud communications software and solutions provider,today announces its consolidated interim results for the six months ended 30 September 2018.

Interim results look good, at the adjusted level. Statutory profit is modest, as it's weighed down by acquisition-related costs. Basic EPS is a small loss, of -0.2p, but adjusted EPS is positive at 6.6p (fully diluted) for H1.

Outlook - solid;

We have had a strong start to the second half and remain confident about the Group's prospects for the full year. We expect full year results to be in line with management expectations."

Balance sheet - I'm not keen on this. As with a lot of acquisitive groups, the balance sheet is becoming top heavy with intangibles. So NAV of £56.2m becomes NTAV of negative -£16.3m. That's a deal-breaker for me, as I rarely invest in companies with negative NTAV.

My opinion - I've met management of IMO twice in recent years, and was very impressed both times. The client list is very impressive too - big companies, which rely on IMO for important IT services.

I'm less than keen on the weak balance sheet. Also, a forward PER of almost 20 looks fully priced. I don't have the knowledge to predict how this company might perform in future. IT can be very fast-moving, and I don't have the skills to analyse it further, hence will pass on this one.

Quick comments from yesterday's announcements, to finish off;

Eckoh (LON:ECK)

Interims to 30 Sept 2018.

Revenue actually down 2%, and adjusted EBITDA down 15% to £1.6m in H1.

Company says this poor performance is in line with Board expectations. IFRS 15 accounting rule changes have had an impact. Business has a pro-H2 seasonality.

Lots of upbeat comments about order intake & outlook. "Record visibility for second half".

My opinion - I struggle to see how this company is worth £94m.

The valuation hinges on expectations of future growth, rather than its unimpressive historic track record of low profitability.

SRT Marine Systems (LON:SRT)

Half year report

More of the same - poor interims, and promises of jam tomorrow.

Shareholders have been extraordinarily patient here.

The company seems to inherently have almost no visibility on sales & profits.

Solid State (LON:SOLI)

Interim results

Look OK - revenue up 4%, adjusted PBT up 6%.

Divi yield is about 3.8%, and interim divi up 5%, well covered by earnings.

Most noteworthy is the strong order book - up 46% to £29.4m at 31/10/2018.

The Board is confident that the prospects for the remainder of the year are positive and it expects the Group to deliver a strong performance in the second half of the year.

In addition, it believes the Group is well positioned for future growth and to deliver enhanced value for the Company and its shareholders.

Balance sheet is strong.

My opinion - worth a closer look. This looks to be a modestly-valued company, which is performing well.

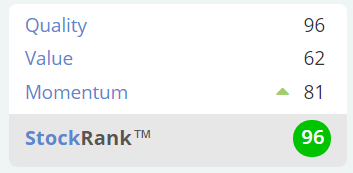

Stockopedia approves too, with a "Super Stock" classification, and excellent StockRank;

That concludes yesterday's updates. On to Weds company updates below;

Creightons (LON:CRL)

Share price: 31.0p (up 14.8% today)

No. shares: 62.4m

Market cap: £19.3m

Creightons is a manufacturer & distributor of toiletries & fragrances.

These interim figures look good to me;

- Strong revenue growth - up 34% to £22.3m

- Profit before tax up 44.4% to £1.38m in H1

- Diluted EPS is up an even higher percentage, up 65% to 1.8p - this is flattered by a reduced tax charge

- Modest divis, unchanged on last year

Balance sheet - overall looks OK to me.

NAV is £10.8m. Only £0.7m intangibles, so NTAV looks sound at £10.1m.

Working capital - current assets of £17.7m, less current liabilities of £9.6m, gives a current ratio of 1.84, which is healthy. There are no long-term liabilities, which is excellent.

Net debt of £1.96m is worse than last year - the reason being significant increases in working capital - i.e. inventories & receivables. That's inevitable when revenues rise considerably, as they have. So I don't see this is a problem. When a business grows its revenues, the balance sheet effect can be negative. This is because two assets rise, namely inventories & receivables, but only one liability rises - trade creditors. Therefore a growing business will usually see cashflow tighten during the growth phase, requiring additional drawings on bank facilities.

Outlook - I may have missed it, but cannot seen any reference to the outlook for the full year.

The commentary sounds positive in tone, and includes this comment;

The Board and I believe that this half year's results including investments in resources and capabilities places the Group in an excellent position to take advantage of any opportunities that may arise.

My opinion - it's difficult to value this share, because I can't find any broker forecasts.

Taking a broad range, if current year EPS comes out between 3-4p, which seems likely, then at 31p share price the range would be PER of 7.8 to 10.3 - that looks good value for a well-financed company, achieving impressive uplift in sales & profit.

It's a similar valuation to Swallowfield (LON:SWL) which I also wrote about here recently. SWL is about double the size & market cap of CRL, so will be more liquid. Also it pays a better divi yield. However, CRL is growing faster. So I can see attractions to both shares.

