Good morning, it's Paul here with Tuesday's SCVR.

Estimated timings - let's try for 1pm. I've started before 7am, and feel unusually perky this morning, so that should be do-able!

Edit at 12:03 - as usual, everything is taking longer than expected. How can 5 hours go by in the blink of an eye? It's looking more like 4pm finish time, as I need to do more work on G4M & Scapa.

Update at 15:57 - today's report is now finished.

.

Covid treatment/vaccine

Given that I have no medical knowledge, I've tended not to think about the likelihood of a vaccine appearing any time soon. Experts in the field told me a few months ago that a vaccine would probably be late 2021 (at best), and maybe not at all. This is similar to what the UK Govt said in its document about the lockdown a few months ago.

However, much more promising signs seem to be appearing. An article in the Telegraph today really gave me a jolt (in a positive way). This suggests that, admittedly only in a best case scenario, the Oxford/AstraZeneca vaccine could be ready by this October. In a similar vein, Jim Cramer keeps saying on CNBC that the tone he's hearing direct from top US pharma company CEOs has become much more positive of late.

If effective treatments to suppress covid are only months away, then this changes everything. It means that humanity could get back to something like normal maybe by early 2021? That means travel, holidays, hospitality, retail, and every other sector can ramp back up to normal. Therefore I'm wondering if I should be pushing the boat out a bit more with some shares that could rise strongly if that scenario plays out. The key factor is whether companies have enough liquidity to survive into 2021? If they do, then the future for such shares could be much more positive than currently expected. Plus they could see pent-up demand, and less competition.

I appreciate it must be a bit frustrating for readers, because I change my mind on this topic more often than I change my socks!

We've got to balance up optimism over treatments/vaccines, with the negative of current resurgence in cases in some states in the USA, in Germany, and other places. It's certainly not under control yet, but if that's only months away, then as investors we should probably be positioning ourselves for recovery, not armageddon. Therefore I'm going to go on a spending spree when the market opens, and buy some shares that I previously thought too risky.

.

UK mortgages

Press reports are suggesting that lenders are (understandably) worried about house prices falling, and new borrowers going into negative equity. This seems overblown to me (at least outside London). With such low interest rates, probably/possibly for a long time, then personally I cannot see any reason why house prices would fall much. Mortgage monthly payments are so cheap now, if you can stump up a decent sized deposit.

Although there could be some short-term problems, as apparently the big lenders are withdrawing the low deposit mortgage deals. Pity, as that hurts younger people keen to buy their own home.

We could see the housing market struggle for some time to come. Hardly surprising though, is it?

For this reason, I've decided not to revisit the housebuilders' shares just yet. They don't look cheap enough to tempt me back in.

.

Quote of the week

I’m very much enjoying the superb emails from John Authors, from Bloomberg (highly recommended). Several people have forwarded them to me, but I’m already on the list, so thanks, but no need to send them on to me!

This comment from him seems very pertinent right now;

In a bubble, you’re not investing in a company, you’re instead placing a bet on the collective behaviour of other investors. That behaviour reveals itself in chart patterns rather than in balance sheets or valuations.

Thought-provoking, and undeniably true, in the short term.

.

Volex (LON:VLX)

A reminder that there is a results presentation online at 10:30 this morning. It's on Investor Meet Company, an excellent new platform to connect investors with listed companies.

I'll be attending this event, and will reflect back any interesting points.

I like Volex, it's a very good turnaround, and has a strong balance sheet. Although obviously covid will have some impact on this year's results. I covered it here last week, and think this is a good share, with a medium to long term view. Not one I currently hold, but as always I reserve the right to buy some if I like the results presentation.

EDIT: Actually, I've got more important shares to focus on this morning, so will watch the video recording of Volex's results webinar this evening. End of edit.

.

Shoe Zone (LON:SHOE)

Share price: 85.0p (down 3% today, at 08:37)

No. shares: 50.0m

Market cap: £42.5m

This is a retailer of cheap, Chinese-made shoes., from 490 shops.

Shoe Zone plc ("Shoe Zone", the "Company" or the "Group") is pleased to announce its Interim Results for the six months to 4 April 2020.

