Good morning, all.

Today I am interested in:

- Creightons (LON:CRL)

- James Cropper (LON:CRPR)

- Carpetright (LON:CPR)

- Dillistone (LON:DSG)

- Rosslyn Data Technologies (LON:RDT)

- Velocity Composites (LON:VEL)

- Blue Prism (LON:PRSM)

Lots of updates today, let's see how far I can get!

Cheers

Graham

Creightons (LON:CRL)

- Share price: 27.75p (+7%)

- No. of shares: 60.6 million

- Market cap: £17 million

Please note that I currently own shares in CRL.

Creightons Plc (the "Group" or "Creightons") is pleased to announce its preliminary results for the year ended 31 March 2018.

This is a small company in the sector often referred to as "FMCG" - fast moving consumer goods. It makes haircare, skincare and beauty products.

I bought into it after its "good" profit warning a few months ago. I've topped up my holding today

The issue was that Creightons couldn't handle all of the demands upon its manufacturing capacity. So as not to let down external customers, it outsourced the manufacture of its own branded products.

Unfortunately, manufacturing own-branded products is where it makes its highest margin.

As a consequence, gross and operating margin were reduced by £229k in these results.

Even without this problem, gross margin would have fallen due to rising raw material costs and other input prices.

By my maths, even without the capacity shortage, the gross profit margin would have fallen to 41.3%, from 42.5%.

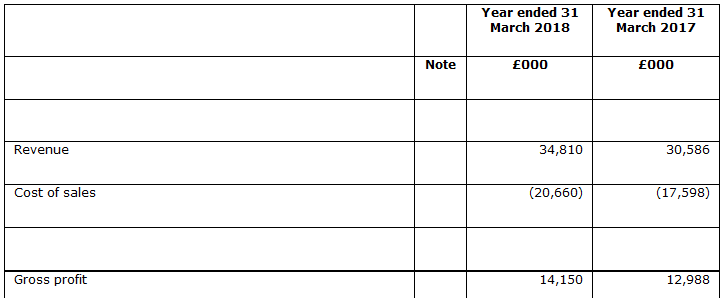

From a more positive point of view, we can say that on an absolute basis, the gross margin contribution still rose rather impressively, due to rising sales:

The capacity shortage increased Creighton's distribution costs, too - an operating expense.

The operating profit margin reduces by 0.2% to 4.7%. In the absence of capacity issues, operating profit margin would have increased to c. 5.6%.

So the quality of the performance clearly deteriorated from an operating margin point of view, due to this problem.

But again, on an absolute level, operating profit increased, due to the higher sales throughput.

I believe the capacity issue has now been addressed, to meet recent levels of demand:

The Group chose to outsource some manufacturing for a period while we invested in personnel and equipment to meet unexpectedly high growth in demand. This has been successful with all previously outsourced manufacturing brought back in house by the end of May 2018.

Of course, it is possible that demand will once again outstrip supply in the months and year ahead. If that happens, profit growth will not be as rich as it might otherwise be.

But this is a nice problem to have, I feel. I'd rather own shares in a business which has under-invested relative to its growth, than one which has over-invested.

If you add back the £299k of capacity-related costs, operating profit for the year was £1.9 million.

The company's cash position has been significantly reduced (to support its growth, according to management). Nevertheless, it retained a small net cash position at year-end. The dividend for the year is unchanged, offering a token yield of c. 1.5% for investors at the current share price.

In the absence of any material finance costs, my adjusted profit number of £1.9 million only needs to be reduced by a normalised tax charge. Applying 19% gives me a net income figure of £1.57 million.

This is the normalised net income figure I am using to determine the present valuation, so at a market cap of £17 million I get an adjusted trailing P/E ratio of 11x.

Looking at the quality of the performance from a balance sheet point of view, according to my calculations the company employed average fixed assets plus net working capital during the year of £8.7 million (ignoring intangibles).

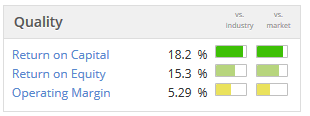

Using the actual operating profit generated of £1.6 million, that suggests a return on tangible capital employed of c. 18.9%.

