Good morning, it’s Paul here with the SCVR for Tuesday.

Timing - today's report is now finished.

Agenda - here’s something I prepared earlier (last night) -

Staffline (LON:STAF) - trading update - OK, but looks like it needs to do another fundraising

Asos (LON:ASC) - acquisition of Arcadia's top brands. BOO (I hold), Next & Asos as "marketplace" platforms.

Dx (group) (LON:DX.) - positive trading update, but looks expensive now.

Today's news -

Idox (LON:IDOX) - a quick review of its results FY 10/2020

Moonpig (MOON) floats

Gyg (LON:GYG) - my first look at this superyacht painting company. FY 12/2020 trading update.

.

Staffline (LON:STAF)

56p - mkt cap £39m

Trading & Business Update

Staffline, the recruitment and training group, is pleased to provide the following trading and business update for the year ended 31 December 2020.

It looks like 2020 ended decently -

The Group expects to report underlying operating profit marginally ahead of expectations for the year ended 31 December 2020.

Strong peak trading over Christmas, thanks to good demand from food retail, ecommerce & logistics sectors.

People Plus division moved into u/l operating profit in H2, after ditching its apprenticeships operation

Net debt - heavily flattered by £42.9m VAT arrears. Good disclosures though, of this boost, and also giving the average net debt figure, which is more meaningful than the snapshot at the year end, I wish all companies would provide this important information -

At 31 December 2020, the Group had pre-IFRS 16 net debt2 of c. £9.0m (2019: £59.5m), with average net debt throughout the year of c. £38.1m (2019: c. £85.2m).

The year-end position represents an improvement against expectations resulting from the increased focus on working capital and cash generation during 2020, as well as a number of timing effects, including the benefit of deferred VAT relief from Q2 2020 of £42.9m.

VAT is repayable in instalments between Mar 2021 - Mar 2022 - a highly significant cash outflow. Will the bank be happy to finance that, I wonder? Possibly, at least in part, because the bank lending is now secured against the receivables book.

Covid - still disrupting things.

Refinancing - it raised fresh equity in June 2020, but admits today that it needs another fundraise -

Notwithstanding the combination of corrective measures taken in 2020, which has resulted in a significant improvement in working capital, the board continues to evaluate its options in relation to strengthening the Group's finances.

Looking back at its interim results as at 30 June 2020, it shifted the bank borrowings onto a receivables financing facility. This jogs my memory, and I think we discussed it at the time, with this being done at banks’ behest, in order to make the borrowings secured, as opposed to unsecured. I think that’s correct. Which is good, as it makes the bank more likely to maintain the lending facilities, being secured against a receivables book of blue chip clients, i.e. lower risk lending than say an overdraft.

Balance sheet - even after the fundraising in June, STAF has a really bad balance sheet. NAV was £28.9m, less intangibles of £88.5m, takes us to NTAV horribly negative at £(59.6)m.

Therefore, this business needs another, substantial fundraise. The market cap is only £39m, so allowing for a discount on the placing, it would really need to do a 2 for 1 equity fundraising to just bring the NTAV back to zero! That would be a tripling of the share count.

My opinion - if you’re going to bet on a recovery in this sector (not a bad strategy actually, as recruiters should be doing well in a recovery, and when lots of people get made redundant and hence need a new job), then I think it would make sense to find a share which has a solid balance sheet, not one like STAF which is financially very stretched.

The business has basically only survived because the VAT man has extended it a huge loan, and the bank has maintained the borrowing facilities. That’s not a secure base. Best avoided in my view, as risk:reward is not favourable, given heavy dilution being likely in 2021 at some stage.