I won't dwell on the interim numbers, because;

- SHOE has a heavy H2 seasonal bias, hence interims don't really matter that much

- Lockdown caught the tail end of the interim period, and will have obviously changed everything for the last 3 months

- Outlook for re-starting trade, and the liquidity position (will it survive or go bust?) are the key issues that I need to focus on, as with everything at the moment

In short though, interims (Oct 2019 to Mar 2020 + 4 days in April) say;

Revenue down 5.6% to £68.9m (was up 2.6% for the 5 months to end Feb, before lockdown hit the figures in March)

Digital sales small at £6.5m (9.4% of total sales), but rising strongly (up 31.9% in H1). However, excellent growth during lockdown, reaching 17% of previously budgeted (pre covid) total sales - this is encouraging. Driven by aggressive discounting, to turn inventories into cash - a smart move, but obviously damaging to profit margins.

Loss of £(2.5m) in H1 (LY: H1 profit of £1.0m) - not a good performance

Balance sheet - I'm a bit taken aback by the IFRS 16 lease asset/liabilities, which are larger than I expected. Previously the company has emphasised that it have flexibility due to very short leases. That doesn't actually seem to be the case. Of course lease commitments don't matter if a retailer is trading profitably from sites. Leases are only a problem if trading is deteriorating, loss-making, and that is combined with a long lease commitment.

Note there is a £9.95m pension deficit, not a disaster, but an unwelcome line on the balance sheet. It is a cash drain of c.£0.9m p.a. (see cashflow statement)

Liquidity - net cash of £3.6m at end March 2020. As previously notified, divi was scrapped, Drawn down £10m of £15m facility under CBILS Govt backed loan scheme, so liquidity should be OK.

Outlook & covid - Shops closed on 24 Mar 2020, and re-opened on 15 June 2020. I can't find any comments or figures on how the resumption of physical stores has gone, so I imagine not very well - otherwise they would have told us! This doesn't sound encouraging;

Whilst the group has taken all possible steps to ensure that the business will survive through the crisis and continue into the future, the impact is likely to continue to be felt for several years.

The Board remain confident that the Group's current level of funding will be sufficient to secure the future of the business, assuming that sales return to a high proportion of previous sales during the next year.

I think it looks fine for now, so shareholders have no need to worry about SHOE going bust any time soon. That could change though, if retail footfall & spending doesn't improve as 2020 progresses.

No V-shaped recovery for the High Street then, it seems. Although I do think it's too early to judge. With distancing now being relaxed, and nicer weather coming, plus re-opening of bars & restaurants soon, then town centres could start to come alive again, possibly? Time will tell. I don't have a strong view on this either way, we don't really know yet.

There's more detail in the announcement, but I've seen enough to make up my mind.

My opinion - this business should survive, as it has adequate liquidity for the foreseeable future.

Given that management have very large shareholdings, then they won't want to dilute themselves or anyone else, with an equity fundraising. So far go good on that front. Although we have seen with other companies, that sometimes bank support comes with an (often undisclosed) side agreement that the company will raise fresh equity when it can.

The lease liabilities look higher than I was expecting, so it would be useful to have an update on that from the company.

I like the fact that online sales are growing. The company needs to increase the proportion of its sales that are made online, which it is doing. Driving growth through heavy discounting is fine, because once a customer has made an initial purchase, then the company can communicate & drive offers free by email. SHOE is doing BOGOFs (buy one, get one free) online, to drive growth & clear inventories - a good idea.

Overall, I think the current valuation looks about right, given the difficult circumstances. There should be some upside if the economy returns to normal, if covid is tamed with treatment/vaccines. I can't see any particular appeal to rush out and buy the shares now at 85p - that's not a cheap enough valuation to tempt me in.

Ignore the outdated broker forecast & dividend yield.

It currently seems as if the retail sector recovery is likely to be a long & painful journey, with many falling by the wayside. A lot of smaller retailers don't seem to be re-opening now, even though they can. Why would they? With staff on furlough, and not paying rents or business rates, then it's cheaper to remain closed whilst footfall is low.

I suspect there are likely to be many empty units in the High Street after Xmas. Maybe some retailers might re-open for Nov & Dec, to generate some cash from stock clearance, and then close for good in Jan 2021?

The more I think about it, the more bearish I'm becoming on property REITs with exposure to retailing, and am going off the idea of revisiting that sector.

.

.

Gear4Music

Share price: 390p (up 22% today, at 10:29)

No. shares: 20.95m

Market cap: £81.7m

(at the time of writing, I hold a long position)

Gear4music (Holdings) plc, ("Gear4music" or "the Group") (LSE: G4M), the largest UK based online retailer of musical instruments and music equipment, today announces its financial results for the year ended 31 March 2020.

