Good morning, it's Paul here!

Apologies, I conked out after getting back home yesterday, so nothing more got done for the day. Pangs of guilt got me out of bed early today, so let's start with a few snippets of news left over from yesterday:

Water Intelligence (LON:WATR) - the share price rose 7% to 308p (mkt cap of £47m) on a

Positive trading update.

- The company mainly operates in USA, fixing water leaks, partly through franchisees.

- Sales for YTD (9 months to 30 Sep 2018) up an impressive 40%, to $18.5m.

- Profits also doing well;

Underlying profits before tax comfortably in-line with expectations, despite significant reinvestment expenses

There's lots more detail in the RNS - I'd say it's worth taking a look.

My opinion - The valuation looks high, at 35 times this year's forecast earnings, dropping to 28 times 2019 forecast, but I suppose bulls must be hoping these figures can be beaten. This looks quite an interesting growth company.

WYG (LON:WYG) - an "international project management and technical consultancy"

- In line with expectations interim results.

- Full year guidance unchanged

- Order books stable

- Expecting a stronger H2, as usual seasonality

- Divi maintained (yield is quite good, at 4.3%)

I'm not keen on the balance sheet, with a lot of working capital tied up in work-in-progress and receivables. NTAV is under £2m. Doesn't interest me.

Vianet (LON:VNET) - this group owns the "Brulines" beer flow monitoring business, and several vending machine telematics businesses.

- Interim results look OK, if unexciting - which sums up this share actually

- Revenue up a little

- Adjusted operating profit up 6% to £1.8m in H1

- Net debt of £1.0m (worse than net cash of £2.7m a year earlier)

- Interim divi held at 1.7p

Outlook - I can't find anything relating to market expectations for the full year.

My opinion - the PER of 10, and yield of 5.4% look about right to me.

New products seem to take years to develop commercially, and then only on a small scale. Meanwhile the Brulines business faces a continuous headwind of pub closures. So it's difficult to get excited about this share.

Now onto today's results/trading updates;

Joules (LON:JOUL)

Share price: 207p (pre market open)

No. shares: 87.8m

Market cap: £181.7m

Joules, the premium British lifestyle brand, today provides a trading update covering the 26-week period to 25 November 2018, the first half of the Group's 2019 financial year (the 'Period' or 'first half').

There always seems to be something in Joules' trading updates which is unsatisfactory, or ambiguous. Today it's this;

Strength of the Joules brand and flexible 'total retail' model deliver first half profits ahead of initial expectations

What are "initial expectations", and from when? It's not explained. It sounds like the company is trading ahead of expectations, exciting.

The above is then toned down to "slightly ahead of initial expectations, further down the statement (my bolding & italics);

Given this sales performance, the Board anticipates announcing a level of Underlying Profit Before Tax (PBT) that is slightly ahead of initial expectations for the Period.

The full year outlook is then toned down again, to just in line with expectations;

... These attributes, combined with the robust first half performance and a strong Spring/Summer 2019 wholesale order-book, give the Board confidence in the Group achieving full year 2019 PBT in line with its expectations.

The above gives me a feeling that the announcement has been over-PRed. It's much better if things are kept brief, and crystal clear.

Other points;

- Good H1 revenues growth of 17.6% to £113.1m

- International growth is good - is now 16% of total revenues (up from 11.3% in H1 FY 05/2018). USA & Germany are key target markets

- Ecommerce sales now 50% of total retail sales (so about £40m eCommerce, out of £80m total retail sales in H1)

- UK market conditions expected to remain challenging

Brexit planning - this is very interesting, and not something I've seen before from other small caps.

Contingency plans have been put in place to mitigate the expected disruption that could arise in the event of a 'hard Brexit'. These plans include establishing an EU based 3rd party distribution facility; scheduling earlier inbound product deliveries for our Spring/Summer 2019 ranges; preparation for expected increased administrative activities; and hedging US Dollar requirements more than 12 months forward.

