Good morning, it's Paul & Jack here with the SCVR for Tuesday.

Agenda -

Paul's Section:

Beeks Financial Cloud (LON:BKS) (I hold) - I review its interim results to 12/2021. Very strong organic growth, and lots of recent contract wins, suggests the future is bright. At this stage though, it's little above breakeven, so tricky to value.

Scs (LON:SCS) (I hold) - poor H1 results, but that's against unusually strong, distorted prior year comps. Outlook comments seem confident about recouping backed up orders into revenue in H2, with an in line with expectations guidance. Balance sheet laden with cash. Looks interesting, and I'm tempted to average down.

Luceco (LON:LUCE) - 2021 results look solid. The big question, is how much the doubling of profits from 2019 to 2021 was lockdown-fuelled? A PER of 12 looks attractive, but we could have just seen peak earnings maybe? At this stage it's tricky to value, and really depends on your personal view of the macro outlook.

Knights Group (LON:KGH) - profit warning from this legal services group has collapsed the share price by an astonishing 50%. Is this an over-reaction? Possibly, but I don't know the share well enough to be sure. I don't see solvency risk, and it remains decently profitable. So there could be a trade here for a rebound, maybe? I'm more worried about the read across to the whole sector, with corporate work slowing.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul's Section

Beeks Financial Cloud (LON:BKS) (I hold)

144.5p (down 1% yesterday) - market cap £81m

21 March 2022 - Beeks Financial Cloud Group Plc (AIM: BKS), a cloud computing and connectivity provider for financial markets, is pleased to announce its unaudited results for the six months ended 31 December 2021.

These figures came out yesterday. They seem neutral, as the share price barely moved, on only 100k shares traded.

The main attraction with this share, is an acceleration in organic growth, now looking rapid, with continued momentum in order intake. There was a flurry of big orders (c. $6m total) received and RNS’d in Feb 2022 alone. The total market opportunity is large, and global. That’s why I think this is a very interesting share, although as mentioned before it’s difficult to value at this stage. Also bear in mind growth/tech shares have borne the brunt of the recent market sell-off and de-rating, as investors prepare for higher interest rates (which puts downward pressure on PERs generally).

Another key point is that growth investors generally want growth companies to maximise that growth, rather than maximising profits during the rapid growth phase. Hence BKS strategy is to do exactly that - with out-performance & upgrades to revenue being utilised in increased spending.

Tech companies are facing skills shortages & higher salaries, so they need to be delivering strong organic growth just to absorb higher costs. Thankfully BKS is doing more than fine in terms of growth.

This is all reflected in the half year highlights below - strong top line growth, but not much above breakeven on an underlying basis, and a £(266)k loss before tax on a statutory basis -

Gross margin is a lot lower - it’s come down from 49% to 40.5%. The explanation provided sounds reasonable to me, but we need to check future results to ensure gross margin does indeed move back up -

Underlying gross profit in the period, which is calculated by deducting amortisation on acquired assets and grant income increased by 21% to £3.14m (H1 2021: £2.59m) with gross margin down at 41% (H1 2021: 49%), in line with expectations. The expansion of our asset base across our growing data centre estate has led to an increase in depreciation and data centre costs at a faster rate than our revenue growth during the period.

The gross margin percentage has also been impacted by a higher proportion of hardware sales during the period which are at a lower gross margin than our typical infrastructure sales. As we deliver the material signed contracts over the second half of the year, we expect gross margins to increase in percentage terms as the cost of the infrastructure investment has already been made.

Outlook - continues to sound really good -

The prospects for Beeks have never been more promising, as demonstrated by the record third quarter trading, with over $8.3m to date in Total Contracted Value, resulting in ACMRR increasing to £17.7m as at end of February 2022.

Even excluding the potential contribution from Exchange Cloud, the Board are confident in achieving results for the year in line with market expectations, having already upgraded FY22 revenue expectations three times in the last six months.

Our position as an established technology provider to financial markets, provides us with a strong foundation to drive our business forward. Most financial institutions now see the cloud as a fundamental pillar of their business strategy and cloud adoption is already well underway for financial services. We will continue to invest into the development of our offering and increased sales and marketing activities to capitalise on our early successes in this significant market. We have a considerable and growing pipeline and look to the future with confidence.

Note that the new “proximity cloud” service has only generated negligible revenues of £17k so far, to end Dec 2021. That should grow considerably in future, as new announced contracts are implemented.

Taxation - is low at 9%, due to favourable effects of R&D tax credits, and the new super-deduction.

