Hello, it's Paul here.

This report is 2 working days late, which was missing from the sequence last week. My apologies for the delay.

Readers have specifically asked me to look at these stocks, which I think are interesting, so am happy to oblige.

Norcros (LON:NXR)

Share price: 228p

No. shares: 80.3m

Market cap: £183.1m

Norcros, a market leading supplier of high quality and innovative bathroom and kitchen products, today announces its results for the six months ended 30 September 2018.

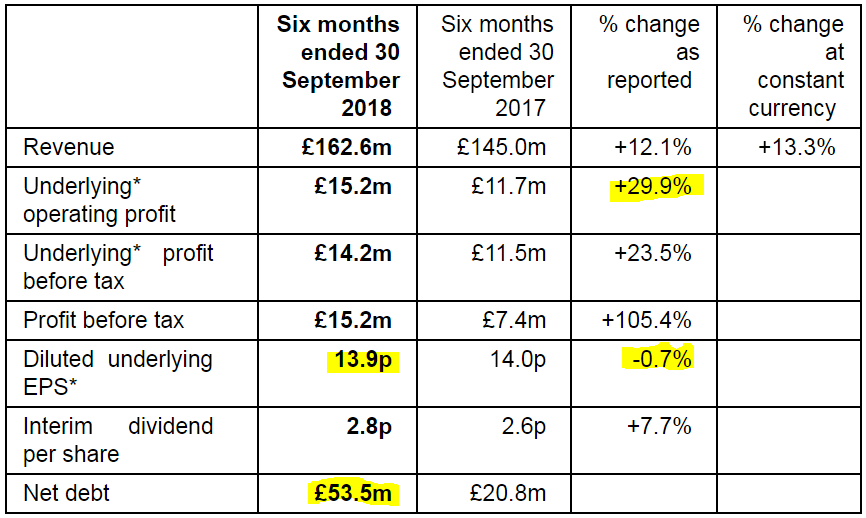

The financial highlights look strong;

Note that underlying operating profit growth of 29.9% is well ahead of revenue growth of +12.1% - impressive to see an improved net profit margin. Sales growth is from acquisitions.

Organic revenues growth was -0.3% on a like-for-like, constant currency basis. Although if Johnson Tiles UK is excluded (which suffered from Kingfisher buying less product), the rest of the group achieved an impressive +4.4% organic growth.

The 105.4% increase in statutory profit before tax is a red herring, because of a one-off £4.3m finance income credit - relating to a favourable movement on derivatives (I assume forex hedges). The underlying figures make more sense to me. I've checked the adjustments, and they look reasonable, apart perhaps from the £0.7m pension scheme administrative expenses, which I think should not be adjusted out, as it's a real, ongoing cost.

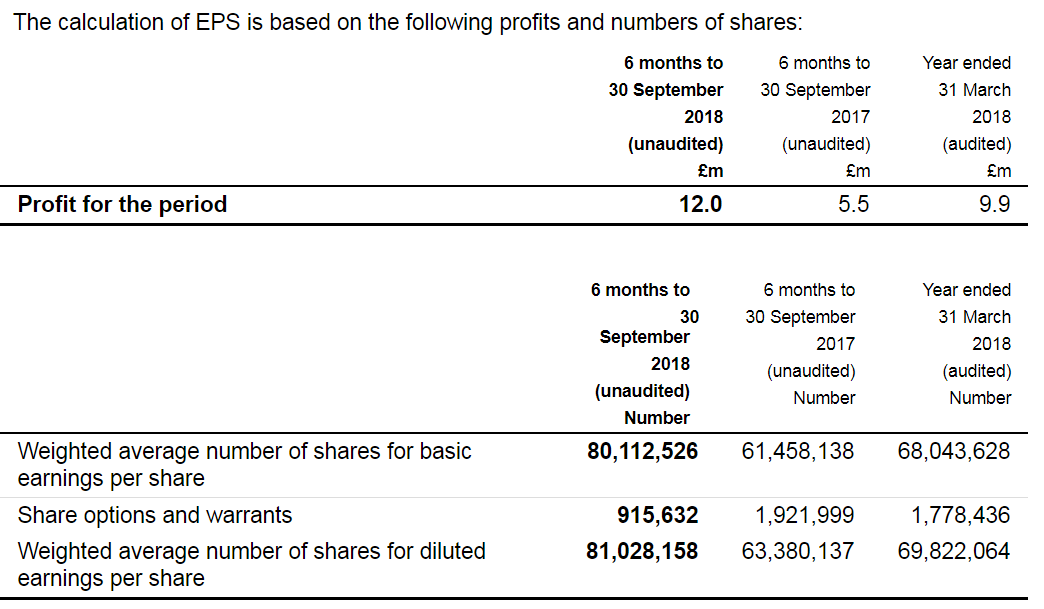

Diluted underlying EPS is actually slightly down, despite profit being up. This is due to dilution - 18.25m new shares were issued in a fundraising related to an acquisition called Merlyn Industries Ltd, in Nov 2017.

