Good morning, it's Paul here, with the SCVR for Tuesday.

Timings - I have to be finished before 1pm, as am taking my niece to visit a stately home this afternoon!

Today's report is now finished.

Here is today's agenda;

Dfs Furniture (LON:DFS) - trading update

Alfa Financial Software Holdings (LON:ALFA) - trading update

Proactis Holdings (LON:PHD) - trading update

Carclo (LON:CAR) - results FY 03/2020

Next Fifteen Communications (LON:NFC) - Trading statement

As usual, many thanks to MrContrarian & Dan Holland-Smith, for their early snapshots in the comments below. I am finding these posts very helpful in selecting which small cap shares to focus on myself in more depth. Thanks to both!

.

Clarification re Up Global Sourcing Holdings (LON:UPGS)

An adviser to UPGS contacted me yesterday afternoon, to say that the company was very upset about yesterday's SCVR. I reported on UPGS's RNS stating that they have decided to return the Govt furlough monies. In the same section, I reported on another item on my agenda, an article in the Telegraph about research saying that furloughed staff had widely been working from home, part time, in the UK generally, during April & May.

On reflection, I shouldn't have put these two items together, in the same section, as that led UPGS to misunderstand, and think I was linking the issues, or implying wrongdoing on their part. That certainly wasn't my intention, at the time it just seemed to make sense to put the one subject in a single section. I thought my use of the word "Separately...." made it clear that I wasn't linking UPGS to the Telegraph article.

On reflection, this was a mistake on my part, and I can understand their point of view, so am happy to give an unreserved apology for any offence caused. If I'm wrong, am happy to admit it, and apologise, so this has not been forced out of me, it's a genuine apology from me, as I can see why UPGS took offence, even though it was unintentional on my part. As stated in yesterday's article, UPGS has traded strongly, and I have been very impressed with its resilience & financial performance throughout covid.

UPGS is adamant that it's returning the furlough monies because this is the right thing to do, and out of a sense of civic responsibility, so I am happy to pass that message on to readers here. I'll go back and edit yesterday's article when I get a minute.

(I think they've forgiven me, just got email thanking me for the clarification, so peace is restored )

.

Dfs Furniture (LON:DFS)

Share price: 173p (up 15% today, at 08:46)

No. shares: 255.4m

Market cap: £441.8m

DFS Furniture plc ("DFS" or "the Group"), the UK's leading retailer of living room furniture, provides the following update on recent trading since our previous statement on 14 July 2020.

Strong trading continuing both online, and in showrooms.

The following section is rather confusingly worded, surely they could have simplified the numbers, by putting them in a table? I've bolded the bit that matters;

... year-on-year order intake growth over the last six weeks that is equivalent to c. £70m of revenues.

This trading is significantly ahead of our initial expectations and is in addition to our previously announced strong opening order book that will generate a further in year revenue benefit of c.£100m.

Reasons for strong trading -

- Cconsumers spending more on homes

- Pent-up demand post lockdown

- Advantage from hybrid stores/online offering [but surely all main competitors also do this?]

Outlook comments -

- Significant uncertainty re covid & Brexit

- "Exceptionally difficult" to assess outlook

- "Some consumers may be bringing forward spending decisions"

The last point is particularly interesting . I wonder what their evidence is for this? Why would people bring forward spending? Fear of future lockdowns, or Brexit disruption maybe? I don't know. If true, this might have read-across for other companies & sectors - i.e. are we seeing a short-lived spending boom at the moment, before consumers retrench again? Who can say.

Summary -

Notwithstanding these risks, recent trading and our current momentum does increase our earnings resilience and it has significantly strengthened our financial headroom. Furthermore, the Board continues to have confidence that the business is well-positioned to capitalise on opportunities as its markets recover.

Remember that furniture retailers typically receive customer deposits up-front, and pay manufacturers later, a favourable working capital business model. So an increase in the order book immediately leads to improved liquidity. That's the opposite of many other sectors, where increased orders can push weak companies into insolvency, as inventories & debtors both rise simultaneously when business picks up, resulting in them running out of cash headroom. Spring 2021 will be particularly key in this regard, as the favourable cashflow effect of deferred VAT unwinds.

It's a pity that today's update is so vague, as I can't take it any further without more specific guidance. There's nothing on Research Tree.

Remember that DFS has a horrendous balance sheet, but nobody seems to care. So it's really quite risky - e.g. in the event of another banking crisis, if banks were to withdraw credit again, which happens from time to time.

