Good morning, it's Paul here!

Please see the header above, for the companies I intend writing about today.

I might do a preamble later, about the US markets recovering. Or possibly tomorrow, we'll see.

Last night's TV programme which attempted to demonise Vice Chancellors at Universities struck me as being a damp squib. Yes, some of them are probably overpaid, but comparing salaries with that of the Prime Minister is complete nonsense, and lazy journalism. Directors of listed companies deserve far more scrutiny over their bloated remuneration, and would have made a much better TV show.

As for the so-called scandal of the university heads' expense accounts, I was scratching my head to understand what the problem is? They have to travel abroad for various reasons, and flying business class on a long haul flight, and staying in a 5 star hotel, seems perfectly reasonable to me, given that these are the heads of quite big organisations. The grand total from almost 200 universities, was £8m p.a. spend - completely immaterial relative to the further education budget.

I've heard stories of horrendous greed on expense accounts at listed companies, even very small ones. It's quite common for company Directors to use their expense accounts freely, to fund really lavish overseas trips, with first class travel, and all the trimmings. Often on a largely spurious pretext. What a pity we shareholders can't file Freedom of Information requests on the expense accounts of listed company Directors. If we could, I bet we'd discover some real horrors, not the spurious horrors that last night's TV programme presented. It's always worth asking Directors what class they fly, and watch them squirm!

Another disappointment, was that all the students who were asked for a reaction simply provided the faux outrage that they realised they were expected to give. Not a single one gave the correct answer - which is that they would need more information and context to form an informed judgement on whether the cost of an overseas trip by the Vice Chancellor was justified.

Although maybe such replies ended up on the floor of the editing suite? Years ago, I took part in 2 documentaries, and discovered that TV really is all down to the edit. If they like you, then the TV people will edit your pieces sympathetically. If they're trying to demonise you, then the whole thing is edited to stitch you up, complete with ominous-sounding continuous low note dubbed over the audio, to indicate that you're bad! Such programmes start with a pre-determined conclusion on who is good, and who is bad. The clips are then edited to suit that narrative.

I thought Universities were supposed to teach people to think, and to question everything? Sadly, I suspect that might be disappearing, being replaced by mindless group-think, in many areas.

Right, on to the small caps news!

Johnson Service (LON:JSG)

Share price: 136.7p (up 0.4% today)

No. shares: 366.5m

Market cap: £501.0m

Preliminary results - for the year ended 31 Dec 2017.

This group was originally a dry cleaners (disposed of in Jan 2017), but has morphed into a UK textiles services group, through a series of acquisitions. This is taken from its website (as a description wasn't given in today's results statement);

Headquartered in Preston Brook, Cheshire, we provide textile rental and related services across a range of sectors throughout the UK. We are the leading supplier of work wear and protective wear in the UK, offering these services through the Apparelmaster brand. We also provide premium linen services for the hotel, catering and hospitality markets, and high volume hotel linen services, through the Stalbridge, London Linen, Bourne, Afonwen, PLS and StarCounty brands.

Our ability to clean, maintain and care for textiles means that we are fundamental to the everyday operations of our clients. We take pride in our work and believe in quality, reliability and a personal approach in everything we do. After all, first impressions are lasting impressions.

Note that the financial highlights are for continuing operations - i.e. excluding the disposal of the dry cleaning business. This makes complete sense to me. Also, I've had a quick look at note 5, which shows the calculations used in arriving at adjusted profit. This is always worth checking, as some companies abuse adjustments to artificially inflate profit. In this case, the adjustments look fine to me, with the main adjustment being to reverse the book entry for amortisation of intangibles relating to acquisitions. So I'm happy to value the company on its adjusted figures.

We already know that JSG has been buying in growth, through acquisitions. If in doubt though, this can be checked by having a look at the balance sheet, and seeing if goodwill & other intangibles (as they're sometimes called other things now) are large, and increasing, which they are here.

I often search the RNS for keywords too, so pressing CTRL+F and then searching for "organic" and "acquisition" is a useful shortcut. The "organic" search brought up this phrase in the narrative (which I usually don't have time to read in full);

Strong financial performance reflects organic revenue growth of 5.1% 3 and successful delivery of earnings from acquisitions

Organic revenue growth of 5.1% sounds pretty good to me, assuming that margins are static.

