Morning folks.

These are the stocks which have caught my eye today:

- Ranger Direct Lending Fund (LON:RDL)

- Tricorn (LON:TCN)

- Carpetright (LON:CPR)

- MS International (LON:MSI)

- Amino Technologies (LON:AMO)

- Harvey Nash (LON:HVN)

1pm edit: Lots of interest in Amino Technologies (LON:AMO), so I'll be taking a look at this, too.

Cheers,

Graham

Ranger Direct Lending Fund (LON:RDL)

- Share price: 797p (unch.)

- No. of shares: 16.1 million

- Market cap: £128 million

Oaktree releases open letter to Ranger shareholders

Some (most?) of you are probably familiar with Howard Marks of Oaktree Capital. He runs an alternative investment firm with particular expertise in high-yield bonds, distressed debt, etc.

Marks has become well-known through his published memos (available here), containing a great deal of investment wisdom.

His memos have also been published in book form: The Most Important Thing: Uncommon Sense for the Thoughtful Investor, which I enjoy reading and am happy to recommend. His value-oriented philosophy can be applied to pretty much any asset class.

So I was intrigued to discover recently that Marks' firm has been engaging in some activism in relation to a small British investment vehicle: Ranger Direct Lending Fund (LON:RDL). (Note that Marks himself is unlikely to be heavily involved in this project.)

Oaktree has bought up 19% of Ranger and is now pressing for Board representation, with the view that a wind-down would be in the best interests of all shareholders.

What went wrong

Ranger's strategy has been to invest in a portfolio of debt obligations issued by direct lending platforms, and distribute quarterly dividends to shareholders.

In USD terms, the returns generated by Ranger on capital deployed over the last three years is as follows:

- 2015: 9.36%

- 2016: 5.53%

- 2017: -2.95%

One particular investment has gone very badly, the "Princeton Alternative Income Fund LP".

This was unfortunately a very large investment relative to the size of the fund as a whole. $55 million was originally invested in it, and it is currently (Dec 2017 valuation) in the books valued at $29.3 million (although a $29.6 million figure is also mentioned).

The auditors issued a "qualified opinion" in relation to what Ranger's holding in Princeton is worth. The case is currently going through the bankruptcy courts in the US. This makes it extremely hard to value. Apparently, Princeton is only communicating with Ranger through its lawyers.

From the most recent annual report:

As described in note 3, the directors have been unable to provide us with sufficient appropriate audit evidence in relation to the investment in Princeton recorded at a value of USD 29.6 million. We were unable to obtain sufficient appropriate audit evidence regarding this investment by using other audit procedures.

The opportunity

The NAV for a Ranger share at March 2018 was 938p, including the dodgy Princeton holding. Total value on the books was recorded at $212 million (see here).

So there is a discount to recorded book value available, and a very active and successful shareholder seeking to make changes.

I haven't been able to convince myself to buy it yet, but I thought I'd leave it here in case anybody else would be interested to research it for themselves.

Incidentally, my request for a quote this morning was prevented from being served, thanks to EU regulations. I was met with the following error message:

You have not confirmed that you have read the Key Investor Information Document for this fund.

Thankfully, Ranger Direct Lending Fund (LON:RDL) does have a KIID on its website. So I should be able to buy Ranger shares by calling up my broker and confirming that I've read it.

This has not been the case with Volvere (LON:VLE), in which I do have a long position. According to the bulletin boards, some brokers have prevented investors from buying it because it has no KIID - and there is no way for them to buy it, unless they can find a different broker, who will allow it!

Tricorn (LON:TCN)

- Share price: 34.5p (+11%)

- No. of shares: 34 million

- Market cap: £12 million

Tricorn Group plc ('Tricorn' or the 'Group'), (TCN.L) the AIM quoted tube manipulation specialist, announces its audited final results for the year ended 31 March 2018.

Some great financial progress from this engineering company based in Malvern.

Revenues are up 20% and underlying PBT has more than trebled:

The adjustments made to PBT this year weren't too dramatic, so the actual PBT was £600k.

Tricorn hasn't paid a dividend since 2014, as it has been carrying between £3 and £4 million of net debt.

Net debt has been reduced back now to £3 million (£0.7 million of cash offset by £3.7 million of gross borrowings).