In this regard, Scs (LON:SCS) is the complete opposite, with a fantastic balance sheet, making it a much safer investment, despite being a lot smaller than DFS.

Before getting carried away with today's positive update, readers should check out the previous update here on 14 July 2020, which is fairly grim - losses of £56-58m for the 52 weeks ended 28 June 2020. Plus exceptional costs on top of that. Therefore the update today should be seen as catching up some of the lost revenues/profits from last year.

For me, its terrible balance sheet makes this share uninvestable. Although note that it raised £64m in a placing, in April 2020, which seems to roughly cover the trading losses incurred in FY 06/2020. Therefore the balance sheet might have stabilised, rather than got any worse. I doubt this will be the last placing DFS needs to do. As we've seen very starkly this year, companies with very weak balance sheets are often forced to raise fresh equity at the worst possible time - when the economy is imploding, and banks are reluctant to lend. This can cause large dilution to existing holders, when emergency funding needs to be raised. Hence why I try to avoid companies with weak balance sheets.

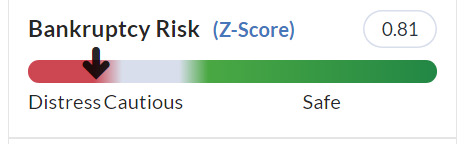

The Z-Score confirms financial weakness. It's always worth glancing at the Z-score, as it has a statistically well proven track record of flagging financial risk. A worrisome Z-score means we should focus on doing more balance sheet & solvency risk research before buying any share;

Its last balance sheet had NTAV negative £(335.5m) - that's ridiculous, even if you take into account the favourable working capital nature of this sector. It's a good business though, just weakly financed to an extent that looks reckless to me, but you may not see it that way, we all have our own way of doing things.

.

.

Alfa Financial Software Holdings (LON:ALFA)

Share price: 76.5p (up c.1% today, at 10:19)

No. shares: 300m

Market cap: £229.5m

This share is completely new to me, so this section will take longer than usual for me to research & type up.

Background

This is what it does -

Alfa Financial Software Holdings PLC ("Alfa" or the "Company"), a leading developer of mission-critical software for the asset finance industry...

