Good morning, it's Paul here with the SCVR for Tuesday.

Jack's busy today, but found the time to contribute an update on ERGO below, thanks to him for that.

.

Lord Lee/Sharesoc campaign re takeovers

Mello Monday, the popular online investor evening (fortnightly) was very interesting last night.

I thought Lord Lee gave an insightful talk about the shortcomings of the current rules of the takeover panel. He gave some examples where companies had failed to notify investors over an extended period, when takeover talks were actually underway.

I'm preparing a letter of my own to the Takeover Panel, to back up John's stance on this. My thoughts are along these lines;

1. Takeover bids are often revealed by the press. Companies are then forced to issue an RNS called e.g. "Response to press speculation", confirming that they are in takeover talks, or have had some approach. Surely this cannot be right? We need a proper system, with rules, for when shareholders should be told about possible bid talks. I appreciate that a preliminary, or speculative takeover approach, should not necessarily be announced to the market, but surely the owners (shareholders) of any company have a fundamental right to be told, if a serious bidder expresses interest & wants to engage with management about a possible bid?

2. False market - if the company is in bid talks (usually at a c.30-50% premium price), then that means the prevailing market price may be false, i.e. people selling their shares are not aware that a takeover bid might be in the pipeline, so they are selling at a price which is not reflecting undisclosed, price sensitive news. Buyers of the shares could be insider dealing, or tipped off about a potential bid, hence might be effectively stealing money from the sellers. As we all know, insider dealing is rarely caught or prosecuted, but is probably widespread, judging from share price movements that sometimes occur just before a takeover bid. Hence why price sensitive information must be promptly disclosed, which should include any credible takeover approaches.

3. It's a fine balance between what to disclose, and what not to disclose, so I feel tighter rules need to be put in place, rather than it seemingly being left to the discretion of companies, or the vagaries of press rumours, to decide what gets announced and when.

4. Can we always rely on company Directors to achieve the best price when they sell a company? In situations where Directors have immaterial personal shareholdings, maybe their own career interests could be their main priority, as opposed to achieving maximum shareholder value? It's not uncommon for Directors to recommend a bid, only for a higher competing bid to subsequently appear. Suggesting that Directors did not maximise value, or conduct a thorough sale process by exploring all options.

5. Sounding out of institutional investors - I recognise that companies might want to sound out their major shareholders, by taking them inside, to determine whether a takeover approach would be acceptable to them. This then locks in the institutions, who as insiders, are not then able to sell. However, they do have a major advantage, because being unable to sell, they are guaranteed to benefit from any takeover bid that does subsequently arise. Whereas private shareholders are left in the dark, hence might sell in the market, unaware of bid talks being underway, causing a financial loss. That is not fair. Clearly the market as a whole needs to be informed at a key trigger point where a bid looks credible and likely.

Possible tests to decide when a bid approach has to be announced;

1) Bidder is of a size, credibility, and financial strength to prove that it has funding available to progress a bid.

2) Major shareholders in the target company have been made insiders, and confirmed they would be supportive of the bid approach - at this point the whole market should be immediately informed.

3) If the market price moves up for no apparent reason, suggesting that information might have leaked.

That's all I can think of for now.

As an aside, I was disappointed with Stephen Clapham's (the next speaker) unjustified attack on Lord Lee's presentation - particularly as Stephen admitted he hadn't even heard the presentation! How can you say someone is talking rubbish, when you didn't hear what they said? Plus you won't win any friends by attacking a national treasure lol! So that was a mistake, but it was good to hear Stephen apologise at the end. Still we all get carried away sometimes, but it does generally pay to make 100% sure of your facts, before expressing a strident opinion!

Still, a little controversy has maybe heightened awareness of this issue.

.

Timing - quite a lot to cover today, so I'll leave it open ended for now. Update at 17:48 - that's all for today - today's report is now finished. I'll cover a few more bits from today in tomorrow's report.

