Good morning from Paul & Graham! Today's report is now finished.

Agenda -

Paul's Section:

Cyanconnode Holdings (LON:CYAN) results for FY 3/2022 show a stretched financial position (see going concern note), so I think yet another placing is likely. Receivables look way too high on the balance sheet, so there's a red flag there too. On the positive side, it's demonstrating strong revenue growth, reduced losses, and positive outlook comments from larger contract wins. Could get exciting if growth continues rising strongly, although above average risk too. It's been a serial disappointer/fundraiser in the past.

Aferian (LON:AFRN) - interim results lack sparkle. Supply chain issues have delayed some sales into H2, but it sounds confident of meeting FY market expectations. Balance sheet is quite weak, but mgt think it's strong, and are talking about more M&A, fuelled by an unusually large (undrawn) debt facility from HSBC, which I'm not keen on, given macro problems. Overall, no strong view either way from me.

Graham's Section:

RM (LON:RM.) (£58m) - A horror show from this educational provider’s interim results. Revenues rise by 4% but the company fails to make any money. The company is upgrading its systems, including warehouse automation and ERP (enterprise resource planning). These upgrades are taking longer and costing much more than expected, and dragging down the company’s results with it. The company has even needed its banking covenants to be relaxed, as net debt has ballooned to over £40m. While the situation is far from catastrophic, and the company may be able to overcome its current problems, I see little to motivate buyers to get involved here.

Harland & Wolff group (LON:HARL) (£18m pre-market) [no section below] - we discussed this one recently so I thought I would follow up with a brief comment on a new contract win. This collection of shipyards announces its “largest export contract award to date” for the yard at Arnish, in the Scottish Western Isles. The customer is a Greenland-based mining company. The revenues from the contract are already within the existing market forecasts; for FY 2022, Cenkos expects revenues of £70m at a gross margin of just over 20%. As I discussed last time, this company needs the much higher levels of turnover it aspires to, if shareholders are ever going to see it break even and eventually be in a position to pay dividends. Today’s announcement doesn’t change the arithmetic or the very risky profile of the shares, though it does at least offer some comfort that the company has a good chance of meeting its FY 2022 expectations.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Cyanconnode Holdings (LON:CYAN)

17.75p (down 3% at 08:16)

Market cap £42m

CyanConnode Holdings plc (AIM: CYAN) announces its audited results for the year ended 31 March 2022.

Good increases in revenue (up 49% to £9.6m) and gross profit (up 61% to £5.0m).

Reduced loss before tax of £(1.2)m in FY 3/2022, down from a loss of £(2.7)m LY.

Balance sheet - NAV of £11.4m reduces to NTAV of £5.4m once we deduct £6.0m of intangible assets.

There’s £2.36m of cash, but £1.87m of short term borrowings, so net cash of £0.5m, looks a bit tight, if there are continued losses to fund.

Trade & other receivables stands out as excessive, at £7.0m. That’s almost three quarters of the whole year’s revenues, which suggests that revenues booked have not yet been paid in cash by customers. An important red flag.