This is in the same ballpark as Stocko's calculations for Return on Capital, probably using last year's numbers:

I would like to see this metric improve, as own-brand sales continue to grow and are manufactured in-house.

Note how the company generates a strong return on capital, despite a low-ish operating margin. That's only made possible by running a very efficient balance sheet, such that you generate a large quantity of sales using very little capital.

Creightons reckons that its balance sheet efficiency has actually improved, at least on the basis of stock turn:

Higher forecast sales in the first quarter of 2018-19 have driven increases in inventories with underlying ratios significantly improved. Stock turn, based on cost of sales in the months prior to the yearend, improved to 4.5 times compared to 3.5 times in 2017.

My view

I am cautiously optimistic. I like "good" profit warnings, as they can be a great time to buy a good stock at a discount (this is not easy to find, however - most profit warnings lead to future under-performance).

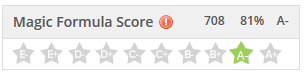

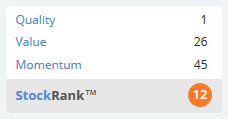

I also like quality companies trading at reasonable prices. That's the essence of Greenblatt's Magic Formula, according to which Creightons almost has a top rating:

The Magic Formula does not take the stock's Momentum into account.

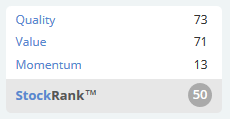

Given that Creighton shares had been trading up at 45p last year, it's clear that the stock doesn't enjoy a lot of momentum right now.

Indeed, momentum is what's holding back its StockRank at the moment:

Personally, I don't mind waiting for Momentum to return to this stock.

Something else worth mentioning: I've been impressed by management presentations I've seen online. They strike me as knowledgeable, disciplined and realistic, while also harbouring significant ambitions for the long-term development of the business.

So I'm holding this stock and will hopefully participate in its future progress.

James Cropper (LON:CRPR)

- Share price: 1422.5p (+2%)

- No. of shares: 9.5 million

- Market cap: £135 million

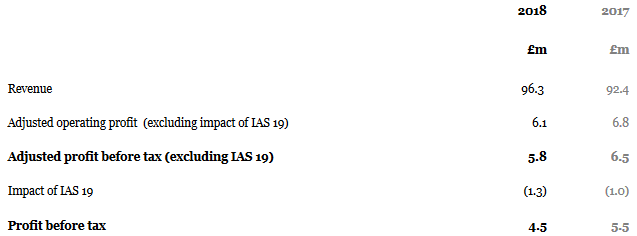

This "advanced materials and paper products group" has hit a bump in the road, as anticipated:

IAS 19 is the accounting standard that governs how pension costs should be measured.

Personally, I don't believe that the accounting standards concerning pensions are unnecessarily harsh on companies. So I would be inclined to use the actual PBT figures shown above, not those which use the company's own version of its pension costs. Like many accounting issues, this is a matter of opinion.

Paper

Getting back to simpler matters, the basic cause of Cropper's reduction in profitability is the increase in pulp prices. These increased costs by £3.5 million - very significant, relative to total pre-tax profit of £4.5 million.

It's very easy to miss a company's sensitivity to commodity prices, until things go wrong. Accrol Group (LON:ACRL) mentioned that pulp prices were an important factor in its admission document. But if you weren't watching these prices, or hadn't read the admission document, then it was easy to be caught off guard when its financials collapsed. I had written about it a few times, and failed to spot this sensitivity.

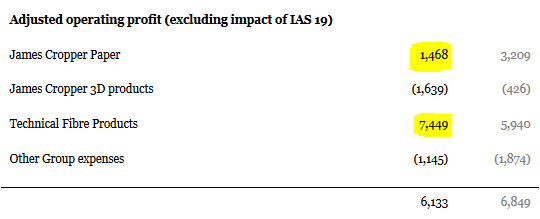

3D Products

Besides the Paper division, another division called "3D products" has generated a small amount of revenue. It's taking longer to commercialise than previously anticipated. Increased losses were seen in this division, also significantly affecting Cropper's operating profit result.

