Good morning!

Agenda -

Paul's Section:

Here's something I prepared last night -

Keller (LON:KLR) - my first look at this niche, but large, international contracting business. It looks surprisingly interesting - low PER, decent balance sheet, and a potentially large Saudi Arabian contract win. I'd like to hear what readers think, who know more about this share than I do. Very impressive long-term track record of generous divis too. I'm intrigued, at a first, superficial look.

On to today's news -

WANdisco (LON:WAND) at long last, a serious contract win of $11.6m, with half receivable up-front. This looks significant - has this jam tomorrow cash burner reached an inflexion point where it might become a viable business? Looks interesting.

PCI- PAL (LON:PCIP) - update on patent infringement claim against it by a competitor. It's difficult for non-experts like me to judge how things might pan out. There's a positive sounding trading update buried in the announcement. Looks interesting, as organic growth is superb, albeit company still loss-making.

IG Design (LON:IGR) (I hold) - an interesting potential turnaround here. Not without risk though, but I like it.

Graham's Section:

Appreciate (LON:APP) (£54m) - This financial company’s main strength is in gift cards, especially for corporate customers and their employee reward schemes. The company announces full-year results today, and a small acquisition whose purpose is to speed up the growth of its B2B division. The results are comforting, the dividend increases, and the stock remains cheap according to conventional value metrics.

Polar Capital Holdings (LON:POLR) (£547m) - This fund manager has recently suffered outflows. Its fund offering is weighted towards technology, and outflows for FY March 2022 were concentrated in that area. However, other investment themes have been holding up better, and Polar has been attempting to further diversify its offering. The stock offers shareholders an attractive yield (>8%) while they wait for investor confidence to come back.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Keller (LON:KLR)

726p (up 4% yesterday)

Market cap £530m

New Contract, Trading Update & Strategic Progress

I’m not familiar with this specialist contracting business, as the sector doesn’t interest me - due to high risk & low margins. Jack covered it here in May 2022, and wasn’t impressed overall, although pointing out the good dividend yield of about 5%.

H1 update today (half year ended 26 June 2022).

Major new contract won in Saudi Arabia - a 170-km long new mega-city called “The Line” - I saw a fascinating documentary about this novel idea - here’s more info. Keller is getting an initial £50m contract, expected to be completed this year, with “hundreds of millions of pounds” potential contracts in future years. This does look quite exciting, with the scale of the construction activity planned for Saudi Arabia being mind-boggling.

Trading is in line -

The Group is trading as anticipated in the first half of the year and the Board's expectations for the full year remain unchanged.

As previously indicated, we expect 2022 to be a year of growth, with full year performance to have the customary second half weighting, and to reflect our usual increase in trading momentum as the year progresses.

Pricing power - “successfully passed on a significant portion of cost increases” in higher prices to customers. “… preserving the absolute level of profitability…” - which implies lower % margin, but static cash margin, which I think sounds OK, although the phrasing used is a bit confusing -

… preserving the absolute level of profitability, whilst the relative measure has been affected by materials shortages, the residual unrecovered inflation and the dilution effect of the material costs passed through to clients.

Record order book - “continues to strengthen” in size & quality. Expected to be £1.5bn at the half year. That sounds decent, given annual revenues forecast of around £2.4bn. Although as always, order book numbers only really make sense if the timeframes are also provided, of precisely when that revenue will be booked.

Positive noises about the energy sector (e.g. LNG to replace Russian gas), and infrastructure. Recent acquisition is doing well.

Strategy - restructured in 2020 & 2021 to become more focused, on higher quality work.

It says more reorganisation is needed in SW Europe, and Middle East & African operations.

Dividends - this is a powerful statement -

The Board recognises the importance of capital returns to our shareholders and Keller has consistently and materially grown its dividend in the 27 years since listing. This unbroken record of dividends clearly demonstrates the Group's ability to continue to prosper through economic downturns, including both the global financial crises and the pandemic.

Interim divi is up 5%, and final divi also expected to be increased.

It mentions “reviewing other options for capital returns” - maybe buybacks or special divis?

