Good morning,

This is what I intend reviewing today;

Revolution Bars (LON:RBG) (in which I hold a long position) - preliminary results

Treatt (LON:TET) - trading update

SCS (LON:SCS) - preliminary results

DX (Group) (LON:DX.) - preliminary results - sorry, I ran out of time, so didn't get round to looking at this after all.

Revolution Bars (LON:RBG)

Share price: 123p (down 1.7% today, at 10:16)

No. shares: 50.0m

Market cap: £61.5m

(at the time of writing, I hold a long position in this share)

Revolution Bars Group plc ("the Group"), a leading UK operator of 76 premium bars, trading under the Revolution and Revolución de Cuba brands, today announces its results for the 52 weeks ended 30 June 2018.

Where to start with this?! This is a classic case of a share where some investors will see negatives, and others (including me) see a turnaround opportunity, with the negatives already priced-in to the share price.

Larger competitor, Stonegate, tried to buy RBG last year, with a 203p recommended cash bid. Very unusually, RBG's larger shareholders then turned down this bid, as undervaluing the company. I'm struggling to think of that happening before, as recommended bids are not usually recommended, unless management has agreed the terms with major shareholders. So a very unusual turn of events.

Negatives

Why has the share price slipped so far down, from the 203p cash bid approach last year, to only 123p now? Partly it's the bid premium coming out of the price of course. But also, here is a list of the things that have gone wrong in the last year;

Management distraction from Stonegate (and Deltic) bid approaches - this is a perfectly valid point in my view - business is bound to suffer, if a small management team is spending a lot of time handling a takeover bid & other approaches.

Lack of leadership - the outgoing CEO (mark McQuater) left on 18 Oct 2017. The new CEO (Rob Pitcher) joined on 25 June 2018. So that's over 7 months without a proper CEO. Again, for a smallish business, that's bound to have a significant impact on performance. Linked to this, today's RNS also mentions the loss of some experienced senior managers, during this period of uncertainty. The "unsettled workforce" is also mentioned.

Extreme weather - this affected everyone in the sector. However, it's a valid point that most of RBG's sites do not have much outside space (just a small smoking area, mainly). Therefore, it makes sense that the extreme hot weather benefited bar operators with big outside space, but will have harmed RBG. Who wants to be indoors, when it's boiling hot, after all?

World Cup - again, I don't see this as an excuse, it's a genuine factor. My experience at the time, was that people were queuing up, in large numbers, to get into pubs with sports screens. RBG generally doesn't have sports screens, so it would have suffered reduced sales for this reason, as customers went elsewhere.

LFL sales deterioration - from +1.9% in H1 (July-Dec 2017), to -3.2% in H2. There's been a further deterioration to -5.0% in Q1 of the new year (July-Sept 2018). Some investors might be alarmed by this (although there's no sign of panic selling today). Other investors (myself included) had already factored in known negatives listed above, and a -5% recent LFL performance is not as bad as I feared it might have been (my most recent comments on RBG indicated that I thought the company could have one more profit warning in it, before the turnaround under new CEO gained traction)

Cost pressures - mainly staff-related, but these have been partially mitigated through better scheduling.

Exceptional provisions - of £11.1m announced today, seems very large. Of this, £3.3m is fees relating to the aborted takeover bid. This seems extremely high, but it's done now, and like other things above, is one-off in nature. Onerous lease provisions & asset impairments this year, of £7.8m is sizeable. Although note that there has been a considerable tightening-up of accounting procedures, reflected in prior year adjustments, etc. This seems like kitchen-sinking, to clear the decks, which you often find when a new CEO starts. Today's provisions are of course tomorrow's higher profits - as some cash outflows are charged against the provision on the balance sheet, instead of going through the P&L.

Increased bank debt - the bank facility is a £25m RCF, and note 13 indicates that the bank covenants were reset recently, to provide more headroom. The facility was drawn down by £19m at the time of signing the financial statements. That's quite a big increase from c.£5m a couple of years ago. Although it's gone up, I don't see bank debt being anywhere near dangerous levels. It's gone from almost nothing, to a level of about 1.27 EBITDA, which is fine.

