Good morning!

We are expecting news in the next day or so from House of Fraser, where Sky News reports that PwC has been negotiating on behalf of its lenders and bondholders, trying to arrange a buyout.

In the absence of a deal, the company is likely to fall into administration and threaten 17,500 jobs. A reminder of how tough things are out there!

Talk soon

Graham

Today I have been looking at:

- Argo Blockchain (LON:ARB) - agreement to expand mining capacity

- Elektron Technology (LON:EKT) - trading statement

- Card Factory (LON:CARD) - trading statement

- AA (LON:AA.) - trading update

Argo Blockchain (LON:ARB)

- Share price: 12p (+1%)

- No. of shares: 294 million

- Market cap: £35 million

Agreement to Expand Mining Capacity

This report normally talks about "good" companies but I feel compelled to mention this £25 million IPO, another symptom of the mass mis-allocation of capital associated with cryptocurrency.

It's shocking to me that some blue-chip institutions were coaxed into backing it.

Let's suppose this was a venture designed to mine a few altcoins (non-bitcoin cryptos). That would be risky enough.

Firstly, crypto miners have to compete with other miners, all of the time. Most of the biggest mining pools are in China, where hardware and electricity are extremely cheap. Every coin they mine is a coin not available to any other miner.

Argo today announces that it has secured energy at 3 US cents per kilo-watt hour, which is at least a good start.

Secondly, you have to accept wildly fluctuating crypto prices. The same as a physical gold mine, your asset will become unprofitable as soon as the market price drops below the cost to mine.

So right off the bat we have a leveraged play on the price of cryptos and on our ability to assemble enough cheap hardware and electricity. It's far riskier than simply buying a few altcoins and hoping for the best.

But even that proposition wasn't risky enough for Argo Blockchain. It has gone one step further and created the new concept of "Mining as a Service", invoking the bubble hysteria associated with today's NASDAQ market and Software-as-a-Service.

The idea is that Argo Blockchain, for a fee, will mine these altcoins on behalf of amateurs who want to get involved in crypto, rather than mining the coins on its own behalf.

So we have another layer of complexity and risk. To make money, Argo will have to find a sufficient quantity of amateurs who want to hire its mining equipment, in order to cover the costs of assembling this equipment and make a profit.

Which makes more sense:

1) to own a gold mine and to mine it for yourself, if it is profitable; or

2) to own a gold mine and to offer amateur investors the chance to own pieces of gold, if they pay you a fee to extract it?

Argo Blockchain is choosing the latter route.

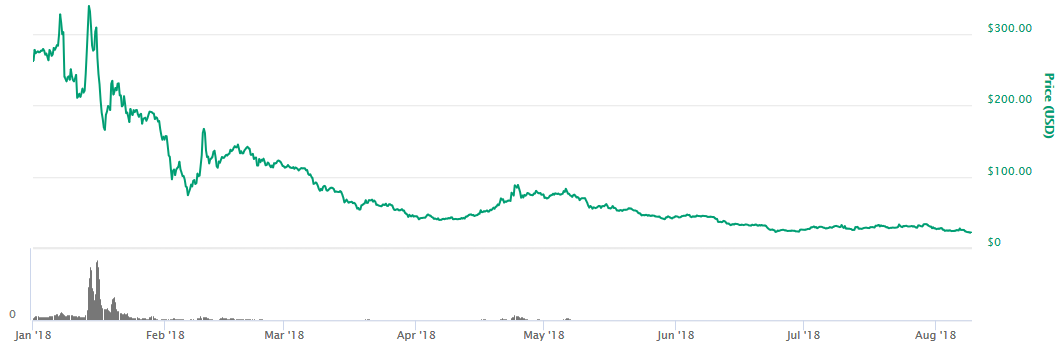

As for the alt coins themselves, Argo offers investors a choice of four: Ethereum, Ethereum Classic, Bitcoin Gold and Zcash.

None of these are doing especially well right now. Bitcoin Gold in particular looks like it is headed for the garbage heap of history.

There are already hundreds of dead alt-coins, who failed to achieve mass adoption and can barely even be given away now, making Charlie Munger's description of crypto coins as "turds" look pretty accurate.

I assume that very few people have gambled a significant portion of their life savings on this stock. If there are any, I think it's fair to ask them: aren't there more entertaining ways to risk going broke than this?

Elektron Technology (LON:EKT)

- Share price: 44p (+6.5%)

- No. of shares: 186 million

- Market cap: £82 million

I restarted coverage of this group in February.

Subsidiaries are as follows:

- Bulgin - designs and manufactures sealed connectors and electronic components, for use in harsh/outdoor environments.

- Checkit - software and devices to help small and large businesses track performance and trends.

- Elektron Eye Technology - screening devices for eye care.

Today's H1 update is ahead of expectations.

