Good morning, it's Paul here with the SCVR for Tuesday.

This is today's agenda;

Luceco (LON:LUCE) - Q3 Trading update

Dotdigital (LON:DOTD) - Trading update

Solid State (LON:SOLI) - Trading update

Transense Technologies (LON:TRT) - Final results y/e 30 June 2020

Cml Microsystems (LON:CML) - Trading update

Timings - I've started late, but should be finished by 2pm. I'm tending to focus on just getting the reports done, rather than becoming embroiled replying to reader comments, so please don't be offended if I don't reply to anything addressed to me for the time being.

Update at 14:01 - today's report is now finished.

.

Luceco (LON:LUCE)

Share price: 244p (up 11% at 10:36)

No. shares: 160.8m

Market cap: £392.4m

Luceco plc ("the Group" or "Luceco"), the manufacturer and distributor of high quality and innovative wiring accessories, LED lighting and portable power products, is pleased to provide the following update on trading for the quarter ended 30 September 2020 ("Q3 2020").

I've written several times this year about Luceco, because it keeps putting out strong trading updates. Here are my notes from the recent interim results, which I've just re-read, to refresh my memory. Back then, on 8 Sept 2020, the company guided us towards 11p EPS for FY 12/2020, with further upside possible. At the time I concluded;

It sounds like the 2020 forecasts could be increased further - therefore I'd say the likelihood is that this share could have further upside potential. It's not expensive at the moment, given how impressive earnings growth has been. [SCVR 8 Sept 2020]

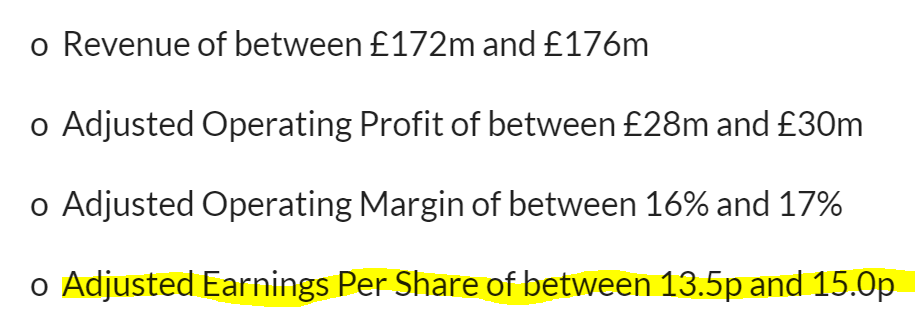

As expected, it's another increase in guidance for this year, by a surprisingly large amount;

Both Q3 2020 performance and current trading are ahead of previous expectations and as a result we increase our guidance for full year 2020 Adjusted Operating Profit from at least £23m to between £28m and £30m.

Why have they switched from guiding on EPS, to adj operating profit? I would have much preferred EPS guidance, as before. The trouble with operating profit, is that it's been mangled by IFRS 16, so is no longer a useful measure, as it omits part of the cost of rental properties (which is now further down the P&L, in finance costs).

I take it back, EPS guidance is given at the end of today's update;

Adjusted Earnings Per Share of between 13.5p and 15.0p

Reasons given for out-performance -

- Strong demand, especially online customers (+25%), producing revenue growth in Q3 of +7.5%, above forecast

- Professional channel returned to modest growth, project channel is slower to recover, due to customer capex constraints

- Strong growth in Europe in Q3, due to pent-up demand from Q2 lockdown

- Higher gross margin (41% in H2), due to more efficient production

- Overheads tightly controlled, should be no higher than H2 LY at £22.6m

Fully recouped covid/lockdown sales -

With revenue growth in early Q4 stronger than Q3, we now expect full year 2020 revenue to at least equal last year's £172.1m, with ground lost to COVID in H1 fully recovered in H2.

I particularly like shares of companies which have demonstrated that (1) sales/profit resilient during covid/lockdown, and/or (2) strong recovery in sales after lockdown, recouping the shortfall. If a company has demonstrated its resilience in this way, then we can be fairly sure that buying/holding the share in future, would be lower risk, if further lockdowns occur.

Profitability - wow, 60% higher for Q3!

Renewed growth, expanded gross margins and tight control of overheads allowed the Group to deliver Q3 2020 Adjusted Operating Profit 60% higher than last year.

Guidance - I wish all companies would give us such detailed guidance - this really is the sign of a good quality business, which has reasonable visibility, and good financial controls, if it can provide such detailed guidance during the year;

.

My opinion - what a fantastic update! Even though the share price has risen a lot, I think the fundamentals justify an even larger increase. Hence in my opinion, it's not too late to join the party here.

