Good morning!

We are now deep in holiday territory. Well done to all of us diehard investors and traders who continue to watch the RNS feed every morning! (Though I'm off to Lanzarote on Saturday, so I won't be watching the announcements for at least a week.)

By the way, there's still a bit of time to vote for Stockopedia in the Shares Awards. We are in categories 15 and 17 - here's the link!

As for today's news:

- CSF (LON:CSFG) - delisting proposal

- IG Design (LON:IGR) - acquisition and placing

- Batm Advanced Communications (LON:BVC) - interim results

- Sopheon (LON:SPE) - new release

Cheers

Graham

Wey Education (LON:WEY) - Leo has written a detailed analysis of this company's recent progress and prospects, so I'm happy to share the link. Here you go.

Joel Greenblatt Interview - wow! It's fair to say that I'm a little bit jealous of Stocko's very own Ben Hobson, who has interviewed Joel Greenblatt in New York. Greenblatt's books and methods are superb and have influenced me for years. Some excellent questions were asked and Joel didn't disappoint.

CSF (LON:CSFG)

- Share price: 2.1p (-11%)

- No. of shares: 160 million

- Market cap: £3 million

Proposed cancellation of trading on AIM

Some years ago, I noticed this was trading at a "cheap" valuation. But it was in Malaysia, and running an unprofitable data centre business. So thankfully, I never got involved.

A Malaysian company, registered in Jersey, and listed on AIM. I hope nobody put more into this than play money that they could afford to lose. Having a rule to completely avoid all stocks like this has been good for my financial health.

CSF made a big disposal over the past year, so that FY 2018 revenues from continuing operations were just £4.4 million.

The Board therefore believes that the Group is now of a size where it is no longer practical or cost effective for it to have its Ordinary Shares quoted on AIM.

I agree. Though a reverse takeover or at least the gesture of a buyout offer would have been a more pleasant way for the story to end.

The Chairman is going to resign whether or not shareholders vote for the resolution to delist, and then Allenby Capital "will need to consider the commercial rationale for their continuing to act as the Company's Nominated Adviser and Broker."

So if shareholders don't vote for cancellation, the shares are likely to get cancelled anyway.

The underlying business is struggling with "monthly revenues still insufficient to cover its monthly operating overheads", and needs "significant" capex to replace the "ageing equipment" at its last remaining data centre.

The problem is that even if the company is not worthless, a minority investor on this side of the world is going to have a difficult job extracting any of its value. So if I happened to own a few shares in this today, I would sell them for whatever I could get.

IG Design (LON:IGR)

- Share price: 542p (+4%)

- No. of shares: 63.9 million

- Market cap: £346 million

Acquisition of Impact Innovations, Inc & Placing

We covered this at its final results in June. It designs and manufactures a wide range of gift and celebration products (gift wrap, greeting cards, gift bags, etc).

This acquisition of the US-based Impact Innovations will double IGR's presence in the Americas.

There is a quick video explanation on IGR's website.

Potential benefits of the deal include:

- increased manufacturing scale, enabling greater innovation

- cross-selling to the combined customer base in the Americas

- selling Impact's products to IGR's customers around the world

- annual synergies of $5 million by year 3.

Trading update - in line with expectations, no change.

Placing - the entire funding requirement is £84.4 million, incorporating £56.5 million for the business excluding debt & cash, plus an adjustment for the cash and working capital in the business at the moment (currently at its seasonal peak).

This is reassuring:

Funds used in respect of the working capital and other adjustment are expected to be repaid within 3 months of the transaction completing from Impact Innovations' operating cash flows.

The proposal sounds reasonable to me.

Of the £50 million placing, £31.9 million will be used for the acquisition.

The rest, assuming that shareholders allow it, will be used for capex and "other opportunities" which the Directors expect to arise.

The placing price is 510p, around where the shares were trading over the past week. Again, perfectly reasonable.

My view - I'm warm toward this deal.

The combined group will have an estimated 22% of the consumer gift packaging market in the USA/Canada: an impressive degree of market share. The directors think it will be the largest consumer gift packaging business in the world.

This makes it a strategic move of the sort that I could get behind. Most acquisitions leave me cold, but I can see a clear rationale for this one.

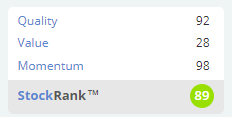

So I maintain my positive impression of this company and its management team. It likely deserves its high rating, in my view.

Batm Advanced Communications (LON:BVC)

- Share price: 40.95p (-0.4%)

- No. of shares: 403 million

- Market cap: £165 million

BATM Advanced Communications Limited (LSE: BVC), a leading provider of real-time technologies for networking solutions and medical laboratory systems, announces its interim results for the six months ended 30 June 2018.

This is not one that I've spent any time on before. Its track record looks quite poor and it's based abroad.

It has two divisions:

- Bio-medical division incorporating diagnostics equipment,waste treatment and distribution.

- Networking and Cyber Division. Creating software and cyber security solutions.

I wonder why these ended up under the same ownership structure? Always tricky when you are dealing with a group of seemingly unrelated businesses.

Interim results:

- revenue up 17% to $58 million

- adjusted operating loss reduced to $0.6 million

- actual loss for the period for BVC shareholders reduced to $1.9 million

Outlook - in line with expectations. The order book has increased and both divisions are experiencing increased demand.

My view - Apologies, but I don't feel capable of providing insight into this company. It has pride of place in my "too difficult" tray. If there are any readers who can explain this company's attractions, that would be great.

Sopheon (LON:SPE)

- Share price: 995p (unch.)

- No. of shares: 10 million

- Market cap: £100 million

Accolade Enterprise Innovation Management

Minor news in the grand scheme of things, but this share is fresh in the mind after recent coverage. Sopheon has released the latest edition of its innovation management software.

What I look for in business software is widespread applicability. The flexibility to solve lots of different problems. Think of Microsoft Excel, for example, and all the people in so many different contexts who use it.

CEO comment:

Sopheon's Accolade decision-support system helps megabrands like P&G, BASF, Conagra Brands, PepsiCo, Parker Hannifin, Covestro, Honeywell and Electrolux better connect strategy and operational execution to realize corporate value faster and increase organizational transparency."

I continue to believe that this share looks interesting and is worthy of further research.

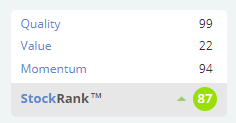

StockRanks agree:

There's nothing else in the RNS feed within my universe of coverage, so I'll call it a day there.

Thanks for the suggestions. Hopefully there'll be a greater supply of interesting stories tomorrow!

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.