Good morning! Paul's in Croatia, although that doesn't mean we won't be hearing from him at all. I'll be holding the fort until he gets back.

Taptica International (LON:TAP)

- Share price: 346.5p (pre-open)

- No. of shares: 61.7 million

- Market cap: £214 million

This is an Israeli mobile (and now video) advertising firm, generating most of its revenues in the US. I've covered it a couple of times in recent months, as it announced some acquisitions expanding its international reach, and moving into video. Now we have the H1 results to June.

From the financial highlights:

- Revenues increased by 27% to $65.6 million (H1 2016: $51.8 million)

- Gross profit increased by 45% to $25.8 million (H1 2016: $17.8 million), with improvement in gross margin to 39.4% (H1 2016: 34.4%)

- Net cash inflow from operating activities of $13.7 million (H1 2016: $4.5 million)

Also worth mentioning the outlook for the rest of the year: strong growth is anticipated which will be in line with market expectations

Digging a little deeper, the growth is said to have been driven particularly by Asia-Pacific. Taptica has offices in China, South Korea and Japan. It also opened an office in the UK during H1, while the $50 million acquisition it made last month is US-based. So it certainly has no lack of ambition!

As noted in the highlights, gross margin improved 5%. It seems to be getting better at what it does:

Cost of sales, which consists primarily of traffic acquisition costs that are directly attributable to revenue generated by the Company and based on the revenue share arrangements with audience and content partners, decreased as a proportion of revenue compared with the prior year due to increased technology efficiency gains resulting from improved use of the big data collected thereby significantly improving the gross margins.

That is the sort of thing that can become a competitive advantage, I think - when a company has so much data and becomes experienced at analysing it, new entrants face the double problem of not having the data and also not having the analysis techniques. See Google!

Taking a quick look at the statements, I see that the net cash inflow from operating activities is flattered by a $5.4 million favourable movement in working capital ($7.5 million receivables increase minus $2.1 million payables decrease).

Without that movement, the net cash inflow from operating activities would have been $8.3 million, much closer to the $8.7 million profit figure actually recorded. So I'd be more comfortable using these numbers as estimates of "underlying" profit, not the cash flow or the adjusted EBITDA of $13.1 million.

The numbers are still very encouraging, and Taptica is planning to have ten international "hubs" within three years.

It remains fairly cheap relative to the stock market as a whole, effectively on sale thanks to the discount for foreign-headquartered companies. And perhaps also thanks to the difficulty for minority investors to understand how a data-oriented company like this really works on the inside.

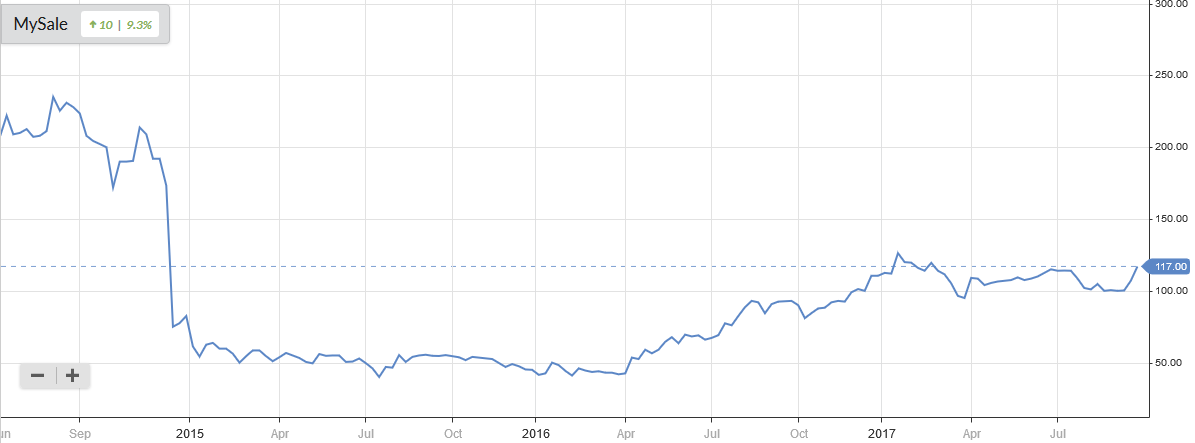

MySale (LON:MYSL)

- Share price: 117p (+9%)

- No. of shares: 154.3 million

- Market cap: £180 million (A$305 million)

This is an online retailer primarily selling into Australia/New Zealand. The share price has mostly been flat year-to-date, but remains a big success for those who bought in after the profit warning it had the same year that it listed, in 2014:

The business is split across both retail and flash-sale websites. On the latter, sales are on a "consignment inventory basis", i.e. MySale doesn't hold the inventory, it merely organises the distribution from supplier to end-user.

These results had already been outlined in a pre-close trading update covered by Paul.

