Good morning! It's Graham and Roland here with today's report.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or

serious problems, so anyone looking at the share needs to be aware of

the high risk.

Summaries

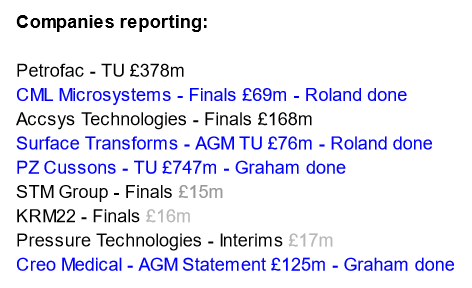

Surface Transforms (LON:SCE) - 31p (pre market) (£76m) - AGM TU - Roland - AMBER

Production issues are gradually receding at this manufacturer of high-performance carbon brake discs, but H1 revenue appears to be a little behind expectations. This still looks speculative to me, but I’m encouraged by the quality of recent boardroom hires.

PZ Cussons (LON:PZC) - down 4% to 167.6p (£719m) - FY update - Graham - AMBER

This update for FY 2023 looks weak in terms of revenue but the company also faces a significant currency headwind to performance for FY 2024, following a devaluation in Nigeria. I like this company but as an investment I think there are superior alternatives.

Creo Medical (LON:CREO) - up 1% to 36p (£126m) - AGM Statement - Graham - RED

This company issues a bullish AGM statement and announces a succession plan for the Chair. Regardless of the value of their technology, they only seem to have a modest chance of getting to profitability without raising more cash. I therefore give it the thumbs down.

CML Microsystems (LON:CML) - up 4% to 464p (£71m) - FY results - Roland - AMBER

This well-established semiconductor design group delivered strong revenue growth last year and has a cash-laden balance sheet. But while profits rose sharply, returns on capital remained very low. On balance, I think the shares are up with events.

Graham's section

PZ Cussons (LON:PZC)

- Share price: 167.6p (-4%)

- Market cap: £719m

Let’s get up to speed with the latest news for this owner of brands including Carex, Imperial Leather and St Tropez. The company has issued a trading statement for FY May 2023.

Key points:

Like-for-like revenue growth of 6.7% in Q4, 6.1% in the full financial year.

Full-year revenue £655m (N.B. this is below the estimate I can see on the StockReport of £669m).

Adjusted PBT at least £70m.

Nigeria

As of FY 2022, PZC generated over a third of its revenues from Africa, with Nigeria being the key location.

Today’s update includes a major section devoted to foreign exchange policy in Nigeria, following a 36% devaluation of the Nigerian currency (“NGN”) earlier this month. About a third of PZC’s revenues are denominated in NGN.

The devaluation will not affect FY May 2023 results. Unfortunately, I think it does mean that the FY May 2023 results are unreliable, as they use the previous exchange rates.

The rates used in PZC’s results are between 536 and 577 NGN to the US dollar, whereas the new rate is a far weaker 750 NGN to the dollar.

It’s a devaluation in the region of 30%. PZC say that every 10% reduction in the value of this currency hits adjusted operating profits to the tune of about £3 million, and reduces the cash balance by £20m.

The company reported a total cash balance (in all currencies) of £196m as of December 2022. A very large chunk of their current cash balance must be in the form of NGN.

I would also note that as of December 2022, their cash balance was offset by £232m of non-current borrowings, so they did have a net debt position.

More positively, they say their Nigerian business has recovered from an operating loss in FY 2020 to a positive operating margin of more than 10% in FY 2023, and they consider themselves well-placed “to withstand any macro-economic volatility”.

CEO comment:

While the Naira devaluation will have a one-off impact to the Group's near-term reported financial performance, we believe the medium to long term prospects for our Nigerian business will be much improved by the economic reforms, currently being introduced by the new government, the likes of which have not been seen for decades.

More widely, PZ Cussons has delivered another year of progress against a challenging economic backdrop. We have continued to transform the business and build brands for the long term, while responding to the day-to-day challenges of cost inflation and meeting the needs of the cost-conscious shopper. This has resulted in a third consecutive year of like for like revenue growth in FY23.

Graham’s view

I have read comments online suggesting that the new NGN exchange rate is now about right, or even undervalues the currency, compared to the previous rate.

That would be good news, as it would undermine the black market and allow legitimate businesses such as PZC to trade the currency at fair prices.

However, my understanding is that the currency remains tightly controlled, so there is nothing to stop a disparity between the official rate and unofficial rates from materialising again.

I wrote previously that I was between Green and Amber on this stock. Today, after reading about these difficulties in Nigeria, I’m going to sit firmly within the Amber (or neutral) camp.