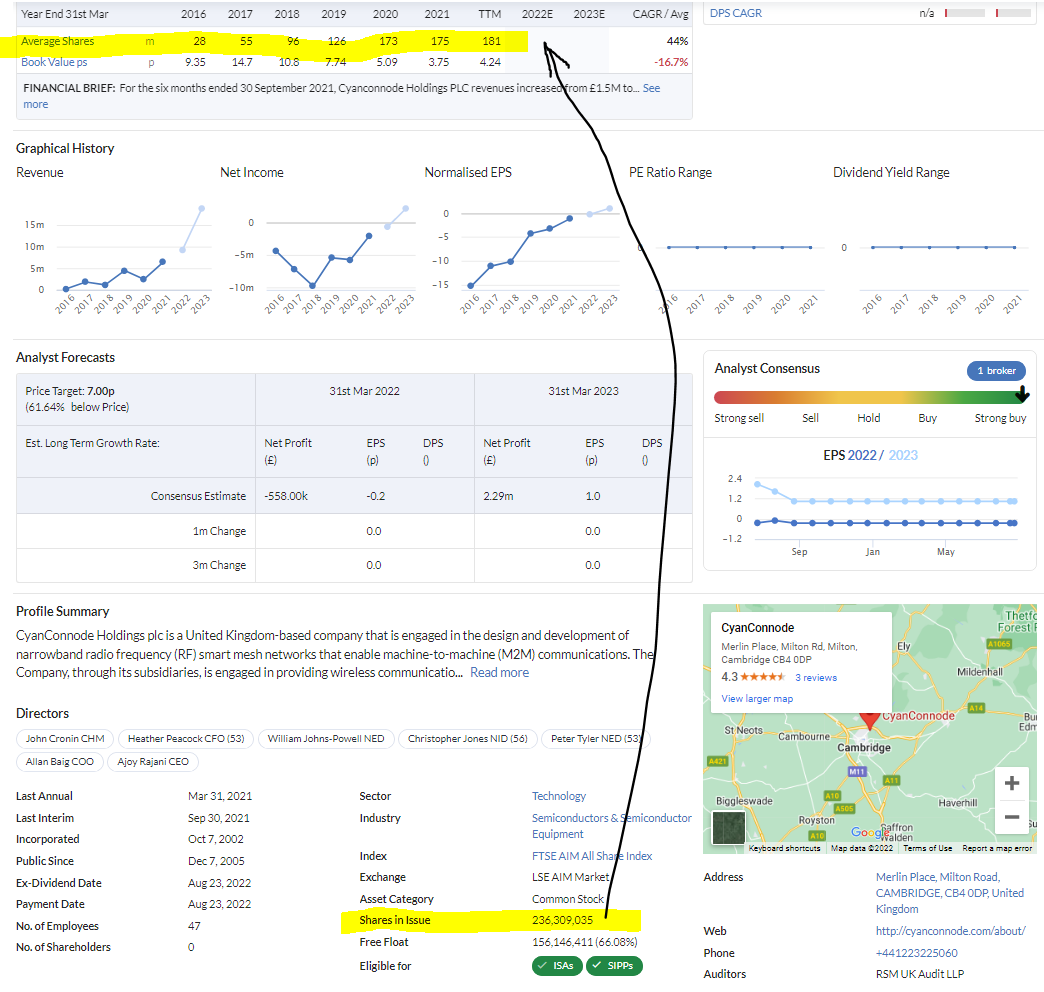

Cashflow statement - poor. The stand out item is £5.18m proceeds from issuing new shares. This is CYAN’s core problem - it has repeatedly come back to the market for more equity fundraisings, and the StockReport confirms this, with the “Average Shares” line being a vital thing to check for every company. In this case, it has risen from 28m shares in issue in 2016, to the latest figure (near the bottom of the StockReport) of 236m - growth of over 8x in the share issuance in just 6 years! That’s so bad.

The rest of the StockReport is a sea of red. Although to be fair, there is a good trend in revenue growth, and maybe CYAN could be getting closer to breakeven, where it wouldn’t need to keep throwing around new shares like confetti?

Going concern note - always essential reading, especially at cash burning enterprises like CYAN. My summary of the main points -

Base case scenario - there’s enough cash to reach profitability.

Pessimistic scenario - “material uncertainty” over being able to continue operating as a going concern. Has levers it could pull, including cost cutting, and offers of loan financing.

Other measures already taken are pointed out (which reinforces my overall view that this seems a financially distressed company) -

To assist with working capital, two directors extended short-term loans of £400,000 in November 2020. These were still in place at the end of March 2022. £100,000 was repaid to Peter Tyler in April 2022. The Company received an advance of £500,000 secured against its R&D tax credit in December 2021 and an invoice discounting facility secured against Letters of Credit for deliveries of Omnimesh modules in India. The advance against the R&D tax credit will be repaid out of the HMRC receipt which is expected to be received by October 2022.

Despite this risk, Directors believe the company is a going concern for the next 12 months.

My view is that another placing could be on the cards, and with the market cap at £42m (why?!) they’d be foolish not to raise some fresh cash while they can.

So expect more dilution I think - not necessarily a deal-breaker though, if it dilutes existing shareholders by say 10-20%, I think that would make a lot of sense actually, to shore up the financial strength of the company, given current macro conditions.

Outlook - the commentary sounds upbeat. 5 new orders won post year-end, to supply smart meters, internationally. This includes an order for 1m smart meter modules in India - impressive.

My opinion - the figures look very weak historically, albeit with now decent revenue growth, and losses shrinking. The commentary sounds upbeat, so clearly CYAN now has a decent product, that’s in demand (or it wouldn’t be winning bigger contracts).