Agenda -

Saga (LON:SAGA) (I hold) - Trading update

Anpario (LON:ANP) - Trading update - well ahead of expectations

Zoo Digital (LON:ZOO) - Trading update - ahead of expectations

Eagle Eye Solutions (LON:EYE) - H1 trading update - in line with expectations

Ergomed (LON:ERGO) - Trading update (this section contributed by Jack)

Manolete Partners (LON:MANO) - intra-day profit warning, down by a third. Looks bad to me.

.

Saga (LON:SAGA)

(I hold)

280p (up 1% at 08:27) - mkt cap £393m

Saga plc ("Saga" or "the Group"), the UK's specialist in products and services for people over 50, provides the following update on trading covering the period from 1 August 2020 to 25 January 2021.

This is a very detailed update, which reads positively to me.

SAGA’s share price is surprisingly volatile, which suggests to me that the market doesn’t really know how to value it at the moment, so it’s buffeted around by tides of sentiment going each way on a daily basis, re covid/vaccines mainly. To me that’s just background noise, but I tend to think longer term than many other market participants.

The financial year for SAGA ends 31 Jan 2021.

I’ll summarise the main points -

Key point - still profitable (underlying PBT) in FY 01/2021. It made an u/l PBT of £15.9m at the interims, so this implies H2 is (at worst) a loss of £(15.9)m, and hopefully better than that. Given that the travel division, including 2 new cruise ships, has been idle for most of the year, that’s impressive in my view. The attraction of this share, is that its profitable & cash generative insurance business is covering the losses & cash consumption of the travel division. Hence this share is a much lower risk way to back a recovery of the travel/holidays sector, than for example cash-haemorrhaging airlines or pure play cruise lines.

Liquidity - looks fine. It has £51m cash available as at 31 Dec 2020, plus an undrawn £100m RCF. Many investors seem to wrongly perceive that SAGA is financially distressed. It isn’t. The £150m equity fundraising a few months ago sorted out the issues. Now it has ample headroom, and the main debt is;

Bond of £250m repayable May 2024 (so not a worry), cheap: 3.375% fixed interest cost, and no covenants.

Ship loans - used to purchase 2 new cruise ships, currently anchored in Tilbury Docks, but guidance from the company is that they should generate £80m p.a. EBITDA once normal travel conditions return. From today’s update it sounds like the ship loans are £514m (calculated as £785m total net debt, less £271m net debt excluding the ship loans).

I really don’t see this ship debt as a problem. It’s just asset funding, and the company owns the assets, offsetting the debt. The lender is co-operative, having already waived covenants for Saga & other cruise line borrowers, given that the cruise ships are mothballed. The last thing a lender wants, is to repossess currently useless great lumps of steel! So it makes sense that the lender is being flexible.

The company is negotiating for further deferrals of ship loan repayments, and covenant easing. The lender & Saga’s interests are aligned, it has been co-operative & flexible to date, so I cannot see any reason as to why that would become more difficult now that a resumption of cruising is probably only months away. Hence unless something untoward were to happen, I’m not worried about the ship loans.

Covenants on the ship loans are;

- Trading EBITDA: Debt service must be above 1.2x.. Actual was 3.8x at 31 July 2020.

- Interest cover - trading EBITDA: net cash interest expenses must be above 2.0x. Actual was 5.4x at 31 July 2020.

Covenant waivers were previously secured, to 31 March 2021. It seems to me that the most likely outcome is an extended waiver on the ship loan covenants, until they can resume trading. But of course that cannot be guaranteed, so it is a potential risk, albeit not a big risk in my view.

Note that no dividends can be paid whilst the ship loans are in arrears, but none were planned anyway.

For more information, see page 207 of the refinancing prospectus from last year.

This is what SAGA says today about debt/covenants -

Whilst the Group has significant liquidity and headroom to the current covenants in short term bank facilities, given the backdrop of continued disruption to the Travel business, we are taking actions to further enhance financial flexibility.

We have commenced constructive discussions with lenders, who remain supportive. We are reviewing the covenants attached to our term loan and RCF, to increase flexibility ahead of the resumption of Travel.