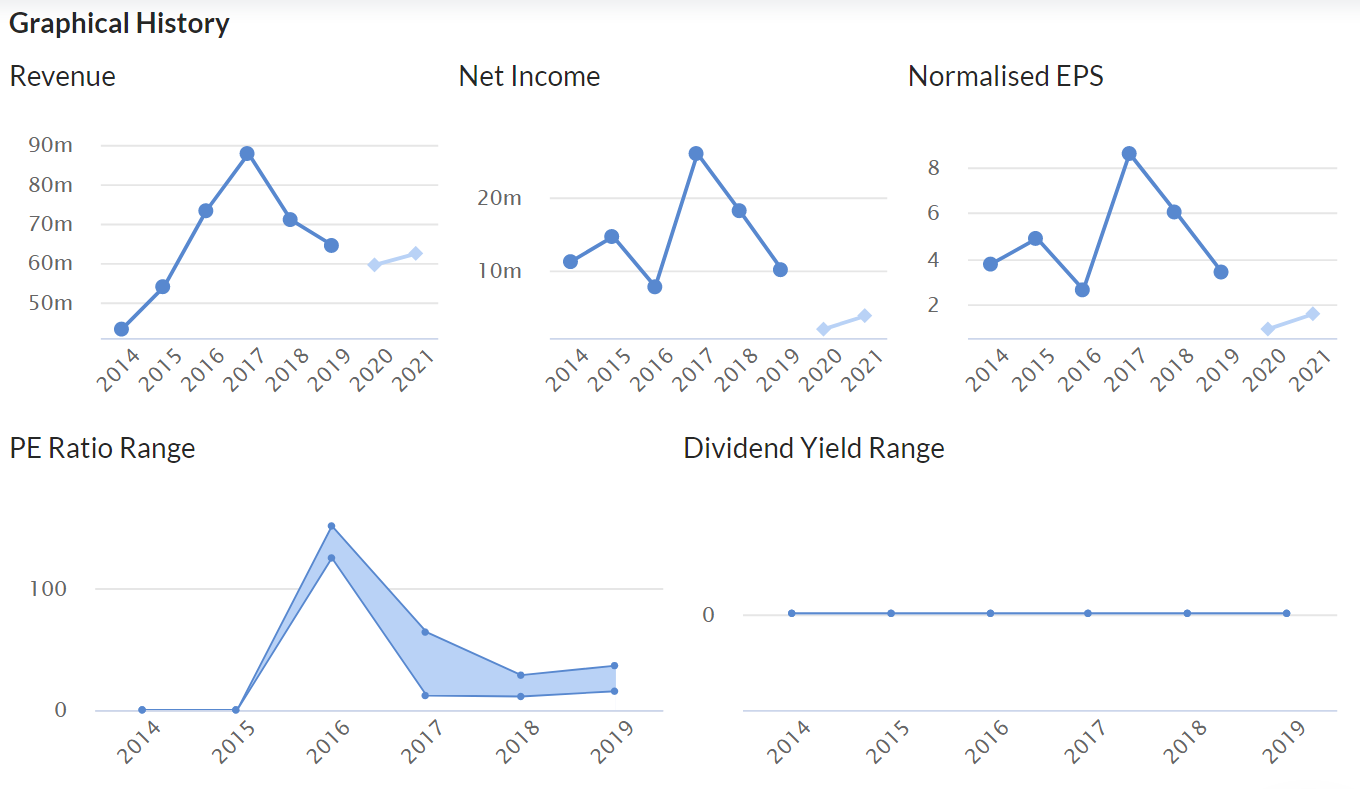

It floated on the main market in May 2017 at 325p, with CEO & Chairman extracting a staggering £250m in the float, plus a £29m dividend pre-float. There's a terrific quick review of the IPO from Graham here in June 2017. Kudos to Graham (and Ramridge!) who correctly foresaw that the IPO was "severely overvalued".

As so often happens, profits subsequently plunged, and have taken the share price down over 75% from the float price. There must be some very angry fund managers (and their clients) who bought into the story at flotation.

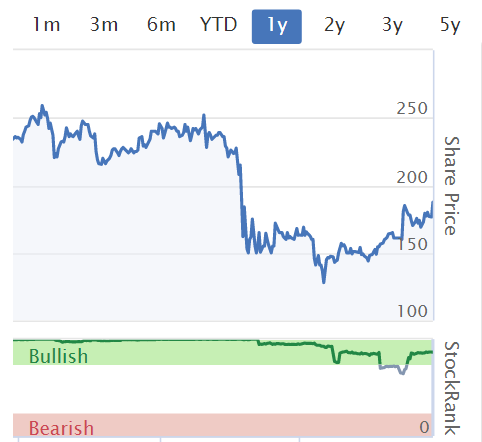

As you can see from the Stockopedia graphs below, the growth story conked out just after floating on the stock market (quelle surprise!), which happens a lot. Therefore it now looks a potential turnaround story, if we're optimists. I'd want to understand why trading & revenues have reversed - is there a competitor that is now eating their lunch, maybe? The figures suggest that might be the case.

.

.

Dividends - I cannot understand why ALFA doesn't pay divis, because it has a balance sheet which is groaning with cash - £58.8m at end 2019, or 19.6p per share cash!. Management seem to like sitting on a huge cash pile, and doing nothing with it. Surely share buybacks would be a good use of the cash, if they don't have anything else to do with it? And/or an acquisition or two?