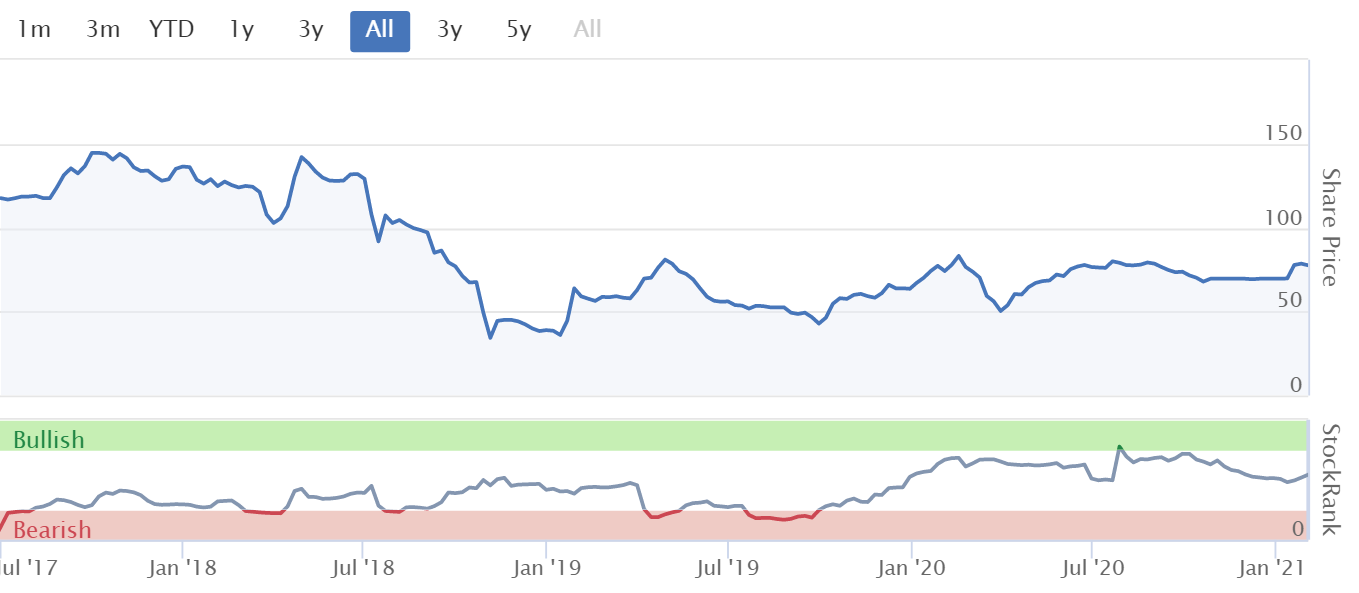

Staffline shares recovered strongly in the so-called "dash for trash" in recent months, which gave a good selling opportunity when it spiked up to 75p.

I’m perplexed as to why the StockRanks system has delivered such a positive verdict? Maybe I’ve missed something positive? Mind you, the computers don’t know it has a massive VAT bill in arrears, and I do, so I’ll rely on my analysis more than the computers in this case!

For me, this share is an avoid until the balance sheet is fixed with an overdue, substantial equity raise. Even then, I don’t trust the company given its history of accounting irregularities, and poor acquisitions, despite new management now.

.

.

Asos (LON:ASC)

4784p (up 7% yesterday) - mkt cap £4.8bn

Someone forwarded me a very interesting article (many thanks) over the weekend, pointing out that online fashion in the UK is concentrating into “platforms”, or “marketplaces”, which sell multiple brands, as well as their own brand.

The market leaders online are -

Boohoo (LON:BOO) (I hold) - teenage customers mostly, but is now broadening out into older demographics with Karen Millen, Coast, Warehouse, Debenhams, and possibly Wallis, Burton & Dorothy Perkins (if that deal happens, as expected, shortly)

Asos (LON:ASC) - very successful selling to twenty-somethings, multiple brands

Next (LON:NXT) - very successful selling to thirty & forty-somethings.

I'm coming round to the view there’s a strong argument for just buying all 3 of those shares, and keeping them forever.

Asos in particular is starting to look a lot more interesting of late, since it’s finally started making a decent profit, after years of low margins, and minimal free cashflows.

Acceleration of ASOS Brands strategy - this announcement yesterday confirms Asos has won the bidding war for Arcadia’s best brands (TopShop, TopMan, and Miss Selfridge, HIIT), pipping Next at the post apparently.

Has Asos overpaid? Maybe, but given its own equity is on such a high rating, then that gives it scope to pay up. The additional profits could even reduce Asos's PER over time.

The rationale is that Asos already stocks these brands, they’re strong sellers, so by buying them, Asos can increase its margin on those products, and drive growth in them, instead of having to share the profits with Arcadia. Apparently Next spotted that buying these brands also opens up the opportunity of attracting the best people back to TopShop (designers, buyers, etc) that drove its 1990s & noughties heyday, but were repelled by the (widely seen as) obnoxious & bullying Philip Green, who as it turns out did a good job of destroying TopShop.

The rationale from Asos is hard to argue with -

- Accretive to margin and double-digit return on capital (post tax) in first full year (FY22)

- Fully funded from cash reserves; cash position remains robust

I reckon BooHoo’s £55m acquisition of Debenhams is likely to produce a very much stronger return in due course, but they’re much cannier management than Asos, and better organised, from what I’ve heard.

My opinion - I’ve got Asos and Next on my watch list, and am looking to buy if/when they have a plunge, as these shares sometimes do. It’s not just BOO, the whole sector has ESG risk, because even with the best possible systems, no retailer can be 100% sure, despite their best efforts, that all factories, all over the world, are doing things absolutely correctly. Hence we could see buying opportunities in future, if that issue rears its ugly head again. Or, Next & Asos might have it fully buttoned up already, I don’t know.