Balance sheet - the most noteworthy point is a rapid increase in property plant & equipment, as the company has been spending heavily on IT kit for its expansion.

Bank debt has increased to around £4.8m, less cash of £1.1m, so net debt of £3.7m - that looks fine to me, in the context of very rapid expansion, and a growing stream of mostly recurring revenues.

NAV is £14.0m, less £6.3m intangible assets, gives NTAV of £7.7m, which looks OK.

Going concern - I’m a little concerned that this note discloses that there was a covenant breach in Dec 2021, but it was “discussed and agreed beforehand” with the bank, which provided a waiver. That’s sailing a bit too close to the wind for my liking, so I would prefer to see the company do a small placing (say 5-10%, which would be £4-8m) to strengthen the balance sheet. Although now is probably not the right time.

My opinion - I occasionally buy growth companies, but only if they are reasonably priced, and display exceptional organic growth, which this is.

There’s a strong headwind at the moment, in that growth shares are out of favour currently. That’s fine by me, as it means I can buy more, and relatively cheaply.

BKS seems to have an outstanding market opportunity, and this is showing all the signs of becoming a much larger, and more profitable company, in a few years. Hence I like it very much as a long-term hold.

Given how much progress the company has made in the last 3 years, this looks a relatively good entry point to me - strong fundamentals, but weak sector market sentiment, could be giving us an opportunity maybe? Either that, or people just overpaid in the past?

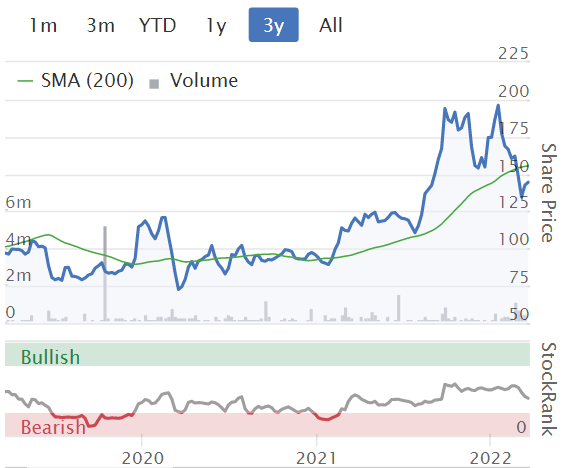

Incidentally, I like the tweaks to the charts, which now show a moving average, and volume bars, both useful additions, without cluttering it up -

.

.

Scs (LON:SCS) (I hold)

182p (pre market open) - market cap £69m

The background here is that SCS shares have performed badly since last summer’s peak, as indeed have many consumer stocks, and lots of small caps generally.

We’ve got general market worries (higher inflation & interest rates, supply chain problems, Ukraine war, energy crisis). SCS has also been hit with a slowdown in order intake previously announced, and supply chain delays causing its order book to extend to such a point that delivery times may be too slow for customers.

Hence I’ve been expecting poor interim results, with hopefully a recovery in supply chains subsequently happening. For that reason I’ve held back on increasing my position size here, until the scale of the damage in H1 became apparent.

This is tricky to analyse, because the H1 comparatives for last year were unusually strong, benefiting from the first re-opening after phase 1 of the pandemic last summer. This results in H1 this year -

Revenue down 16% at £145.9m

Profit before tax of £(3.6)m, down from a (one-off) profit of £17.7m in H1 last year.

Clearly a poor result.

However, the pre-pandemic H1 comps (26 weeks to 25 Jan 2020) are more meaningful, and show only a slight deterioration, with revenue down 4%, and the loss this time of £(3.6)m comparing with a pre-pandemic H1 loss of £(0.6)m.

The company thinks it can catch up in H2 - and has good visibility from the bulging order book. The key question for me, is whether the supply chain can actually deliver the backlog in time for year end (July 2022), or if some of the backlog might run into the new financial year FY 7/2023 - there’s got to be a risk of an H2 profit warning, if they don’t catch up -

During the period increased lead times for product due to supply chain disruption impacted delivered gross sales*, revenue and profitability but has enabled the Group to build a strong order book. This supports the Group's expectation of delivering profitable full year results in line with market expectations…

The Group has returned to a profile more in line with prior traditional financial years, whereby the investment in advertising to support order intake over the key winter trading period results in costs in the first half of the year which support delivered sales in the second half of the year. These costs have led to the Group making a loss before tax of £3.6m for the period, although positive underlying trading has ensured cash generation remained strong, with free cash flow* of £4.4m. The Group expects that the strong order book will support a profitable second half of the year and a full year result in line with current market expectations…

The Group's order book at the end of January 2022 was £148.0m (including VAT), which is £57.5m larger than at the end of January 2021 and double the size it was at 25 January 2020. The Group therefore expect delivered sales in the second half of the period to benefit from delivery of this order book.