The company gave a year end trading update, which I reported on here on 23 April 2020. Comparing the actual results today, with the previous trading update goes as follows;

Revenue: as expected at £120.3m (NB. this is up 2% against prior year, which was a 13-month period. It's actually up 9% on a properly comparable 12-month time frame)

Gross margin: as expected at 25.9% (up 310bps on LY, as the company's stated strategy is to increase margins, rather than chasing low margin sales growth - this strategy has clearly worked well, kudos to the team!). Note from the commentary that G4M absorbs £8.8m of delivery costs into cost of sales. By my calculations, stripping out delivery costs means that the product margin rises to a more respectable 33.3%. Average basket size is quite high too (compared with, say higher margin online fashion), at £117.

EBITDA: looks like a beat, with £7.8m reported today, versus "not less than £7.0m" expected.

Current trading & outlook - this is probably the main reason for today's sharp share price rise. This sounds excellent;

... we have experienced exceptionally strong trading at the beginning of the current financial year.

With the shift from high street to online consumer shopping continuing to accelerate, we remain confident that our business is appropriately configured to achieve long term profitable growth, and that we are in a strong position to build upon the excellent progress we have made during FY20.

Management at G4M are not given to hyperbole, having a good track record of telling it like it is. Hence when they describe current trading as "exceptionally strong", then I sit up & take notice, and so has the market by the looks of it.

Broker upgrade - many thanks to a friend who flagged up a large increase in forecasts this morning from the house broker, very helpful. The existing forecast for FY 03/2021 is 10.6p. This has been almost doubled today, to 20.4p

EBITDA comparisons - the only thing I don't like about these figures, is how the EBITDA comparison doesn't compare like with like. The impressive-sounding £7.8m EBITDA for FY 03/2020 isn't comparable with the £2.3m last year number, because this year is boosted by IFRS 16, and last year suppressed by IAS 17. The real comparison (as shown in a footnote, to be fair) is £7.8m TY, £3.7m LY. Still good, but as a general rule, I feel that tables should only ever be presented with truly comparable numbers, not numbers distorted by anything.

My opinion - this is very pleasing indeed, to hear that the company is trading so well. The only potential issue, is that trading may not remain quite so exceptional once schools go back, it must have benefited from kids being stuck at home during lockdown. that said, I hope the surge in interest in making music continues. We severely undervalue the big social benefits from teaching music to children. Making music gives people (adults and children) pleasure, self-esteem & a sense of achievement, better mental health (hence better behaviour), confidence (from performing in front of audiences), and cooperation/teamwork (from playing in a band or orchestra). Hence I really hope this trend continues, not just for selfish share-price-related reasons!

I've printed off the full results, and will read them in the sunshine now, so will post any further bullet points below once I return.

Some time later: this isn't working, I've got completely bogged down in the detail. The best thing to do is just read the note from N+1 Singer, which is available on Research Tree. It makes many excellent points. I think the bull case has got much stronger today, because of the broker forecast EPS doubling. Therefore I shall probably be increasing my position size here. Obvioously DYOR, this is only one person's opinion, and I may have missed something important.

It's one of only a few shares where we can actually rely on the latest broker forecasts. Also note that the 100% rise in forecast EPS, combined with today's 22% rise in share price, means that the forward PER will actually come down substantially, from 30 to about 20. For that reason, I think this is a bullish development, and am happy to continue holding, and increase my position size. It's good to see the sceptics proven wrong!

.

.

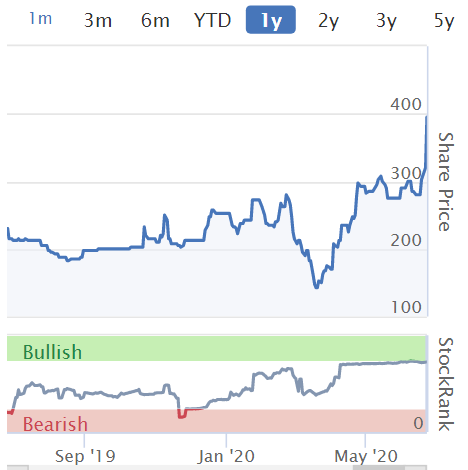

Scapa (LON:SCPA)

Share price: 103p (down 14% today, at 15:01)

No. shares: 186.5m

Market cap: £192.1m

(I hold a long position in this share)

Chairman resigns - he's leaving at the next AGM, replaced by Chris Brinsmead.

Scapa Group plc (AIM: SCPA), the diversified Healthcare and Industrial company focused on bringing best-in-class innovation, design and manufacturing solutions to its customers, today announces its preliminary results for the 12 months ended 31 March 2020.

I bought some shares in this after the equity fundraising, which I reported on here on 18 May 2020.