Given that the company has repeatedly raised guidance this year, then my guess is that it could even beat the 15p upper end of today's guidance for FY 12/2020. A PER of 20 seems justified in my view, so that suggests a target share price of c.300p is possible. Well above today's 244p.

It has shrugged off covid/lockdown, which suggests strong underlying demand for its products. Therefore 2021 could be an even better year, and it's around this time of year that investors switch to valuing companies on 2021 earnings instead of 2020 earnings, if they hadn't already done so. What could 2021 look like? 15-20p EPS possibly? A PER of 20 would mean 300-400p share price target.

Things may not work out to plan of course. Luceco did disappoint severely in 2018 - look at the chart below. So that is a warning as to what could go wrong possibly in future, which perhaps suggests that it might be prudent to use a PER of less than 20, maybe 15? In order to factor in a bit of downside protection.

Overall though, I'm tremendously impressed with how well Luceco is performing this year.

An interesting point to note, is that Luceco previously told us that more forecast upgrades are likely. When companies say that, it could mean (as in this case) that the company is actually doing very well, and a big upgrade is in the pipeline. I suspected that at the time, but unfortunately didn't have any spare cash at the time to buy any Luceco shares. Well done to holders of this share, who spotted the potential.

.

.

Dotdigital (LON:DOTD)

Share price: 156p (up 8% at 12:05)

No. shares: 297.9m

Market cap: £464.7m

dotdigital Group plc (AIM: DOTD), the leading 'SaaS' provider of an omnichannel marketing automation and customer engagement platform, is pleased to provide the following trading update for the three-month period ended 30 September 2020 ("1Q").

Today's update - faster than expected revenue growth is being "reinvested" to drive future growth, so in terms of profit, it's an in line update -

Following a strong 1Q, the Board now expects to deliver a greater rate of revenue growth this financial year versus current consensus expectations.

The strong 1Q performance has been driven by existing customer growth, new customer wins and a significant take up of non-email channels.

The incremental margin will be reinvested in the business to drive future growth, in line with the previously stated strategy, and the Board is confident on achieving consensus earnings and cash for the full year to 30 June 2021....

The Board expect to see the benefits of this investment later this financial year.

That's a good update. I like situations where companies out-perform on the top line, giving scope to increase discretionary spend, in order to drive future growth. That's the ideal situation with a growth company. What I don't like, is when costs are stripped out, in order to meet short term profit targets, at the expense of future growth.

DOTD's update for FY 06/2020 was here, which I'm looking at again. The company seems to be on a roll hence the strong share price this year. Note that DOTD is in the category of companies which sailed through covid with barely any impact, always good to know if you're worried about the second wave. One of the things we've learned this year, is that we don't have to be nervous about the whole market because of covid. It's now very clear which companies were hurt most by it, and which companies were barely touched, or even benefited from it. That can inform all our investing decisions now. Hence I don't see why there would be another indiscriminate sell-off, such as we had in March 2020, even if covid gets worse in future.

I'm also impressed that DOTD is stating confidence in the full year outcome FY 06/2021 relatively early in the year. That's usually a good sign that things are strong, and visibility is good. Hence I feel we can rely on forecasts, with relatively little downside risk probably. That justifies a higher PER than for most other companies with less visibility.

Cash - it had £27.7m at end Q1. The balance sheet is very good, I recall from when last looking at it. At some point, the company could use its cash pile for acquisitions, more likely than special divis I think.

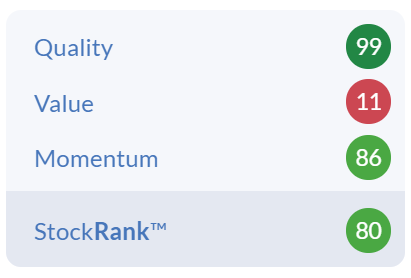

My opinion - since we've got reliable broker forecasts, and an in line update today, then we can rely on forward-looking metrics. The StockRank encapsulates this share perfectly - very high quality, with strong momentum, but expensive!

.

.

Solid State (LON:SOLI)

Share price: 580p (down 7%, at 12:44)

No. shares: 8.54m

Market cap: £49.5m

Solid State plc (AIM: SOLI), the AIM listed manufacturer of computing, power and communications products, and value added supplier of electronic components, announces a trading update and notice of results for the six months ended 30 September 2020.

For background, the last article we have on SOLI was written by Jack here on 11 Aug 2020 on a trading update which looks reasonably good in the circumstances.

H1 update today says -

Solid State expects to announce revenues and adjusted profits similar to the comparative period in the 2019/2020 financial year, which was itself a record first half performance for the Group.

Despite the influences of the COVID-19 pandemic throughout the financial year so far, revenue is expected to be approximately £33.0m (2019: £33.6m) with adjusted profit before tax of approximately £2.50m (2019: £2.67m).