Despite the improvement, I don't think I'd be entirely comfortable with this balance sheet.

Net debt/adjusted EBITDA is about 2x, which is within a normal range.

But if you use a more conservative measure than adjusted EBITDA, e.g. actual EBIT (including joint venture income), then you get a debt multiple of 3.6x (£3 million of net debt divided by £830k of EBIT).

It's not distressed but it's at the upper end of what I would be comfortable with.

In terms of quality, I've just quickly tried calculating Tricorn's return on tangible capital for FY 2018, and got an answer of 15% - not bad.

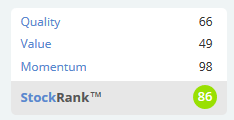

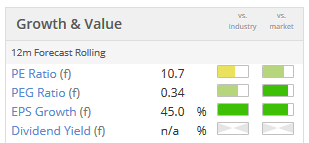

So I think its quality score might possibly be set to improve:

Its value score would also improve if it elected to pay a dividend, but this is not on the cards in the short-term. Other value metrics are good:

Conclusion

A decent stock with an acceptable result this year, although the track record is a bit patchy and the debt load is possibly on the high side. I'm inclined to think there is more upside available for shareholders here - worth looking into, IMHO.

Carpetright (LON:CPR)

- Share price: 34p (-2%)

- No. of shares: 71 million

- Market cap: £24 million

Result of Placing and Open Offer

The carpet retailer has seen strong support from shareholders under its open offer at 28p, with a 92% acceptance rate.

The share count is going to be about 304 million by my reckoning, so the implied market cap at today's share price is c. £103 million. The new shares will start trading on Friday.

The CVA now goes ahead. Recall the key element of the CVA proposal:

A comprehensive review of the Company's property portfolio has identified 205 sites in the UK that are underperforming and/or on unfavourable lease terms, or, in certain cases, not expected to have significant strategic value to the Company going forward. Of these, 92 sites have been identified for closure in the short term under the CVA Proposal, with the balance of 113 sites being subject to a reduction in rental costs and revised lease terms.

The entire estate had about 420 sites late last year, so we should expect a significant trading improvement now that the worst half of them will either be closed or see their rents reduce.

The big cash injection is also great news for the company, of course.

Carpetright's earnings multiple might end up looking very cheap for a year or two, if the planned-for cost savings do materialise, but I think we have to note that carpet retailers are among those retail stocks trading at very cheap valuations at the moment.

Another holding of mine, United Carpets (LON:UCG), is trading at an earnings multiple of 5.1x and an EV/EBITDA multiple of less than 3x (using Stocko data). Investors are extraordinarily sceptical.

In the case of Carpetright, it has been struggling against the competition and in the face of a difficult consumer market, which has led to the need for a recapitalisation.

Speaking generally, it's hard for these companies to build and sustain a competitive advantage. They can do really well for a period of time, but eventually they tend to run into serious difficulties.

So I wouldn't mind holding Carpetright shares for a limited period of time. I think both CPR and UCG could have a nice re-rating higher if they trade well for a couple of years. But I'd probably be very scared to keep them in a buy-and-forget type of portfolio!

MS International (LON:MSI)

- Share price: 236p (+13%)

- No. of shares: 16.7 million

- Market cap: £39 million

It has been a couple of years since I last looked at this stock. At the time, I noted heavy insider ownership, and that remains the case today. The Chairman owns 29% of shares, with another non-exec owning 11%.

It has a very basic website, which is comforting in a way - the company is not at all promotional when it comes to investor relations.

Its operating divisions are: 'Defence'; 'Forgings', 'Petrol Station Superstructures' and 'Petrol Station Branding'. The company produces defence equipment, fork-arms for fork-lift trucks, petrol station superstructures and petrol station branding.

Defense sales are primarily to the export market, as UK defense spending is constrained. I presume that this will remain the case for the foreseeable future.

In petrol stations, the market is changing as ownership passes from oil producers to independent operators such as Applegreen (LON:APGN). This has affected the demand for MSI's services but the company reckons that demand will pick up again once transaction activity slows down.

Petrol station branding is doing better because as petrol station ownership changes, the forecourts must be swiftly rebranded.