Judges Scientific (LON:JDG)

Share price: 2,330p (up 7.4% today, at 12:50)

No. shares: 6.19m

Market cap: £144.2m

The Board of Judges Scientific, a group involved in the buy and build of scientific instrument businesses, updates shareholders and the market on the Group's trading performance in the financial year ending 31 December 2018.

We don't see many of these at the moment - out-performing expectations;

Trading has remained strong since the publication of the interim results and the healthy order intake communicated at the time of the results has continued since the beginning of the second half.

As a result, the Board expects Earnings per Share for the full year ending 31 December 2018 to exceed current market expectations as increased in September.

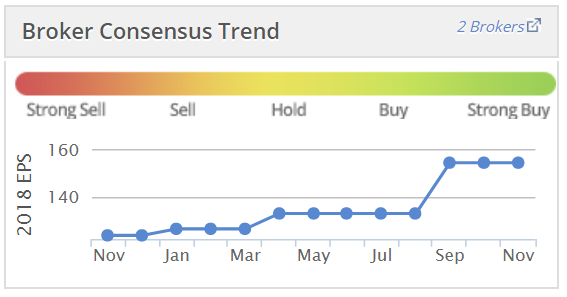

The trend on broker consensus forecast EPS has been smashing this year, and it will be going up again after today's update;

There's a broker update on Research Tree, which shows a 12% increase to 172p adj. EPS this year. The PER is 13.5 - that looks excellent value, for a nice quality group of businesses.

Balance sheet - I've quickly checked the most recent one, and it's fine.

My opinion - what I pity I don't have any spare cash, as I'd be tempted to buy today if I did.

The recent market sell-off is throwing up some good opportunities, and I reckon this could be one of them. DYOR as usual please!

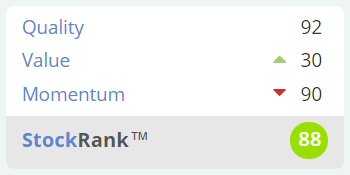

Stockopedia likes it too - a high StockRank, and "High Flyer" status;

Maintel Holdings (LON:MAI)

Share price: 455p (down 25% today, at 14:04)

No. shares: 14.2m

Market cap: £64.6m

This seems to be an IT and telecoms services provider. We had a profit warning yesterday from another company in that sector, KCOM (LON:KCOM) - so I wonder if this is a general sector slowdown?

What's gone wrong?

- The sales mix has shifted towards longer term, recurring revenue projects. Away from shorter term projects where profit would have been recognised faster

- Projects delayed, now completing in 2019, not H2 2018 as anticipated

Quantifying the problem - this is very helpful in giving market guidance;

As a result,the Board now expects Adjusted* EBITDA for the year ended 31 December 2018 to be in the range of £12m to £12.5m (2017 £10.9m).

I'm really not a fan of adjusted EBITDA. Adjusted profit is the figure I much prefer. Adjusted EPS is better still as it's then quick & easy to work out the revised PER.

There's a broker update available today, which has revised down 2018 adjusted PBT by 24% - quite a hefty downgrade at this late stage in the year. Next year's forecast comes down by 21% too.

Adjusted EPS forecast for 2018 is now 63.2p - a PER of 7.2 - apparently cheap. The catch is;

Balance sheet - it's horrible. Too much debt, and NTAV is heavily negative, at -£43.3m - that's a deal-breaker for me.

Liquidity - I thought there must be a data error when I saw that the quoted market price is 410p Bid, and 500p Offer! Our of curiosity, I asked my broker for the real prices, which are 435p Bid (in size of only 1,500 shares), and 475p Offer (in only 250 shares size). What's the point in having a listing, if the liquidity is so bad?

My opinion - the balance sheet weakness rules out this one for me.

I wouldn't invest in this sector either. So definitely not for me.

GAME Digital (LON:GMD)

Share price: 27.3p

No. shares: 172.9m

Market cap: £47.2m

(at the time of writing, I hold a long position in this share)

GAME Digital plc ("GAME" or the "Group") today announces its final results for the 52 week period ended 28 July 2018 (the "period").

This company operates the "GAME" retail stores in the UK & Spain, which sell computer games, consoles, and accessories. The business model is also transitioning into a roll-out (JV with Sports Direct) of the "BELONG" social computer gaming, where customers pay per hour to play computer games, sometimes competitively, in competitive leagues, etc.

A key point to think about with this share, is that the bulk of its retail leases expire or have expired in 2018. Therefore a large scale closure/relocation/renegotiation of retail sites is in progress. This presents both opportunities, but also risks.

The main reason why this share appears to be so cheap, is that the stock market is discounting a possible short lifetime of the business. Are downloads going to take over from selling physical gaming discs, rendering GAME shops redundant, in the long run? The jury's out on that, but there still seems to be a lot of business available in selling new & secondhand computer games.