As part of a package of measures available for the Cruise industry, separate discussions are underway in relation to a further debt deferral and covenant waiver for the two ship facilities. This could allow for deferral of up to £45m of principal payments due to be made from 1 April 2021 to 31 March 2022 and would be in addition to £32m already deferred, due in the period from 1 April 2020 to 31 March 2021. These are early stage discussions and we will provide an update with our full year results.

In a zero interest rate environment, lenders are generally being highly co-operative across the board, because that’s in their own interests. So I think we should be careful not to miss opportunities by being overly paranoid about debt. I missed out on a multibagger with Countrywide because the debt scared me off, for example. Given that hardly any listed companies are seeing lending facilities withdrawn, then maybe it’s time to be a little more gung-ho on this issue? The main risk is if lenders force a discounted placing, as happened at Revolution Bars (LON:RBG) (I hold) for example.

Insurance division - lots of detail given, which reads positively to me overall. described as “resilient in a highly competitive market”. It’s benefiting from reduced claims, as e.g. people use their cars less.

Travel division - planned to resume operations in May 2021. Requirement for customers to prove they’ve been fully vaccinated. This is where SAGA has an obvious advantage, since it specifically caters for the over-50s. They’ve done a lot of preparatory work on this, see the RNS for more details. It sounds well thought out, and includes frequent testing of crew, as well as numerous other measures.

We don’t yet know how/when the travel sector will resume, everyone has their own personal views on that.

Cash burn reduced to lower end of previously guided £6-8m per month for the travel division. Remember that the insurance division covers this cost, so unlike practically all other travel companies, SAGA’s financial position is not worsening. That’s one of the reasons I like this share so much. Strong potential upside, with far less downside risk than most investors seem to preconceive.

Travel bookings are good, reinforcing my view that habitual cruisers are itching to get going again. Remember that in the interims presentation, management repeatedly said, “Demand will not be a problem” when talking about their travel division. It all hinges on Govt restrictions being eased, then the coiled spring is released, in my opinion (and clearly Saga think the same thing too) -

Customer retention across both businesses remains high; the average proportion of Cruise guests who have re-booked rather than take a refund stands at an average of 69% through the travel suspension period, but rose to 86% more recently, showing the pent up demand for Cruise amongst our guests who will benefit from the first round of the vaccine roll out.

Customer deposits - remember that SAGA now ring-fences customer monies in a separate account. Unlike many other travel companies which use customer pre-payments to fund their operations. I imagine customers would find this very reassuring, in giving confidence to book early at SAGA. I think that’s a good example of where old-fashioned image & attitudes can be a positive thing.

Cruise bookings are 68% of capacity for 2021/22 (78% LY), and 28% for 2022/23 (6% LY) - given that the ships are currently mothballed, and nobody knows for sure when they can resume operations, those numbers strike me as remarkable. Clearly the customers want to get cruising again, which augurs well for the future, however long it takes, which doesn’t really matter because the insurance division covers the cash burn whilst we wait. An ideal business model really, in these uncertain times.

My opinion - that all sounds fine to me. My reason for investing is completely intact, namely;

- Insurance division profit/cashflow is funding the travel division losses

- Liquidity/debt looks fine, assuming covenants on ship loans waived/relaxed again (no reason to doubt this)

- Strong pent-up demand for cruise ships in particular, evidence by good forward bookings

- Should become highly profitable once travel resumes

- Medium-term benefits from return of Sir Roger de Haan (founder's son & long-standing CEO), and restoring the business, culture & image back to the original, before private equity & poor management damaged the business

- Longer-term - think about what could be done with a brand name this well-known, and catering for the segment of society that has most of the money & disposable income! Massive potential & brand value, I reckon. If they get it right, this could be a multibagger in my view.

My investing timescale on this one is 2-3 years. The opportunity is for a shorter term re-rating, as travel resumes. Then a longer-term re-rating from sorting out the fundamentals of the business. Time will tell, as always, nothing is guaranteed since the future is so inherently uncertain. Overall I see good risk:reward here, if you can cope with the share price volatility!

