Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Summaries

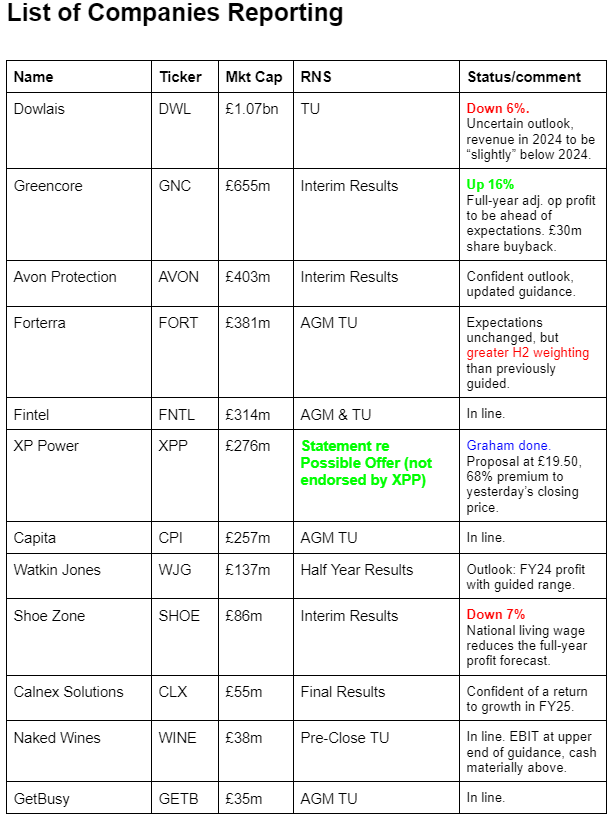

XP Power (LON:XPP) - up 47% to £17.07 (£404m) - Statement re Possible Offer - Graham - AMBER

Bombshell news as we learn that a US-based company wishes to take out XPP. However, three proposals were all rejected by the XPP board, so the potential buyer has decided to go public. I think it’s a generous and credible offer. With many different possible outcomes, I’d consider locking in some gains here.

Greencore (LON:GNC) - up 19% to 165.2p (£760m) - H1 FY24 Interim Results Statement - Graham - AMBER/GREEN

Excellent news from Greencore as profits for FY24 are trending to beat expectations. Broker EPS forecasts are raised by 5% and the company announces that a further £50m will be returned to shareholders, including at least £30m in new buybacks and the first dividend in several years.

Graham's Section

XP Power (LON:XPP)

Up 47% to £17.07 (£404m) - Statement re Possible Offer - Graham - AMBER

It’s an uncommon situation at XPP this morning as we do not yet have an announcement from XPP itself (as of 8am). Instead, we have an announcement from its suitor, the US-based Advanced Energy Industries ($AEIS).

AEIS is “a global leader in highly engineered, precision power conversion, measurement, and control solutions”.

It emerges that AEIS made three all-cash offers to buy XPP, all of which were rejected by the Board.

October 2023: £17 per share

November 2023: £18.50 per share

May 2024: £19.50 per share

It’s important to bear in mind that XPP increased its share count by 20% just after the November 2023 proposal, by raising new equity (covered by Paul here). It did this at £11.50 per share.

Now if I was AEIS, I’d be reluctant to pay £19.50 for shares that the company had just flogged off to investors at £11.50 six months previously. But they are clearly very interested in the acquisition.

It’s also worth reminding ourselves that XPP issued a serious profit warning in February (covered here).

The fact that these two events didn’t stop AEIS from putting in an even higher bid is remarkable to me.

A false market?

There is a point to be made here about the timing of the disclosure of offers to the stock market.

As things stand, market rules don’t require that all takeover proposals be made public in a timely manner, or at all. So XPP investors were in the dark about all of these AEIS offers until now.

Here I do have a slight difference of opinion with Paul. Personally, I don’t think that a company should have to disclose every proposal that it receives, if it would mean that every frivolous, non-binding suggestion had to be published to the stock market.

However, I do have a concern about XPP not disclosing the second offer it received from AEIS on November 5th 2023, at £18.50 per share. Around this time, the company was in covenant talks with its banks and appeared to be financially stressed (e.g. see our coverage in late October).

The very next day, after receiving that second offer from AEIS, XPP announced its funding plan to raise £44m in a placing and up to £1.5m in a retail offer, all priced at £11.50 per share.

Did any of XPP’s investors know that instead of buying more shares at £11.50, they could have potentially sold their existing shares for £18.50?

If they had known, is there a chance they might have preferred that option?

I don’t know what the solution is in terms of the rules, but perhaps XPP should have disclosed the second AEIS offer to its investors before announcing its fundraising.

