Good morning, it's Paul & Jack here with the SCVR for Tuesday.

Mello online investment show - today, free tickets here, starts at 11am until about 15:00. Feel free to dip in & out. All the companies presenting look interesting to me. I've got to think of something clever to say in my slot at 14:50!

Timing - TBC

Agenda -

Paul:

Staffline (LON:STAF) - quick comment re 2nd largest shareholder buying more shares yesterday. Augurs well for refinancing perhaps?

Focusrite (LON:TUNE) - sparkling interim results. How much is caused by lockdown? Not sure, but I think the higher share price here does stack up on fundamentals. This share gets a thumbs up from me.

Gaming Realms (LON:GMR) - quick review of its 2020 results & 2021 outlook. I continue to believe there could be good potential here, but unfortunately I can't fathom how to value the shares.

Jack:

Water Intelligence (LON:WATR) - great growth figures from this water leak detection specialist with corporate and franchise operations, but trading at a premium valuation.

Inspiration Healthcare (LON:IHC) - in line update from this ventilator provider that has seen a Covid-related boost in demand

Paul’s Section

Staffline (LON:STAF)

73p - mkt cap £51m

Holding in company - we looked at Staffline yesterday, so as a postscript, I see there’s an RNS today, saying that major shareholder Henry Spain Investment Services (a stockbroker based in Market Harborough) increased its stake in Staffline from 19.4% to 21.4% yesterday (on publication of a trading update).

Given that Staffline urgently needs an equity fundraising to repair its weak balance sheet, then I think it’s encouraging to see the 2nd largest shareholder buying more shares in the market. That suggests to me that the shareholder is probably going to be supporting in a fundraising.

HRnet owns 29.95% of Staffline, so these 2 shareholders put together have over 50%. Therefore if both are supportive, then a fundraising should be no trouble to get away, although they’ll also be heavily influencing the price. The danger is if they decide to heavily dilute small shareholders. Although I find that’s rare, since often big shareholders want to preserve the value of their own stake, as much as anyone else.

It will be interesting to see how this pans out, and it’s probably best seen as a special situation until the funding situation has been fixed.

.

Focusrite (LON:TUNE)

1,195p (up 7%, at 08:31) - mkt cap £700m

I’ve followed this share here since it floated in late 2014, with the share price since having multi-bagged (about 8 times).

Results today stand out as very strong, so I’m going to take a look at them, despite the market cap now having grown beyond my usual cut-off point of c.£400-500m. It seems a pity, and rather illogical, to stop covering the best companies, because they grow beyond an arbitrary market cap limit!

Acquisition - the third acquisition since listing in 2014 is announced. It’s a high end synthesiser company based in San Francisco, called “Sequential”. The price is £18m, of which £15m is being paid up-front. This is being funded from Focusrite’s existing cash resources, and a partial drawdown on its facilities from Nat West.

In the FY 12/2020 (unaudited), Sequential was profitable with both EBITDA and EBIT at $3.5m (strange that they’re the same figure, which implies it has no depreciation charge - so it must have little, or very old fixed assets!), on revenues of $18.3m.

It looks like a founder selling prior to retirement, perhaps?

This looks a good deal, and it’s going to be earnings enhancing (because cash on the balance sheet earns nothing, so better to buy something that is profitable instead), with other interesting aspects to the deal - e.g. co-developing new products.

Owner-managed businesses like Focusrite (Philip Dudderidge still owns 33% of the group) tend to make good acquisitions in my opinion, because it’s their own money they’re risking. Whereas hired hands, keen to empire build, often make a hash of acquisitions - look at how often we see “non-cash” impairment charges of goodwill, due to botched acquisitions at other companies.

Focusrite plc, the global music and audio products company supplying hardware and software used by professional and amateur musicians and the entertainment industry, today announces its half year results for the six months ended 28 February 2021.

