Good morning, it's Paul here.

Please see the header above for the stocks I intend covering today.

There's a nice recovery underway in decent quality retailer shares at the moment. The emerging trend seems to be that the better retailers (e.g. Next (LON:NXT) ) recouped the sales dip in Nov 2018, in Dec 2018. Although it's once again eCommerce sales which proved key - growth online offsetting the drop in physical store sales, for Next.

Even shares in poor quality retailers seem to be seeing some buying interest, given that share prices have already factored in Armageddon. So anything not too bad, could be seen as positive. Maybe. Who knows, sentiment can turn on a dime at the moment. These are certainly difficult, but rather exciting markets.

To summarise my current thinking, the only retail shares that interest me, should ideally have some combination of the following characteristics;

- Niche or differentiated & desirable products (not re-selling generic, or third party products)

- High proportion (over 30%, preferably 50%+) of sales online

- Sound finances

- Short leases on physical stores

- Low valuation

A lot of smaller, weaker, retailers are likely to go bust in 2019. Therefore there will be more market share available for the survivors. Plus rents are likely to continue falling considerably, on lease renewals. Hence why this sector, whilst a minefield, is very interesting to me. I focus on this sector because I understand it far better than any other sector, and it usually pays to stick to what you know - as the chance of success is greater.

I seem to have writer's block this morning, but will see if I can get into my stride now.

Joules (LON:JOUL)

Share price: 255p (up 4.3% today, at 11:18)

No. shares: 87.8m

Market cap: £223.9m

Joules, the premium British lifestyle brand, today updates on the Christmas trading performance of its retail business for the seven-week period to 6 January 2019 (the "Period").

Checking back, I wrote positively about JOUL here on 5 Dec 2018, thinking it looked good value at 207p. It's up 23% in the month since then - pity I didn't back my judgement with a purchase, but such is life.

Whoever writes the trading updates for Joules should probably be reassigned to other duties, as they almost always strike me as ambiguous & unclear, and sometimes contradictory.

eCommerce is a stand-out positive aspect of this share - it's almost half of Joules' total retail sales. That ties in nicely with my bullet points in the introduction to this article. So a positive tick in that box.

Retail sales - the company lumps together its store sales, and eCommerce sales into one total, not giving us the split between the two. This is unsatisfactory, because we really need to know how the physical stores are performing, since they have large fixed overheads.

Best practice is to clearly state store sales (LF) and eCommerce separately, then also show the combined total. Joules has not done that today.

Anyway, the total is up 11.7% against last year, "on a comparable basis". Is that a LFL figure, or does it include new store openings? Comparable basis suggests it might be LFL, but I'm not sure.

To confuse matters even more, there has been a change in treatment of concessions revenues, from wholesale, to retail. This reporting is absolute rubbish. They should just include a simple table, giving the relevant breakdown of the figures.

Outlook - this at least is clearer;

Retail performance during the Period supports the Board's previously stated confidence in the Group achieving full year 2019 PBT in line with its expectations.

That's impressive, given tough market conditions.

Valuation - the forward PER has moved up from 14.1 a month ago, to 16.3 today. So it's not quite the bargain it was in Dec 2018.

In difficult market conditions, I wouldn't want to be paying more than a PER of low to middle teens, even for a fashion retailer that is performing well online. A higher multiple could be justified if it was online only, and growing faster.

For now, I'd say it's probably priced about right.

My opinion - a good company, which is performing well, in tough market conditions.

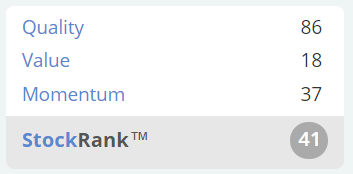

Note that the StockRank system recognises the high quality of the business, but is unimpressed with value and momentum;

Note that the StockRank has edged up from a lowly 37 a month ago, to a still rather mean 41 today. Perhaps that might continue rising, as time goes on? It's interesting to follow how the StockRanks move about, in response to data changing over time. You can monitor this, by clicking on the grey "Print" button on each StockReport. A drop-down menu appears, allowing you to see StockReports going backwards, at monthly intervals. A handy feature.

Footasylum (LON:FOOT)

Share price: 27p (down 17% today, at 12:06)

No. shares: 104.5m

Market cap: £28.2m

Footasylum, a UK-based fashion retailer focusing on the branded footwear and apparel markets, announces an update on trading performance for the 18 weeks ended 29 December 2018 (the "period")...

Online - is now 33% of total sales (up from 30% a year earlier), which is starting to look interesting.

Revenue growth of 14%, which is meaningless, since new stores have been opened, it includes online growth, so they've obscured what the LFL sales performance from their shops is. That's because it's almost certainly negative.

Store sales are up 5%, but again that's not a LFL figure.

Margin pressure - competitive pressures have required discounting to clear stock. Not good.

Therefore, while Footasylum continues to expect to report FY19 revenue in line with consensus expectations, FY19 gross margin is now expected to be lower than current consensus expectations.

Bank covenants - a company that's barely profitable should not have any bank debt in my view. This is a considerable risk for this company, but today it says;

Footasylum remains (and expects to remain) in compliance with the covenants of its £30 million multi-currency revolving credit facility.

Cost reduction plan is being implemented, which will result in exceptional costs.

Profit warning - this doesn't sound too bad, in the circumstances. I was expecting worse;

Footasylum now expects to report an adjusted EBITDA for FY19 towards the lower end of the current range of analyst forecasts.

It's a pity there isn't an asterisk, stating what these forecasts are.

Outlook - challenging.

My opinion - this update is not as bad as I expected. The share price is so bombed out, that the outcome looks pretty much binary - either it's going bust, or there could be a decent bounce at some point. One for (brave or foolish?!) traders perhaps?

