Hi, it's Paul here.

I've been busy setting up a new computer this morning, and it seems to be working OK now. When I say new, it's actually a refurbished Dell, from Ebay. For about £150 you can get a desktop that has the same performance as a £500 new laptop, and a bigger screen. Now all I need, is to work out how to increase the screen brightness, and find my reading glasses, then everything will be perfect. In the meantime, I'll struggle on with varifocals and a rather dim screen.

Let's start with a couple of reader requests, Tristel (LON:TSTL) and Tracsis (LON:TRCS) .

I shall be updating this article throughout the afternoon, as I'm house-bound today, due to being on dog-sitting duties.

Tristel (LON:TSTL)

Share price: 275p (unchanged today)

No. shares: 43.0m

Market cap: £118.3m

Tristel plc (AIM: TSTL), the manufacturer of infection prevention and contamination control products, announces its interim results for the six months ended 31 December 2017, ahead of guidance at the AGM.

Key points;

Revenues up only 10%, but this figure masks stronger growth overseas (up 28%, now half of total sales), offset by a 4% fall in the UK, where it sounds like the market is saturated. These are niche products after all.

Profit margins are excellent, at 18% of revenues.

Pre-tax profits (before share-based payments) up 18% to £2m

Balance sheet is excellent, e.g. current assets of £11.0m dwarfs current liabilities of £2.9m. The only long-term creditor is £185k deferred tax - balance sheets don't come much better than this. So there are no solvency worries whatsoever. Also the company has the capacity to pay decent dividends, which it has in the past. Although the high valuation (forward PER of about 30) means that the dividend yield is modest.

USA launch - this is the main reason that Tristel shares were re-rated a while ago. The £0.5m costs in this half year have been absorbed without hurting profitability. The update today reassures that this new market should be opening up soon;

We are also investing heavily to enter new geographical markets including North America. During the period we spent £0.5m on our North American market entry plan compared to £0.2m in the corresponding period last year.

We are pursuing both FDA and EPA approvals for various products. We have incorporated a Delaware subsidiary but have not yet recruited a business development team. We would expect to do this during the second half.

I am satisfied that we are progressing well towards our strategic objective of generating first revenues in North America in financial year 2018-19.

Hopes for the new USA market probably justifies the punchy rating on this share.

Valuation - there's a broker update today on Research Tree, from the house broker. They leave EPS forecast for 06/2018 unchanged, at 8.2p, only a slight increase against last year's adj EPS of 8.1p. That looks a little pessimistic perhaps, given stronger growth is reported today.

Anyway, it works out at a PER of 33.5 - punchy, but as mentioned above, the price reflects anticipated growth in profits from the large new US market.

My opinion - these interim figures look reasonably good. I can't find anything untoward in the accounts, it all looks nice and clean. Outlook comments sound fine too.

Overall then this company looks a decent, niche business, that makes a good profit margin. I can't get excited about the existing organic growth, so USA growth looks key to the valuation.

The company already operates in lots of countries, yet revenues are only very small in each country. Perhaps the product is too niche? Will this ever become a seriously bigger business? I'm not convinced. So for me, it fails my scalability test - if I'm paying a premium price, then I like to invest in growth companies that could foreseeably grow to maybe 5-10 times their current size. It's difficult to see growth on that scale being achieved by Tristel.

Tracsis (LON:TRCS)

Share price: 515p (up 7.3% today)

No. shares: 28.2m

Market cap: £145.2m

Tracsis plc, a leading provider of software and services for the traffic data andtransportation industry, is pleased to provide the following trading update for the six months ended 31 January 2018.

Things seem to be going well;

Group trading for the first half of the year has been strong across all parts of the business, and in line with management expectations.

All key financial metrics for the six months are comfortably ahead of the previous year with Revenues in excess of 18m (2017: 15.6m), and EBITDA of over 4.3m (2017: 3.5m).

At 31 January 2018, Group cash balances remained strong at c. 18.5m (31 July 2017: 15.4m, 31 January 2017: 12.7m), which reflects continued excellent cash generation in the period. The Group continues to be debt free and highly cash generative.

Acquisitions - Tracsis has a now long-established track record of making excellent acquisitions, using a disciplined approach.

The latest acquisitions are explained here, and additional information here. I like the way the deal has been structured, with a heavy earn-out, based on aggressive growth targets. As with previous acquisitions, this follows a model of making acquisitions (at least partially) pay for themselves via earn-outs.

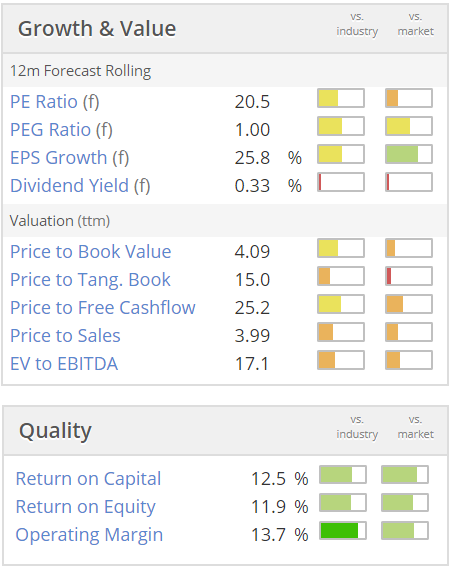

Valuation - given that we're in a bull market, where growth companies are generally expensive, I see Tracsis's valuation as being pretty reasonable;

When you adjust for the strong net cash position, then the forward PER would fall somewhat, into the high teens. That looks perfectly reasonable to me.