That sounds reassuring, given that H1 covers covid/lockdown. The only missing information, is whether this is like-for-like (LFL), or if this year has benefited from acquisitions? I think acquisitive groups like SOLI should always make it clear if figures are, or are not, organic, and give both organic & totals. I'm rushing for a deadline now, so don't have time to check it myself, am just flagging the question, maybe readers who know the company well could confirm either way?

Order book - some useful figures are given -

The open order book at 30 September 2020 was £34.3m (30 September 2019: £36.5m) of which approximately £23.7m is expected to be shipped in this financial year. The order book reflects some delays in order intake and a shortening of client order scheduling in response to COVID-19 uncertainties....

The £23.7m figure for H2 deliveries, is well below H1 revenues, so the company needs to win more business, but bear in mind it's a 31 March 2021 year end, so I imagine there should be scope to do that.

Operating across multiple client sectors is helping smooth out the worst impacted sectors, which is good.

Liquidity looks fine with £3.9m cash, and undrawn £7.5m borrowing facility. Good to see confirmation that VAT & PAYE deferrals have been repaid by end of Q2, so that cash figure should be clean, with no creditor stretch. Also the final divi was paid in Sept.

Acquisitions & capex - previously paused, now activity is resuming. A good sign of recovery.

Guidance - this is useful to give us an idea of what to expect, although note there is some uncertainty, as I would expect -

While the outlook remains opaque, the Board currently anticipates an outcome to the 2020/21 financial year similar to the prior year.

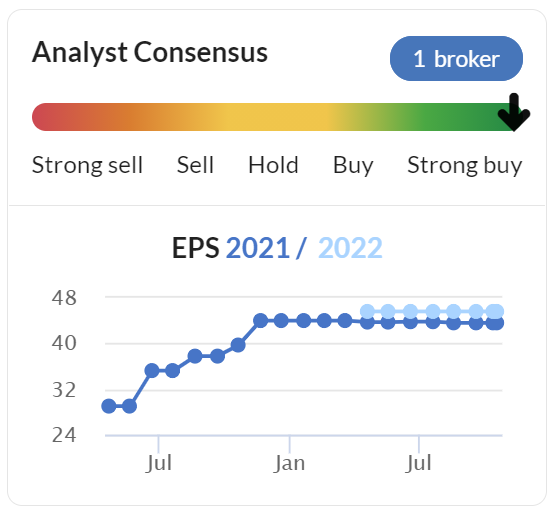

My opinion - it did 46.3p adj EPS last year (annoyingly, TR adjust their EPS figures to make them consistent for all companies, so are not always directly comparable to forecasts). Using the company's figures, then it looks as if we can rely on the broker consensus numbers for this year;

.

Hence at 580p per share, the PER looks to be about 12.6 (based on my estimate of 46p EPS). I can't see that any new shares have been issued, so the EPS number shouldn't diverge from the post tax profit number.

It looks as if SOLI has managed to make multiple acquisitions without diluting shareholders, and without taking on excessive debt, which is pretty impressive. This little line on the StockReport is always useful to check, as well as scanning the list of RNSs - which includes a couple of recent share buybacks.

.

Overall, I think this share looks quite good. It's fared well through covid/lockdown, looks securely financed, you get divi yield of about 2.5%, and the outlook sounds reasonably sound.

Although it's difficult to see why I would chose to buy this share, when there are other more interesting things out there, with better growth potential? Upside potential here might come if it makes some kind of transformational acquisition in future maybe? As it stands, I'd say the valuation looks about right.

It's interesting how the StockRank has been jammed at maximum since 2018 (green line below the share price graph below);

.

.

Quick comments to finish off with, as I've run out of time.

Transense Technologies (LON:TRT)

I got muddled up, thinking this was a much larger company. It's a jam tomorrow type of share, that's been racking up losses for years, and revenues have been going down, to only £0.6m for FY 06/2020.

The balance sheet looks thin, so another fundraising seems likely. Receivables very high, more than a year's revenues, so that needs looking into.

The interest seems to revolve around a deal for tyres with Bridgestone. If we can quantify the likely profits from that, then who knows?

I've got too many speculative shares as it is, so don't want to add another one to my portfolio, as they rarely work.

The share price is down 4% today, so the market doesn't seem impressed. Looks illiquid & hence thinly traded.

.

Cml Microsystems (LON:CML)

There's nothing in this update for me to go on, the main bit just says;

Market conditions through the first six months of the financial year have continued to display the characteristics reported at the time of the AGM in July, with contrasting market conditions and associated trading performance from each of the Group's two main market sectors.

The share price hasn't moved today on tiny volume, hence there's nothing else to report.

All done for today, many thanks for reading if you got this far!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.