Given that more acquisitions have been made, I'm surprised that net debt actually reduced from £98.2m to £91.3m. This suggests that either the acquisitions were smaller than profits, and/or that more equity was raised. I see from the StockReport here that the average number of shares in issue increased every year from 2012 to 2017. So it looks as if the company is at least part-funding acquisitions through fresh equity funding. That's fine, it's a good reason to have your shares listed on the stock market. Although this means that to properly assess growth, we should be focusing mainly on earnings per share, not the total profits.

Also net debt becomes more important to consider at acquisitive companies. Quite often we see acquisitive groups take on too much debt, and then run into serious trouble once the next recession kicks in, and earnings collapse. For this reason, I'll look at JSG's balance sheet first, as the most important consideration.

Balance sheet - I'll focus on my usual, simple measures;

NAV is £167.6m

As you would expect, intangibles are high, due to multiple acquisitions, at £120.3m goodwill and £43.5m intangible assets, totalling £163.8m. Deduct that from NAV, and we arrive at;

NTAV of £3.8m - that's a very slim net asset base for a group with lots of equipment and rental assets. This suggests that the group relies on bank debt to fund its operations, something I'm not at all keen on.

Borrowings (i.e. interest-bearing bank debt usually) is shown as £14.5m in current liabilities, plus £82.1m in long-term liabilities, giving total gross debt of £96.6m. There's a scrap of cash, at £5.3m, so net debt was £91.3m at 31 Dec 2017. Remember that, as with all companies, this is just a snapshot on one day. So companies nearly always have a push to collect in receivables just before the year end date, to present a favourable year end net debt balance. Often, the figures at other times during the year can be worse. So I tend to view the balance sheet net debt as probably showing a favourable picture.

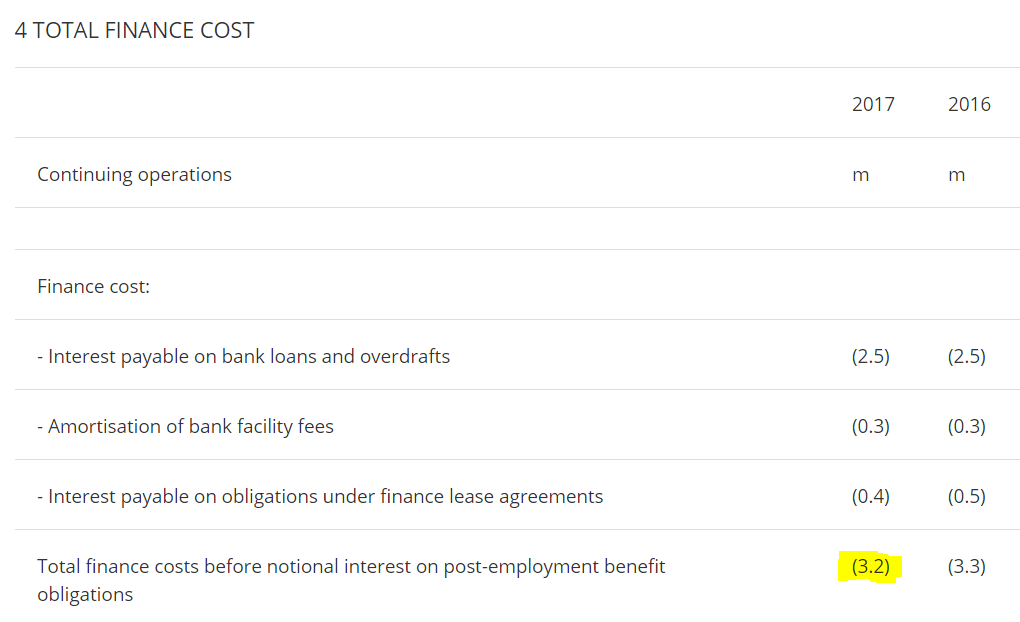

We can sense-check year end net debt levels by comparing them with the interest charge on the P&L. In this case, note 4 shows us this;

A year's interest cost of £3.2m looks quite reasonable on gross debt of £96.6m. Therefore this gives me comfort that the year end net debt figure probably hasn't been window-dressed in this case.