The sharp fall in share price today seems a bit perplexing, as the FY 03/2020 figures are as expected. The balance sheet was shored up with a recent placing at 105p, and look fine once you add on the placing proceeds (which happened post year end). All the bad news, about losing a big contract with Convatec last year, was already known.

Current trading/outlook - this is a bit of a muddle, and seems contradictory;

Year-to-date trading better than initially forecast under Scapa's COVID-19 scenario, but recovery is at a slower pace

How can it be better, but slower? That doesn't make sense to me. Maybe the slower pace of recovery refers to the forward order book? It should have been explained more clearly.

It then goes on to say;

Continue to execute against the COVID-19 scenario and expect trading to be in line with the outlook provided at the time of the placing

There's something for everyone in those outlook comments - we're up, but we're slower, but we're in line!

Forecasts - a fresh forecast has come out today with 5.4p EPS forecast for this year, FY 03/2021. Obviously that's a long way down on prior year (which was itself down on prior year), due to covid and the loss of its major customer. Still nobody is valuing companies on their 2020 earnings, the market is looking ahead to recovery in 2021 and beyond. I haven't seen any forecasts for FY 03/2022, so am a bit in the dark on this.

My opinion - it's refinanced, and remains profitable even in the year of covid. Profit margins look strong normally, and the turnaround plan sounds sensible. It looks an obvious takeover target too. However, despite that, something is clearly bothering the market, with more sellers than buyers today.

The chart is also suggesting that there are persistent sellers in the market, feeding out stock whenever buyers come in. Looking at the most recent "Holding in company" announcements, Octopus and Allianz IARD are both selling, with 8.5% and 5.0% remaining. Whilst Blackrock is a buyer, with 6.25% when last disclosed.

I'm not confident enough in my knowledge of the company to increase my position size, so I'll just sit tight with a medium-sized position, and see what happens.

.

Residential Property portals

Rightmove (LON:RMV)

(I am currently shorting this share)

By far the market leader in the UK. It has a market cap of £4.89bn, after today's 5% fall in share price.

Today's update says it gave a 75% discount to all its estate agent customers in April-July. Today it is offering a 60% discount for August, and 40% discount for September, to assist estate agents as they rebuild their sales pipelines. The total lost revenues for this will be £82-95m. That's going to hit profits very hard, since incremental sales are 100% profit (or loss, in reverse).

The platform is now very busy, indicating considerable consumer interest in moving house, perhaps? Plenty of people like browsing though, with no intention of moving. Or just to have a virtual nose around local properties!

Customer numbers are down 3.8% since the end of 2019. Unwilling to provide guidance.

My opinion - I really dislike this business. It's unethical, because it price gouges its customers, abusing a near-monopoly position, to effectively be a tax on estate agents. Hmmm, okay I don't think there's likely to be much public sympathy for that line!

.

OnTheMarket (OTMP)

(I am currently long of this share)

This challenger portal also updates today. It's a minnow compared with Rightmove, with a market cap of only £56m, which is not much more than one-hundredth of Rightmove's value! However, it has a large stock of listings, achieved by allowing agents to start with a free trial. It is also majority owned by estate agents, who funded it initially, before the launch on AIM. Free shares are available to "reward" agents that sign up to full price deals. The concept is that, if estate agents are incentivised to do so, they might hopefully help topple Rightmove. That's not happening yet, but who knows what the future holds?

Rightmove is having to give away massive discounts to keep its customers. Will it really be able to crank the fees back up again to the previous (outrageously high) level? I have my doubts. There's a clear opportunity for OTMP to drive sweeping change in the current circumstances, but it's running low on cash, and is searching for a new CEO. I hope it doesn't miss the big opportunity.

OTMP is also offering discounts, but a much lower % than Rightmove, at 33% in month 1 & 20% in month 2. Bear in mind that OTMP's standard fees are about a quarter of RMV's - because it has far lower traffic to its website than RMV has.

OTMP also says it is seeing strong growth in website visitors, despite spending less on marketing.

My opinion - obviously OTMP is a complete punt. If it was valued at say one fifth, to one tenth of the market cap of RMV, then I wouldn't be interested. What makes it interesting, is that it's valued at almost one-hundredth of the value of RMV. Imagine if a 100:1 bet were to pay off. I think those odds are quite interesting. I only have a tiny long position in OTMP, because I'm waiting for the next placing to take a bigger stake. It's got enough cash to tick along for now, but a proper resumption of growth (in particular heavy advertising to drive more traffic to its website) would need a fresh fundraising.

.

That's me done for today. See you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.