H1 figures look stunningly good against the pre-covid prior year H1 comparatives. Although note that Focusrite seems to have been a beneficiary from the pandemic, much like Gear4music Holdings (LON:G4M) (I hold), since the lockdowns fuelled demand for their products from people developing hobbies in music, and other audio. Although in both cases, I think there’s also evidence that they are gaining sales from structural, long-term growth. We just don’t yet know the split of one-off, vs permanent growth.

Look at these highlights - pretty spectacular, including 64.3% organic growth in the top bullet point -

.

Amazing as those figures are, it’s worth noting that if you split last year into H1 and H2, then H2 was very strong (benefiting from lockdown 1). So sequentially the half year performance (i.e. H1 this year, vs H2 last year) is not quite so striking, but still very good.

Component shortages are mentioned, as causing supply problems, and is a global issue, likely to “affect supply for some time”.

Earnings - adj EPS is 36.3p for H1. I’m happy with the adjustments, which is almost all goodwill amortisation, which is fine to adjust out.

I can’t find any broker research, but Stockopedia shows the broker consensus for FY 08/2021 being 38.8p. Therefore, having achieved almost all of that in H1 alone, clearly the full year forecasts need to be greatly increased.

The difficulty is predicting whether, and by how much, sales/profits might reverse once lockdowns end fully? Some product lines (e.g. Martin Audio) are likely to benefit from re-opening, as live gigs and venues open up again & want to upgrade their speakers.

Also, the main product lines at Focusrite (61% of group sales) could continue to see strong demand, from the digitisation of music, and people creating music content & podcasts, etc, at home. I can’t see that trend reversing at all, although this is not my area of expertise. I’ll ask my family, who are musicians & report back.

Just spoken to the family, who told me: Focusrite products are excellent. Over lockdown, a lot of music teaching moved online, so musicians needed to buy a decent quality microphone & that usually needs a Focusrite interface. Although once bought, the setup will last years, so repeat business might be an issue. Any readers with knowledge of this sector, do please leave a comment in the comments.

Forecasts & Valuation - bearing in mind the above, I’m leaning towards assuming there’s some one-off boost to H1 from lockdowns. With 36.3p in the bag for H1, I might assume H2 could be a bit softer, maybe 30p? That gives 66.3p for the full year. Then maybe a step back to 50p EPS next year? At 1185p the PER is 23.7 times my guess of 50p future earnings. That looks reasonable, and based on what seem to me quite conservative assumptions. I haven’t factored in any extra earnings from the acquisition of Sequential either.

Based on this simple back of the envelope stuff, I think the valuation seems reasonable.

Hopefully there could be upside on my 50p EPS estimate?

Outlook - in H1 the group performed “exceptionally well” - which might be hinting that lockdowns brought a benefit which may not necessarily be ongoing?

Although the next bit suggests that growth could be permanent -

… revenue for the period being slightly ahead of our revised expectations as announced on 19 February 2021. As previously discussed, we believe the customer base has materially grown, with more people utilising these solutions for music creation, podcasting, social media broadcasts and other streaming workflows. The digitisation of almost every facet of modern life continues unabated, and audio is no exception…

We expect demand to remain higher than pre-COVID-19 levels for our ADAM Audio and Focusrite businesses, but recognise the uncertainty that the end of lockdown will bring.

While demand for Martin Audio products continues to be constrained by the shutdown of live events, we are now seeing the pipeline increase for both installed and tour sound business.

As always, we remain appropriately cautious given the unique global circumstances, but also optimistic about the future prospects for the Group."

Cautious and optimistic. What are we supposed to make of that?!

Balance sheet - looks healthy, no issues here.

My opinion - these are really impressive numbers.

I don’t know how much lockdowns have benefited TUNE, there must have been some benefit.

It’s difficult to buy a share that I’ve been observing for years, and has 8-bagged, but I’m happy that the current valuation can indeed be justified, even on fairly cautious assumptions, as demonstrated above.

Combine that with another good acquisition announced today, and the owner-manager model with the founder still holding 33% of the equity (much like Gear4music Holdings (LON:G4M) which I hold), and I think this share looks attractive.