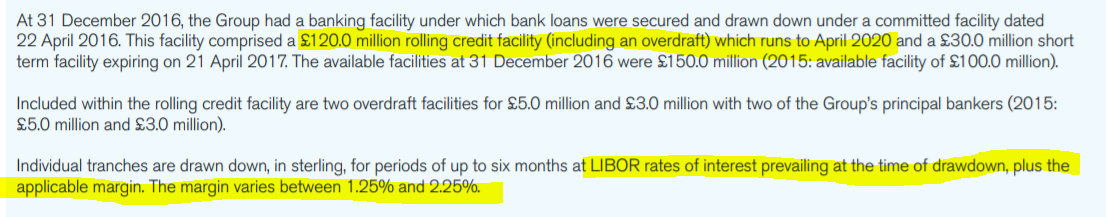

I've had a quick look at the 2016 Annual Report, to check the terms of the bank borrowings, and it looks well-managed. The group seems to be well within its facilities limit of £150m (that might have changed since 31 Dec 2016, but I'm just trying to get a rough idea of whether debt looks under control, or might be problematic);

(extracted from note 20 of 2016 Annual Report)

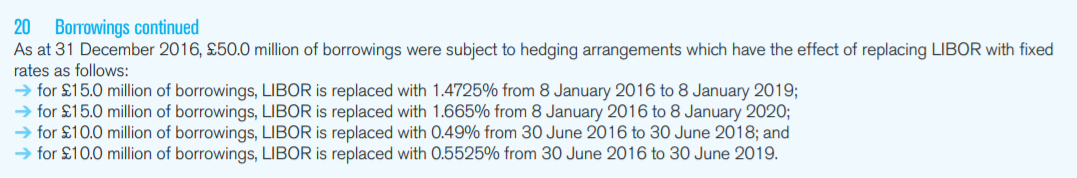

Also, I see that the company has taken out interest rate swaps, to lock in a low, fixed rate of interest. This looks a smart move, although the expiry dates are quite soon (although these may have been extended since 31 Dec 2016);

Anyway, I've seen enough to suggest that the average net debt throughout the year looks consistent with the year-end balance. That some debt is at fixed rates, via the interest rate swaps, is reassuring.

My main problem with the debt, is that it could become a serious burden when the next recession strikes.

Overall then, the weak balance sheet, and reliance on bank debt, for me are deal-breakers, hence I'm not interested in investing here. Those things are not a problem right now, everything looks fine. I just worry about this structure perhaps not being resilient enough in an economic downturn.

Hospitality sector - as anyone who reads sector specialist Langton Capital's utterly brilliant free daily emails will already know, it's absolute carnage in the casual dining sector. There's serious over-capacity, and numerous cost headwinds. So the weaker players (such as Jamie Oliver's rubbish, over-priced offerings) are going bust. Many PE-backed chains expanded too fast, taking on rent + rates that were far too high. Wages costs are increasing, and there's a serious shortage of decent chefs around.

Therefore, my worry is that the only solution is a multi-year contraction of the casual dining sector, through a painful process of survival of the fittest. We've seen that happen with pubs, and nightclubs, over the last 10 years, where capacity has shrunk substantially - thus creating opportunities for the remaining operators.

Consumers are the winners, as discounted dining offers now abound, but many weaker operators will be going bust. That's bound to have some negative impact on JSG. Although I appreciate they serve other sectors too. It's not just potential lost business, but also the balance sheet hits from (probably) lots of small bad debts. For this reason, I would be sceptical about JSG being able to continue generating 5% organic growth.

Valuation - the 2017 adjusted EPS is 8.7p (up 14.5% on 2016), which works out at a PER of 15.7, which seems a punchy rating, given that the business is carrying a fair bit of debt. Stockopedia is showing broker consensus of 8.6p for 2017, so the outcome seems to be slightly above expectations, which is pleasing. I always like companies which keep a little bit tucked away, so that forecasts are beaten.

2018 forecasts - broker consensus of 8.65p is flat against 2017 actuals - so nothing exciting in the pipeline, based on current broker views.