I want to like it, as the brands strike me as being fundamentally sound, but like-for-like revenue growth remains slightly too pedestrian for my taste, especially considering the inflationary environment.

Additionally, the risks in Nigeria are perhaps bigger than I previously understood. And the balance sheet is not exactly overflowing with riches.

The stock isn’t expensive according to the metrics and as a long-term hold it may have some merit. But I suspect that investors can find better options than this, particularly in the branded consumer goods sector.

Creo Medical (LON:CREO)

- Share price: 36p (+1%)

- Market cap: £126m

We have an AGM statement from the Chair of this medical devices company.

Excerpt:

"Creo Medical continues its evolution from UK medical device innovator into an international group focused on the clinical and commercial adoption of a full suite of electrosurgical products. Having reported revenues in 2022 of in excess of £27m, we continue to experience growing demand for both our core technology and our complementary range of endotherapy devices."

As noted by Paul, this company raised £34m in March at 20p per share, so it has been a pleasant few months for shareholders since then.

Funds are being used “to enable world-leading clinicians to develop new ways to treat a growing number of indications with our devices and technology with the intention of driving the business through to cash flow break even, and, ultimately, profitability”.

Later in the statement, the Chair announces a succession plan for himself::

I have agreed with my fellow directors that we should seek to recruit an experienced international medtech executive as an additional independent non-executive director who would be suitable to succeed me as Chair and for those changes to take effect no later than the 2024 annual general meeting of shareholders.

Graham’s view

Creo clearly believes that it needs new Board leadership for the next stage of its growth. Fair enough if that’s what it wants.

The bigger issue here is that adjusted pre-tax losses are forecast to come in at £24m for the current year, and £15m for 2024. I don’t think we have forecasts for 2025 yet, but they would have little predictive value anyway.

According to an analyst note published last week, “we estimate the company is funded to operational profitability into H1 2026”.

However, it looks very tight to me. The company had cash of £13m at the end of 2022. It then raised £33.7m (gross) with net proceeds of I believe c. £32m. So that’s about £45m in total cash resources.

With the official forecasts suggesting £39m of adjusted pre-tax losses across 2023 and 2024, and with those forecasts most likely being on the optimistic side, and with more losses likely in 2025, the cash runway here does not look long enough for comfort. I therefore have no choice but to give this share the thumbs down.

Roland's section

Surface Transforms (LON:SCE)

- 31p (pre-market)

- Market cap: £76m

- AGM Trading Statement

I last commented on this manufacturer of high-performance car brake discs in April, when I speculated that problems ramping up production might still leave the business short of cash. Today’s AGM statement reports that manufacturing output has improved, but still hasn’t reached target levels.

Sales for the half year to 30 June are expected to be £3.3m (H1 2022: £2.9m). However, the volume of production discs manufactured during the period has increased by more than 80%, reflecting production improvements.

According to a note from broker Zeus this morning (available on Research Tree), this level of revenue is below their analysts’ H1 forecast of £5m.

However, the company has reiterated its guidance for 2023 and 2024 and broker FinnCap has also left full-year forecasts unchanged.

The company says it lacks the capacity to make up for disruptions to production but is continuing to add capacity. By the end of this year, management expects to have surplus capacity over current demand.

Separately, I notice Surface Transforms has just hired a very experienced-sounding new CFO from James Cropper (LON:CRPR) and a new COO with carbon fibre manufacturing experience. I’ll be interested to see if these appointments prompt any changes over the coming weeks.

I think Surface Transforms is a good example of a recurring issue that growth investors sometimes overlook – rapidly ramping up to commercial levels of production can be very difficult, even when you have contracts in the bag and a good product.

Roland's view: This business is still a little too speculative for me and I continue to think there’s a risk cash could run short -- there's no update in today's statement on cash levels.

However, I think there’s a credible story here and am impressed by the apparent quality of recent boardroom appointments. If the company can deliver on 2023 and 2024 guidance, the shares might not be too expensive at current levels. I’ll be watching progress with interest and have tentatively gone to amber on this one.

CML Microsystems (LON:CML)

- Share price: 446p

- Market cap: £69m

Full-year results y/e 31 March 2023

"This has been a strong performance for CML with trading for the period ahead of initial expectations.”

Today’s results cover the year to 31 March and appear to show solid growth in revenue and profits. Cash remains a dominant feature of the balance sheet, providing significant downside protection.

This AIM-listed semiconductor design group operates in areas such as microwave communications and RF technology.

CML has been listed on the London markets since 1986 and appears to have been a solid investment over the last 20 years, at least for investors who’ve caught the periodic lows:

Let’s take a look at today’s results.