You can see from the long-term chart, that Saga was badly mismanaged under old management, destroying shareholder value. Then covid clobbered it again in the spring of 2020. Note also that the share count roughly doubled in the recent fundraising, so we need to adjust for that when looking at the upside. i.e. a recovery to 1500p would really be equivalent to 3000p on the chart. The chart has been adjusted for a 15:1 share consolidation, in case the numbers don't tie in with your recollection of the past.

.

.

Anpario (LON:ANP)

607p (unchanged at 10:21) - mkt cap £141m

This is one of many shares that is on my ever-growing, “I like the company, but it’s too expensive” list. Quite often though, companies on that list tend to out-perform market expectations, revealing the reason why they were expensive. Plus of course we’re in a roaring bull market for growth companies, where ratings are going through the roof in some cases, as investors prioritise momentum ahead of valuation. Risky stuff, as the music inevitably stops at some point! Nobody knows when, but the party’s in full swing right now, especially across the pond. Anyway, back to Anpario.

Anpario, the independent manufacturer of natural sustainable animal feed additives for health, nutrition and biosecurity, provides the following trading update for the year ended 31 December 2020.

It’s good to read a nice factual, numbers-based update here -

The Group has delivered a very strong operating performance despite a very difficult year around the world due to the pandemic. Full year sales are now expected to be not less than £30m and profit to be well ahead of expectations. This performance is reflected in the Group's strong cash generation with year-end cash balances of £15.8m (31 Dec 2019 £13.8m) after a £1m buyback programme and in addition to increased dividend distributions.

Diary date - FY 12/2020 results are due out on 17 March 2021.

Corporate video has been published, which is here:

.

Share price - hasn’t moved today, but there are only 17k shares (c.£100k) printed so far. The published spread is ridiculously wide, thus deterring both buyers & sellers, although the actual spread is often well inside the published prices, because of the antiquated pricing system we have in the UK for small caps. Putting a dummy trade into an online dealing platform, then cancelling it, is a good way to find out the real prices.

It’s still surprising for a price to not move, given that the company has just published a “profit well ahead of expectations” statement. Maybe it’s been anticipated by the recent price rise before today’s update?

My opinion - I can’t find any broker updates today, so haven’t really got anything accurate to work on. Stockopedia shows broker consensus of 18.0p EPS, so let’s guess at maybe close to 20p actual. That puts the PER about 30 - it’s difficult to see why the price is so high, when historic growth has been quite pedestrian. I’d need to see much more growth to get me interested at this valuation. The company's market share must be tiny, from the global animal feeds market. That could be an opportunity if sales take off (massive market size), but at the moment Anpario seems a niche also-ran. I'll keep an eye on it though, for signs of growth accelerating. In the meantime, it makes a very good profit margin, and has plenty of cash.

.

.

Zoo Digital (LON:ZOO)

98p (up 7% at 12:23 - mkt cap £73m

ZOO Digital Group plc, a world-leading provider of cloud-based localisation and media services to the global entertainment industry, today provides an update on current trading and outlook for the financial year ending March 2021.

This share got a boost from a weekend Sunday newspaper tip, and is up again today, so might be a nice point to take some profits perhaps? Buyers on newspaper tips are often beginners, who might have an attention span of about a fortnight before they sell up and move on to the next thing! That’s based on what I was like in the 1990s!

The company is having a good H2 (Oct 2020 - Mar 2021) -

… revenues for the full year are now expected to be at least $38 million (FY20: $29.8 million), an acceleration of growth in the second half over the first half of 35%. Based on this strong performance, the result for the year is anticipated to be ahead of market expectations.

I like the strong Y-on-Y growth, up 28%

Other points -

- More work from back catalogues, offsetting new productions “on hold” due to covid. This factor is not expected to continue as things normalise. It would have been useful to see a table of numbers, to put this into perspective.