Net debt -

Keller continues to deliver strong, resilient cash generation. The net debt to EBITDA (IAS 17 basis) leverage ratio at the half year is expected to be around 1.2x, with an intention that this reduces to below 1.0x at the year end.

Balance sheet - I’ve reviewed the last one, as at 31 Dec 2021, and it looks a large & complex business, capital intensive, with a lot of plant & equipment (NBV of £323m, original cost of £911m, suggesting that a lot of it is well worn, and requiring considerable maintenance capex).

There’s a small pension deficit, not a big issue.

NAV of £443m becomes NTAV of £302m after writing off intangibles.

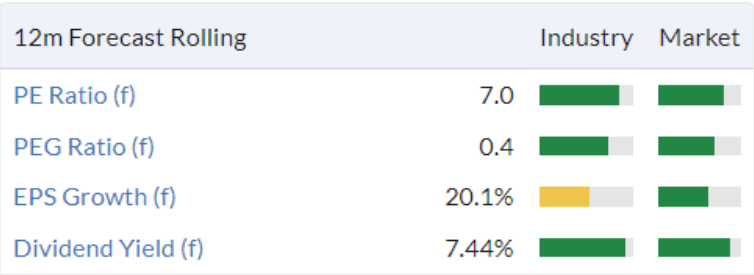

Valuation - it looks attractively priced on value metrics -

.

My opinion - I was expecting to dismiss this, but on a quick initial review, I think Keller actually looks quite interesting. Definitely worth a closer look & discussion, for readers who are interested.

The share price has done some big oscillations, so if you’d timed your buys at the lows, and sold at the highs, then this could have been very lucrative (same for any share though!), along with generous divis too.

Divis are really impressive actually -

.

.

High StockRank gives me further comfort -

.

WANdisco (LON:WAND)

269p - before market open

Market cap £182m

I looked recently at the late, and absolutely dire FY 12/2021 results from this software company. It seemed perplexing that the company was able to get another fundraising away, for $19.8m, at a 6% premium (270p) about 2 weeks ago.

Today we find out why another placing was successful, with what looks like an impressive contract win, the biggest ever -

WANdisco (LSE: WAND), the data activation platform, is pleased to announce that it has signed its largest ever contract with a value of $11.6m with a top ten global communications company (the "Customer"). The terms of the contract provide that 50% of the $11.6M will be paid in advance. As it is a Commit-to-Consume contract, revenue will be recognised as the customer moves its data.

This is the third consecutive deal with the Customer, after the initial Commit-to-Consume agreement worth $1.5m, signed on 23 March 2022 and the follow-on order for $1.2m announced on 31 March 2022. The cumulative total from this one Customer for WANdisco is $14.3m and demonstrates the scale opportunity of the Commit-to-Consume model.

The Customer is one of the world's largest suppliers of Internet of Things ('IoT') applications...

My opinion - this looks game-changing, and if more contract wins follow from other customers, then perhaps WAND might have, at long last, reached a point where it might grow into a viable business, instead of a jam tomorrow cash burner?

Looks interesting - could be worth a look, for adventurous investors maybe?

.

PCI- PAL (LON:PCIP)

61p - before market open

Market cap £40m

Update on Patent infringement claims

PCI-PAL PLC (AIM: PCIP), the global cloud provider of secure payment solutions for business communications, provides an update on the unfounded patent infringement claims made by a competitor. [as usual, my bolding]

This issue has understandably cast a cloud over PCIP shares. That’s a pity, because trading has been strong, as evidenced in a positive (“better than current market expectations”) trading update here on 26 April 2022.

The group’s niche software, for securely processing telephone credit card payments, is experiencing very good organic growth, so there’s clearly something interesting here. Although the company remains loss-making, as costs keep rising (which often happens at small growth companies).

Today’s update refutes the validity of the claims against PCIP made by Sycurio.

US court hearing is not expected until mid-2024, which seems very slow.

PCIP is trying to get the patent infringement claim thrown out, as being invalid. It sounds complicated.

PCIP says its patented technology was found to be “innovative and novel” over Sycurio’s patents.