I like that 33% of sales are online. The key missing information, is what leases the company is committed to? How onerous are they? How long are the lease expiries? If it can manage down its retail estate, and migrate more online, with just a handful of flagship stores, then there might ne something here. Very high risk though, so DYOR is more vital than ever.

Accrol Group (LON:ACRL)

Share price: 12.25p (down 42% today, at 12:25)

No. shares: 195.2m

Market cap: £23.9m

This is a tissue processing company.

It's another profit warning;

... the continued weakening of Sterling against USD since September 2018 and increasing tissue prices have impacted profitability considerably

The figures look pretty grim;

... the Board now expects that Adjusted EBITDA in FY19 will be c.£1m*. In terms of the overall turnaround plan itself, this is expected to result in up to £8.0m of exceptional costs in the business during FY19.

Revenue is rising, expected to be up c.8% to £126m in FY19.

Net debt - this is the deal-breaker;

Net debt as at 31 October 2018 was reduced to £22.6m and management expect FY19 year-end net debt to be no more than £30.0m (FY18: £33.8m), which is a result of improved working capital management.

My opinion - performance of this company has been diabolical since it listed. Is it a viable business at all? With a ton of debt, it's difficult at the moment to see how the equity has any value. Maybe performance might improve in the future, who knows? Do I want to punt on that happening? No.

Staffline (LON:STAF)

Share price: 1120p (down 10.4% today, at market close)

No. shares: 27.9m

Market cap: £312.5m

Staffline, the Recruitment and Training group is pleased to report that trading for the financial year ended 31 December 2018...

Trading has been in line;

... is expected to be in line with market expectations.

Why is the share price down 10% today then?

- Significant costs incurred in winding down the Government's Work Programme - resulting in £20m of exceptional costs

- Net debt increased to £63m - as a result of these exceptional costs, plus payments related to acquisitions in H2

Results for 2018 will be published on 30 Jan 2019 - a pleasingly tight reporting schedule, which suggests to me that the finance dept at Staffline must be on top of their game. Rapid reporting nearly always means good financial controls are in place, together with a capable finance team.

My opinion - this is a long-standing favourite of mine - I remember flagging it as a good share when it was under 300p, after meeting management, years ago. Despite today's setback, there is a generally positive tone to today's update, with more detail given which I've skipped over here.

The valuation looks about right to me at the moment.

MissGuided

(private company)

The Guardian apparently reported that this fast fashion eCommerce company (similar to Boohoo (LON:BOO) ) has just released terrible figures. Given that it's a private company, I figured that the journalist must have had an email alert from the Companies House website (a very useful feature). Therefore I've had a look at its figures at Companies House (which is now free, it used to cost £2), and the numbers & narrative are both very interesting.

Missguided website is here - warning, a fast-moving graphic on the home page might trigger an epileptic fit.

As a key competitor to BooHoo, I had previously assumed that Missguided must also be rapidly growing & highly profitable. Actually yes, it has grown rapidly, but profit has only ever been small, and in decline since 2015.

Results for the 53 weeks to 1 April 2018 are dire. Here's a snapshot;

- Revenue up 5% to £216m

- Pre-exceptional EBITDA down from +£3.7m to -£26.5m

- Loss before tax (after exceptionals) of -£46m

- Gross profit margin crashed from 51.9% to 43.7%

- Balance sheet NAV dropped from +£4.9m a year ago, to -£41.6m

- A new shareholder loan of £27.9m has propped up the company - without this, I think it would have gone bust by now

What's gone wrong? The narrative points to 2 main problems;

- A large increase in overheads, including bringing in a new layer of management (who have obviously screwed things up spectacularly) - this resulted in a 60% increase in central support costs, which is crazy

- "Poorly selected product" - requiring deep discounting to clear it

- Physical stores opened, which are "too large", and loss-making. Required a £5m onerous lease provision, and write-off of £4.5m of previous capex

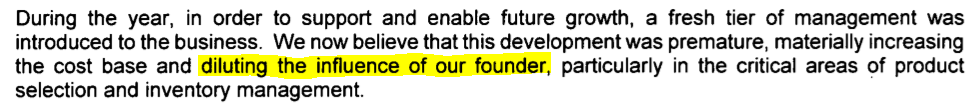

The comment below, from the narrative, is particularly important;

This has read-across to Superdry (LON:SDRY) which has also lost its way recently, after a dominant founder retired. It seems to me that fashion businesses in particular, are often highly dependent on a key individual or maybe a couple of key people. The founders are the driving force of any business, so there's a lot of risk when they decide to move on.

Once entrepreneurial businesses grow too much, and become too corporate, then the life blood of the company can quickly ebb away. Missguided seems to be a dramatic example of that. Clearly incompetent new management has almost wrecked the business. Luckily the shareholder(s) have deep pockets, and have been able to rescue the business with that £28m loan. How much more funding they have available, I do not know.

This situation also reinforces just what an iron grip the Boohoo (LON:BOO) group has on the young, fast fashion space. Its 3 brands dominate this area, and seem to be killing the competition. Missguided needs to get its act together fast, or could face insolvency - which would be a big boost for BooHoo of course.

One of the great skills of BooHoo's founders, is that they built a great team of talented people around them. I noticed this positive culture when I visited BOO's HQ a couple of years ago. The founder showed me round, and he acknowledged every member of staff. The body language from his staff was positive - they obviously respected him a lot, and were not fearful.

Missguided has clearly failed, spectacularly, to make the transition from owner-managed, to a larger, more corporate arrangement. This is something worth pondering, and looking out for at other growth companies. As we've seen here, the consequences for out-growing the ability of management to manage, can be disastrous.

OK, all done for today.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.