Technical Fibre Products

By far, Cropper's most profitable division this year was TFP (Technical Fibre Products). This sounds more high-tech:

We work with a broad range of specialist fibres including, but not limited to; carbon, aramid, metal coated carbon, glass, polyester and thermoplastics, and convert these into high quality nonwoven mats and veils. We can tailor the properties of these to fulfil our customers' specific technical or aesthetic requirements through fibre-type & binder selection as well as the addition of particulates to the structure.

TFP is achieving double digit organic growth, sales up 17%.

This division has similar challenges to Creightons:

Recently installed capacity is ensuring demand is met.

Additional capacity is being planned to support continued volume growth.

Add it all up, and this is the summary of each division:

Outlook remains very positive for the long-term:

As intimated by the recommended final dividend increase, the Board and I continue to be excited about the prospects of the Group. We recognise there are significant challenges in recovering the margins lost in Paper to pulp costs and that continued research, innovation and investment will be vital to maintaining our position and creating future value.

My opinion

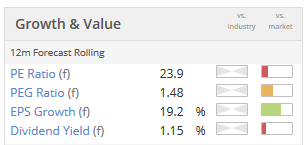

Overall, I have a positive impression of the company.

The StockRank isn't too high (27), as it doesn't appear to offer much value at the current level.

I also can't see why it deserves such a high rating as this. I'll leave it on the watchlist.

Carpetright (LON:CPR)

- Share price: 28.4p (-5.5%)

- No. of shares: 304 million

- Market cap: £86 million

Paul and I covered this stock several times in recent months.

Most recently, I noted the successful completion of its Placing and Open Offer.

232 million shares were issued at 28p, i.e. more than 3/4 of total shares outstanding today were issued.

The placing price can act like a magnet for subsequent share price action. Today's weak results have helped see the shares slip back toward that 28p level.

We have a dramatic reduction in EBITDA, and an underlying loss:

- Group revenue decreased by 3.0% to £443.8m

- Underlying EBITDA of £6.4m (2017: £28.6m)

- Underlying loss before tax of £8.7m (2017: profit of £14.4m), in-line with previous guidance

Net debt ballooned to over £50 million as supplier credit was withdrawn.

The equity financing took place after period-end, so we can't see it in these statements.

It raised £65 million, enabling the CVA proposal to go ahead with the approval of landlords.

Under the CVA, about 200 sites will either be closed or have their rent reduced by 30%-50%.

That's about half of the original estate.

Meanwhile, the entire estate is being refurbished with new branding a fresh fit-out.

So as I said last time, there is potential for a really significant improvement over the next 12-24 months. Although the trading update provided today is mixed:

In more recent weeks, following the approval of the CVA and completion of the recapitalisation, the Group has begun to see the benefits of stock replenishment by suppliers and less negative publicity, although UK like-for-like sales remained negative.

Factors contributing to the decline in EBITDA last year were as follows:

The margin was impacted by higher product costs in the UK as a result of the depreciation of Sterling against the euro, promotional measures taken to address competition and the inevitable disruption to trade resulting from the adverse publicity surrounding the restructuring.

The highlighted factor is the one which bothers me the most - increased competition.

Can carpet retailers differentiate themselves at all, or is it a fully commoditised product set?

Market valuations are saying that they are commoditised. Which is unfortunate for me, as I currently continue to hold United Carpets (LON:UCG).

I'm not planning to go bottom-fishing with Carpetright. While I think the company has a good chance of making a financial recovery in the short-term, I worry that competition will remain too tough to make it a comfortable long-term hold.

3pm: Time is getting away from me - I will need to speed up coverage of the remaining stocks!

Dillistone (LON:DSG)

- Share price: 64p (-18%)

- No. of shares: 20 million

- Market cap: £13 million

Dillistone Group Plc, the AIM quoted supplier of software for the international recruitment industry, is pleased to announce a trading update ahead of its Annual General Meeting

It's a dour update in reality.