My opinion - this one gets a thumbs up from me. I like the good quality collection of companies that has been assembled by the talented management team at Tracsis. It's remarkable to see how this group has been built via acquisitions, yet few additional shares have been issued along the way. Self-funding acquisitions are fantastic for shareholder value. Judges Scientific (LON:JDG) is another group which has adopted the same approach, successfully.

Anyway, everything seems on track with Tracsis, so I'm sure shareholders will be pleased with today's update.

Synectics (LON:SNX)

Share price: 190p (down 7.3% at market close)

No. shares: 17.8m

Market cap: £33.8m

Synectics plc (AIM: SNX), a leader in the design, integration, control and management of advanced surveillance technology and networked security systems, reports its audited final results for the year ended 30 November 2017.

The figures look good, but as reader "sharw" points out in the comments below, the outlook comments are rather disappointing. Still, I would much rather see companies managing down investor expectations early, when necessary. This is a far better approach than issuing a profit warning later at a later date.

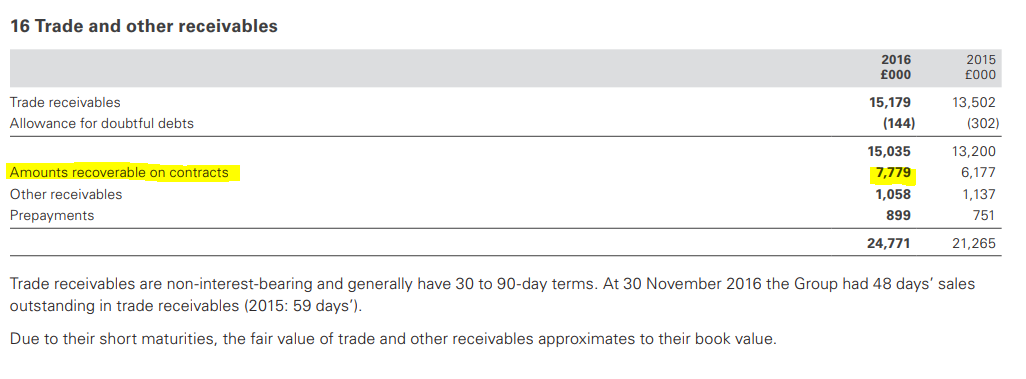

As you can see from the wonky highlighting, I haven't mastered the mouse on the new computer yet!

Taking underlying diluted EPS as the best measure for valuation, which it usually is, then the historic PER is only 12. That looks cheap for a company which also has net cash on the balance sheet.

Balance sheet - there's one item which jumps out at me as looking much too high, and that's receivables of £24.4m. This is essentially unpaid invoices by customers. It's normal to have about 60 days unpaid invoices, but with revenues for the year of £70.1m, I calculate that receivables should be about £11.5m. Even if we assume that all sales are UK, and VATable, then that figure would only rise to £13.8m. Yet the actual reported figure is much higher, at £24.4m.

There was a similar issue last year end, with the figures looking very similar.

High debtor days is a red flag, of possible aggressive accounting. It can indicate problems surrounding aggressive booking of sales just before the year end. Or it could be that there might be disputed invoices which customers are refusing to pay?

Curiosity has got the better of me, so I've looked up receivables in note 16 to the most recent Annual Report from 2016, which says as follows;

I've highlighted the item which is the main cause of receivables looking high - namely the "amounts recoverable on contracts". To me that means that the company is booking sales & hence profits on partially-completed customer projects. Whilst that seems a reasonable accounting treatment, it does increase risk.

The big problem with this security equipment sector, which we've seen repeatedly cause problems at Indigovision (LON:IND) (in which I hold a long position) for example, is that contracts tend to be large & lumpy. Sales cycles can be lengthy & unpredictable. This is one of the reasons why Synectics is unlikely to ever achieve a high PER. So it's not necessarily cheap on a PER of 12, since visibility on future sales/profits will always be fairly limited.

Oil & gas sector - high exposure to this sector has hurt Synectics in recent years;

During the 2016/17 financial year the Group's results continued to reflect the impact of the 2015 collapse in global oil & gas prices on one of our largest customer sectors.

Management has taken action to maintain profitability in that area by reducing costs, and delivered a very creditable increase in operating margin in our oil & gas activities last year...

Increased R&D spending & outlook - this suggests that the outlook for profits is positive, but that the company intends spending the extra profit on increased R&D;

We expect the trend of growing profitability of our business operations to continue in the current financial year. In addition, opportunities have been identified for innovative development of our core product set, using emerging technology applications being introduced in other fields to expand Synectics' offerings to its current markets.

Consistent with our growth strategy, the Board has authorised a significant increase in R&D expense to capitalise on those opportunities. The increased expense for this investment means that the Board's current expectations are for reported profits in 2017/18 to be broadly flat compared to last year.

Personally I like R&D spending, so this is not a negative to me. The market seems to disagree, as the share price is down 7% today. Although this is based on reported trades of only 58k shares today. So a few small trades can move the price all over the place - such is the joy of small caps investing!

My opinion - The valuation looks modest, and there's a dividend yield of just over 3%. Plus the balance sheet seems solid, albeit with high receivables.

It's difficult to see why this company is listed on the stock market. It looks a fairly sound small company, which is modestly profitable. Although I'm not sure whether its stock market listing is worth the expense and hassle, given that the market only attributes a value of about £34m to the company. Perhaps the listing adds prestige & helps when tendering for new business? I've heard a number of small cap CEOs make that point.

Looking at the last 3 years' chart, the gains have mostly been given up in recent months. So a broadly sideways chart, in a roaring bull market, means that investors here have suffered a potentially big opportunity cost - missing out on many multi-baggers, by being stuck in this share, often unable to get out (if a large holder).

Overall then, it looks quite cheap on paper, but that's probably justified.

There's nothing else of interest to me today, so I'll leave it there.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.