Obviously I don’t have any idea what the future holds, that’s the problem. But based on the excellent track record, and that it’s selling into a large, global market, with products that do seem to have a competitive edge, then I imagine it’s more likely to do well in future, than badly.

Overall then, a thumbs up from me.

.

.

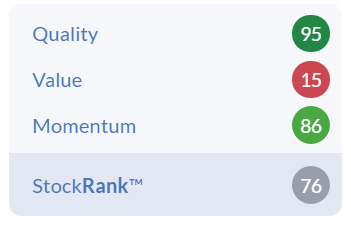

Note the StockRank below shows a poor value score. However, this is based on existing broker consensus earnings forecasts which are way too low. Therefore, I think we can manually adjust that to a higher figure, which should feed through if/when revised broker forecasts appear - although this share seems under-researched, and we don't have access to any notes, being insignificant little pipsqueak private investors! Bloody annoying isn't it.

.

.

Gaming Realms (LON:GMR)

40.3p (down 9%, at 11:51) - mkt cap £116m

This share has done phenomenally in the last year - it’s 8-bagged from the covid crash low in March 2020. It’s been on my radar for a while, as potentially interesting, but I haven’t got a clue how to value it, that’s the trouble with companies that are historically loss-making.

The share price has reacted negatively to today’s update, but as you can see below, that looks like a blip on a very positive chart.

.

.

Gaming Realms plc (AIM: GMR), the developer and licensor of mobile focused gaming content, announces its annual results for the year ended 31 December 2020 and Q1 highlights for 2021.

Impressive revenue growth of 66% to £11.4m

Profitability - pick a number which you prefer! Here are the options:

- Adj EBITDA (continuing) £2.94m

- EBITDA (continuing) £2.02m (after £468k restructuring costs, and £449k impairment)

- Loss before tax £(1.53)m - why such a big difference? The main costs are £2.82m amortisation of intangibles, and a heavy finance expense of £882k

Balance sheet - quite weak, NTAV is slightly negative at £(0.2)m. I cannot understand why the company hasn’t raised a bit more cash, given that it has a £116m market cap. In their shoes, I’d do a £5-10m placing, to make the balance sheet bulletproof, which wouldn’t be much dilution. Strike whilst the iron’s hot! There is no charge for this sage guidance!

Cashflow statement - the key number is £2.44m of capitalised development costs. This is perfectly normal for a software company, but it renders EBITDA meaningless. In the real world, this is not a profitable company, it’s trading at a small loss, once you take into account development spend.

Current trading -

… the Board has every confidence in the strategy being pursued and in the Group's prospects for the year ahead. The Company is trading marginally ahead of Board expectations.

Outlook - upbeat, but non-specific -

… strong pipeline of new and exciting branded Slingo games, the Board is confident in the future prospects of the business and looks forward to keeping its shareholders updated on progress."

My opinion - neutral. I like the growth, and the products are clearly well-established, and Slingo looks a fun game, with an impressive client list, especially in the USA. So there’s lots to like here, I completely understand why some investors are excited by the growth potential.

High gross margins mean that there’s exciting operational gearing, if growth continues to be very strong.

My problem is, it’s impossible for me to value, because I don’t know what the future growth is likely to be. Good luck to holders, it looks an interesting share.

I’ve been listening to the company’s presentation on Mello, whilst typing this. I like the combination of the calm Chairman, and the younger CEO, it works well. For anyone who missed it, worth watching on the recording.

There is something interesting with Gaming Realms, I just don’t know what it’s worth. Sorry if that is unsatisfactory!

.

Jack’s section

Water Intelligence (LON:WATR)

Share price: 838.5p (+3.52%)

Shares in issue: 15,492,443

Market cap: £129.9m

(I hold)

I’ve been looking into Water Intelligence (LON:WATR) and will actually have something more detailed out next week.

It’s a bit of an oddity and is off the radars of most investors and brokers. But this is a high Quality-Momentum small cap that has been growing very strongly, and the group’s global addressable market is vast.

