Good morning! It's Paul here.

Italy/ Euro

It seems to me that we're entering a new phase of the ongoing crisis with the single currency. Previous measures, centred around Greece, were little more than papering over the cracks, of a currency union which is unworkable in the long term, in my view.

The press are now picking up on the political crisis in Italy, whereby the President has blocked the appointment of a eurosceptic finance minister, thus causing the collapse of the latest Government after 4 days. So new elections are now necessary, which are likely to cause a bigger eurosceptic majority (according to opinion polls), putting Italy on a collision course with the EU establishment.

To me, this seems far more serious than the Greek Euro crisis, because Italy has 2.3 trillion Euros of national debt. We know what the EU's strategy is, in dealing with rebel Governments, since Yanis Varoufakis recorded all his meetings on his iPhone, and then published a book about it - "Adults in the Room" - highly recommended.

I feel that the only solution for the Euro, is for Germany to leave. Running an export surplus of 8% of GDP (breaking the EU rules limiting it to 6%), is sucking money out of the rest of the EU, into Germany. This is one factor is causing the Italian economy to have stagnated for the last 20 years, and its people have had enough. Whether they have the stomach to leave the Euro, and see their banking system collapse, is another matter. Ultimately that's what caused the Greeks to capitulate.

So what to do? Personally, I opened some shorts (via spread bets) on the Italian market, and bonds, last week, which unfortunately got partially stopped out over the weekend. However, the remaining positions are now nicely profitable, which is doing as planned, and protecting the rest of my portfolio.

My small cap shares are too illiquid to trade in & out of generally, so that's why some portfolio hedging is important to me. Also, as I use gearing, then hedging is very important. I'm also in the process of selling all my liquid, large cap positions, to kill my gearing. After all, they're easy enough to buy back, when this Italian crisis has abated.

Idox (LON:IDOX)

Share price: 32.5p (down 17% today)

No. shares: 414.9m

Market cap: £134.8m

Idox plc (AIM: IDOX), a leading supplier of specialist information management solutions and services, today issues a trading update for the six months ended 30 April 2018, ahead of its half year results, which are expected to be announced at the end of July.

A separate announcement says that a new CEO has been appointed, David Meaden.

I've not kept up-to-date with Idox, but it sounds as if they've disposed of the problematic digital division, which cushions the blow of today's profit warning;

The Board therefore now expects the Group's full year Adjusted EBITDA* to be in the range of £13-15m, including the impact of a c.£5m EBITDA reduction in Digital, compared to current market expectations of around £22.8m.

However, the underlying performance excluding the discontinued Digital division is expected to be in the range £18-20m (prior to the effect of cost savings).

The majority of these impacts have been incurred in the first half, which will result in Adjusted EBITDA* of c.£1m (H1 2017: £10.3m) for the period.

That doesn't sound too bad to me.

Outlook - this strikes me as fairly reassuring;

Underlying operating performance in the majority of the Group, including Public Sector and Health, has been as expected with good delivery of the cost savings identified and previously reported, and solid order intake.

With the closure of Digital, the reduction to the cost base is now expected to be in excess of £10m on annualised basis (compared to £7m announced in the AGM Trading Update on 19 April 2018).

In summary, in future years the Group's financial performance is expected to benefit from a reduced cost base, the rationalisation of Digital, and a stronger commercial focus on recurring revenues and cash conversion.

Net debt - updated as follows today;

Group net debt at the half year stood at £25.5m (30 April 2017: £28.2m; 31 October 2017: £32.1m).

Interim dividend - is suspended. The company intends to pay a final divi.

My opinion - in a way, the above sounds reassuring - the group seems to have taken decisive action to fix things that were wrong. Therefore, on a quick initial look, it seems to fit into the category of a profit warning driven by temporary, fixable problems. Generally speaking, I'm more inclined to view such situations favourably, as potential buying opportunities.

The problem for me with Idox, is that it has a really ropey balance sheet. Looking at the last reported balance sheet, dated 31 October 2017, the key figures are;

NAV: £91.3m, but this includes intangible assets of £122.75m, resulting in;

NTAV: -£31.4m - I rarely touch any share with negative NTAV.

Current ratio: 0.93 - well below my preferred minimum of 1.3

Looking at the last cashflow statement, it capitalised £5.7m into intangibles, which looks like capitalised development spending. That's a fair whack, and means that EBITDA is meaningless.

Overall then, it fails my balance sheet testing, as being insufficiently financially robust. Therefore it's not one that I would be interested in buying.

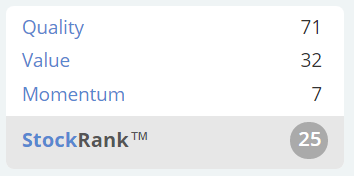

Stockopedia doesn't like it either, with a low Stock Rank, and "falling star" categorisation, a negative rating;

Redstoneconnect (LON:REDS)

Share price: 116p (up 34% today)

No. shares: 20.8m

Market cap: £24.1m

Final results & Proposed Disposal

RedstoneConnect (AIM: REDS), a leading provider of technology and services for smart buildings and commercial spaces...

There are 2 announcements today - results, and news of a disposal - the latter looks more interesting, so let's take a look at that first.

The disposal is of its systems integration, and managed services divisions, for £21.6m - that's almost as much as the current market cap of the whole group. Of which, £2m is held back until completion of a particular contract. A further £1.4m of inter-company debt is being waived. If I'm reading the announcement correctly, that seems to go in the company's favour - i.e. REDS owes the money to the purchaser of the businesses, which is waiving this debt, so REDS doesn't have to pay it.

The remaining business will be just the existing software division, which I think is quite small (see below).