Financial highlights: profits for last year were boosted by a £2.1m profit from the sale of surplus property owned by the group. To provide a clearer view of the performance of the operating business, I’ve stripped property profits out of the results below:

Revenue up 22% to £20.6m

Operating profit up 142% to £2.93m

Pre-tax profit up 77% to £3.2m

Earnings per share up 161% to 19.2p

Full-year dividend up 22% to 11p per share

Net cash of £22.3m (FY22: £25.0m)

CML’s profitability increased dramatically last year, with the group’s operating margin doubling from 7% to 14% – the highest since 2017:

This increase in margins appears to be the result of operating leverage – a feature of businesses with high fixed costs and low variable costs.

In this example, we can see CML’s staffing and overhead costs only rose by 9% last year, whereas revenue rose by 22%. With gross margin unchanged at 75%, much of the extra revenue dropped through to the bottom line, providing a big boost to profits.

This is nice to see, but I still have some concerns about the profitability of this business. Even if we include the property gain, CML only generated a return on capital employed of 8.8% last year. Excluding property, my sums suggest ROCE was just 5.2%.

I think that one reason for this is that CML appears to capitalise quite a lot of its development expenditure onto its balance sheet. This means that associated costs, such as staffing, may not be fully reflected in operating expenses.

Today’s balance sheet shows £13.8m of development costs listed under non-current assets, up from £11.2m last year:

Scrolling down to the cash flow statement, we can see the amortisation and cash costs associated with these assets:

Amortisation of development costs: £1.8m (FY22: £1.5m)

Investment in development costs (i.e. cash expenditure): £4.5m (FY22: £3.5m)

Capitalising development expenditure in this way is perfectly legitimate when the products being developed are expected to deliver commercial revenue over a number of years.

But this approach can also flatter reported profits. Last year’s amortisation charge of £1.8m was subtracted from reported profits, but the £4.5m “investment in development costs” will have been excluded from operating costs.

The effect of this is that CML’s operating profit last year was £2.7m higher (£4.5m - £1.8m) than it would have been if the company had expensed all of its development costs in the year they occurred.

As always, I think free cash flow tells the real story. Looking at today’s accounts, I estimate underlying free cash flow (excluding property and acquisitions) of just £182k, compared to a reported net profit of £3.1m before property gains.

Looking at these numbers, I think it’s reasonable to argue that CML’s low returns on capital employed may provide a more accurate reflection of the group’s true profitability than its operating margin.

In fairness, another reason for low ROCE is the £22m cash balance, which represents about one-third of total assets. My sums suggest that reducing net cash to £5m would increase ROCE by about 2%.

Trading commentary: CEO (and 8% shareholder) Chris Gurry reports “broad based” revenue growth last year across “resilient end-markets”.

Seven new products were released and the company entered the broadcast sector with a low-power DRM receiver solution (a digital radio product).

The company says it invested 25% of revenue into research and development last year, reflecting my comments above.

The acquisition of US firm Microwave Technology, Inc. for $18m that was announced in January remains underway, subject to certain approvals.

Further property disposals are planned, with another £2m sale expected this year.

Outlook: the company says its confident the current strategy will “yield the sustainable long-term growth we are looking to achieve”.

Expansion into the microwave sector is now said to be delivering “tangible results”, with good growth expected.

The Board expects to report “solid growth in revenues and operational profitability” for the year to 31 March 2024.

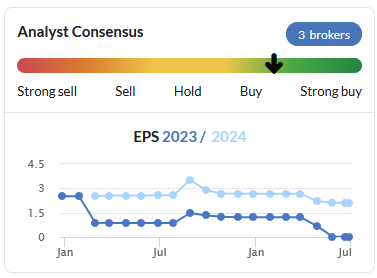

There doesn’t seem to be any change to existing expectations today. Existing consensus forecasts shown on Stockopedia suggest adjusted earnings could rise by 19% to 23.2p per share, putting the stock on a forecast P/E of 19.

A further increase in the dividend is expected to 13p per share, giving a prospective 3% yield.

Roland’s view: I’ve only taken a brief look at CML’s activities today. My impressions are that this is a decent business, but it’s having to invest heavily in new products in order to generate growth.

While the balance sheet looks bulletproof to me and is being further bolstered by cash proceeds from property sales, the accounts for recent years suggest to me that CML may not be generating very attractive returns on its operating assets.

The bull case here would be that current investment will yield attractive returns in the future, as revenue scales up. That may be possible.

However, as far as I can see, ROCE has been below 10% every year since at least 2017. I think that merits a degree of caution, in terms of pricing in future growth.

On balance, I’m neutral here. I think the valuation is up with events, but this business does have some attractive features and a reassuringly low track record of operation as a listed business.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.