Trading update - it’s not described as such, but effectively this is a reassuring trading update today -

"As the fastest growing company in our market, and recently ranked as the 56th fastest growing company in the U.K. by Oresa Growth Index, the current financial year has seen the Company continue to make strong progress despite these unfounded claims of patent infringement. Whilst the claims have been an unwelcome distraction, it has not stopped the Company from continuing to deliver against its strategy and demonstrating excellent growth.

My opinion - management sound robust in their defence against Sycurio.

I’ve no idea what the outcome will be, as I’m not an expert on legal action re patents.

It’s difficult to know how to value PCIP, given that market conditions are now so much more bearish for loss-making tech companies, plus it makes sense that there should be a discount for the uncertainty & costs re patent legal action.

However, the very strong organic growth remains impressive, and I have a generally positive impression of this company.

For disclosure purposes, I’m not currently holding, due to being forced into having a clear-out in my margin account, where it was previously held. But I remain positive about the fundamentals, whilst obviously being a bit nervous about the long duration, and costs, of the patent legal claim against PCIP.

With hindsight, the price probably got ahead of events last year. Hindsight eh!

.

IG Design (LON:IGR) (I hold)

78.5p (up 15% at 08:46)

Market cap £76m

I had a quick look at the headlines, and outlook comments first thing, and didn’t see anything that looked particularly positive, so I’m surprised this share is up 15% so far in early trading. I’ll take a closer look now, ahead of its webinar at 11am today, which I’m registered for via PIWorld - signup link.

The background here is that IGR shares have collapsed, due to major supply chain problems last year, and questions over bank funding. Hopefully now it might be a recovery situation. The announcement of revised bank facilities which I reported on here on 6 June 2022, was very positive in reducing risk.

Cancellation of Value Creation Scheme -

This is fantastic news. I loathe and despise so-called value creation schemes. I see these as legalised theft, and I hope institutions push for these grubby schemes to be abolished at every company where they have been implemented.

These schemes set performance targets, then give away a chunk of the ownership of the company to management, often through a convoluted intermediate holding company. It’s an outrage that companies & advisers ever thought this was acceptable.

I’ve noticed a dramatic improvement in behaviour by institutional shareholders recently. They’re (at last!) pushing back against excessive remuneration, and other corporate governance issues. For example, there have been a lot of AGM Results announcements recently, with big no votes, often against remuneration reports. Whilst these are only advisory votes (why?! They should be compulsory I think), companies do take notice - e.g. Boohoo (LON:BOO) (I hold) recently said this (17 June) -

The Board notes that while Resolution 2, giving shareholders the opportunity to cast an advisory vote on the Directors Remuneration Report for the year ended 28 February 2022, and Resolution 3 the introduction of a new Long Term Incentive Plan (LTIP), were both approved, 33.47% of the votes cast were votes against Resolution 2 and 25.36% of the votes cast were votes against Resolution 3.

Over the coming months, the Board will reflect on the result of Resolution 2 and Resolution 3, and the Remuneration Committee looks forward to ongoing engagement with the Group's shareholders as it continues to shape the Group's future remuneration policy.

This is all music to my ears, I’ve been ranting on about the way institutions have seemed absentee owners in the past, leaving companies management to do whatever they like, especially over remuneration.

Whereas recently, ESG pressures seem to have changed institutional behaviour, many of whom now seem to be thinking & acting like owners, and voting against excessive, greedy management rewards. Long may it continue.

Going back to IGR, its value creation scheme was intended to give away 12.5% of the company to management over a 3-year period (absolutely outrageous!). That’s now been cancelled, with the agreement of the scheme members. I’m delighted to read this. IGR concludes -

The Remuneration Committee will look to put in place a more appropriate incentive scheme moving forward. The Company will inform the market of the new scheme at the relevant time.

Let’s hope the new arrangements don’t involve nil cost options, that’s another disgrace that needs to stop. What happened to people just doing the job that they’re paid a generous salary to do?! Instead we (shareholders) seem to end up paying inflated salaries, often for lousy performance, with layer after layer of extra rewards (bonuses, share options, value creation plans). This frequently incentivises bad behaviour - e.g. reckless acquisitions, excessive gearing, then management walk away from the wreckage, having banked the profits often (remember the former CEO at Staffline (LON:STAF) for example, and that clown at Vislink a few years ago).

I enjoyed that, you can’t beat a good rant every now and then.

