Good morning - this feels like one of the busiest days of the years for company news. Three shares I own have made announcements, plus a very long list of others.

The list finished up as:

- Next (LON:NXT)

- Park (LON:PKG)

- CMC Markets (LON:CMCX)

- Ranger Direct Lending Fund (LON:RDL)

- S&U (LON:SUS)

- Swallowfield (LON:SWL)

Next (LON:NXT)

- Share price: £55.64 (+8.6%)

- No. of shares: 140 million

- Market cap: £7,773 million

Results for the Half Year ending July 2018

(Please note that I currently hold NXT shares.)

This half-year report is a long document. But it's not a long list of random and disconnected statistics - far from it. It's truly a narrative that shows you how the business has performed and how management are planning for the future.

Future MBA degree courses (maybe current ones) should use Next's investor results presentations as the material to demonstrate successful leadership:

- how a retail business survived the move online

- how to communicate with the outside world

- how to plan for change

- how to manage costs, margins and cash flows

Perhaps I'm getting carried away. Next itself will admit that the future is highly uncertain and that it faces major cyclical and structural challenges. The "endpoint" of so much change in retail could yet turn out to be bleak for Next and its shareholders (including me!)

Next shareholders are enjoying the twin benefits of a company that A) reports in a detailed manner, and B) reports punctually.

Even in a bear-case scenario, these detailed reports will at least help to us to understand what happened and why. We will know which assumptions turned out to be false. We will see the trends that led to failure. There are so many small-caps where their stated reasons for disappointing leave so much unsaid.

Secondly, note that these are half-year results forJuly! The average small-cap with decent financial controls is a month behind. One of the surprising benefits of big-caps is how quickly they can get their numbers out, compared to small-caps.

Let's consider some of the main features of these results:

- Total full-price sales up 4.5%, total sales up 3.9% (within this, Retail down 6.9% and Online up 16.8%). Full-price sales growth better than previous guidance of +2.2%.

- PBT up 0.5% (margin pressure in Retail)

- EPS up 4.9% (reduced share count increases EPS)

- ordinary dividend increased to 55p

Retail margins - not only are Retail sales falling, net margin on Retail sales also fell from 9.6% to 7.9%. The problem is that as Like-for-Like sales fall, the rent bill increases as a percentage of sales, even if rents are flat. This factor reduced margins by 1.7%.

The company closed 15 stores that were profitable and making a 13% margin. It's unfortunate for those who lose their jobs, but this approach seems sensible:

We would not normally actively seek to close stores making a 13% net margin. However, these stores were at the end of their lease and, in the current environment, we believed it was unwise to make a new long-term commitment to these shops at this level of profitability.

When a Next store is closed, about 20% of the lost sales are apparently showing up in the nearest other Next store. That's a nice feature of closures that could easily be forgotten.

On the subject of lease renewals, the company expects that rental costs will fall 28% during the current financial year, where the lease is being renewed.

Half of the remaining lease commitments will expire in the next six years, while 70% of commitments will expire in seven years.

That's still a long-term exposure, and is longer than others on the High Street (e.g. £GMD). The company is explicit about its plans for future renewals: where it is highly profitable, it will take a lease of up to 5 years. Where profitability is low (less than 15% margin), it will only accept leases which can be terminated at will, or it will close the store. I buy into this strategy.

Online continues to trade strongly. Profit is up 18% to £163 million for the period. The company says that it will be able to continue investing in the Online business (warehousing & logistics) using funds that would otherwise have been ploughed into Retail capex. Sounds good.

Next Finance manages £1.1 billion of consumer debt and generated £58 million of profit in H1, after funding costs.

My view - I'm happy to continue holding. One of the most important things for me when buying and holding shares is that I trust the company, i.e. that I trust the managers are serious about defending and building shareholder value. I believe that Next management absolutely deserve my trust, as they lay out their strategy so clearly and thoughtfully.

In addition, they make very clear forecasts which they update in a timely fashion and which usually turn out to have been reasonable or conservative (e.g. H1 full-price sales).

I believe that Next is successfully managing the transition to online. And I believe that when the current period of extreme structural change has reached its conclusion, Next could achieve a similar valuation rating as online-only retailers like ASOS (LON:ASC) and Boohoo (LON:BOO) (at that future point - I'm not saying that Next (LON:NXT) will be on a 40x or 50x rating!)

For now, the market is concerned about the legacy of High Street operations and what sort of complicated mess could be involved in making the transition. That is a reasonable concern and one where I'm happy to take a chance, based on my view that management are doing the best job that can be done in the circumstances. If they fail, at least they will have tried!