- Positive industry trends - some new productions resumed, more content for streaming, rising consumer spending on entertainment content.

- Using the cloud has been an advantage for ZOO

- New customers added

- Claims technological leadership with its IT platform

Research update - there’s a new note out from Progressive, forecasting only $1.2m adj PBT for FY 03/2021 and $1.7m next year. That’s nowhere near enough to justify a £73m market cap, in my opinion.

My opinion - the current year PER is about 100x, falling to about 70x next year’s forecast EPS (from a note issued today). That looks a bonkers valuation, pricing in significant out-performance, for several years.

Historic performance has been lacklustre too, so if I held this share, I’d be cheerfully banking my recent profits at this price.

The only reason to buy or hold, is if you think it’s going to smash existing profit forecasts by a very large margin. Otherwise, the valuation doesn’t make sense. Dubbing & subtitling seems to be a very competitive, lowish margin sector, so not something that interests me at all.

.

.

Eagle Eye Solutions (LON:EYE)

421p (down 7% at 13:33) - mkt cap £108m

Eagle Eye, a leading SaaS technology company that creates digital connections enabling personalised, real-time marketing through coupons, loyalty, apps, subscriptions and gift services, is pleased to provide an update on the Group's trading for the 6 months ended 31 December 2020 ("the Period").

The heading says -

Strong profit growth and new domestic and international customer wins

H1 revenue growth is +8% Y-on-Y - not madly impressive, and down from +11% in Q1 which I reported here on 17 Nov 2020. It previously indicated growth was expected to accelerate in the rest of the year, which hasn’t happened in Q2.

Adjusted EBITDA of £2.1m in H1 (up 62%). All very well, but LY the company capitalised £2.8m of development spending, which means that EBITDA here over-states real world profits.

Net cash only £0.1m, although that’s improved from £(2.2)m a year earlier. Undrawn £5m borrowing facility.

Last reported balance sheet was weak, with negative NTAV, although it does benefit from favourable working capital flows - customers paying up-front, and has little tangible fixed assets, so doesn’t particularly need a strong balance sheet.

Bull points -

- Very high gross margin of 94%, hence big operational gearing

- High levels of recurring/repeating revenues

- Low customer churn

- Amazing client list of major retailers

- International scope, so big market potential

- This type of tech/growth business is highly rated in the current stock market conditions

Bear points -

- Barely profitable, once capitalised R&D is expensed

- Slow, complex implementations of new client wins

- Sluggish growth rate

- Weak balance sheet - is this limiting growth perhaps?

- Expensive

Outlook -

COVID-19 may continue to cause new contract discussions to be extended, and is expected to continue to impact the Group's F&B and Non-Grocery customer segment, causing the Board to remain cautious in its outlook for this segment.

However, the careful management of the business, successful new wins in the first half of the year and growth of the existing customer base, mean profit for the financial year ending 30 June 2021 remains in line with the Board's expectations.

Never has digital engagement with consumers been of more relevance to the global retail sector. The Group's new business pipeline continues to grow at record levels internationally, including multiple enterprise level opportunities, providing the Board with confidence in the ongoing success of the business.

My opinion - the market cap of £108m seems too high to me (I seem to say that about many companies at the moment). Why would I want to pay up-front for several years’ more growth?

Here’s the progression of revenue growth in sequential half years.

H1 2018/19: £8.0m

H2 2018/19: £8.9m

H1 2019/20: £10.1m

H2 2019/20: £10.3m

H1 2020/21: £10.8m

Admittedly covid will have impacted the last 2 half years, but even so, it’s not madly exciting growth is it? For a £108m market cap company that only just makes a small profit, it’s not enough for me to want to pay up anything like the current share price of 421p. Would I be keen to buy at half that price? Not particularly. Looks a good time to bank profits, in my view. Like a lot of things, the price has got ahead of reality, in my opinion.