Looking first at the P&L;

Statutory results -

- Revenues of £782m (flat against LY) - still a substantial business, even though market cap is only £47m

- Loss before tax of £-7.4m (improved from £-10.0m in prior year)

- Basic loss per share of -6.0p (prior year: -7.1p loss)

- Net cash £58.7m (up from £47.2m a year earlier) - NB. the net cash balance is higher than the market cap, very unusual

Adjusted results -

- Adjusted EBITDA positive at £10.1m (up 26% vs LY)

- Core retail EBITDA fell from £14.0m to £12.2m. The reason total EBITDA rose, was due to eliminating £3.9m of prior year losses in the non-core eSports division. Note that Spain generates nearly all the EBITDA, with UK around breakeven.

- Adjusted loss before tax of £-3.5m (improved a bit compared with prior year of £-4.3m)

My interpretation of the above is that it seems surprisingly resilient, given how bombed out the share price is.

Current trading - again, surprisingly resilient;

Though early in the year, the Board remains cautiously optimistic with the prospects of the Group in the future.

Trading for the first 14 weeks of the year has been ahead of the prior year, with Group Retail GTV up 4.5%. GTV in both UK and Spain are up on last year 6.6% and 1.7% respectively in local currencies reflecting the benefits of a stronger performance from new game releases this year.

BELONG pay-to-play performance has been encouraging for the first 14 weeks, up 50% year-on-year (excluding the two new arenas).

A 6.6% growth in transaction value in the UK seems remarkably good, given that the stock market has pretty much written off the prospects of this company, valuing it below its own net cash. BELONG up 50% is also very encouraging.

Cost savings - seem to be keeping pace with the reduced gross profit - note that whilst revenue held up, gross profit fell from £205.1m last year, to £196.2m this year. Offset by cost savings;

During the period the UK retail business delivered cost savings of £11.4 million, as we continue to take advantage of our flexible lease profile to renegotiate leases, relocate or close stores.

In addition, store operating efficiencies, procurement benefits and a reorganisation of our head office have also realised further savings this year.

It's clear that the lease expiries are absolutely key here. If the company did not have this flexibility, then I imagine it would be heading quickly towards insolvency - a CVA or a pre-pack. As the leases are mostly coming up for expiry or break (average 0.9 years), that's not necessary here, a key advantage;

Our UK business has an average lease length to break of 0.9 years and we have over 200 potential lease events by the end of 2019.

We have achieved savings of 42% from leases renegotiated in the year and, as at the year end date, we have a total of 25 stores on zero rent and 99 stores on flexible arrangements, usually a three-month rolling break option.

The store estate in Spain is continually reviewed and a low average lease exit period of one year gives flexibility to move to better stores in existing locations and to open in new locations.

BELONG update - at the moment, the stock market seems to be attributing little value to the potential for the new format BELONG stores - which combine the traditional GAME store, with a basement or mezzanine level gaming arena;

"BELONG, the Group's esports and experience-based gaming proposition, remains core to our transformation strategy and we continue to expand the business through the opening of larger BELONG gaming arenas while improving our GAME Retail offer to fully capitalise on the strong growth potential in the esports market.

The first of these larger BELONG arenas has opened and trading results to date are promising. Planning for the further rollout of arena locations is well advanced."

The only issue I can see is that Sports Direct has its hands full currently, dealing with House of Fraser. So I'm not sure whether BELONG will be much of a priority for SD?

Cashflow - was positive £11.7m. Note this came from disposal proceeds of £14.9m + £3.2m, which are obviously one-offs. Taking into account future capex, the group probably is not going to be generating any more positive free cashflow any time soon.

Debt facilities - despite having net cash of £58.7m at the balance sheet date, the group also had undrawn borrowing facilities of £169m. This suggests there must be large cash drawdowns at peak trading periods, e.g. to buy all the stock needed for busy Xmas trading.

Dividends - have stopped, as it's prioritising growth capex for the new BELONG sites.

Going concern - says that the group has adequate finances to continue trading for 12 months, as is usual in these statements. There is also a "Viability statement" which confirms that the group should be able to continue trading for 3 years. This is something new to me. It looks like a new regulatory requirement.

I've googled it, and this regulatory reference is to the UK Corporate Governance Code. Some bedtime reading there for anyone who likes reading up on rules & regulations.

Balance sheet - looks healthy to me.

NAV: £98.5m, less intangibles of £24.0m, gives

NTAV: £74.5m, well above the £47.2m market cap.

There are negligible long term creditors.

Working capital - a current ratio of 1.61 is very good.

Overall, there looks to be no issue at all with solvency - the group is well financed. Borrowing facilities are only for peak trading, and are undrawn at year end. Banks love that type of lending, as it's very low risk.

My opinion - I like this. The legacy business is holding its own, and has unique flexibility to vacate loss-making sites, due to very short leases.

BELONG seems to have promise, and could become a decent format, ultimately rebuilding profits, if it works out.

The valuation is extraordinarily cheap, and more than backed by net cash.

Yet investors are showing absolutely no interest in the company whatsoever. Sports Direct is probably too busy to think about buying it out completely.

Maybe the share price will just continue to languish? Yet I remain of the view that there's interesting potential value in this share, longer term, if BELONG works.

All done for today! I'm handing over now to Graham for Thurs & Friday.

I hope to see lots of you at Mello London on Monday & Tuesday :-

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.