Strategic rationale for the proposal

AEIS has a market cap of £3.1 billion (converted from USD) and is offering £468m for XPP’s equity: not a trivial amount for a company of its size.

AEIS says that the proposal would solve a range of problems.

XPP investors: they would exit at “a highly attractive valuation”, and no longer have to worry about the low liquidity of XPP’s shares.

XPP itself: the company would benefit from additional scale and resources, less cyclicality as part of a larger company, a more comprehensive product portfolio, broader R&D resources and technologies, etc.

AEIS: they have “over $1.0 billion of cash on hand and low-cost debt”. From their point of view:

Advanced Energy's proposed offer is consistent with the company's strategy to focus on precision power and deliver more value to customers in Industrial, Medical and Semiconductor applications. Advanced Energy's strategy is to grow revenue with highly engineered customized power conversion solutions. XP Power's engineering capabilities and product portfolio would complement Advanced Energy's existing technology and product base.

Graham’s view

We’ve followed XPP’s story with interest here at the SCVR, although it hasn’t been an easy one.

Most recently, in April, I took a neutral stance, arguing that the company “still appears troubled”. The order book was still falling, revenues were still falling, and net debt remained significant at £103m.

That net debt level was manageable to my eyes, but still not comfortable even after all the fundraising efforts.

What would I do? I’d probably take the £19.50 offer, if it turns into a firm offer.

XPP’s current problems may be temporary, but I think the 10-year chart tells the story. The company did pay out a useful dividend stream during this time, however in the end it took on too much financial risk given the cyclicality of demand for its products. I wouldn’t want to go through another ten years of this:

The latest potential offer from AEIS is at nearly 23x the consensus EPS forecast for 2025, with AEIS also taking on XPP’s debts. It’s a good deal, so personally I would take the money and run.

However, there is a strong chance that the XPP board will disagree. It could get complicated.

The current share price of about £17 reflects that it might not be straightforward for the deal to go ahead at £19.50. But it’s still a very nice price: 20x EPS for 2025.

Therefore, as with Keywords yesterday, I’d consider selling some XPP shares today, to lock in some value. But hopefully patient shareholders will ultimately get £19.50 or more.

Greencore (LON:GNC)

Up 19% to 165.2p (£760m) - H1 FY24 Interim Results Statement - Graham - AMBER/GREEN

We’ve not looked at this Irish convenience food manufacturer in the SCVR before but it made it onto Ed’s New Year NAPS for 2024.

Despite being headquartered in Ireland, its manufacturing and distribution sites are all in the UK (see here).

Today’s interim results show a surge in profitability, even though total revenue declined. Revenues fell due to a disposal and the “decision to exit a number of low margin contracts in FY23”.

(This is one of my favourite themes - when businesses transform their profitability simply by abandoning unprofitable activities. See IG Design and AO World.)

Some key bullet points from the announcement:

Volume growth ahead of the wider market, although LfL volume growth was only 0.5%.

ROIC up to 10.2%

Net debt to adj. EBITDA modest at 1.4x

FY24 adj. Operating profit to be £86-88m, ahead of current market expectations.

Shareholder returns: a new £30m buyback is announced, with a plan to return £50m in total to shareholders over the next 12 months. The first dividend since 2019 will be paid if trading continues as expected.

The company already made £50m of share buybacks between May 2022 and Feb 2024..

Balance sheet: new £350m five-year debt facility. Net debt (excluding leases) £244m.

Pension deficit: £22m. The pension scheme should be fully funded by September 2025. Contributions by Greencore of nearly £10m p.a. should cease then.

Outlook: a Greencore site in Sheffield has had excess capacity, but a new ready meals contract in Q4 (July-Sep) will improve its profitability and returns from FY25.

£6-7m is being spent in the current financial year on an IT transformation programme.

Graham’s view

It’s difficult for me to not take a positive view on this, considering that despite all of the good news, the valuation doesn't seem to have reached extraordinary levels.

As of last night, these were the value metrics:

Latest EPS forecasts from Shore Capital (many thanks) suggest adj. EPS of 10.2p in the current financial year, putting the shares on a PER of 16x. Based on the 11.6p forecast for next year, the PER falls to 14x.

The StockRanks give it a big endorsement:

I’ll rein in my bullishness a little and take an AMBER/GREEN stance, since these earnings multiples are admittedly a little high for a food manufacturing business. And it's always slightly intimidating when you see a chart like this, combined with persistent share buybacks - is there a risk that the share price has got ahead of itself? It last reached these levels in 2021:

But there is a lot to like here. Greencore supplies both supermarkets and the foodservice sector so it offers broad-based consumer exposure - it’s not “just” food for consumption at home or “just” discretionary purchases on the go. And it’s thought to be the world’s largest sandwich maker!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.