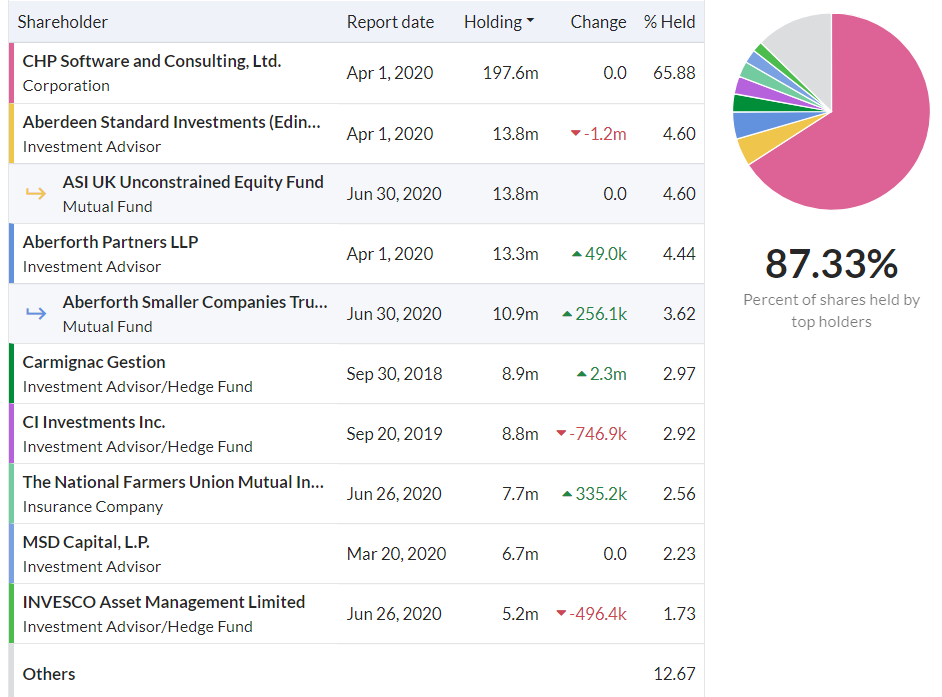

Controlling shareholder - as indicated on Stockopedia's page on shareholdings, there's a dominant shareholder called CHP Software and Consulting Ltd, which owns 65.88% of the whole company. So everyone else is along for the ride, which can sometimes be bad, and sometimes good. Does anyone know who CHP is? It might be connected to Directors, but it's going to take me too long to find out, so I'll crack on.

.

.

That's set the scene, so moving on;

Today's update - a bit mixed, but positive overall I think.

... as a result of strong year to date trading along with good progress on securing revenue, that the Board's expectation of results for the year ending 31 December 2020 are now ahead of current market expectations....

... we now expect our revenues and profits for the full year to be ahead of current market expectations.

Consensus market expectations are currently for revenue of £60m and EBIT of £4m.

We now expect revenues to exceed this by about 5% with the vast majority of this improvement also falling through to EBIT.

Many thanks to the company & its adviser (Tulchan Communications), for giving us the market expectations figures, this is so helpful, I wish all companies would do this.

This implies guidance of £63m revenues for 2020, and EBIT (operating profit) of perhaps c.£6.5m? As we've seen with other companies, EBIT is no longer a reliable number, because IFRS 16 means there might be property rental costs included lower down the P&L, in finance costs. Hence companies need to disclose (adjusted) profit before tax as the key number, not operating profit, and definitely not EBITDA.

H1 2020 trading has been very strong, with even more cash piling up (these numbers are not yet audited);

... we now expect to report total revenues of c.£38m with an EBIT of c.£10m and a net cash balance of c.£68m.

H2 2020 trading - is expected to be loss-making. Various factors are mentioned, including staff doing more billable hours in H1 and not taking holidays, which will reverse in H2.

Outlook -

- Strong H1 continued into July

- Making good progress on converting pipeline

- Increasing overheads, taking a long term view, so profitability could be lumpy;

- We continue to believe that this is the right approach and are therefore prepared that in the short-term we may, at times, have a mismatch between secured revenue and our cost base.

- Not yet secured all necessary revenue for 2020, but sound optimistic about this

- Early stage pipeline "weaker than we would like", so uncertain & cautious for 2021 & 2022 outlook

.

My opinion - this is just an initial impression, on first looking at this share. I like businesses with high quality metrics, and substantial historic profits, which have crashed in value because of short term problems. Hence this is the type of thing which inherently looks of initial interest, to do more work on.

The dominant shareholder, and lack of divis, concerns me, as it looks like a private company with a listing, where the controlling shareholder just does what they like. That can be a disaster (e.g. French Connection (LON:FCCN) in which I am long), or it can work brilliantly, e.g. Best Of The Best (LON:BOTB) (I'm also long), and (sometimes) Mike Ashley at Sports Direct, BooHoo (I'm also long) is another example of fantastic share price performance despite the supply chain issues rumbling around at the moment. Many top investors (e.g. Lord Lee, David Stredder) have done very well over the years targeting their investments into companies that are family/owner managed. Hence I just want to know more about the major shareholder in ALFA, and what its agenda is. Management remuneration is another thing to double-check when the major shareholder can do anything it wants.

I'd rather invest in something that has just delivered a blow-out profit in H1, and is cautious on H2, than the other way around! Maybe current momentum could continue, and deliver a better than expected H2?

I wonder what the split is between licensing revenues, and SaaS revenues? That's always a key consideration with software companies.

Finally, talking to customers who actually use the software is often a good way of identifying decent investments, and avoiding bad ones . I've known a couple of companies whose software was panned by people who used it, which turned out to be terrible investments in the long term.

Overall then, I'm intrigued on first look at ALFA, and would love to hear from any readers who know more about the company & its products.

The chart is dismal since floating, but seems to be forming a base, which might attract short term traders if it starts breaking out. Hence there might be a trading opportunity here, as well as long term investment possibility?

.

.