The company is pleased with the outcome of its R&D spending:

A key feature is sustaining our creative and innovative product development programmes across the Group, which also results in us owning, unquestionably, the intellectual property rights of products we develop, particularly important in the defence sector.

The outlook statement is positive and dividend is marginally increased.

Conclusion

I like the company's style of corporate governance, with heavy insider ownership and an understated approach to its shareholder communications.

It also has a nice track record of profitability. It has been profitable every year since 2002.

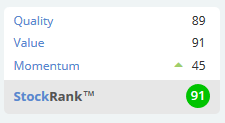

It is a little bit too "heavy" for my liking, in terms of the amount of capital it has had to use to generate these returns. You can see that the quality metrics are a bit weak:

It used to earn really strong returns on capital, but I'm guessing that was when UK defense spending was more abundant and when the petrol station market was more predictable, too.

It's possible that those conditions could return at some point, though I don't know when. For now, I'm happy to keep this one on the watchlist.

The StockRanks like it a little bit more than I do - perhaps I am missing something!

Amino Technologies (LON:AMO)

- Share price: 200p (-3.6%)

- No. of shares: 72.7 million

- Market cap: £145 million

Amino Technologies plc (LSE: AMO), the global media and entertainment technology solutions provider, provides the following trading update for the six months ended 31 May 2018 ("H1 2018").

I haven't covered this one before. Today's update says that expectations for the full year remain unchanged.

H1 revenues are lower by almost 20% to $41 million, but H1 orders are up by 40%, as seasonality with a second-half weighting is guided.

The Chairman is positive for the full year result:

"As operators transform their services to IP delivery to meet consumer demand for entertainment 24/7 on any device we are seeing good traction for our three clear market opportunities - upcycling, the transition from cable to IPTV, and Android TV. Good visibility provided by our order backlog and pipeline underpins the Board's confidence in full year expectations."

I have been trying to familiarise myself with what Amino actually does:

Amino is a global leader in innovative Internet Protocol (IP) solutions that enable service providers to connect with consumers.

It's providing software, set-top boxes and the like, so that TV services can be delivered digitally.

It has been seeking to increase its recurring revenues, still rather small as a proportion of the total:

Exit annual run rate recurring revenues increased in the period to circa $5 million (H1 2017: $3.7 million).

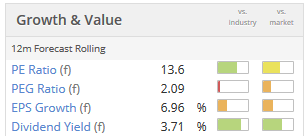

The historical financials look great and the Stocko algorithms are convinced, too, awarding it a StockRank of over 90.

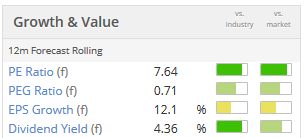

Valuation is not stretched at all:

I would need to read more about it to really understand its products and services.

Some people might be worried about the second-half weighting but I think this is mitigated, more or less, by the increase in orders.

Overall, it's hard to argue with the numbers. I wouldn't mind including a few shares of this in a StockRank-derived portfolio.

Harvey Nash (LON:HVN)

- Share price: 114p (+7.5%)

- No. of shares: 73.5 million

- Market cap: £84 million

This recruiter's share price was around 87p when I covered it in March, the same level it was at when I covered it the previous September.

It was trading near its historic low in P/E terms then, and is still rated quite cheaply in historic terms (despite the recent share price gains).

It has a January year-end; for the Q1 period ending April, gross profits are up 7%.

The UK & Ireland region has been outpacing Mainland Europe and the Rest of the World in gross profit growth, and that trend continued in Q1.

UK & Ireland is up 20% while the Rest of the World segment continues to suffer, down 23%. This is blamed on difficult comparatives.

Overall, Harvey Nash is doing better than planned:

"I am very pleased to report that the strong organic growth reported in the second half of last year has continued into the current year and the first quarter is tracking ahead of budget. The Group has a clear growth strategy, and with the additional contribution from the annualised effect of the acquired businesses and of the transformation programme, we are confident of continuing to make significant progress in 2018."

My opinion

I like this stock and I reckon it makes for a decent investment at the low earnings multiples typically assigned to it by the market. It's hard for recruiters to differentiate themselves much from the competition, but they can and often do generate acceptable returns for shareholders. I'd buy it for the yield, not expecting too much capital growth:

All done for today! Thanks for dropping by.

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.