Pricing power - absolutely key in this time of higher inflation. Can companies pass on higher input costs is the no.1 question we need to ask when considering buying or holding any share.

SCS makes positive-sounding comments on this -

As we forecast at the start of the year, gross margin* was 44.6% (44.8% in H1 FY20) despite significant rises in product material and shipping costs, as the Group has been successful in managing these pressures. The Group is working closely with existing suppliers, and is also actively engaging with new suppliers, to maximise our value offering and to improve lead times for our customers. Our tight control of margin extends to other costs, which we have managed closely. Our promising strategic progress and growth in key teams has come whilst ensuring a lower overall headcount than at the same point in the prior year.

Retailers do have an advantage, in that they set the selling prices directly. There’s no negotiation with customers, or contractual supply agreements which might need to be amended. So whilst many investors seem to be eschewing retailers, they could actually turn out to be quite good investments in an inflationary environment, who knows? I suppose the main drawback, is that we don’t currently know how customers will react to higher prices. What is the elasticity of demand for various products? I don’t have the answer to that, we’ll find out. Conventional thinking is that people keep spending on essentials, but cut back on discretionary items, when incomes are squeezed by inflation. However, SCS sofas are quite cheap, and there is an interest-free credit offer, so perhaps some sales might shift from outright sales, onto credit sales? I don’t know, we’ll have to wait and see.

Balance sheet - very healthy. NAV is £37.7m, less £2.2m intangibles = NTAV £35.5m.

A key point is that furniture retailing as a sector, has negative working capital - i.e. customers pay the cash before suppliers are paid for manufacturing it, and almost everything is made specifically to order.

Therefore, on a rolling basis, furniture retailers sit on a big cash pile. This can either be hoarded, and do nothing with it (which is what SCS has done), or it can be distributed to shareholders, which is what DFS has done.

I explain this point, with the numbers, in this video, which compares the balance sheets of SCS & DFS. This is factual, not an opinion, so people who dispute the point that SCS is sitting on huge surplus cash, are just factually wrong, as my video explains -

If that link doesn't work, try this link.

Distribution of cash - I’m pleased to see that SCS management has listened to shareholders, I know many have been nagging them to do something with the excess cash.

Today it announces a useful share buyback, of up to £7m (about 10% of the company) over the next 12 months. Hopefully that should soak up some selling overhang, and of course enhances future EPS and dividends. At the current market cap, it’s a no-brainer, and very pleasing. The company has done share buybacks before. It also didn’t need to raise cash in the pandemic, so unusually the share count is in a long-term downward trend - excellent for shareholder value on a low PER share.

.

.

There’s also a 50% rise in interim divi to 4.5p.

These measures barely put a dent in the massive cash pile, which reached £91m recently.

The cash will reduce, as order book backlogs are reduced over time.

Valuation - Stocko shows 28.5p for FY 7/2022, and 21.4p for FY 7/2023 - presumably brokers are being cautious due to the squeeze on household incomes, which is bound to have some downward impact on order intake I imagine.

At 180p per share, that gives us a PER of 8.4 times next year’s forecast EPS, and 6.3 times this year’s forecast. In other words, very cheap.

Given the immense balance sheet strength, and cash pile bigger than the market cap currently, then you couldn’t really ask for more downside protection.

My opinion - I thought it was cheap at 300p, so probably best ignore my opinion! That said, the consumer is facing a tight squeeze this year and probably well into next year, a lot worse than was expected this time last year. An article this weekend said that people need a 10% pay rise, just to keep up with inflation and tax rises.

We should find out imminently what the Chancellor is going to do, to alleviate household incomes, but I think his reputation for competence is already slipping, seemingly asleep at the wheel as the economy faces the risk of slipping back into recession.

SCS has a more variable cost base than some other retailers, as a lot of staff pay is performance related, i.e. sales bonuses for achieving targets. Another big cost is marketing, which can be dialled up or down to reflect the circumstances.

Overall, the H1 numbers look poor, but the commentary and outlook sound confident about H2. Therefore I’m tempted to average down. Valuation remains remarkably cheap. EPS should return to c.30p in due course, and take the share price back up to c.300p. I’ve no idea how long that might take though? Maybe 1-2 years? Who knows, my crystal ball is in for recalibration at the moment, after a period of underperformance.