Outlook - sounds reasonably upbeat;

The Group's performance since the year end has been in line with management expectations and with strong new business sales, existing strong cash flows and an established strategy, we remain confident in the year ahead.

So maybe my fears of a hospitality sector slowdown are overblown? Time will tell.

My opinion - probably already covered in the sections above. It looks quite a good collection of businesses, which make a decent profit margin. I imagine in this sector that most revenues would be recurring, which is another positive. The group seems to have established a good track record of making sensible acquisitions.

On the downside, I imagine that this business would be cyclical, hence vulnerable to an economic downturn. Combine that with a balance sheet that's weak on a NTAV basis, and has a fair bit of bank debt, and it's not something I'd particularly want to own.

The 3-year chart below is starting to look a bit tired, after a good run. Has the trend changed? Possibly - it looks to be at a key level, where the key moving averages seem to be changing direction. I only mention that because some market participants are using Minervini-style chart techniques, and momentum trading, to time their exit from the chart. So those sellers could create a headwind to the share price going any higher. Overall, I think there are probably better opportunities out there. How did this section get so long, it was only meant to be brief!

Swallowfield (LON:SWL)

Share price: 342.5p (up 6.2% today at 12:02)

No. shares: 16.87m

Market cap: £57.8m

(at the time of writing, I hold a long position in this share)

Swallowfield plc, a market leader in the development, formulation, and supply of personal care and beauty products, including its own portfolio of brands, announces its interim results for the 28 weeks ended 6 January 2018

The market seems to like these results, with the share price up 6.2% at the time of writing.

Acquisition - there's a separate RNS today, which might have helped move the share price up. Swallowfield is acquiring a brand called "Fish", which sells hair styling products for men. Personally, to avoid cluttering up my bathroom with products, I tend to put shaving gel in my hair when it becomes unkempt, and just pray that it doesn't rain, potentially turning my head into a menthol, foamy mess.

The terms are £2.7m cash up-front, with a potential £0.3m 12-month earn-out (doesn't seem much). This buys a brand with revenues of £1.7m in calendar 2017, generating £0.4m EBITDA. It's being financed with a new term loan. The rationale is to increase distribution of Fish, and to introduce new products.

Interim results - revenue is up marginally, at £40.0m (H1 2016: £39.7m), but an improved product mix more towards own-branded products means that underlying operating profit rose 10.7% to £3.4m - not too shabby.

Net debt - rose 27% to £7.0m, due to a £1.85m deferred consideration payment for a previous acquisition. This is a good point actually - that we should check balance sheets for what other liabilities are in the pipeline. It's easy to overlook things like that.

With another £2.7m debt relating to Fish, post period end, then net debt is probably now knocking on the door of £10m. I think that's starting to look a bit too high, so hopefully the company might concentrate on paying down some debt in 2018 and beyond.

Balance sheet - NAV is £24.4m.

Take off intangibles of £9.0m, and we have NTAV of £15.4m - that looks reasonable, for the size of company.

Inventories & receivables look fine to me, for a business with £74m revenues last year.

Working capital looks fine, with current assets of £31.4m and current liabilities of £22.6m, giving a surplus of £8.8m, and a current ratio of 1.39 - which is reasonably healthy (I generally like to see over 1.3 for this type of company).

Note that there is a £5.7m pension deficit, which has usefully reduced from £8.7m a year ago. So not a particular worry, although we should chip off a bit from the PER to allow for this long-term liability. It sounds modest, in terms of cash outflow;

The deficit reduction payment will continue to be 108k per annum for the current year. Whilst contributions are likely to increase next year, any increase is expected to be offset in part by the reduction in the PPF levy.

The net debt is really financing the fixed assets - property, plant & equipment is £11.5m. I have to check if that includes any freehold property - hoorah, yes it does! The 2016 Annual Report (note 12) shows £4.8m of freehold property. That gives me much more comfort that the bank debt is not excessive after all.

Note that plant & machinery looks old - the original cost was £24.1m, with £19.0m accumulated depreciation, giving net book value of £5.1m. So it would be worth querying with management whether there is a large need for replacement capex in future? I might be on to something here, as the company today says;

Capital expenditure was 1.1m which was 0.4m above depreciation. We expect capital expenditure to be higher than depreciation in this financial year as we have made a number of investments to improve line efficiencies and support incremental new customer contracts which will positively impact the second-half and beyond.