Back to IGR -

As expected, profits have collapsed (due to serious supply chains mishaps last year).

IGR reports in US dollars.

It’s a substantial business, with revenues of $965m

Profitability is just below breakeven, with adj PBT at $(1.3m)

Net cash of $30.2m looks good, but the company runs heavy net debt at seasonal peaks (e.g. building up inventories for Christmas peak trading). Still, it’s very reassuring to see the debt cleared each spring - attractive, lower risk lending for the bank.

Divis on hold for now - that’s fine in the circumstances.

Outlook - I read this (below) as moderately positive, although it’s frustrating that the turnaround seems to be a slow process. Hopefully a new CEO will put a rocket under the company, and get things back on track. If so, the upside could be very exciting, as it doesn’t take a lot of margin improvement to get big profits rolling in for a group with nearly $1bn annual revenues.

Cost pressures - the commentary gives more detail on the supply chain problems. Increased container freight charges (nearly tripled in price), and key raw materials also rising, e.g. paper up 50%, and polypropylene up over 100%.

Meanwhile prices seem to have been agreed with customers before these cost headwinds hit - revealing a big flaw in the business model, in its vulnerability to unexpected cost increases. The solution, I’m guessing, would be forward purchasing/hedging of key input costs in future, where possible.

Labour costs also shot up, and rushing to get delayed product to customers before Christmas, created distribution inefficiencies.

All pretty bad, but the way I look at things, this should all be fixable - so with a back to basics, hands-on management & strategy, hopefully profitability should recover. Whether that happens in time for Xmas 2022, who knows? Plenty of companies are telling us now that supply chains are beginning to loosen up, and container freight costs are coming down (albeit still very high).

Refinancing - is this hinting at an equity raise next year, maybe?

As originally planned, the Group aims to complete a full refinancing in the second half of FY2023. More details relating to the amended and restated facility arrangements are included in the Detailed Financial Review.

Guidance - all self-explanatory - stabilising things, rather than a meaningful turnaround this year -

Consequently, as announced in the April 2022 Trading Update the Group expects to deliver a marginal profit improvement in FY2023, reflecting progress being made in DG Americas, with the Adjusted loss before tax expected to be broadly flat on the FY2022 results and driven primarily by the increased finance costs in the year ahead.

Average debt across the Group is expected to increase to c. $75-80 million over FY2023, compared with c. $15 million in FY2022 reflecting the expected higher working capital requirements throughout FY2023 as the Group navigates the outlined challenges.

The Board aspires to return to paying dividends in line with its historic policy but based on the current outlook for the Group, the Board does not expect to be in a position to pay a dividend in relation to the 2023 financial year.

Balance sheet - it’s a big business for such a tiny market cap.

Inventories stand out as very high, at $230.9m (LY: $176.2m)

NTAV is actually robust, at $262.3m. Surely that can’t be right, for a company valued at only £76m, but it is, I’ve double-checked.That’s NTAV of £213m in sterling. I’m amazed at the extreme discount to NTAV, which is very nice for investors buying now.

Cashflow - poor, and probably likely to remain so, as inventories have to be built up - higher input costs, and the need to stock up to avoid a repeat of supply chain problems. The big issue with IGR is that a lot of the product is Christmas-related, so it’s worthless in January. Hence production/shipping delays can’t happen.

Going concern note is good, with adequate financing headroom & covenants, even in a severe but plausible scenario.

My opinion - this looks very interesting, as a recovery/turnaround special situation. The asset backing is really surprising, and the overall position looks stable.

Potentially exciting upside, but still a bit risky.

Right, the webinar is just starting now...,

.

Graham’s Section:

Appreciate (LON:APP)

· Share price: 29.1p (+4%)

· Market cap: £54m

This was formerly known as Park Group, and I’m a former shareholder. I lost money on this one – did very poorly with it. I continue to stubbornly think that it might do well for those who are willing to continue holding it.

The company’s main brand is love2shop, a popular gift card accepted by most high street retailers. Appreciate owns the website highstreetvouchers.com.