Apart from that, I'm only interested in niche online retailer (with some shops as well) Joules (LON:JOUL) (I hold). All other fashion and non-food retailers, are probably best avoided. I reckon Works Co Uk (LON:WRKS) could be a value trap - looking cheap, but probably won't survive long-term.

Why mess around in shares of declining businesses, when we have the opportunity to back the winners, in Boo, Asos, and Next?

.

Dx (group) (LON:DX.)

36p (up 3% yesterday) - mkt cap £209m

It’s been a while since I looked at this specialist freight company, which also operates the declining DX secure postal service for solicitors (being gradually usurped by email attachments). I had written it off in my mind as a basket case, so am surprised to see the market cap now over £200m. Something good must be happening.

What an impressive recovery in share price in 2020 -

.

Trading Update

DX, the provider of delivery solutions, including parcel freight, secure courier and logistics services, is pleased to provide an update on trading for the 27 weeks ending 2 January 2021, the first half of its current financial year.

This looks good -

Trading over the period continued to track materially ahead of last year up until Christmas. Since then momentum has remained encouraging although B2B volumes have been modestly impacted by the national lockdown imposed in December.

Nonetheless, the Board now anticipates that DX will materially exceed current market expectations for adjusted profit before tax for the financial year.

“Materially” usually means at least 10%. Timing also has to be taken into account. Being this positive half way through the year, usually means that performance is well ahead of expectations, and that the outlook is also positive. Otherwise they probably would have held back, and kept any out-performance in the back pocket, as a contingency reserve, in case H2 disappoints. So, all good.

Other points -

- Strong performance of DX Freight - volumes & margins both up vs LY

- DX Express - volumes slightly better than expected, but margins softened due to mix (more B2C, less B2B)

- Pipeline of new business “very healthy” for both divisions

- 3 new depots opened - for growth & better productivity, 3 more underway

- Liquidity high, significant headroom re invoice discounting bank facility

- Diary date - interims in early March 2021

My opinion - I’m impressed with this upbeat trading update.

Research Tree has two broker update notes, from Finncap and Liberum, many thanks to them for helping us with access to this important information. Both have substantially raised EPS forecasts for FY 06/2021, by about 30%, but have held back on changing future years’ forecasts. So there could be more upside to come on next year's forecasts, with future increases possible maybe?

Both brokers are forecasting 1.4p EPS this year, so that’s a PER of 25.7 times - that seems awfully high for a freight company. The reason seems to be that future years assume substantial further earnings growth, to a range of 2.6p - 3.1p for FY 06/2023. That would bring down the PER to between 11.6 to 13.8, which looks about the right price range for this sector. It’s a low margin, highly competitive sector that needs a lot of capital, hence why the shares should be valued on a PER in the low teens.

We’re being asked to pay up-front for 2 years’ future growth, and a doubling of profits. Why would I want to pay up for growth that hasn’t happened, and isn’t guaranteed?

DX looks fully, or over-priced to me. After such a stellar price rise, I’d be tempted to bank the profits now at 36p.

Note that the balance sheet is weak - when last reported at 30 June 2020, it had negative NTAV of £(8.0)m , calculated as NAV of £23.0m, less intangible assets of £31.0m. That limits its ability to pay future dividends, and increases risk. Note also the large lease liabilities.

.

Idox (LON:IDOX)

54p (up 1%, at 08:24) - mkt cap £240m

Quite good figures - adj EPS up 39% to 1.81p (LY: 1.3p)

PER 29.8 looks pricey

StockReport says consensus forecast was 1.87p, so looks a slight miss, but not enough to worry about

Outlook - in line with expectations so far in FY 10/2021.

Good H2 order book

Recurring revenues from public sector clients

Weak balance sheet - NAV £47.0m, less intangibles of £81.7m = NTAV negative at £(34.7)m

Lots of debt - long term borrowings of £35.1m, plus Bonds in issue of £11.8m. Although it also has cash of £30.8m - probably a seasonal spike, otherwise it wouldn’t need the borrowings.

My opinion - doesn’t interest me, due to weak balance sheet, unreliable/erratic historic performance, and negligible divis.

.

£MOON

An interesting company floating today, the popular greetings card app/website.

Priced at 350p per share

342.1m shares in issue = £1.2bn market cap!

Only raising £20m in fresh cash for the money. The rest of the shares being sold (148.6m shares) is selling shareholders, banking their profits. Let's hope it's not an opportunistic sale after the boost from covid? (I agree with MrC's comments below)

Prospectus is not on their website yet, but should be published later today they say.

Financial information available on Moonpig's investor relations website section looks remarkable - a rapid growth, highly profitable business.

My opinion - this looks very interesting, I'll be rummaging through the Prospectus once it's published. I imagine the vendors are delighted with the £1.2bn valuation.