I’d like to see more firm evidence that deliveries to customers in H2 are recovering. The trouble is, if we wait for that evidence, then the share price could have already anticipated it, and be higher than now. Tricky one. It is tempting to trickle feed some money into SCS, starting now, whilst accepting there is a risk of an H2 profit warning, so maybe keeping some powder dry to buy more on any future falls.

The cash pile remains a beacon for takeover bids, although maybe the company is too small for private equity players?

Stocko shows a 7.5% forecast dividend yield too.

SCS seems a strong candidate for a value investing portfolio.

.

Luceco (LON:LUCE)

240p (up 3%, at 09:59) - market cap £386m

Luceco plc ("Luceco", or the "Group" or the "Company"), a manufacturer and distributor of high quality and innovative wiring accessories, LED lighting, and portable power products, today announces its audited results for the year ended 31 December 2021 ("2021" or "the year").

These figures look pretty good, and ahead of the consensus forecast shown on the StockReport: 20.2p adj EPS actual, vs. 19.3p forecast.

Liberum’s update note today (many thanks for this) says 2021 is in line with their expectations, and forecasts EPS essentially flat for the next 2 years.

Luceo makes a strong profit margin, with a 15.5% operating profit margin, demonstrating decent pricing power. So the products must be good.

Pricing power - “mitigate” suggests not all cost increases have been passed on, due to a time lag, but overall this sounds encouraging to me -

Successfully implemented selling price increases to mitigate cost price inflation…

Gross margins came under pressure for all manufacturers given inflation in raw materials and freight costs. Cost inflation increased progressively through the year, costing £13.6m in 2021 and expected to cost £25.0m on an annualised basis. We swiftly and successfully implemented selling price updates designed to offset the £25.0m annualised impact in full, albeit with an inevitable modest lag due to notice periods and order lead times.

Temporary gross margin compression from the implementation lag was mitigated by hedging arrangements, further manufacturing efficiency gains from automation, and solid operating leverage on strong sales growth. The latter is illustrated by the fact that in the last two years the Group has added no extra overheads despite £52.5m of organic revenue growth. ..

Inflationary trends stabilised in the final quarter of 2021 compared to the second and third quarters but have resumed in the wake of recent tragic events in Ukraine. We are mindful of the impact that real wage deflation could have on consumer spending, including home improvement, and therefore remain vigilant.

Note that gross margin was 38.5% in H1, and 37.1% for the full year, which implies a fall to just under 36% in H2 - not a disaster, but it’s worth noting that margins are under a bit of pressure.

Lockdown benefit - profitability doubled over the pandemic 2 years, from the 2019 base figures. So the question is, to what extent has LUCE benefited from the surge in demand for home improvements during the pandemic? Or how much of the increased profit is due to self-help, e.g. moving production to lower cost facilities in China? The group has also made acquisitions, including a small electric vehicle charging point business announced today, called EVCP, for £10m (previously 20% owned by LUCE, now 100%).

It’s this question about lockdown benefit, which has held me back from buying LUCE shares so far, despite the financials & valuation looking attractive, after big recent falls.

Hence it’s a difficult share to value, because future profits might go up or down, we don’t know at this stage. That’s why it’s priced on a low PER though.

Balance sheet - looks reasonable. NAV is £87.7m. Take off intangible assets of £32.9m, and NTAV is £54.8m.

Working capital is healthy, with a current ratio of 1.9 (for this type of business I regard anything above 1.5 as being good).

Note there is £36.8m of interest bearing debt in long-term creditors - that’s not a problem whilst the business is strongly profitable, but could become an issue if we go into a recession and future profits tumble.

Net debt (excl. leases) is £30.6m. Personally, I wouldn’t want to see that get much bigger, because profits could fall if there’s an economic slowdown, so this is really not a time to be running up more debt. Buying the remaining 80% of Sync EV, announced today, looks to be adding £8m to net debt. Maybe not such a good idea?

There doesn’t appear to be a pension scheme, I’m pleased to report.

Outlook -

"Luceco has a long history of market outperformance. The accelerated progress we have made over the last two years, in which our profit has doubled, is the product of our market focus and business model. We favour RMI construction markets because of their resilience in uncertain times, and undoubtedly benefited from that focus in 2021. But it was our advantaged business model, with its inbuilt resilience and agility, combined with our "can-do" culture, that allowed us to prosper more than most. We moved quickly, won new business and saw growth opportunities across our diversified customer base.