Shareholder approval looks likely, and 34.5% support is already in the bag.

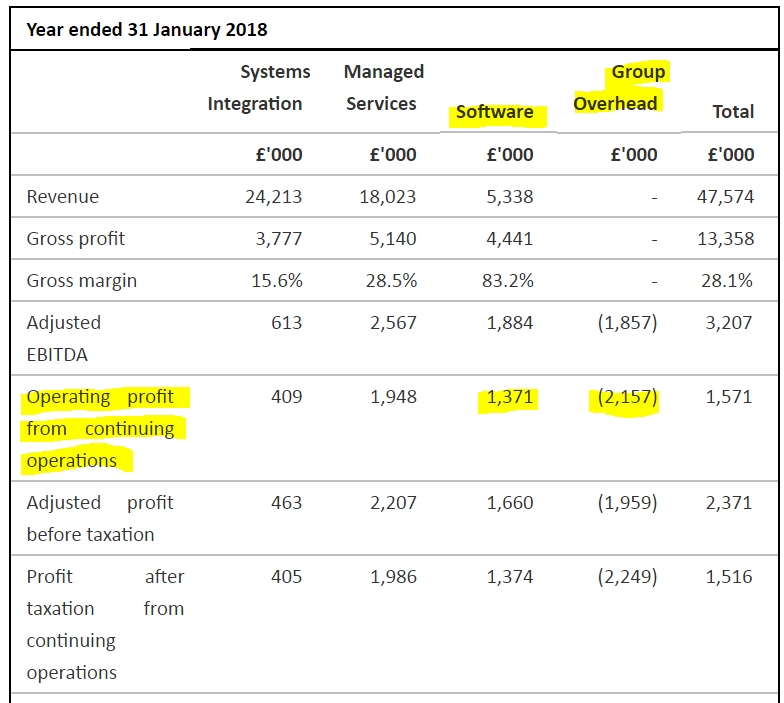

Results - I won't go through these in detail, as the bulk of the group is being sold. This table below gives an idea of how the business should look after the disposal, with the software division being the whole group effectively going forwards;

I suppose the main issue/query I have, is how much of the "Group Overhead" will disappear with the disposals? If a lot of that overhead is leaving, then the much smaller new group, could be profitable. If not, then the central costs would outweigh the divisional profits from software, and make the group loss-making. Also, if a group only has one division, then central costs just become costs!

My opinion - I visited this company some time ago, to a briefing on its turnaround strategy under relatively new management. They seem to have done a good job, as this was earlier a basket case under old management, and the old name of Coms.

There will be fees associated with the disposal. I'm not sure of the tax position - whether any profits on disposal would be taxable?

Overall, it looks an interesting situation. This share is now really a bet on seemingly good management being able to develop a successful software group. It sounds like they want to retain the cash and make acquisitions, rather than returning it to shareholders.

I quite liked this company when I paid them a visit. Management seem down-to-earth, and competent. It could get quite interesting, if they use the cash pile wisely.

The latest balance sheet is pretty good. With the sale proceeds added, then it will be bulletproof - giving scope for some acquisitions.

Belvoir Lettings (LON:BLV)

Share price: 104p (unchanged today, at 12:18)

No. shares: 34.9m

Market cap: £36.3m

(at the time of writing, I hold a long position in this share)

This is a franchised estate agency, with a focus on lettings.

Trading during the first four months of the current financial year has continued well and is in line with the Board's expectations with increased revenue from the three key income streams of residential lettings, property sales and financial services.

The Group continues to follow its successful growth strategy of acquisition and diversification at both the corporate and the franchisee level.

That seems mildly surprising, given that other evidence seems to be pointing towards a slowing housing market. I suppose lettings continue unabated, whatever is happening with property sales.

Competitive/regulatory issues - seem to be working in BLV's favour;

The Group is seeing an unprecedented number of smaller independent lettings agents choosing to withdraw from the sector in the face of increased legislation and the previously announced ban on tenant fees, now expected in the Spring of 2019.

As a result, there remains a strong pipeline of further opportunities to underpin the Group's growth target for 2018.

I should probably try to find out what impact the ban on tenant fees might have in 2019.

The acquisition of Brook Financial Services is going well, with (unspecified whether revenue, or profits) up 20% on last year.

3 new franchisees have been added this year.

My opinion - I've got mixed feelings about this share, and am not convinced that it should actually be in my portfolio!

Positives - it looks cheap, pays excellent divis, has a high StockRank, and seems to be performing well despite being in a tough sector.

Negatives - unknown impact of ban on letting fees, weak balance sheet.

Overall - I might chuck them out, of markets generally go into a bear market, but for now will probably keep hold of my shares.

OnTheMarket (LON:OTMP)

Share price: 171.5p (down 2.6% today, at 13:20)

No. shares: 60.5m

Market cap: £103.8m

(at the time of writing, I have a long position in this share)

This is the UK's 3rd residential property listing website - a long way behind the main players, Rightmove & Zoopla. This sector seems to be hotting up, with a takeover bid for Zoopla launched by a big financial investor recently.

Today's update from OTMP seems fairly similar to its last update. It is adding lots of new estate agents to its portal - although it's using discounts, and even free membership, to attract agents.

My opinion - I picked up a few of these shares, purely as a punt. The chances of it succeeding seem remote, but the takeover bid for Zoopla made me reappraise things - maybe someone might bid for OTMP, and then put serious money into making it a proper challenger?

I certainly wouldn't want to own Rightmove (LON:RMV) - given that its outrageously high profit margins look likely to attract some serious competition, sooner or later. Although clearly shareholders in RMV have done very well out of the company to date.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.