Recurring revenues are down for its existing systems and its new product, GatedTalent, has not achieved the take-up that the company was looking for.

GatedTalent is a tool enabling high-level executives to chat with recruiters.

The update concludes as follows:

We had anticipated that GatedTalent would be loss making in 2018 and this remains the case. The lower than anticipated initial number of profiles and subsequent delay to profile monetisation will impact further on revenue. As stated above, the Board is aiming to deliver a growth in profits year on year, prior to the impact of the anticipated GatedTalent loss, acquisition related items and the impact of IFRS15 adjustments.

I have looked at this stock once before, and didn't see it having many attractions the first time, either.

It still has £1 million of cash but doesn't look particularly cheap relative to earnings or fundamental quality.

Good luck to holders but this one is not for me.

Rosslyn Data Technologies (LON:RDT)

- Share price: 4.65p (-3%)

- No. of shares: 188 million

- Market cap: £9 million

Rosslyn Data Technologies plc (AIM: RDT), the provider of a leading cloud-based enterprise data analytics platform today announces a trading update for the year ended 30 April 2018.

I intended to cover this in a little bit of detail but have quickly concluded that it is not something I can contemplate investing in.

It has made a significant loss in FY 2018 and is down to less than a million in cash. It says it is on track to achieve cash-flow breakeven "during the current fiscal year".

But it has been loss-making for its entire existence, and accumulated losses have grown to £15 million. This could be the point at which it finally turns around but it remains too speculative for me.

Stocko algorithms also provide a warning:

Velocity Composites (LON:VEL)

- Share price: 67.5p (+5.5%)

- No. of shares: 35.8 million

- Market cap: £24 million

Velocity Composites plc, the leading supplier of advanced composite material kits, providing engineering value-solutions for the global aerospace industry, is pleased to announce its interim results for the six months ended 30 April 2018.

A couple of things jumping out at me from these results.

- Gross margin rather low, at 15.2%. Suggests there is not much "value-add" being performed by Velocity. The company is conscious of this, and points to higher gross margin of 18.2% in April (performance over a single month is not too important, however).

- Visibility over revenues appears low. If you scroll back to the April trading update, you find a very long and complicated explanation as to why contracts were delayed and revenues and profitability for FY 2018 were set to be lower than originally anticipated.

This appears to be the nature of the business that it is in, delivering kits for the production of aircraft parts. Aircraft is a lumpy business that depends on oil prices, upgrade cycles, etc. While it should grow over time, it will never be predictable.

The outlook statement today reflects the unpredictable nature of results:

Board remains confident of meeting the market's revised full year expectations, subject to customer demand fluctuations

Customer and programme pipeline remains strong with over 60% of FY19 revenue market expectations and over £60m of business for the remainder of FY18 through to FY20 under contract

So there is still some uncertainty over FY 2018, and up to 40% of FY 2019 revenues are still up for grabs.

The explanation for the operating loss is that there was "continued investment arising from the Company's listing, additional sites and growth strategy."

It doesn't strike me as a particularly helpful explanation, and I'm left without any particular reason to believe that things are set to dramatically improve.

It is priced at a trailing price/sales ratio of approximately 1x but given the low gross margins, losses and lack of visibility, that strikes me as generous.

Blue Prism (LON:PRSM)

- Share price: 1834p (-1%)

- No. of shares: 67 million

- Market cap: £1,223 million

This is a massively high-flying robotics company.

It is creating a new workforce of software robots to take over mundane human chores.

The key sales number is now as follows:

Exit run-rate (recurring licence revenue) increased to £4.4m per month at 30 April 2018 (30 April 2017: £1.7m per month)

So if it stood still from the April 2018 level, it would generate £53 million of revenue per annum.

Stocko is showing a forecast sales figure of £52.6 million for FY 2018.

Compare that to the market cap of over £1.2 billion.

It's impossible for me to value this company. I just think it's worth mentioning, as investors are obviously willing to pay up for it. We don't often see price/sales ratios like this!

Made it through the entire list!

Have a good evening.

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.