Morning! Graham here.

Bankruptcies

I'm sure you will all appreciate the cheery headline.

As a follow-up to yesterday's Covid-19 update, I thought I would spend a few minutes reflecting on the poor financial health of the travel & leisure industry, which is currently a fast-moving situation.

Airlines

Last night, it emerged that Virgin Australia entered into a voluntary administration (Sky, BBC), after the Australian government turned down its request for a loan.

It had already been struggling under a large pile of long-term debt (A$5 billion), and figured that this was the best way of restructuring.

Shortly before that news broke, Sir Richard Branson (who owns 10% of the company) published an open letter to employees. He wrote:

We are hopeful that Virgin Australia can emerge stronger than ever, as a more sustainable, financially viable airline.

With regards to Virgin Atlantic, he said:

...we will do everything we can to keep the airline going - but we will need government support to achieve that in the face of the severe uncertainty surrounding travel today and not knowing how long the planes will be grounded for. This would be in the form of a commercial loan – it wouldn’t be free money and the airline would pay it back (as easyJet will do for the £600m loan the government recently gave them).

The entire industry is facing calamity.

I've been doing some work on Easyjet (LON:EZJ) recently - that's a stock that I would consider selling short, to hedge against the risk of continued lockdown and/or to speculate on its cash burn accelerating via operating losses and too many Airbus orders.

The dispute at easyJet with its major shareholder adds to the controversy and the drama.

The general public shouldn't be overly concerned by any of this - as others have noted, it doesn't matter to them who owns the planes or the brand they are flying with.

For equity holders, it's a different story. There is a real risk of airlines changing hands, from their current owners to their lenders or to new investors.

Something I didn't mention about Berkshire Hathaway (BRK.B)* in yesterday's report: one of the few noteworthy trades it made recently was the sale of $400 million in airline stocks.

It still owns big stakes in the airlines, so I don't want to over-egg the importance of these trades, but I still thought it was interesting. It's not as if Berkshire has any particular need to raise money...

Hotels

Travelodge is in difficulty, though not currently in administration.

It didn't pay its landlords for this quarter, choosing instead to see what it could negotiate with them.

One of the landlords, Secure Income REIT (LON:SIR), made an RNS announcement yesterday:

Secure Income REIT plc has already reluctantly initiated actions to recover this debt, but remains hopeful that this matter can still be settled prior to those options being fully pursued.

The hotel group has hired Deloitte and Moelis to help it figure out what to do. Never a great sign.

Travelodge last got restructured in 2012 and is owned by its former lenders. It looks like the equity might get passed around again.

Restaurants

While there is plenty of domestic demand for restaurants, none of that matters when the doors are shut.

So far, I've noticed the collapse of Carluccio's, Chiquito (owned by Restaurant (LON:RTN) ). and Mark Hix. Many more are vulnerable

At the risk of sounding obvious, these sectors are likely to have a shared destiny: airlines, hotels, their landlords. And restaurants, to an extent.

And for companies which supply each other, the bankruptcy of one can lead to financial difficulties for another, as bills go unpaid.

Central banks will print like crazy to prevent this from happening, but what we are looking at is the classic spiral in a depression as financial failure creates knock-on effects across the economy.

Far from a V-shaped recovery, I see the future as a Nike "swoosh" - a quick financial collapse, followed by a gradual rebuilding.

Negative Oil

In other unusual news yesterday, which is related to the collapse of travel, the price of US oil for the May futures contract fell to minus $37.63.

I should probably mention that the May contract wasn't "front month". Almost nobody was trading it, and the open interest (number of outstanding contracts) was tiny - only about 3% of the June contract. This means that the "negative oil price" will have affected very few people.

In addition to the over-supply of oil, the negative price might have been driven by a technical factor such as the implosion of an oil trader.

So I wouldn't get too worked up about it. It's still highly unusual, of course - not something you see every day!

*Disclosure: Long BRK.B.