Gyg (LON:GYG)

76p (down 2%, at 11:05) - mkt cap £35.6m

This company floated in July 2017, and so far I’ve never properly looked at it. Why? Too small, and I couldn’t see any reason why it would be a listed company. Taking a quick look at its Admission Document, the answer seems to be that it floated as a partial exit route for existing shareholders (£21.5m raised at 100p per share) and to raise some fresh money for the company too (£6.9m at 100p). Zeus Capital floated it on AIM.

It seems to have only paid a 3.2p divi in June 2018, and that’s it. The share price now sits 24% below the listing price. Therefore, it has not been a successful float, so far anyway, for investors. The vendors and the brokers did nicely out of it though.

As you can see below, it generates meaningful revenues, but not much profit. Are they busy fools, is the first question in my head? It claims to be the market leader in painting superyachts.

.

Looking at the shareholdings structure, a couple of things jump out at me;

1)Woodford fund seems to hold 20.0%. Is that an overhang? Or since cleared?

2) There’s very little free float, with about 80% of the shares concentrated in >3% holders, according to the company’s website. What was the point of floating it then, with such concentrated shareholdings? Zeus clearly didn’t give any thought to creating a liquid aftermarket, and most days there are only a few small trades.

There’s been a flurry of big blocks of shares changing hands recently, see the Holding in Company RNSs;

- Lombard Odier has increased to 26.19%

- Oryx International Growth Fund (run by Harwood Capital, activist Christopher Mills) also bought more, holding 17.16% now

- Lonsdale Capital Partners has sold its 16.77% stake.

Mills has a great track record of identifying undervalued companies, and often shakes things up, including lowish takeover bids from himself (e.g. Essenden, which I still bear a grudge about, as it was floated again at a much higher price, after he whipped it away from us in a lowball takeover bid a few years ago). However, Mills is very shrewd, so finding him on the shareholder register with a big stake, indicates that this share is almost certainly too cheap, and that something might happen in terms of a deal or restructuring, so I’ll have a closer look now.

Interim results 06/2020 - a quick skim of the figures reveals these key points -

- Hit by covid, so revenues down 12% to E29.1m (reports in Euros)

- Loss before tax of £(460)k

- Lumpy contracts

- Impressive growth in order book, and good visibility

- Net debt of E10.9m

- Outlook - confident in meeting market expectations

- Weak balance sheet, with negative NTAV of £(6.7)m, or £(4.3)m if we remove deferred tax liabilities - not good, but not a disaster either. It seems to get money up-front from customers, so probably OK to operate with a weakish balance sheet, providing orders don’t dry up

- Cash generation - nothing really in the last 2 years, which does make you wonder, what’s the point? The instis buying more shares must see some opportunity to improve performance, I suppose.

Full Year Trading Update - issued today.

GYG (AIM: GYG), the market leading superyacht painting, supply and maintenance company, today provides the following trading update for the year ended 31 December 2020.

This sounds a bit mixed -

Overall the Group delivered a robust performance and effectively managed the considerable disruption caused by the pandemic, albeit some Q4 projects were delayed into Q1 2021 with associated deferral in revenues. As a result, the Board expects to report revenue of €58.5m with Adjusted EBITDA also marginally below current market expectations, and additional COVID-related exceptional costs incurred during Q4.

The Group has focused on delivering further operational improvements and has started the new financial year well positioned to deliver an improved level of profitable growth.

What a pity they didn’t give us any figures for profits, or market expectations.

Many thanks to analyst James Tetley at N+1 Singer, for coming to our rescue, making estimates available on Research Tree, which is incredibly helpful.

FY 12/2020 forecast is E2.4m PBT, and 3.6p EPS (I’ve converted from 4.1 Euro cents) - that’s a PER of 21

Future years look more interesting, with a big rise to 6.3p in 2021, and 8.0p in 2022, which would lower the forward PER to 12.1 and 9.5

My opinion - the growing order book suggests it makes sense to expect growth in profits. If the forecast 2021 & 2022 numbers are achieved, then I think that could propel the share price up maybe 50% at a guess? So quite reasonable upside there. Maybe divis might be paid in future, if forecasts are hit?

Overall, this share looks quite good I reckon. Watching TV programmes about superyachts, it seems to become an obsession for the owners, who want bigger & bigger superyachts as soon as they take delivery of a new one, like spoiled children. Therefore GYG is probably well positioned to benefit from that fashion. Its order book is impressive too. This lends weight to the idea that profits could increase in the coming years.

To conclude, it gets a thumbs up from me. I can see the merit in taking a small position here, since it looks a decent GARP share (growth at reasonable price), reinforced by having a noted shrewdie on the major shareholder list (Christopher Mills).

The StockRank is middling, at 54, although it almost got into the green zone (see below) in 2020.

.

.

All done for today. A couple more items from today will be in tomorrow's report.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.