WATR is a leading multinational provider of precision, minimally-invasive water leak detection and remediation solutions. It provides its corporate and franchisee plumbers with proprietary equipment that allows them to locate leaks without breaking down walls or floors.

This helps to reduce costs and enhance water conservation.

The company started as Qonnectis, but things went wrong here a decade or more ago and this prompted a reverse acquisition of American Leak Detection (ALD), which has been the core business ever since. ALD was established in 1974 and operates primarily in the United States as a blend of corporate and franchised operations but it is steadily expanding internationally.

Liquidity is an issue here: with a share price of 806p and an exchange market size of 500, only about £4k worth of stock can be reliably traded but sometimes less in practice. Aside from that, the obvious catch is relative valuation.

There’s no two ways about it: you’re paying up for this growth and you want it to continue, or even accelerate.

Thankfully for the shares, this looks like an ‘ahead of expectations’ update or (as Mr C points out) a ‘quadruple outstanding’ statement...

Highlights:

- Water Intelligence revenue +38% reaching $11.4m (1Q 2020: $8.3m),

- Implied total annualized sales to customers (franchise system sales plus direct sales from corporate locations) would surpass $140m ‘providing critical mass’,

- Both businesses (ALD and Water Intelligence International, WII) grew business across residential, commercial, and municipal customers,

- ALD revenue grew by 36% to $10.2m (1Q 2020: $7.5m),

- WII revenue grew 63% to $1.3m (1Q 2020: $0.8m),

- Water Intelligence profits before tax (PBT) adjusted for non-cash amortisation expense and share-based payments +115% to $1.78m (1Q 2020: $0.83m)

Reporting segments:

- Royalty income grew by 3% to $1.84m (1Q 2020: $1.78m), despite eight franchise reacquisitions during 2020,

- Franchise-related sales (national accounts; parts and equipment; franchise territory sales) grew 15% to $2.4m (1Q 2020: $2.1m)

- Key insurance business-to-business channel grew 19% to $2.3m (1Q 2020: $1.9m)

- Corporate location sales grew 64% to $5.9m (1Q 2020: $3.6m);

The group has had an outstanding first quarter and has built upon its consistently strong compounded annual growth (CAGR) trajectory. Revenue and PBT growth rates are an eye-catching 30%+.

Water Intelligence has been busy buying back select franchise operations and buying back its own shares this quarter. Commenting on the good performance, executive chairman and major shareholder, Dr. Patrick DeSouza said:

Once again we are reporting outstanding results. We are racing ahead as an 'essential service provider' offering valuable water-related solutions to our residential, commercial and municipal customers during this late-Covid period. As noted in a recent release, even as we move beyond Covid, we expect that market demand for our solutions will only increase as a result of the Biden Administration's American Jobs Plan and its anticipated $100 billion investment in water infrastructure.

Conclusion

These first quarter results continue the impressive 2020 trading momentum which, despite Covid, produced 17% growth in revenue to $37.9m and 78% growth in statutory profits before tax to $4.2m.

Since 2016, Water Intelligence has achieved a CAGR of 33% in terms of revenue and 53% in terms of profits before tax.

Audited results for 2020 are expected during the second half of May.

The results are very good, but we come back to the relative valuation. A forecast PE ratio of 42.5x and a forecast PEG of 5.4x. Solely in terms of price multiples, there are more attractively valued growth opportunities out there.

Are we looking at the future of global water conservation, or an expensively valued network of plumbers? It’s possibly a mixture of both, and the global opportunity for the group is promising. As is the optionality created in its hybrid corporate/franchise structure.

It could be a good ‘buy and forget’ candidate, but there’s no doubt we would be paying a premium for the privilege, and that makes for precious little margin for error. The group is putting quite a lot of capital into its International corporate store segment at the moment, and there is execution risk here.

It is notable, though, that the company has bought back shares recently, but only in small amounts. Either management understands those shares are cheap on a longer term view, or this is a poor use of capital that could be more profitably allocated elsewhere.