Capex - the company is spending heavily on 5 large new sites (with heavy capex) in H1. Heavy capex is discretionary, so can be switched off fairly quickly, if necessary. Therefore, I don't have any worries over the increased bank debt, providing it doesn't continue rising considerably. The commentary indicates that a more cautious approach will be taken to future expansion, whilst they put their house in order, with operational improvements. That's absolutely the right thing to do, and it should see bank debt peak, then start reducing next year.

Overall then, there are lots of things to latch onto, if you want to take a negative view of this company. However, it's all in the price I reckon. If the above issues were not present, then the share price would probably be double what it currently is. So you get what you pay for.

Positives

Hands-on new CEO - it's too early to judge, but the commentary today from the new CEO is music to my ears. All this business needs is decent, hands-on management. It sounds like that's what we've now got;

Historically, the Group's brands have led their market segments but sustained success is delivered by focusing on the detail of our customer proposition - something that has waned due to management distractions and operational management change...

I view all the issues in the negatives section above as being temporary, or one-off factors, that should be relatively straightforward to fix (apart from ongoing upwards pressure on wage costs). Therefore, my view is that, given perhaps a year to mend the business, we could be looking at a much better picture (and hence share price too) this time next year.

New openings - this is a roll-out, with the estate continuing to expand, at an accelerating pace in Jul-Dec 2018, so the new CEO certainly has a lot on his plate. I'm impressed that he's already visited 50 of the company's sites, in his first 3 months.

Mention is made of a new site in Torquay having performed badly, but the rest seem to be doing well. Bear in mind that new sites take about 9 months to mature to full profitability. If I'm reading it correctly, the section about returns on capex seems to be saying that;

- last year's new sites have generated at 18% EBITDA return on capex (held back by Torquay under-performing), but

- this year's new sites are performing much better, at 30% EBITDA return on capex expected once maturity is reached

So not completely plain sailing, but the recent openings appear to be achieving a payback in the 3-4 year range, which is not bad at all. It's clearly a good investment, if the right sites are chosen. Management needs to avoid any more mistakes on site selection. Highly seasonal Torquay seems a strange choice of site.

Dividends - the final divi of 3.3p is maintained, as was the 1.65p interim divi. The total is 4.95p for the year, giving a yield of 4.0%.

Clearly though, paying decent divis, at the same time as a heavy, expansionary capex programme, is causing bank debt to rise (as mentioned above), although that's not a current concern to me. I don't see anything wrong in taking a previously ungeared balance sheet, and incurring new bank borrowings to fund a heavy capex programme - where the capex is delivering an excellent return. If you can get an 18-30% return on investment, then borrowing money at probably 3-4% makes a lot of sense. Providing the total bank debt doesn't become excessive, and result in insolvency in the next recession (as happened to Luminar in 2011).

If the bank debt reduces, once the current heavy capex programme is completed, then it would be fine to continue paying divis. However, if the company keeps ploughing on with new openings, then it would possibly be wise to reduce the divis, or suspend them for a year, perhaps?

Operational improvements - there's loads of stuff in the narrative about steps being taken to improve day-to-day execution. I won't regurgitate that all here - if you're interested, you can read the narrative with today's figures. It all seems excellent to me though, and exactly what is needed.

Outlook - there is some early indication of things improving, re Xmas bookings;

In the first quarter of FY19, like-for-like** sales are -5.0%. However, with many exciting initiatives planned or currently being implemented, as detailed in the CEO's statement, we are confident of improvement.

In addition, pre-booked revenue for the critically important Christmas trading period is currently up 20.3% on the same time last year (up 13.8% on a like-for-like** basis), which we expect to aid our performance.

Furthermore, we do not anticipate a recurrence of the same external circumstances experienced to date in 2018.

I think it's too early to get excited, but there seem to be good initiatives in place to rejuvenate trading over Christmas (Q2 contributes just under half of full year profit).