Hence this share is really all about whether a profitable, growing company can emerge from the poor track record in the past, or whether it’s going to be more of the same - jam tomorrow, cash burning, and repeated fundraisings?

Another fundraise looks likely, given that it’s looking strapped for cash, and to repay Director loans, but with the market cap at £42m, this looks a good time to be raising fresh cash, at a buoyant valuation despite the small caps bear market.

The next step would be for sector experts to look into CYAN’s actual products, and compare them with what the competition offers. Does CYAN have any enduring competitive advantage? That’s going to be key to whether the shares do well, or not.

I can’t predict the future, and know nothing about the smart meter products, so am neutral on CYAN shares. Although the strong growth, and order intake, does look impressive. It's always good to broaden your research away from just what the company itself tells us. All companies will naturally talk up how great their products are, but it often turns out that competitors are pulling ahead of them, so growth fizzles out. Hence talking to customers, and competitors, is often a lot more useful that just being spoon-fed a positive spiel from the company itself. If they all say CYAN is the best smart meter system out there, miles ahead of the competition, then the shares would be potentially very interesting.

At this stage though, it’s still quite speculative, and clearly needs to raise more cash (and collect in its overdue receivables). So higher than usual risk at the moment I’d say.

.

Aferian (LON:AFRN)

133p (down 1% at 09:16)

Market cap £114m

Aferian plc (LSE AIM: AFRN), the B2B video streaming solutions company, announces its unaudited results for the six months ended 31 May 2022 ("H1 2022"), which demonstrate a performance in line with the trading update announced on 14 June 2022.

Rather lacklustre interim numbers, which it blames on supply chain causing H1 product shipment delays. Expecting higher revenues in H2 as component availability improves. (note it reports in US dollars)

Bank facility (undrawn) seems excessive at $100m. It mentions M&A, but the last thing I would want to see is the group gearing up in the current uncertain/gloomy macro position.

Outlook - expect an H2 weighting, but the reasons given look pretty solid to me, so I’m inclined to believe this -

Trading since the period-end has reinforced the Board's full year confidence, as expressed in our 14 June 2022 Trading Update. The Group remains in a strong position both financially and operationally. With a solid H2 order book, availability of components much improved since H1, delayed orders from H1 now shipped and H2 production weighted to Q3 to mitigate any potential, additional supply chain issues, the Board expects to deliver a much improved second half performance.

Therefore, subject to continuing availability of components and shipment levels, the Board remains confident in achieving results in line with its expectations for the year ending 30 November 2022.

Balance sheet - NAV: $96.3m, take off $97.2m intangibles, gives $(0.9)m NTAV - so a little on the weak side. Another reason why I really wouldn’t like to see Aferian making debt-fuelled acquisitions, as that would deplete NTAV more.

Receivables look too high at $18.3m - tighter credit control needed?

Also, large trade & other payables of $29.2m, but that probably includes deferred income from the recurring revenues.

No immediate alarm, but it’s not a strong balance sheet, and it concerns me that management seem to think it is.

My opinion - this has only been a quick look at the numbers, and there doesn’t seem anything particularly good or bad.

Valuation is showing at a forward PER of 12.0, which assumes the H2 weighting does occur - which it might do, although I tend to prefer situations when a bumper H1 is in the bag, and FY forecasts look set low. It’s the opposite here.

A bit like with CYAN, to take this investment idea any further, you would need to properly understand AFRN’s products, and markets, to determine whether you think it can grow profits & market share. I don’t have any knowledge on that front, so will just say I’m neutral, maybe leaning slightly away from this share, as it doesn’t look cheap in a market that’s throwing plenty of bargains at us.

Also note that broker consensus has been dropping -

.

.

Graham’s Section:

RM (LON:RM.)

- Share price: 68.54p (-31%)

- Market cap: £58m

This has been an awful investment to hold over the past year. Commiserations to anyone holding this one today, after another major blow to the share price:.

Checking through the archives, I’ve only written about it a handful of times. Back in 2019, I thought that its financials were OK. My main challenge was untangling its various divisions: it has three streams of activities (1/2/3) and lots of moving parts to understand.

Let’s take a look at these interim results for the period to May 2022:

- Revenue +4% to £100m

- Adjusted operating profit £5m (last year: adj. operating profit £8.6m)

- Actual pre-tax result: loss of £7.2m (last year: pre-tax profit £2.9m)

There are enormous adjustments involved - you can get a sense of the difference between the adjusted and the actual results from these bullet points.