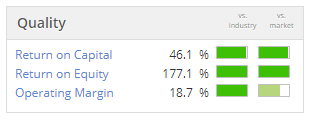

Another very important feature of management is that they allocate capital extremely well, focusing on margins and payback periods and generally achieving very high rates of return for shareholders. This is reflected in these numbers:

The StockRank is 92. It's reassuring to be on the same side as the algorithms this time!

Park (LON:PKG)

- Share price: 67p (-0.4%)

- No. of shares: 186 million

- Market cap: £125 million

(Please note that I currently hold PKG shares.)

A quick word on this gift and reward voucher business. I am sitting on a loss with this one, but don't really think that I should be.

This is another case of High Street gloom affecting the valuation for what I think is a very good business.

Investors are perhaps expecting that with less High Street shopping in future, High Street vouchers will be going out of fashion. Park's vouchers can be used online in many instances but it's true that there is an emphasis on in-store purchases. So there could be a secular headwind arising from that factor.

Anyway, this update doesn't tell us much that's new but it does reveal that the outlook for the full year is in line with expectations. It also does us the wonderful favour of including in the statement what those expectations are: Thank You!

The company-compiled analyst consensus forecast is that the business will generate £13.6 million PBT on revenue of £300 million.

This is a cash-rich company that has built some highly effective shopping technology and might even be considered part of the retailing infrastructure of the country, holding the number one spot in gift cards.

It is consistently profitable but doesn't make a fuss, and I believe the shares are unduly neglected by investors.

But I thought that when I first bought the shares, too, at a higher price! So I guess I must be missing something.

CMC Markets (LON:CMCX)

- Share price: 149.7p (-9.5%)

- No. of shares: 289 million

- Market cap: £433 million

This financial spread betting company is an important rival to IG Group (LON:IGG) (in which I have a long position).

Today it confirms what IG said recently about lower volatility and lower trading activity among clients.

We also have the regulatory impact of ESMA rules, which was expected.

The result is a profit warning: net operating income for 2019 below previous guidance: leveraged trading revenue down 20% rather than 10-15%.

This strikes me as roughly what would be expected if the short-term trends at CMC are about as bad as they are at IG, taking both the range-bound markets and the ESMA rules into account.

Similarly to IG, CMC does not want to draw any hard conclusions from just a couple of months of implementation of the new rules.

I've frequently been tempted to add CMC to my portfolio. If I had the spare funds and was not already heavily exposed to IG, I'd probably be thinking about it again today.

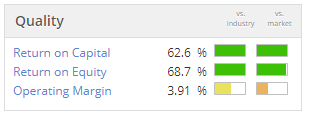

The balance sheet is extremely strong and liquid and the StockRank identifies it as a Super Stock. Lots of reasons to research this in more detail.

Ranger Direct Lending Fund (LON:RDL)

- Share price: 775p (-0.4%)

- No. of shares: 16 million

- Market cap: £125 million

(Please note that I currently hold RDL shares.)

This fund is in wind-down mode, after a boardroom battle which resulted in nearly all of the previous Board being replaced by representatives of two major shareholders. One of these is a fund at Oaktree, the firm set up by Howard Marks.

The new Board writes very disparagingly today about the performance of the previous one, as might be expected.

I'm happy with the current direction of the fund. Capital returns are expected to start "in the coming months."

I treat this as a fixed income holding in my portfolio, which it could be argued is an aggressive assumption (e.g. there are preference shares Ranger Direct Lending Fund (LON:RDLZ) which RDL shares are subordinated to, so RDL shares are certainly the equity component of the capital structure, and there is some implied leverage).

The bottom line is that we have $176.7 million of NAV as at the end of July, assuming that RDL's stake in the large bankrupt Princeton fund is completely worthless. The RDL Board is spending significant sums in legal expenses pursuing Princeton, so hopefully they will get a positive return out of all that spending.

The July NAV translates to 834p per share at latest exchange rates.

Outlook - the Board is working "to exit the majority of the Company's portfolio before year end". That would be a great result. Most of the debt is short-term, so ultimately all they need to do is let it mature. For the stub of longer-term loans which they have to hold on to, they are organising a team to manage it.

My view - this has been a useful place to park some money for a while, diversifying my currency exposure into USD and offering the potential for a modest capital gain without taking on very much risk. I plan to continue holding while capital is returned.

S&U (LON:SUS)

- Share price: £25.83 (+1%)

- No. of shares: 12 million

- Market cap: £310 million

A "good" set of results from this provider of motor and property bridging finance.