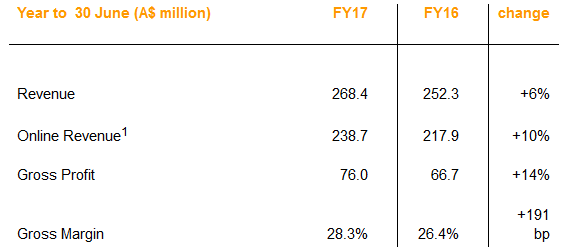

Overall revenue is growing at a modest pace though if you focus only on the online segment, ignoring the planned reduction in offline revenue, it's a bit better at 10%.

Outlook is strong:

"Underlying EBITDA for the year expected to be at least in line with upper end of market expectations"

I note that Sports Direct is a near-5% shareholder in MySale, with the latter having access to 150,000 products of the former (the business model is primarily about selling product from the UK/Northern Hemisphere to Australia/Southern Hemisphere)

Despite the positives, MySale still recorded a loss for the year. Operating expenses increased 10%, though the company says the cost base is now fixed as such increases will not be needed in future years.

The company as it stands doesn't seem to have much prospect of achieving significant profitability in the near-term, i.e. of justifying the current market cap.

The investment thesis must therefore be to do with its "proprietary technology platform":

This enhanced, data-driven, platform transforms our opportunities with brands and customers. We have a fully customisable, integrated proposition for brands to seamlessly support all their needs. We have even greater data insights to our customers' needs and now they have access to our 'Endless Aisle' with an even greater choice of products at compelling discounted prices.

''The Endless Aisle combines our increasingly long tail of inventory, now over 300,000 SKU, with our new, single live view of that global inventory, to which all our websites are linked, providing increased customer choice and merchandising opportunities.

So the scale of ambition has gone up a notch or two here: it's looking to offer a central meeting point between all of its brands and its retail customers.

I wonder if the 300k SKU might include 150k from Sports Direct, depending on how the Sports Direct gear might be counted? Just thought I'd point that out.

Anyway, I'll need to do a bit more research over time into MySale's plans although I reckon a fair dose of scepticism is justified, particularly as they have changed so much since IPO.

Since this is the Value Report, I should add that I don't think this stock is good value at the moment, and the Quality remains highly questionable given the failure to generate net income yet. The KPIs include an emphasis on growing underlying EBITDA, which is an instant turn-off for me.

Card Factory (LON:CARD)

- Share price: 315p (-11%)

- No. of shares: 341.5 million

- Market cap: £1,075

This manufacturer and retailer of cheap/value greeting cards is a bit big for the SCVR, but its half-year report is fairly interesting so I will make an exception!

I was very sceptical of this stock when it first listed in 2014, seeing it as another Clinton Cards in the making (the card retailer which left stock market investors with a wipeout in 2012).

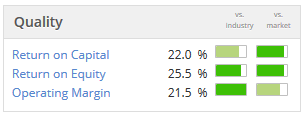

But it has proven resilient up to this point. A lot of this has to do with its business model - it has vertically integrated successfully, meaning that it manufactures its own products from facilities in the UK. So the overall margin it earns is quite high (over 30%), considering that it is selling pieces of cardboard in what you might think would be a highly competitive, saturated market. Those strong margins have provided it with a degree of insulation compared to outsourcing production.

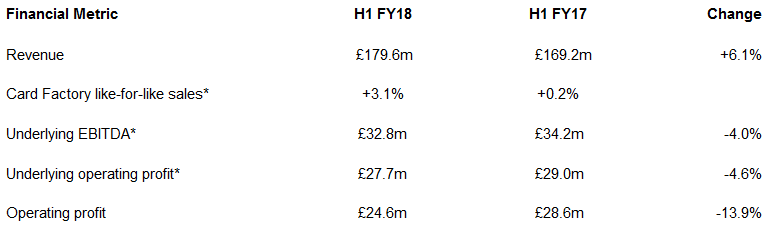

Today's results are a cause for concern, however. Like-for-like sales are up 3%, but underlying operating profit is down 4.6%, while reported operating profit is down 13.9%.

The decline in underlying EBITDA margin is attributed to:

stronger growth in revenue from lower margin non-card sales, investment in the future and cost headwinds of c230bps (£4.2m) from foreign exchange and national living wage pressures.

Underlying EBITDA and underlying operating profit do not include a £2.8 million loss on FX derivatives. This seems highly unsatisfactory to me although I've seen it happen before, where a company suffers FX headwinds to its business and also simultaneously suffers losses on its FX hedges. That's not how such derivatives are marketed!

Anyway, the statement maintains a bullish tone and the interim dividend is increased, along with the announcement of a special dividend of 15p.

I can't deny that the company has performed really well for IPO investors, making some great dividend payments along the way.

Net debt ticks up to £146 million or 1.5x underlying EBITDA, and that's before payment of the latest dividends in December, which will be together worth some £60 million.

But the underlying business model appears robust enough, and the company big enough, to carry this debt load.

I'm still a bit conflicted about the stock, because I can't get away from this nagging feeling that this is a commodity industry, especially at the tier in which Card Factory (LON:CARD) operates.

So even though the quality metrics are strong and the business continues to generate real cash for dividends, I would have no interest in owning the shares for the long-term. It could be that this view is a bit harsh. If the shares were on an ex-growth earnings multiple, I could possibly be tempted to hold them for a while.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.