The deterioration in the adjusted result is attributed to: “required turnaround in the RM Technology division, impacts associated with the IT implementation programme and increased freight costs in RM Resources”.

The deterioration in the actual result is attributed to the lower profitability and also to £7.7m of ”investment” costs that have been expensed. These costs relate to the IT programme, as RM struggles to replace its enterprise software.

Complexity

This IT project involves “the configuration and customisation costs of a lot of inter-related systems''. It has been “more challenging than anticipated, leading to extended timelines and increased project cost”.

The fact that it has spent nearly £8m in six months attempting to reorganise its software systems is proof in my mind of the complexity of this company.

Indeed, given the cost overruns and the delays, there must be plenty of people on the inside who are struggling to keep on top of what is going on. What chance do us poor analysts and private investors have!

Balance sheet woes

In May, RM’s previous CFO announced that he would be departing this year. I’m beginning to understand why. Net debt rises to £41.5m, and there will be no dividends in the short-term as the company attempts to get its house in order.

RM’s bank covenant tests have been relaxed for May 2022 and November 2022 - this is a major red flag for potential financial stress. Thanks to the relaxation of the test, the leverage multiple will be allowed to rise up to 3x, instead of 2.5x.

There is no sign of any immediate problem, and the lending banks are said to be “supportive”. They “have made clear they currently have no intention of accelerating all or any part of the loan repayments”, i.e. they currently have no intention of pulling the plug. But RM admits that it didn’t meet the previously agreed covenant test for May 2022.

For those who like to play it safe, any failure to meet previously agreed banking covenants is a sign to get out. The equity of any company in this position should almost automatically be considered high-risk, and that’s true even when the relaxation of the covenant is fairly mild, such as in this case.

Will the company be able to fix the balance sheet itself? H1 does usually involve an outflow ahead of exam season, so there’s a chance that RM can get back within its covenants, without any help from investors. As of the end of H1, the company still had headroom of £24m in RM’s existing facilities.

I should also mention that in the going concern note, the directors describe a theoretical “worst-case scenario”. They think that with the help of mitigating actions including various cost cuts, the company would be able to pass its future covenant tests even in this scenario.

Remember that RM also has a pension deficit that eats up cash. The good news is that these cash payments are reducing: they are currently £4.4m per annum, and will fall to just £1.2m in 2025.

So it’s not all bad on the balance sheet front. Things are a bit stressed right now, and the company has little or no tangible asset backing, but it’s still possible that the company can get through this with the support of its banks.

Operational news

I’ve written a lot so far about RM’s poor financial performance and the balance sheet. Let’s talk about some of the broader company news:

- Education purchasing behaviour reverts to “normal, long-term growth rates” after a temporary Covid-related spike.

- Larger school trusts with more than 10 schools are showing a preference to work with RM.

- Assessment is gradually and inevitably becoming more digital, with RM helping customers to make the switch.

Outlook - there are headwinds in terms of salaries, energy costs and general inflation. Revenue prospects sound ok, but visibility around costs is poor:

Profit conversion will remain subdued in the short-term as we progress through transition and have elevated commercial uncertainty both from the macro-economic environment and from the impacts of the IT platform implementation.

My view

Today’s results ask investors to look beyond the next two years and see a future where the company is earning “consistent mid-single-digit, profitable revenue growth, improving operating leverage and attractive cash generation”.

But that’s a lot to ask of investors, especially considering that previously agreed banking covenants are being breached right now.

There are still some positives to hold onto. I would agree with the company that it should be able to earn decent long-term revenue growth from these activities relating to the modernisation of schools. The customers are likely to be sticky (not shopping around for alternatives very often) and much of the revenue should be recurring in nature, e.g. the same exams being held around the same time every year.

The problem is that the actual financial performance of RM is so underwhelming. The company has been listed for a very long time, and yet is still deep in micro-cap territory. I can’t help feeling that a really high-quality business would have achieved more by now.

And with the latest difficulties around upgrading its IT infrastructure, I have to question what is going on internally: is it just too complicated and bureaucratic? Is it trying to do too many things at once and doing none of them very profitably? Or have management messed up and failed to execute a plan that others could have been done faster and at much lower cost? Is it all of the above?

The StockRanks still think there is value to be had with the shares, but they also notice the warning given by the very poor momentum. All is not well with this one.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.