Gift cards are excellent business: take money in now, interest-free, and pay it out on some future date (if the customer remembers to use it). Or if the customer forgets to spend it, then you don’t have to pay it out! This logic applies to the corporate side of Appreciate’s business:

The Group's multi-retailer redemption products may be partially or fully redeemed, and the unused amount (i.e. the non- refundable unredeemed or unspent funds on a voucher, card or e-code at expiry) is referred to as non-redemption income. Where the end user has no right of refund (corporate gifted cards), the Group may expect to earn a non-redemption income

I thought this was very clever, until I discovered the strategy being employed by the American-backed rival, one4all voucher company, which took an aggressive approach:

One4all Gift Cards can be spent free of charges for 12 months following the purchase date (i.e. when the card was bought from a Post Office or online). After this time a monthly charge of £1.45 will be deducted from funds remaining on the card, until the card balance reaches zero.

I don’t know about you, but I think this is scandalous! Negative monthly interest of £1.45, until the card is worthless – regardless of the card’s face value. What is the APR on that?

So if you’re buying gift card presents, I’d stick to love2shop.

From my perspective, the main drawback with love2shop is simply that it can’t be spent at Amazon. If the customer is happy shopping at High Street brands, then it’s fine. But if they prefer shopping on Amazon, eBay, Asos or boohoo, then it doesn’t work so well.

Let’s dig into these results for FY March 2022:

· Revenue +15% to £123m

· Adjusted pre-tax profit £8.4m (FY 2021: £2.3m)

· Pre-tax profit £5.6m (FY 2021: loss of £0.1m)

If I need a handy excuse as to why I did badly with this share, I can blame lockdowns, which destroyed Appreciate’s financial performance last year.

But in FY 2022, Appreciate has bounced back well.

Full-year dividend: 1.8p (up from 1.0p last year).

MBL Acquisition: in a separate RNS, we get some details about this acquisition. The price is £1.65m (plus £1.8m deferred), and the point is to accelerate Appreciate’s technology plans.

CEO Ian O’Doherty:

The acquisition of MBL rapidly accelerates the Group's technology plans and immediately enhances our capabilities, particularly in our Corporate business, where we are already enjoying increased customer demand for our products. The MBL platform will help us improve the competitiveness of our offerings and bring forward opportunities that can deliver higher levels of growth.

This company has had a few different owners in recent years. It was sold in Nov 2020, and the buyer is now offloading it to Appreciate.

Strategy: one major reason for the MBL acquisition is Appreciate’s newfound focus on the corporate, B2B side of their business. This assists corporate customers with their employee reward schemes.

Appreciate says their Corporate business has seen “three quarters of consecutive double-digit growth following market repositioning in FY21”. Their Consumer business, on the other hand, is reducing in size.

Outlook: trading in the new financial year is in line with expectations.

My view

These are very nice, comforting results for shareholders.

I would note this important acknowledgement by the CEO:

As outlined in our year end trading statement on 28 April 2022, the lockdowns in FY21 caused a delay in the redemption of the Group's products for which income is recognised at the point of redemption. The financial impact of this in FY21 was to reduce profits by £3.9m and, as expected, part of this has reversed in FY22 increasing profits in the year by £3.4m.

If I eliminate these shifts, then maybe we can get a truer picture of performance over the last two years.

· Adjusted pre-tax profit for FY 2021: £2.3m + £3.9m = £6.2m

· Adjusted pre-tax profit for FY 2022: £8.4m - £3.4m = £5.0m

Personally, I think this is the best reflection of the underlying profitability trend. There has been a mild reduction in profitability as overall activity has reduced.

The question is whether growth in the Corporate side of the business can overcome the weakness elsewhere.

I do believe that this is a good value stock: the balance sheet, for example, has equity of £18m with barely any of that consisting of goodwill. The company reports a year-end cash balance of £20m, with effectively zero borrowings. And it has always been a cash-rich, cash-generative stock.

This has been reflected in the dividends, and Stocko calculates the forward dividend yield at around 7% (depends on the exact share price you use).

Here’s a snapshot of the Value Metrics (again, depends on the share price you use to calculate them):

The major drawbacks, as I’ve mentioned, are the High Street exposure (with limited exposure to purely online retailers), and the evidence of somewhat pedestrian underlying growth. Perhaps the new acquisition will help to accelerate the growth, as intended!