On the point of spending, the group says:

As our profits increase, we are committed to reinvest not only in more execution capabilities for current market capture but also in leading technologies that reinforce our brand and our growth throughout this decade. We have a strong matrix of clean water and wastewater solutions and we aim to be market leaders with respect to the world's most precious resource.

For now, momentum continues across the group’s key performance indicators as it passes the mid-point of the second quarter. Water Intelligence is scaling its operations and it could be one to watch on a longer term view.

On the other hand, in the shorter term, a lot of good performance is priced in.

Inspiration Healthcare (LON:IHC)

Share price: 116.7p (-4.73%)

Shares in issue: 68,121,447

Market cap: £79.5m

Another company, and another share price up by 50% or so over the past six months. It’s been a very strong period in the market and you can see the All Share is up by some 26.44%.

Unlike Water Intelligence, though, IHC’s valuation metrics actually compare favourably to its Healthcare equipment & supplies peers.

We’re afforded a more forgiving price multiple here.

In fact, Inspiration Healthcare (LON:IHC) qualifies for the Neglected Firms Screen. This screen compares companies to their industry peer group’s across EPS growth, PE ratio, net margin, price to book, and five-year returns on equity.

IHC is a global supplier of medical equipment with a range of products for neonatal intensive care and patient warming. The group provides customer service and technical support around these products and supports the work done ‘to save and improve the lives of some of the world’s most fragile patients.’

Highlights:

- Group Revenue up to £37m (FY2020: £17.8m) including 'one time' Covid-19 related orders and contribution from SLE Limited,

- Adjusted Operating Profit up to £4.3m (FY2020: £1.5m),

- Net cash position up to £10.7m (FY2020: £4.5m)

- Gross Margin up to 48.7% (FY2020: 48.2%)

Adjusted operating profit excludes £579k of acquisition expenses and a £435k final settlement of contingent consideration.

On 7 July 2020 the group acquired the entire issued share capital of SLE, which is a leader in the design and manufacture of ventilators and capital equipment for neonatal intensive care, treating premature and sick babies.

It looks like this was a good opportunity for funds to initiate or increase stakes.

The year-on-year adjusted operating profit increase is primarily due to the increase in underlying revenue plus contributions from Viomedex, SLE and the 'one off' Covid-19 related revenue; offset in part by increased administrative expenses.

Shares are down on this in line update.

It’s better to journey than to arrive, as they say, and another phrase: the markets are forward-looking. So perhaps investors are getting off this train and entering the overheated reflation trade.

Conclusion

It’s an in line statement with revenue for the year up 108% and adjusted EBITDA up 150%. That looks attractive, but the share price has already rerated.

It’s a bull market and today’s drop might just be profit taking from shorter term holders who have found them with a very respectable six-month performance.

I’m more interested in whether or not this could be a long term investment and on that note it looks potentially of interest given the markets it operates in and the revenue growth over the years.

Returns on equity have been falling though, so there are questions around whether this growth is actually particularly profitable.

On that note, net profits have been small but they are forecast to pick up so it could be worth digging into the investment case a little more.

Diluted earnings per share of 5.07p, up considerably from 2.15p and underlying diluted EPS of 6.89p (vs. 2020 of 3.62p), values IHC at 16.7x FY21 underlying diluted earnings. Not bad, but it looks like the group has had a bit of a Covid windfall, which may explain the share price fall this morning.

Inspiration announced its first NHS Covid orders in March 2020, and delivered £7.3m of equipment to the NHS over the period.

That’s about 20% of the revenue figure that, presumably, will not be repeated. If you deduct 20% from the underlying EPS that would make for underlying EPS of 5.5p and an adjusted FY21 PE ratio 21.2x.

If there’s a really good longer term opportunity then that could be a decent entry point, but I’m slightly skeptical given the group’s historic lack of net profit growth. Barring this year’s Covid affected results, why haven’t net profits grown in line with revenue?

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.