The period being reported, of 6 months to 30 Sep 2018 includes a full half year of trading from Merlyn. That is reflected in the average number of shares in note 5 being the same as the total number of shares currently in issue. So there's no further dilution to come through in future reporting periods.

As you can see, the share count has risen by about a third in the last year, to fund acquisitions. The group is doing a buy & build - making good quality acquisitions of complementary companies, then pushing more sales through its existing sales network. This strategy makes a lot of sense to me. A key advantage, is that over time, the gigantic pension scheme is becoming gradually diluted over a bigger operating group, with each acquisition made.

H1 results seem to be in line with broker forecast, as far as I can tell (there are no broker updates on Research Tree). Therefore I assume that Edison's forecast of 29.3p EPS (normalised, fully diluted) still stands. This gives us a current year forecast PER of 7.8 - good value - although we have to adjust for the big pension scheme, and the net debt. Once that's done, then the PER looks more normal.

Outlook - sounds OK;

The Group has delivered a substantial increase in underlying operating profit in the six months to 30 September 2018 against the backdrop of a challenging trading environment in our key markets.

This growth reflects the successful integration and performance of the recently acquired Merlyn business, the return to profitability of the Johnson Tiles UK business, the strong performance of our market leading Triton business and share gains in a number of our other brands.

The robust performance in the first half continues to demonstrate the strength of our market positions, our leading brands and the financial resilience of our diversified business model.

The Board remains confident that these attributes will continue to drive market outperformance and will enable the Group to make further progress in line with its expectations for the year to 31 March 2019.

Subjectively, this does seem a stronger story than in recent years previously, where there always seemed to be some part of the group going wrong, which dragged down the whole. That's not the case now, it seems.

Balance sheet - overall this looks acceptable to me, although it's quite heavily reliant on bank debt.

NAV: £122.3m - includes £96.6m of intangibles, which once deducted gives;

NTAV: £25.7m - this looks on the low side, for the size of the group.

Pension deficit has reduced sharply to £28.8m (down from £52.1m a year earlier). That's great, but remember that the actuarial deficit is usually a lot bigger than the accounting deficit. The main reason for the fall in deficit is rising bond yields - now a trend which is favourable for companies with pension deficits, after many years of being a drag on them.

The key number is the deficit funding cost, which is £2.6m p.a. - remember that's real cash that could otherwise be paid out in divis. So an adjustment needs to be made on valuation - because this £2.6m is not accounted for as a cost on the P&L. Although you can see in note 10, that the pension scheme deficit recovery payment of £1.3m looks quite a modest number in the overall context of £16.6m operating cashflow (before working capital movements, which were negative in H1).

Net debt of £53.5m is probably at the top end of what I'd be comfortable with here. Gross debt of £75.5m looks a tad too much for my taste, so it would be good to see the group pay down some of its debt before making any more acquisitions, just to be on the safe side.

My opinion - things are looking good here. That's been reflected in a remarkably resilient share price of late. Whilst all around us has been wilting, this share has held solid, as you can see from the 2-year chart below.

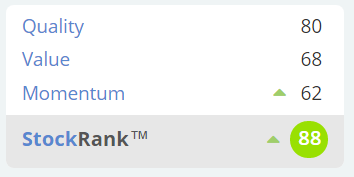

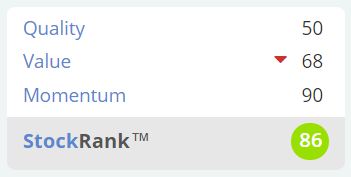

Note that Stockopedia also likes it, with a strong StockRank, although only a "Neutral" style classification;

Card Factory (LON:CARD)

Share price: 192.7p

No. shares: 341.5m

Market cap: £658.1m

(I do not currently hold any position in this share)

Card Factory, the UK's leading specialist retailer of greeting cards, dressings and gifts, announces its trading update for the nine months ended 31 October 2018.

Graham wrote an excellent review of the H1 trading update (to 31 Jul 2018), here on 9 Aug 2018.

I covered the interim results in detail here on 21 Sep 2018. There were lots of things I liked about the company, mainly the high margins, great cashflow, and generous divis (plus special divis too). On the other hand, even with plenty of new store openings, profits seem unlikely to increase in future, so the low PER is probably justified.

Q3 trading update - retail sales LFL were down 0.7%, year to date, at the end of Q2.

At the end of Q3 this had improved to 0.0%, suggesting that sales in Q3 were positive on an LFL basis. That's surprisingly good. Given that High Street footfall is supposedly down almost everywhere, how come CARD is achieving a positive LFL performance? The company says;

This reflected further growth in average spend and improved performance of our redesigned Everyday ranges, in addition to our growing Card Factory online business.

Expectations - the company gives guidance as to underlying EBITDA expectations, which remain unchanged at £89-91m.

Cost pressures -

"The business faces reduced, but ongoing, external cost pressures such as national living wage and foreign exchange-related input cost increases; the latter is expected to ease in FY20. We remain focused on mitigating these headwinds with our ongoing programme of business efficiencies.