Outlook - this snippet is buried in the main narrative, and sounds encouraging;

We are very pleased that during the period a number of significant new contracts and product launches have been confirmed and we have either commenced production or received purchase orders in the weeks since the period end.

The Board is pleased to report that trading since the end of the reporting period has been in line with expectations.

We expect the positive momentum seen in our owned brands business to continue, albeit without the boost from Christmas gifting experienced in the first half. Further new product launches and retail distribution gains have been secured in the UK and internationally which will contribute to growth in the second half and into the next financial year. The earnings enhancing acquisition of the 'Fish' brand will add further to this momentum,

In our manufacturing business, the second half will see the start-up of production on a number of significant new contract wins which will contribute positively to the second half of this year and next.

We are seeing upward pressure on material and operational costs but have put in place a range of projects to mitigate. This combined with strong trading momentum, leaves us well placed to achieve planned profits for the full year.

That reads to me as if there are more positives than negatives.

CEO change - seems to be planned, and not acrimonious.

The new CEO, Tim Perman, seems to have a lot of relevant experience;

Tim will be appointed Chief Executive Officer with effect from 1 July 2018. He is currently Group Category & Brand Director and Divisional Director, Global Beauty at PZ Cussons and has more than 30 years' experience in the consumer products industry. Previously, he has held senior leadership roles at Seven Seas Healthcare, Campbells Grocery Products and Bristol Myers Squibb. Tim will join the business on 2 May 2018 and work for 2 months alongside Chris to affect a smooth transition.

I very much like the 2-month handover period too.

Valuation - from the above, it sounds as if we can be comfortable with this year's forecasts, or possibly even hope for a beat?

The house broker has put out a 1-page update, available on Research Tree. It's increasing 6/2019 EPS to 28.7p, so that's a forward PER of 11.9 - which strikes me as good value, for a business than seems to be humming along nicely.

My opinion - I like it. The numbers are pretty good, and the outlook comments seem buoyant. There's a modest dividend yield of about 2%. My initial balance sheet worries were extinguished when I saw that it owns freehold property, and has a healthy working capital position. The pension deficit isn't a big problem.

For me, this is a relatively small position in my portfolio, which I hold on a tuck away and forget basis. Providing the updates continue to be positive, then I'm happy to run with it, and see where we get to over the next few years. The valuation seems modest, and the news is positive - that's usually a pretty good combination!

Looking at the chart below, it's remarkable how similar lots of smaller caps charts are looking at the moment - with a relentless rise, peaking in the summer, then seemingly topping out since then, with a failed attempt to reach a new high in the autumn. Again, as with the almost identical chart above for JSG, the moving averages look to be peaking, or starting to decline. So there's no denying that future gains may be harder to come by, than in 2016-17, when you could buy pretty much any half-decent company and the shares would go up. I think those days of easy pickings might be over now, so fundamentals once again matter now.

dotDigital (LON:DOTD)

Share price: 85.9p (down 9.6%, at 14:10)

No. shares: 295.8m

Market cap: £254.1m

dotdigital Group plc (AIM: DOTD), a leading omnichannel marketing automation platform, announces its Interim Results for the six months ended 31 December 2017 ("H1 2018"). The results reported here represent strong progress towards the Company's strategic pillars of geographic expansion, strong partnerships and product innovation.

I see that a bit of PR found its way into the company description there! The market doesn't seem to agree with the "strong progress" message, with DOTD's share price currently down almost 10% today.

A few key numbers, remember this just for a half year;

Organic revenue up 17% to £17.5m (total revenue up 25% to £18.8m, which includes a part-year contribution from an acquisition called Comapi)

Last year, the interim results highlights section showed, as the second item, this;

Profit before tax up 30% to £4.3m from £3.3m

This year, PBT has been dropped, and replaced by this;

Group adjusted EBITDA grew 8% to £5.7m from £5.3m in H1 2017

My initial thoughts were suspicion that the change in highlighted item might be due to a deterioration in PBT. However, once exceptional costs are ignored, PBT rose 6.2% to £4,547k - not that much different from the +8% EBITDA figure in the highlights.