Ok, small-caps of interest today:

- Severfield (LON:SFR)

- Joules (LON:JOUL)

- Goco (LON:GOCO)

- Flowtech Fluidpower (LON:FLO)

- Lidco (LON:LID)

Severfield (LON:SFR)

- Share price: 66.4p (-2%)

- No. of shares: 306 million

- Market cap: £203 million

This is a structural steel manufacturer. Let's see how it's doing:

- "factories and sites are remaining operational where it is safe and practical to do so".

- Order book £293 million - this is down from November, still up compared to the same time last year (£274 million a year ago).

- No material impact to the result for FY March 2020.

Guidance is withdrawn, as almost all companies have done.

Balance sheet - gross cash at year-end is £44 million, and total headroom is in excess of £50 million.

This is after drawing down fully on its RCF. Net funds are £16 million.

Indian JV - no guidance for what this might achieve in the current financial year. The scenes from India have been frightening, as the lockdown pushes large numbers of people immediately into food poverty. I'm sure many of them feel that they would prefer to get the virus, than to go hungry.

The capacity of this JV has increased, but again the order book is down, compared to November.

My view

No strong view on this, as it's not a sector I know well.

I will say that the cash headroom looks more than sufficient - about six months of the operating expenses seen in prior years.

Some construction work is still taking place. That being the case, and with Severfield closely managing its costs, I think the bank should remain relaxed.

Joules (LON:JOUL)

- Share price: 84.4p (+12.5%)

- No. of shares: 108 million

- Market cap: £91 million

Joules has been fixing its balance sheet, first with a £15 million placing at 80p, and now with an increase in its RCF at Barclays.

The £15 million increase in the RCF brings it up to a new size of £40 million.

Net debt as of two days ago was £6.9 million, with available headroom of £43 million.

When we are looking at survival prospects in the very short-term, it's the headroom that counts, much more than the net debt position. Headroom going to zero means that the cash has literally run out.

In the case of Joules (and SFR), headroom is currently plentiful. So they are not at immediate risk of cash running out.

This changes if debt facilities are withdrawn, e.g. if covenants are tripped in an RCF or if an overdraft is called in. Barclays appears to be supportive of Joules, judging by its action today.

E-commerce - open for business and doing better than Joules expected it would, when lockdown began (I don't know how low those expectations were).

Historically, e-commerce was responsible for half of revenues.

My view - this appears capable of surviving the lockdown, having raised fresh funds. The available headroom represents c. five months of historic operating expenses, and current operating expenses should be running much lower than their historic levels.

Goco (LON:GOCO)

- Share price: 70.8p (-7%)

- No. of shares: 420 million

- Market cap: £297 million

Formerly known as Gocompare, I held Goco until January of this year. I don't like the new name at all (but that's not why I sold!)

This is a very confident RNS, despite withdrawing financial guidance for the current year:

- cash is £27 million and £22 million is undrawn from RCF, i.e. total headroom is £49 million.

- debt is 2.1x trailing adjusted EBITDA, below covenant (the covenant is 3.0x - more companies should say what their covenants are, when they discuss their RCF)

- expects to generate positive operational cash flow "even under multiple stress scenarios"

- will pay the 0.5p dividend previously announced. That costs only £2 million, no big deal.

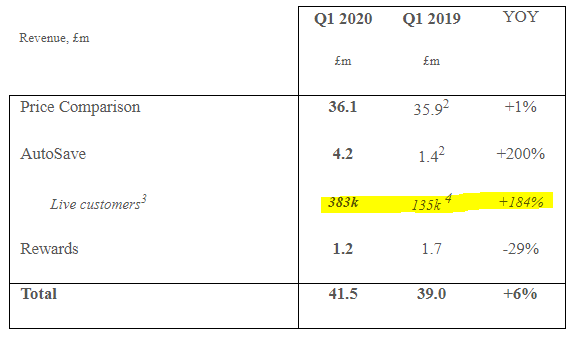

Q1 (January to March) was quite good, revenues +6% year-on-year.

There is some serious growth happening in the "AutoSave" segment (comprised of Weflip and Look After My Bills).