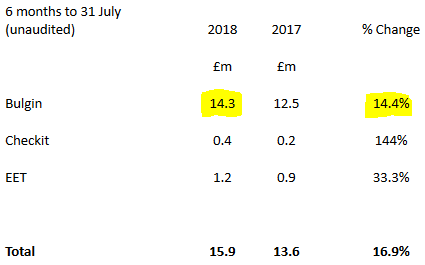

Sales from continuing operations:

I've highlighted the numbers at Bulgin in yellow as it's responsible for the lion's share of revenues.

All divisions are reportedly doing very well, and the company has net cash of £6.8 million.

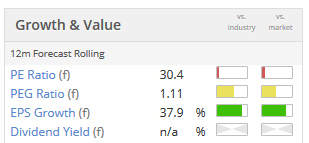

The encouraging level of growth and strong balance sheet go some way towards explaining the high rating attached to the shares:

As has been mentioned in the comments, it does look a bit strange to have three such different companies, operating in such different markets, under the same corporate umbrella. It looks to me as if their customers are completely different and the devices they produce have little in common. So I can't imagine what the synergies might be.

That said, the three underlying businesses sound like they are doing well, with Checkit and EET looking quite early-stage while Bulgin is the more established of the three.

So it could be worth looking into in a bit more detail.

Card Factory (LON:CARD)

- Share price: 190p (-10%)

- No. of shares: 341.5 million

- Market cap: £649 million

Card Factory, the UK's leading specialist retailer of greeting cards, dressings and gifts, announces the following trading update for the six months ended 31 July 2018.

This is the worst performer in the FTSE 250 today after the following announcement:

- like-for-like store sales -0.7%, "due to weak consumer environment and extreme weather conditions", impacting high street footfall.

- underlying FY 2019 EBTIDA in a range of £89 - £91 million, depending on Q4 performance (FY 2018 underlying EBITDA was £94 million, converting to £73 million of PBT).

On the positive side:

- on track to open c. 50 new stores for the full year.

- remains "highly cash generative". net debt is approximately unchanged compared to six months ago at £160 million.

- Return of 5p-10p per share surplus cash forecast for the end of the financial year.

My view

Another contrarian play, it's worth mentioning that Card Factory is different to other card retailers as it designs and prints its own products.

Its cards don't have the prestige of Hallmark but they do offer good value instead.

And making its own supply means that it earns consistently high margins. It's not merely the distributor of someone else's gear.

So there's a lot more to talk about with this one than you might initially think.

When I covered it in September 2017, with the share price at 315p, I said:

If the shares were on an ex-growth earnings multiple, I could possibly be tempted to hold them for a while.

We are now arguably at that level, with the shares having fallen by 40% since I wrote that, but earnings not having dipped by all that much.

It would never be a high-conviction long-term hold for me, because I don't think this has the quality of a brand like Hallmark.

But it has proven to be a powerful cash machine, generating free cash flow to the firm of between £60 million and £70 million for the past several years.

While the growth outlook is pretty poor in the short-term, I think it is still much too soon to say that the wheels are coming off.

So I'm tempted to open a small, starter position in this.

AA (LON:AA.)

- Share price: 116.6p (+2%)

- No. of shares: 612 million

- Market cap: £714 million

AA plc, today publishes a trading update for the six-month period ended 31 July 2018. Despite the extreme weather conditions we remain on-track to deliver our previously announced guidance of Trading EBITDA of between £335m to £345m for FY19.

An unusual situation. We have a super high-quality and universally recognised brand, serving a wide and mostly loyal customer base, that is loaded with an inordinate amount of debt.

It is one of the most heavily shorted names in London. 8.5% of shares are sold short by seven funds.

Despite net debt of £2.7 billion (January 2018), it hasn't panicked and has even been paying modest dividends to shareholders in recent years.

Today's update is mostly reassuring.

The membership base at the Roadside division is down marginally, impacted by competition and pricing pressure.

At the Insurance division, motor policies are up 7%.

Cash conversion remains "strong and predictable" - music to the ears of both bondholders and shareholders, I'm sure. The next debt maturity event will in January 2022.

There's been useful analysis of this share by "lavinit" on this website.

He has wondered how the debt issue might ultimately be resolved.

I reckon that this will roll on its current form for the foreseeable future, for reasons he outlines.

Late 2021 and 2022, being the next round of refinancing, is when it will get interesting again.

If business remains steady, and there is not much difficulty refinancing it again, and especially if the debt multiples can start to reduce, then I believe the equity will be a multi-bagger.

This has a place on my watchlist and I'd like to buy it when I have a firmer belief that it's going to pull through. I'm merely collecting the evidence at this stage.

We shouldn't ignore the presence of short-sellers, either - they're likely to have some good reasons for their positioning. So in some way this requires even more careful analysis, to prove that they're being overly pessimistic in this case.

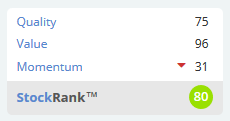

The StockRanks love it, except for Momentum:

I'm not seeing much else worthy of comment, so I'll leave it there.

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.