As a reader points out below in the comments, this is not an impressive rate of profit growth, compared with what the company has achieved before. However, does that actually matter? If the company is spending now, on product improvements that could propel the next surge in future growth, then it could be argued that that's money well spent. Focusing on short term profits now, might harm the longer term growth, or worse still that a big market opportunity could be lost altogether to a competitor, if companies are too cautious to spend when they need to. This is the big problem with growth companies being listed on the stock market, and judged on short term profits. Arguably growth companies like DOTD are possibly better off in private ownership, where more risks can be taken, and short term profits don't matter.

I do wish software companies would stop quoting EBITDA, as it's completely meaningless - due to it ignoring development spend altogether - both the capex, and the amortisation charge are not present in EBITDA numbers. For software companies, that can mean that a decent chunk of the payroll cost is not accounted for at all.

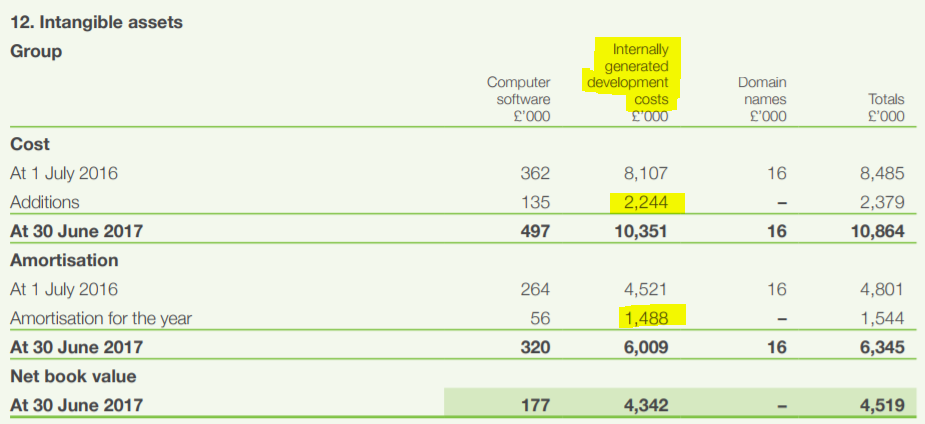

Development spend - talking of which, DOTD seems to have a growing appetite to capitalise development spend. Looking back to the 2016/17 Annual Report, note 12 (see below) shows that £2,244k of internally generated development costs were capitalised last year. This is £756k more than the £1,488k amortisation charge which went through the P&L.

There's nothing wrong with this, I am just pointing out that last year's reported profit was boosted by £756k compared with if all development spend had been written off as incurred. I like to adjust accounts to this more prudent basis, but other people may be perfectly happy with the company's basis of reporting, which is fine.

The reason I take a more prudent view on development spending, is because software companies have to run to stand still. They can't just switch off development spending, or the company would wither and die. So I see development spending as just a normal day-to-day cost of running the business, hence I don't particularly like to see it capitalised.

Looking at today's interim results, the cashflow statement shows £1,718k of "purchase of intangible fixed assets", which as we can see above from last year's figures, is overwhelmingly internal costs which are parked on the balance sheet. That's a sharp increase on the £964k in H1 last year.

I just want to flag up this point, and then readers can regard it however you wish. It's clear from the narrative today that there is plenty going on with product development - integrating with major partner companies like Shopify, Magento, Microsoft, etc. That could open up potentially much bigger market opportunities for DOTD. So to my non-expert eye, there does seem to be interesting potential here.

Outlook - given that pre-exceptional PBT is only up 6% against H1 last year, I'm a bit surprised that the Directors are sounding confident for the full year;

Based on dotdigital's strong performance during H1 2018 and the continued demand for our core product solutions we have seen at the beginning of the second half, the Board remains confident in its expectations for the full year.

Corporation Tax - I've just spotted that the tax charge of £356k in H1 this year is a good bit lower than the £627k charge a year ago. That's why the 6% rise in PBT translates into a 14% rise in EPS.