Those gains are offset by the large fall in revenue from MyVoucherCodes (the "Rewards" segment). GoCo says this is purely down to the C-19 crisis.

Media trends - people aren't searching for car insurance much these days. Why would they?

Search traffic via Google is lower. On the other hand, people are spending more time on Facebook, YouTube, etc.

People who were marginal drivers before now, are becoming non-drivers. More than half a million cars were taken off the road in March (double the number seen in February).

Additionally, young people will delay getting their first car (e.g. because they have no job and can't afford one, and/or because they aren't allowed to go anywhere).

These are very negative trends for the car insurance market. One of the few silver linings is that it's now much cheaper for Goco to buy TV advertising.

My view

I didn't particularly want to sell this share.

The new products are innovative and being received very well. And the core busines is holding its own, with a very well-known brand (maybe "well-liked" would be pushing it, as the ads are hated by many!)

Stocko gives it the thumbs up as far as Quality goes, with a QualityRank of 91.

Management strike me as reasonable, so I would take the dividend payment as a good sign that the business remains healthy, despite these extraordinary circumstances.

Flowtech Fluidpower (LON:FLO)

- Share price: 68.8p (+15.6%)

- No. of shares: 61 million

- Market cap: £42 million

Like almost everybody else, lockdown hurt the end of Q1 for Flowtech, a provider of components and services:

Many of our suppliers and customers suspended operations, although recent indications suggest that some have either already reopened or are planning to reopen in May, albeit with reduced capacity.

Whenever you hear about capex being cut back, there is a supplier somewhere who is missing out.

That supplier could be an equipment manufacturer, who in turn is supplied by someone like Flowtech Fluidpower. The ripples of spending decisions are felt all around the economy.

Outlook - no guidance is given. Customers in the manufacturing and construction sectors might get active again in May, or they might not be. Nobody knows.

The outlook statement is a blank. They don't know what is going to happen, and don't bother pretending that they do. They do say that more cost reductions might be needed, if the lockdown is extended.

My view

There seems little point in trying to guess what might happen here, since this is not an industry I know much about, and the company itself can't guide investors.

Prior to Covid-19, EPS was forecast to come in around 12p. A cheap multiple against pre-Covid earnings, then.

The company seems relaxed about cash flow/debt, and has up to £9 million - £10 million available in its banking facilities.

If you liked this company before the crisis, then you should probably like it even more at the current share price. Watch out, though - the end-markets are looking weak in the short and medium-term.

Lidco (LON:LID)

- Share price: 8.75p (-3%)

- No. of shares: 244 million

- Market cap: £21 million

From one type of flow to another. Lidco is in the business of cardiac monitoring.

FY January 2019 shows good growth in the revenue from Lidco's own products (19%), at the expense of third -party products. Total revenues are up just 3% to £7.55 million.

The boost in own-product sales helps to increase gross margin, and reduces the loss for the year.

This company seems to have been around for a long time, with a very patchy record of profitability. More often than not, it makes a loss.

The share count has increased significantly over time, with the most recent increase in 2017.

Year-end cash was £1.36 million.

Covid-19

Some big news was already priced in:

Significant increased demand as a result of COVID-19 with 195 monitors sold to date, predominantly to the UK market, compared with 219 monitors sold in the whole of FY20

Board expects that sales in the three months ending 30 April 2020 will significantly exceed total sales of £3.5m achieved in H1 FY20

The body's reactions to viral infection can cause sepsis (blood infection). While Lidco's products aren't specifically designed for Covid-19 treatment, they do apparently help to treat sepsis.

Recurring revenues

it's trying to improve visibility with long-term customer contracts, and appears to be making progress on that front (recurring revenue base now £2.2 million).

It hasn't cracked the US yet - is working on that.

Outlook

The company expects a large cash inflow in H1 on the back of the spike in demand.

My view

I can't express a strong view here, since I don't know enough about Lidco's markets and products. If it can use the windfall profits wisely, perhaps it can create a better future than its past?

Calling it a day there, thanks everyone.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.