Such strong progress in 2021 naturally creates a tough comparative, particularly in the first half when UK residential RMI activity was at a lockdown-driven peak. We therefore expect revenue in the first half of 2022 to be broadly in line with last year. We are mindful that recent geopolitical developments, and their associated impact on inflation, may make progress harder during the year.

We have strong positions in attractive markets with an advantaged business model and a clear strategy. We have a well-funded business with clear growth opportunities, particularly from our recent entry into the electrical vehicle charger market. We face the future better prepared than ever and I am confident we have what it takes to continue to outperform our market."

My opinion - there’s no doubt that LUCE has performed very well indeed in recent years. The guidance (H1 2022 revenues flat, tough comps) suggests to me that it’s probably best to regard c.20p EPS in 2021 as being peak earnings for the time being.

Hence at 240p per share, the PER is 12 - probably about right, for a company which might be around peak earnings, coming up against tough comparatives, and with some net debt (about 8% of the market cap, so not excessive).

However, as a long-term proposition, if earnings growth resumes, then this could end up looking a good entry point.

Overall then, the uncertainty over future earnings makes this difficult to value, because there’s a fairly wide range of possible performance over the next year or two, depending on how macro factors unfold. That said, I’m tempted to take a small, initial stake, dipping my toe in, and then see what happens. There’s also a reasonable dividend yield, about 3.4%, which is worth having.

As you can see from the chart, the market has scrubbed off growth expectations, halving in price since the Aug 2021 peak. That could re-rate back up again once we’re through this current wobbly macro patch maybe? Even if profits fall by a third, the PER would still be under 20. So there seems a fair bit of downside protection at 240p per share. So it really all depends on how you see the outlook for the economy, and future earnings at LUCE. Dust down your crystal balls!

EDIT: check out the Director dealing - some multi-million selling has occurred.

.

.

Knights Group (LON:KGH)

186p (down 50% at 12:44) - market cap £154m

Trading Update (profit warning)

This is one of the flurry of acquisitive legal services groups which listed a few years ago, this one in 2018. Jack normally covers this sub-sector, but he’s been carrying me recently, so I’ve told him I’ll do today’s report solo. No harm in having 2 opinions on any share, we like to do that, to compare notes.

Jack sounds sceptical here on 12 Jan 2022, when he reviewed KGH’s interim results. At the time, the group thought it would experience the usual H2 seasonal weighting and achieve market forecasts.

That’s gone out of the window today, with a profit warning for FY 4/2022 which I’ll summarise, with my comments -

Slower than expected H2, especially Q4

Reasons? Staff sickness due to omicron, slower benefit from return to office working, slowdown in corporate work due to downturn in business confidence. The only one that sounds credible to me is the last one.

Some improvement recently, but not enough.

No loss of significant clients or staff.

Revised guidance: £126m revenue, £18m underlying PBT - so it’s still a decently profitable business, and H2 is better than H1 (which was £7.6m underlying PBT. I’m not sure what previous guidance was as no broker notes are available.

Guidance for 2023 - organic growth of 5% in revenues is all it says.

Margins “rebuilding to historic levels over time” - doesn’t sound too good, suggesting to me there’s something wrong here.

Cash conversion robust.

Balance sheet - when a share plunges 50% on a profit warning, that tends to mean there’s something serious wrong. Is there solvency risk? Not that I can see (on a review of last, interim balance sheet). It’s not great, mainly being goodwill from acquisitions, but NTAV is almost £10m, which is OK.

Receivables & unbilled work are high at almost 6 months revenues.

Net debt looks OK at £23.3m, not excessive for a firm expected to make c.£18m annual profit.

My opinion - this looks an extreme market reaction, but that can often be because brokers have slashed forecasts brutally. I don’t have access to any forecasts. Is the business really worth half what it was worth yesterday? It did look over-priced to begin with, and could now have overshot on the downside? So if you like the sector, and the company, then it could make sense to buy it at half price today, I don’t know.

This could have read-across for other listed legal firms. If business confidence is declining, and new work is reducing, then that’s likely to have at least some impact on other firms too.

Or the problems could be confined to KGH, which doesn’t strike me as likely.

Maybe work will recover, who knows?

I’m not keen on this sector, for the fundamental conflict there is between shareholders and fee earners personal interests. If they get fed up with paying divis to outside shareholders, then the talent could drift away to set up in competition, it’s all about personal relationships with clients & lawyers after all.

All the share price gains in the last 4 years have gone out of the window, in one day.

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.