Overall, I still have a positive view on the prospects here.

.

Polar Capital Holdings (LON:POLR)

· Share price: 542.7p (+3% yesterday)

· Market cap: £547m

Readers were discussing this yesterday, so we thought we would throw it into the pot for today.

My approach, when looking at fund managers, is to take a customer perspective. Firstly, can the managers beat the indexes? Since the answer to that question is usually no, the next question is: why would a customer want to invest with this manager, even if the returns are lacklustre?

The answer to that question is usually something like:

· Ethical reasons (ethical funds that avoid controversial industries)

· Environmental reasons (clean energy, etc.)

· High-returning assets that an ordinary investor can’t access (e.g. unlisted companies).

· Non-correlated or lower-risk assets that an ordinary investor can’t access (infrastructure, toll roads, etc.)

Looking at Polar’s offering, it has a range of investment teams, with those managing the most AuM being:

· Global Technology

· Global Insurance

· Global Healthcare

· UK Value

· Emerging Markets and Asia

I’m going to focus on the enormous Global Technology Fund (£4.4bn AuM), because it’s the largest fund run by the Polar investment team, which controls 42% of Polar’s total AuM.

It has top holdings you’ll recognise: Microsoft, Alphabet and Apple (disclosure: Graham has a long position in Alphabet (GOOGL)).

I’m pleased to see that the fund has a high active share (60%). This is presumably measured against the Dow Jones Global Technology Index. This means that it’s a proper active fund, not a “closet indexer” (i.e. a passive fund pretending to be active).

Charges according to the KIID (Key Investor Information Document) include: an entry charge of up to 5%, an ongoing charge of 1.62%, and a performance fee.

The performance fee is 10% of returns over the benchmark, measured annually. I don’t see any evidence of a “high-water mark” to protect customers from excessive risk-taking. This means that underperformance by the fund in any given year will not count when it comes to calculating the bonus in future years.

Long-term performance is good, although the last few years have been tough. Over a 5-year and 10-year timeframe, performance is similar to benchmark:

Overall, I have a positive impression of the fund. I don’t have a view on whether it can outperform its benchmark index, and the fees are obviously far more expensive than you would get with a passive fund. But that goes with the territory. If somebody wants to invest in an active technology fund, they could do worse than this.

Results – time to see how Polar Capital holdings did in FY March 2022:

· Average AuM +37% to £22.8bn

· Closing AuM +6% to £22.1bn (final quarter was tough)

· Pre-tax profit down 18% to £62.1m, due to lower performance fees.

The company says:

"Investment performance has been more challenging than the prior year when our portfolios benefited from many of the so called 'Covid-19 winners'

(This is why high-water marks are so useful! Without them, bonuses are awarded to volatility, rather than to sustained outperformance.)

The performance of most of Polar’s AuM is still in the top two quartiles against peers, i.e. against other funds.

The full-year dividend is increased by 15%.

Strategy – new funds have been launched, dedicated to clean energy and the decarbonisation of transport.

Fund structure – this is a useful table:

The open-ended funds are the least dependable in a bear market, as outflows can be rapid. The fees from running investment trusts, on the other hand, are very safe.

You can see from the table above that open-ended funds ended the year flat in terms of their AuM, after some heavy outflows towards the end of the year. But investment trusts, by contrast, succeeded in growing AuM.

Flows – the technology funds saw £1.3bn of outflows for the year. Since I continue to expect the NASDAQ and tech in general to be weak, I would expect this trend to continue for the time being.

However, other funds saw good inflows, and overall Polar flows were positive. Polar is sufficiently diversified to benefit from changes in investor tastes and preferences, e.g. switches from Tech to Value.

My view – I’ve checked some analyst forecasts this morning, and found that diluted EPS is predicted to come in at 40.8p for this year (FY 2023), and 38.7p next year (FY 2024). Estimates have been reduced due to the current negative trend in AuM.

But for me, this stock is in value territory. It can always get cheaper, but I think there is a cushion in the sense that the multiple is already low, that earnings should change trajectory as soon as investor sentiment recovers, and it offers an attractive yield to sit on until that happens.

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.