Outlook - confident;

"Given our new ranges and our seasonal performance to date, we approach our Christmas trading period with confidence. We also remain positive about the growth prospects for the business over the medium term."

My opinion - as mentioned previously, given current wobbly market conditions, I'm being cautious. So I've pruned out non-core positions from my portfolio, which included ditching my small, recently opened position in CARD.

It's an excellent business, paying very generous & sustainable divis, so I might well revisit this one once the political/Brexit situation has calmed down.

Stockopedia gives it a thumbs up, with a "Super Stock" rating, and a high StockRank;

Swallowfield (LON:SWL)

Share price: 253p

No. shares: 17.1m

Market cap: £43.3m

Swallowfield plc, a market leader in the development, formulation, and supply of personal care and beauty products, including its own portfolio of brands ...

The company has a 30 June 2019 year end.

"The Group's trading in the first four months of the year is in line with expectations.

Brands business is doing well.

Manufacturing business remains challenging. Mitigating actions are being taken, expected to affect H2 this year positively.

Outlook sounds OK;

While we are conscious of the continuing macro uncertainty both in the UK and internationally, overall we expect to maintain our positive progress and are well positioned to deliver against our expectations for the full year."

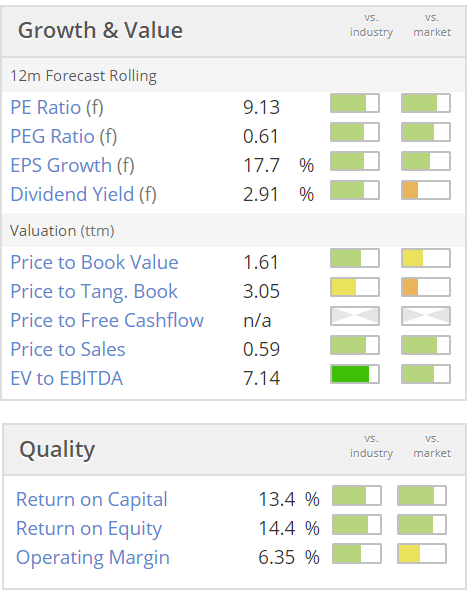

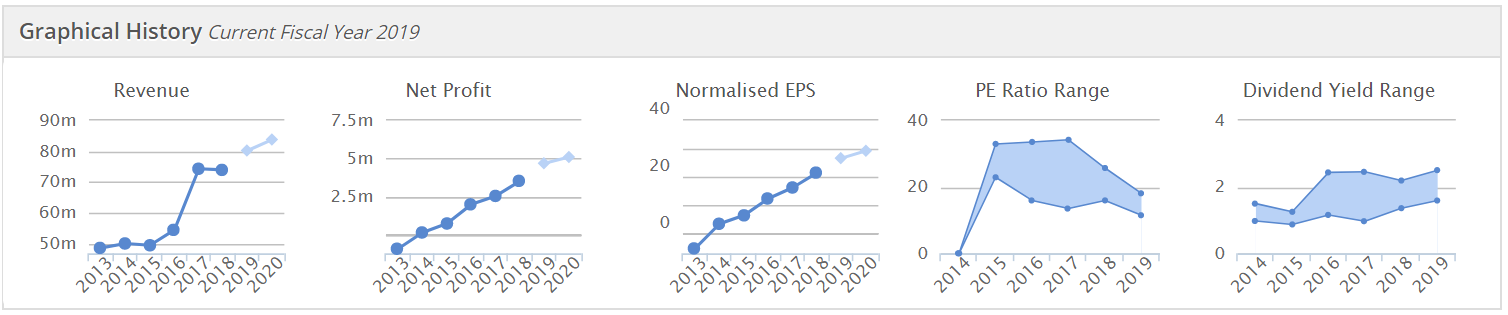

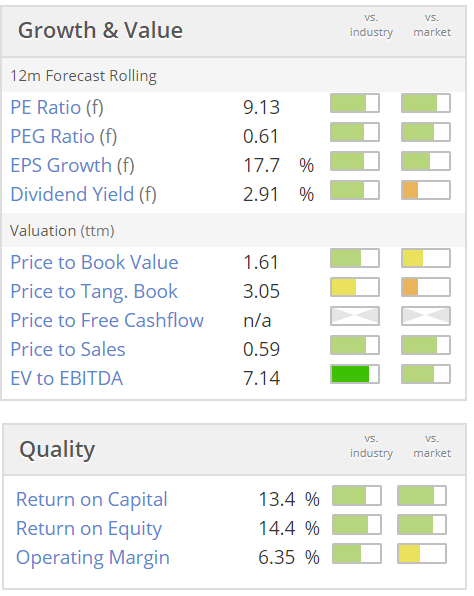

Valuation - looks good value;

My opinion - this looks a nice GARP (growth at reasonable price) share.

The progression above in profit & EPS is impressive, and that this can be bought at a forward PER of only 9.1, strikes me as an interesting potential purchase.

It's not clear why the share price fall has happened, when trading is in line with expectations. Could be a buying opportunity perhaps? I'd say it's worth a closer look anyway, and I'll add it to my watchlist.

That's it for today.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.