My opinion - I accept that opinions will differ on this share. It's a classic case of operational problems emerging, and performance declining somewhat as a result. All we have to decide, is whether these are signs of structural decline, or whether the business can recover from temporary problems? My view is firmly that this is probably a recovery situation, but we'll have to be patient to find out.

If the new CEO delivers solid Christmas trading, and it sounds to me as if that's a likely outcome, then I see this share price heading back up towards 200p.

The wild card is whether someone decides to bid for it. Stonegate aren't the only potential suitor. Something might happen with Deltic too, although I suspect probably not. It sounds to me as if the new CEO wants to prove himself by sorting out RBG's own operations. After that, who knows.

I think the turnaround at RBG could be fairly straightforward, and reasonably quick. The business doesn't have any major problems. It just needs a period of new ideas, and decent, hands-on management. They always say that "retail is detail", and it's exactly the same with the hospitality sector too. I like the report from the new CEO today - he seems to be focusing on the right things, and in time this should deliver improved performance. That's just my initial impression though, we'll have to wait and see what the future numbers look like.

Bottom line, if a competitor wanted to buy it at 203p, and nothing has fundamentally changed since then, why would it be worth a lot less now? In fact, it now has more sites, and the new sites are performing well overall. So logically, once the operational issues are sorted out, then the value of the business should be heading upwards of 203p in due course.

We should also consider the downside risks. With more bank debt, things are more highly leveraged to decent performance. If bank debt gets out of hand, and that combines with really bad Q2 trading, then things could get a bit sticky. Although, in the worst case scenario, the business could just shelve the new openings programme, and let the cashflow naturally reduce bank debt. So I'm not sure this is a big risk.

Treatt (LON:TET)

Share price: 473.5p (down 1.8% today, at 12:32)

No. shares: 58.4m

Market cap: £276.5m

Treatt Plc ('Treatt' or the 'Group'), the manufacturer and supplier of innovative ingredient solutions for the flavour, fragrance, beverage and consumer product industries today publishes a trading update for the year ended 30 September 2018.

Key point;

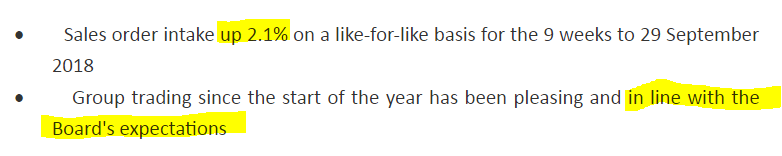

The Board is pleased to confirm that the Group has performed well in the second half of the financial year and despite some foreign exchange headwinds expects to report profit before tax and exceptional items for the year ended 30 September 2018 in line with the Board's earlier expectations.

I'm not sure why they've used this wording, instead of just saying in line with market expectations, which should be the default.

There's more detail, which I'll summarise below;

- Recap on the year - equity fundraising, and disposal of non-core business (Earthoil Plantations)

- US expansion going well - should be operational in H1 2019

- UK site relocation - plans progressing well

- LFL revenue up c.9% in 2018 vs 2017 - all product categories have grown

- Gross margins down a little, due to forex, raw materials & pricing pressures on new business

- Year end net cash £9-10m

- Year end receivables up

- Entering a key investment (capex) phase

- Board looks ahead with confidence

- Results will be published on 27 Nov 2018

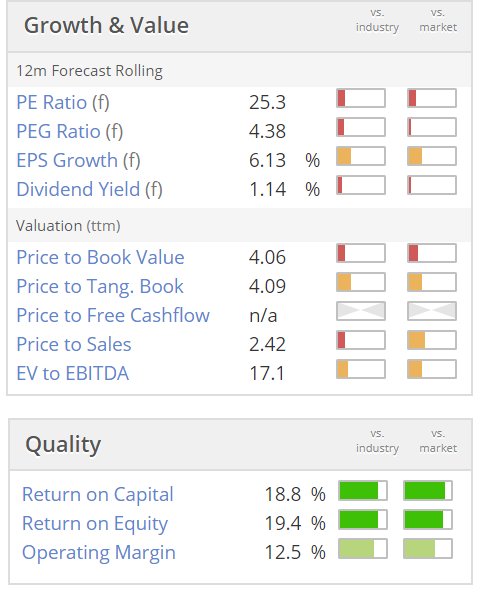

Valuation - I can't find any broker updates today. I'll assume there are no changes, as the statement says in line with expectations.