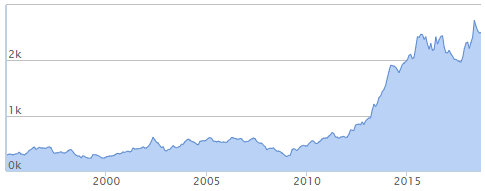

Advantage, the motor finance division, has developed a remarkable track record of profitable growth over the years. The success is evident in S&U's long-term share price chart:

It is tightening its lending criteria and is now accepting only 25% of applications, compared to 31% a year ago. This is a defensive measure in an economy where loan applications have soared thanks to record employment, but where consumer debt levels remain very high.

Financial stress has been impacting the customers acquired a year ago: impairments have increased to 24.7% of revenue and ROCE has fallen 100bps to 15.4% (that would still be an acceptable ROCE for me, if I held this share).

The company reassures that tightened underwriting criteria has resulted in lower impairment from its most recent customers.

So it sounds like an improved level of discipline has been imposed and the company has things under control, based on current conditions.

Outlook:

To paraphrase Samuel Johnson "great works are performed not only by strength but by perseverance". Irrespective of current political and economic uncertainties, demand for the service and products S&U provide remains strong; the experience and skills within the Group underpin our record of sustainable and consistent growth over many decades and give us quiet but sure confidence for the future.

My view

S&U generated ROE during the six month period of 8.8% (my own calculations). This is consistent with Stocko's published ROE for it (16.7% on an annual basis).

That's an attractive return. I remain interested in this share, but am on the sidelines.

The valuation is about 2x book value, which is unfortunately beyond the levels where I'd be willing to buy it.

As regular readers will know, I do hold shares in the similar company PCF (LON:PCF). It's currently at 2.1x book value. I'm happy to hold shares for this type of company at these valuations, but I'm rarely a buyer!

Swallowfield (LON:SWL)

- Share price: 282.5p (-9%)

- No. of shares: 17 million

- Market cap: £48 million

Swallowfield plc, a market leader in the development, formulation, and supply of personal care and beauty products, including its own portfolio of brands, is pleased to announce its final results for the 53 weeks ended 30 June 2018.

This is another one to keep track of because of its similaries with something that I do hold, namely Creightons (LON:CRL).

Swallowfield has a new CEO following "a smooth and thorough handover".

Much like Creightons, there is a combination of own-brand and 3rd-party manufacturing work. Owned brands have done well in the period, while cost inflation and delays have impacted manufacturing. So it's a bit of a mixed bag.

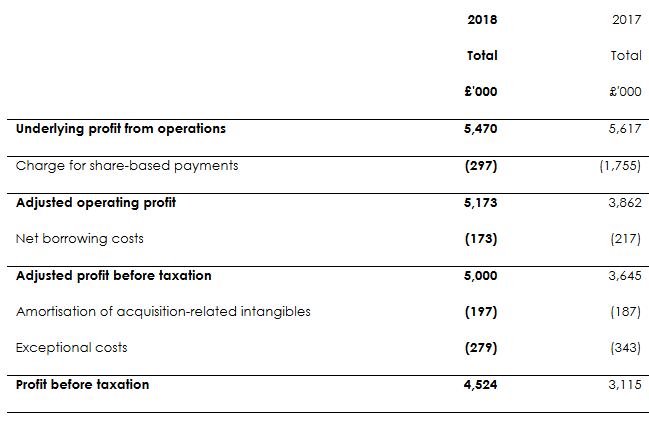

I wish the company didn't bother with quite so many adjustments to its profit figures. Fortunately, most of the adjustments are small (except for last year's share-based payments):

Indeed, if the company didn't bother adjusting out share-based payments, exceptionals, etc., investors might be feeling a bit more positive today about the 45% increase in actual PBT!

Outlook - conditions remain "challenging" in manufacturing but momentum in own-brands is strong.

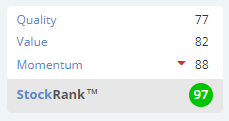

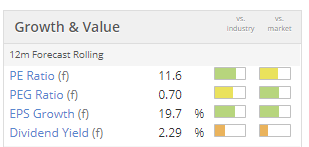

I'll continue to monitor developments as this sector generally treats investors well, and SWL looks like a decent candidate within it. It's not overly expensive, either:

Time's up again. Apologies, we had a lot of requests for Next Fifteen Communications (LON:NFC) and Learning Technologies (LON:LTG), but there are only so many hours in the day. It's always so tricky when there's an avalanche of news, like there was this morning.

We do have a lot of quality comments in the discussion thread below, so if you have an interest in those two stocks or in any others, there are plenty of informed people you can discuss them with here - more informed than I am, anyway!

Have a good evening and thanks as always for dropping by.

Best regards

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.