Next Fifteen Communications (LON:NFC)

Share price: 440p (up c.18% today, at 11:52)

No. shares: 90.64m

Market cap: £398.8m

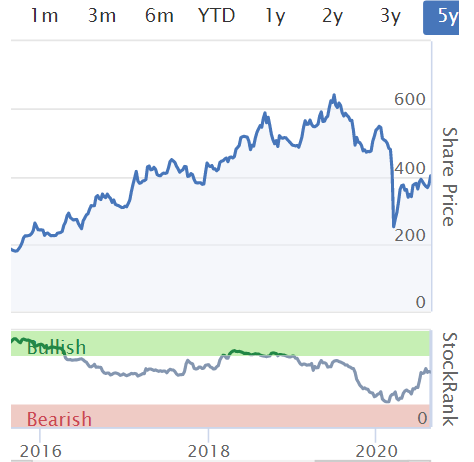

This is a marketing & PR group. I've not looked at it for over 3 years. As the 5-year chart below shows, it did really well, then got smashed in the covid sell-off, but is now recovering strongly.

.

.

Appointment of Joint Broker - Berenberg are now acting alongside Numis. Neither show any interest in private investors, not giving us access to research notes, so might as well not exist, for all the difference it makes to us. Which is a pity, because it means less PI interest in the shares, and hence less market liquidity.

Trading Statement - the year end is unusual 31 Jan 2021.

Next 15 is pleased to announce that trading has continued to remain resilient over the first half of the financial year and is well ahead of management expectations set in March of this year.

H1 to 31 July 2020;

Revenues up 6.5% vs LY, at £126m, BUT organically (excl. acquisitions) revenue was down 6%, which is a more meaningful number

Adj PBT up >16% to £20m+

Operating margin over 16% (LY H1: 14.7%) - although careful as this might include a benefit from IFRS 16, not stated either way

This is an interesting point, with read-across;

Client budget declines were typically related to those industry sectors most affected by Covid-19, whereas sectors such as technology and the digital services we provide have seen increases over previously budgeted spend.

Outlook - "cautiously optimistic" for H2. "Highly uncertain" economic environment. Despite this;

... we currently expect results for the year to be materially ahead of current market expectations.

That is really impressive, in current circumstances.

Liquidity - sounds fine;

We will continue to tightly manage our cost base and conserve cash. The group is highly cash generative and has a strong balance sheet, with net debt as at 20th August, after recent acquisition related payments, of less than £1m.

Dividends - resumption is under review.

Capital Markets Day - on 8 Sept. Combined with new joint broker appointment today, looks like a fundraising is in the offing. If so, why not? It's trading well, so it's good to raise money from a position of strength, if that's what they are doing, I'm just speculating here.

Checking the last balance sheet, it's quite weak, with negative NTAV and a fair bit of deferred/contingent consideration re acquisitions, so I think an equity fundraise to move NTAV into positive territory would be a sensible move. And/or to fund more acquisitions.

My opinion - I'm really impressed with how well this PR/marketing group has fared during the current crisis. Conventional wisdom is that investors in this sector should run for the hills at the first sign of an economic downturn, because discretionary spending on marketing/PR is usually the first thing that customers slash. NFC's comments on this are enlightening, re different sectors.

.

Proactis Holdings (LON:PHD)

36.5p (down 4%) - mkt cap £37.8m

Proactis sells spend management software.

Checking my previous notes, patchy performance & weak balance sheet was my impression. There were no takers when the company put itself up for sale.

Today's update is for FY 07/2020. It's in line with expectations (not specified).

Positive noises about record order intake, and growing pipeline - sounds encouraging.

The Board expects to report revenues of £49.2m for the year and adjusted EBITDA of £11.8m.

Net debt barely changed at £37.1m - too much. Where's the cash generation?

Outlook - mixed;

Overall, the outlook for the new financial year remains encouraging, although the Board remains cautious given the macro-economic backdrop and associated risk across new business trends, project implementation deferrals, volume-based contracts and customer solvency. The Board looks forward to the next 12 months and is confident of delivering significant value with the business now well positioned and with a pipeline that is building.

My opinion - not of interest to me, because it's got too much debt, and doesn't seem to generate cash.

.

Carclo (LON:CAR)

On a very quick skim of the numbers, it's much as I reported the other day, this is high risk, due to heavy net debt, and big pension deficit. However, recent deals on both have greatly reduced risk. The core business looks good, and this share could recover in time, possibly. Not a basket case any more, but won't be able to pay divis for a long time, and ultimately will need to do an equity raise to repair balance sheet.

All done for today!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.