Stockopedia regards it as a "high flyer" (one of the positive classifications), and it has an upper-middle StockRank of 64 - which reflects good quality & momentum, but poor value.

My opinion - this share is one I've held before, and have a positive view on fundamentally.

I'd like to buy back in at some point, but three things make me too nervous to do so now;

- High valuation, and

- Big expansion capex in the pipeline - whilst this seems positive, in that it should increase capacity to meet demand, it also introduces more execution risk than I'm comfortable with.

- I'm not confident enough about the macro/political picture, to want to add any new positions right now, unless they're complete no-brainers

Therefore, whilst today's update sounds OK, this doesn't feel like the right time for me personally, to buy back into this company. Fundamentally though, I have a positive view of this company, and am certainly interested in following its progress from the sidelines.

SCS (LON:SCS)

Share price: 215.5p (up 8.3% today, at 15:12)

No. shares: 40.0m

Market cap: £86.2m

ScS, one of the UK's largest retailers of upholstered furniture and floorings, is pleased to announce its Preliminary Results for the 52 weeks ended 28 July 2018.

The market clearly likes these numbers, with the share price up 8.3%. I can't get hold of any broker research, which is a nuisance, so that limits what I can say about the company. It looks like an earnings beat - with actual EPS of 26.8p comparing favourably with the consensus forecast shown on Stockopedia of 23.8p. This equates to a PER of 8.0 - attractively cheap, providing good performance continues.

So many retailers are complaining about poor footfall, low consumer confidence, etc, it's refreshing to see a company bucking the trend. ScS must be executing well, to be achieving good results.

Current trading - also looks impressive. To be achieving positive LFL sales growth right now, is pretty impressive - many other retailers are not doing so;

House of Fraser concessions are clearly a headache at present, but it doesn't sound too bad;

Due to the ongoing changes at House of Fraser, trading within our concessions, which represented 7.1% of FY18 gross sales, remains challenging and we are working with the new owners to address this as a priority. Performance in our core ScS business has been encouraging.

Flexible costs - I like this section below. It's a really good point, that I hadn't considered before;

The nature of the Group's business model, where almost all sales are made to order, results in the majority of costs being proportional to sales. This provides the Group with the ability to flex its cost base as revenue changes, protecting the business should there be wider economic pressures.

Lease exposure - this is the number one issue for most retailers. ScS reassures on this point today;

The Group has reduced the average remaining lease tenure of our store portfolio. This has been achieved by targeting lower tenures on existing lease renewals and on new stores. This provides the Group with increased flexibility to exit or relocate stores where required. The majority of recent leases entered into are 10 years in length.

Average remaining tenure length for the Group has dropped from 8.4 years at the end of FY16 to 6.8 years at the end of FY18 (FY17: 7.6 years).

Dividends - total divis of 16.2p are proposed, giving a very healthy yield of 7.5%.

Balance sheet - in the past I've not been terribly keen on this, as the cash pile comes from customers paying up-front. However, on reflection, I'm wondering whether my previous concerns were misplaced? Looking at the balance sheet fresh today, it looks fine to me. There's a £48.2m cash pile, and no bank debt.

Cashflow statement - looks excellent to me. This business is generating a lot of genuine cashflow, and has little capex requirement. So it can pay out big divis without putting any strain on the balance sheet.

My opinion - this business is performing much better than I imagined it would. Whatever they're doing, it's clearly working very well. If this strong performance (in tough conditions) continues, then this share would certainly look great value.

If all the political/macro stuff works out OK, then this share would certainly be on my buy list.

Sorry, I ran out of time before looking at DX (Group) (LON:DX.) results.

See you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.