Forecast - the house broker note this morning (available on Research Tree) maintains full year adjusted EPS of 3.0p, which is in line with consensus. That would be a 26% growth rate against last year, well above the 14% rise in H1. So it looks as if the full year forecasts could be a challenge to meet.

The share price of 85.9p gives a PER of 28.6 times, which does look rich on a conventional view.

Balance sheet - still very strong, even after the company spending half its cash pile on the acquisition mentioned above. No issues here at all, with £10.5m net cash remaining, and a nicely cash generative business.

My opinion - this share looks expensive, for an arguably not particularly strong H1.

However, I can't help feeling that its product development might lead to bigger things in future, particularly being integrated into very popular eCommerce software from Shopify & Magento. If there was significant take-up of DOTD's products through those new channels, then the upside could be very exciting.

It's my job to just review the numbers, and give an initial impression. To form a more expert view would I think need a lot more work, to appraise DOTD's software, judge it against competitors, find out what users think, and assess the likelihood of sales (and hence profits) really taking off in future. I certainly wouldn't bet against this company, as it's produced excellent results to date.

You only have to look at the valuation of $SHOP for example - currently valued at £11bn (at a share price of $137), rated at a 2018 PER of 1,212, falling to 258 times forecast 2019 numbers. When sales really start to explode upwards, then PER goes out of the window. I wonder if DOTD might end up getting a little slice of that sort of action? It's possible. How likely, I don't know.

EDIT - a friend has just pointed out that DOTD could suffer some impact from the new GDPR regulations, due to kick in this May. This requires people on email lists to confirm that they want to remain on each email list. This could (and hopefully will!) decimate many email lists, which are mostly spam.

Personally I despise email, as it takes up so many hours of each day. Some of it is necessary, but it's infuriating the way any business I buy something from, puts me on to their email (spam mostly) list without my specific consent. Therefore I have to unsubscribe from several email lists every day. Spam clutters up my inbox so much, that often important emails are submerged in garbage emails. So I welcome the GDPR rules.

How is this going to impact DOTD though? If email becomes a much more difficult marketing route for them to use, then surely the revenues & growth are likely to decline? On the other hand, I note that DOTD is becoming omni-channel (groan!! Another buzzword), and is integrating messaging, social media, etc, into its offering.

So I'm not quite sure where this leaves DOTD? Do any readers have thoughts on this? I'm definitely less bullish on DOTD after taking into account this factor.

I have to wrap this up now, so just 2 very quick comments on a couple of micro caps, both of which I own;

Image Scan Holdings (LON:IGE) - (I hold a long position in this share) - the market cap here has dropped back below our usual £10m lower level, after a big surge in price in the autumn. A series of positive updates got everyone (including me!) excited, which boosted the share price to allow a big holder to exit in a secondary placing at 8p. Then bad news came out, of a large order being cancelled. How unfortunate.

There's a fair bit of detail in today's update, which sounds generally positive. This bit sums it up, and doesn't seem too bad, considering the large cancelled order;

The business is trading in line with revised market expectations. As noted in the Company's trading update on 1 February 2018, FY18 sales are expected to be weighted towards the second half. Whilst the Company expects to remain profitable over the full financial year, due to the weighting of sales, the Board expects to report a small loss in the first half.

I don't normally like H2-weighting. A small H1 loss isn't too bad, I can live with that.

It will take some time for the company to rebuild investor trust.

Crimson Tide (LON:TIDE) - (I hold a long position in this company) - a tiny, but profitable mobile IT company. 2017 trading update;

- Revenues up 23% to £2.3m

- Higher gross margin

- Headcount has doubled in 18 months

- Launching IoT sensor-based product in Q1 2018

- Making first in-roads into NHS

- Strong pipeline & demand

- 2018 revenues likely to show similar growth (23%) to 2017, then to accelerate in 2019 & beyond (sounds interesting)

- Recycling profits into growth (marketing & sales), so profits likely to be static at c.£0.4m

- Directors optimistic, "tremendous upside" from IoT module.

My opinion - I have a little scrap of these in my portfolio, and see it as potentially interesting, with a long-term view. Today's announcement is enough to keep me interested.

Got to dash! See you tomorrow.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.