That all sounds pretty sensible to me, and probably at minimal cost. If you're supplying goods into Germany, then why import them into the UK first? It makes a lot of sense to set up a German subsidiary company (which wouldn't need any staff at all), and then send imported food goods direct from the Far East, into the German equivalent of Clipper Logistics (LON:CLG) , thus by-passing the UK (and any potential customers bottlenecks) altogether.

Hedging the dollar more than 12 months forward could backfire, if everything turns out to be OK, and sterling recovers.

Bringing in Spring/Summer deliveries ahead of potential trouble in late March 2019, also makes a lot of sense to me. It wouldn't cost much, but could prove very smart, if the ports do clog up as some people expect.

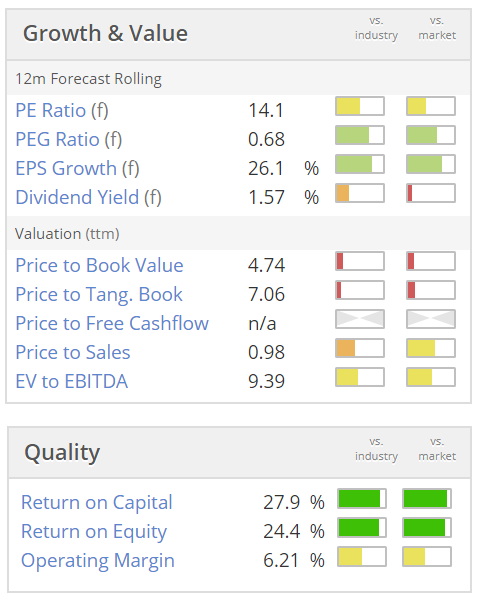

Valuation - given the good growth, and a successful eCommerce operation, this looks an attractive valuation to me. Before the market correction, this share was on a PER over 20. Now it's 14.1, despite nothing much having changed, in terms of the company's performance. This could be a buying opportunity, but who's brave enough to buy right now?!

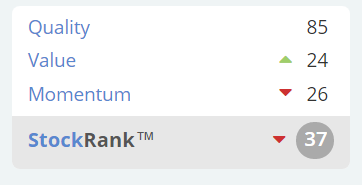

I was expecting to see a strong StockRank, however the Stockopedia computers take a fairly dim view of JOUL;

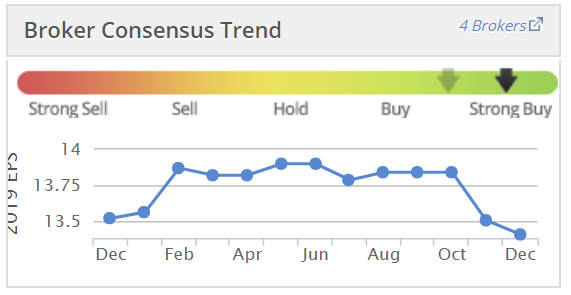

The share price almost halving since July will have pushed down the momentum rank, but also broker forecasts have wobbled, but only slightly;

My opinion - in this case, I'm minded to ignore the low StockRank, because it seems to me that unusual market conditions have pushed down the share price, rather than deteriorating fundamentals. So perhaps this is a time for us to be ignoring share price momentum, or even using it in a contrarian way? Since so many small price movements have really been indiscriminate, and often on low volume, they could be more opportunities than problems?

What I see here is a decent, lifestyle brand, which somehow manages to charge huge prices for (what to me) look fairly ordinary clothes! For example, a red men's gilet is £54.95 on JOUL's website. I've got something that looks identical hanging in my cloakroom, and it cost me £8 from Primark. Still, it doesn't matter what I think - if enough people love the Joules brand, are emotionally engaged with it (a very important point), and are happy to pay high prices for clothes, then that makes Joules a very good business.

Overall, if I had any spare cash, then this share would be high up on my list of possible purchases. Once all the Brexit uncertainty has been fixed, one way or another, then shares like this are likely to be more expensive.

How does this chart make sense, when the company is trading well?

I'll leave it there for today, as nothing else looks of interest to me.

I don't cover financials, Graham does, so if you ask him nicely, he might be persuaded to look at it tomorrow.

Best wishes, Paul

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.