It's remarkable how many charts look similar to this one - sideways for a while, then 50-100% gain in the last c.4 months. They can't all be right. I think we're overdue a general correction, as too many things have had indiscriminate rises, despite only producing in line or slightly ahead of expectations trading updates.

.

.

Ergomed (LON:ERGO)

Share price: 1,100p (+12.24%)

Shares in issue: 48,719,526

Market cap: £536m

(Jack writing)

Ergomed (LON:ERGO) is focused on providing specialised services to the pharmaceutical industry. It’s in the Investment Club (you can find the original pitch here).

It provides outsourced expertise to the pharmaceutical industry - a high margin niche that has seen the group expand to a market cap of more than half a billion pounds, with operations in over 100 countries. Customers range from top 10 pharmaceutical and generics organizations to small and mid-sized drug development companies.

What’s more, it is still growing strongly and it looks like there are plenty of opportunities ahead.

The Ergomed group currently consists of three separate arms:

- Clinical Development Services - ERGO is a leader in the global clinical research (CRO) industry and has experience in planning, managing, monitoring, and reporting over 600 Phase I – IV trials. CRO revenues were broadly flat for 2020 at £31.3m (including £1.1m MedSource revenues) but were up 15.2% year-on-year in H2.

- Orphan Drug Development - This team is led by PSR Orphan Experts (PSR), Ergomed’s rare disease subsidiary. PSR is one of the few companies exclusively focused in orphan disease drug development.

- PrimeVigilance - This is a global pharmacovigilance (PV) service provider that supports companies in managing the global safety of their products from early clinical trial development through to full post-marketing activities. PV revenues increased by 56% overall to £55.1m and by 30% to £46.0m on a like for like basis (excluding the impact of Ashfield PV, which is now PrimeVigilance USA).

Full year Trading update

Growth continues apace at Ergomed:

- Adjusted EBITDA ahead of market expectations

- Total revenue growth 26.5% over 2019 (2020: £86.4 million vs 2019: £68.3 million)

- Strategic acquisitions in CRO and pharmacovigilance in the USA strengthen global specialist leadership

- Forward visibility underpinned by strong order book up 53%

On the whole, ERGO expects revenue for the year to be in line with expectations and for adjusted EBITDA to be ahead.

It ends the year with strong trading momentum and a promising forward-looking order book across both PV and CRO. The total combined order book at 31 December 2020 is expected to be up 53% to approximately £190m.

Conclusion

Given what occurred around the world in 2020, this is a remarkably resilient result. It’s testament to the group’s attractive CRO and PV-focused business model.

In fact, the acquisitions of Ashfield Pharmacovigilance in January 2020 and MS Clinical Services (MedSource) in December 2020, have strengthened its position in the USA - so ERGO has not just survived but thrived.

Admittedly, ERGO shares look expensive at 35.2x forecast earnings, but with growth this strong and a market this big, a high multiple can be justified. It’s not an obvious bargain at this price, but I don’t see why the group can’t continue its long track record of top line growth.

.

.

Manolete Partners (LON:MANO)

197p (down 35% at market close) - mkt cap £84m

(Paul writing this)

My commiserations to shareholders here, I know a few friends hold this one. It’s not a sector I would ever invest in (litigation financing), and it’s only been covered here once in July 2020, where I didn’t like the look of it at all.

Q3 Trading Update (profit warning)

A profit warning is bad enough, but one issued during market hours, at 14:47 today, is even worse. It gives an unfair advantage to market professionals, who can sell quickly, whereas your hapless private investor may not find out until later, when the damage is done.

Manolete Partners Plc (AIM: MANO), the leading listed insolvency litigation financing firm in the UK, announces record case completions and record completed case cash inflows but a continued low level of new case investments caused by the ongoing extraordinary UK Government economic support measures...

The company previously indicated on 10 Nov 2020 that new cases had begun to slow sharply. This has continued in Q3 and the start of Q4 (financial year end is 31 March 2021).

Negative impact on new cases expected to continue.

Completed cases look good, 108 to date, compared with 54 last year.

Gross settlement value of £23.9m, comfortably exceeding board expectations.

Lots more figures are given, but I don’t know enough about the company to draw any conclusions. Cutting to the chase, it says -

As a consequence of the above factors, the Board expects realised profits to be above, but unrealised profits to be significantly below, market expectations and therefore for the Company to be overall marginally EBIT profitable in H2.

Which sounds very poor.

Management comments suggest these problems are temporary.

My opinion - I wouldn’t want to waste any more time on this. It says insolvencies are artificially low. That’s true, but both Begbies Traynor (LON:BEG) (I hold) and Frp Advisory (LON:FRP) (I hold) seem to be managing fine. I know Manolete’s business is different, but why is it suffering when BEG & FRP are doing OK?

MANO made a £6.6m H1 EBIT profit. It’s saying H2 will be only just above breakeven. That seems to show a terrible lack of visibility to its business model.

It made 11.8p EPS in H1, and the consensus is for 23.9p FY 03/2021. It sounds like actual will be maybe 12.0p (assuming very little in H2), which is a big miss.

I would dump my shares, move on, and not look back, with a memo not to invest in this sector again. It’s a minefield, and companies like this have too many moving parts.

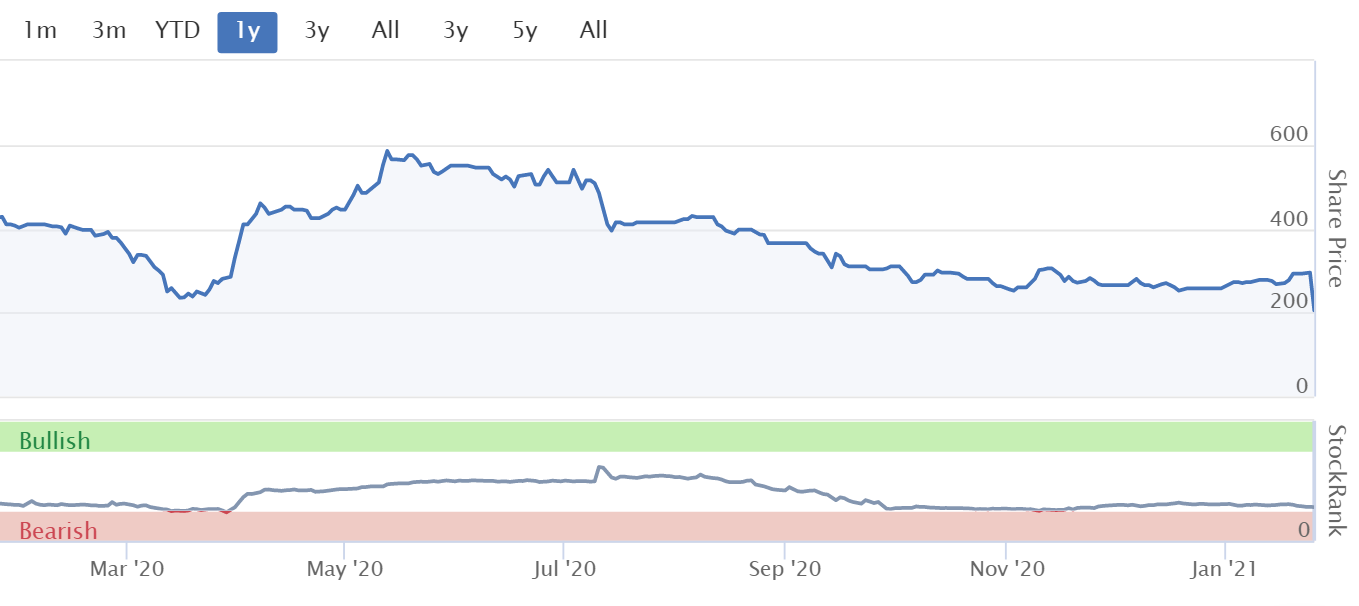

It's lost two thirds of the peak price back in May 2020 -

.

.

That's it for today. See you tomorrow.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.