Good morning, it's Paul here.

Monday's complete report is here.

It's a quiet day for news - please see the header for the shares I'll be covering today.

Estimated time of completion - should be done by 1pm or earlier. Scrub that, I'm running late, as I spent so much time on BMY. Let's make it 3pm revised completion time. Update at 3:20 pm - today's report is now finished.

.

.

Bloomsbury Publishing (LON:BMY)

Share price: 254p (down 2% today, at 08:04)

No. shares: 75.3m

Market cap: £191.3m

Bloomsbury, the leading independent publisher, today announces unaudited results for the six months ended 31 August 2019.

I'm writing this just after the market has opened, so we'll have to wait and see where the share price settles down, as only a few small trades have been printed so far.

There's a nice summary at the top of the results announcement, which is the best format - I wish all companies would do this, providing it's accurate of course!

The Group delivered an encouraging first half and performance is in line with the Board's expectations for the full year. Traditionally, sales of trade titles peak for Christmas and sales of academic titles at the beginning of the academic year in the Autumn. With our strong Consumer list in the second half, our sales are therefore expected to be even more second-half weighted than in previous years.

Seasonality - I recall from looking at BMY's previous interim results, that there's not much point in getting into detailed analysis, because it makes nearly all its profit in H2 each year - e.g. adjusted operating profit was 20% H1, 80% H2.

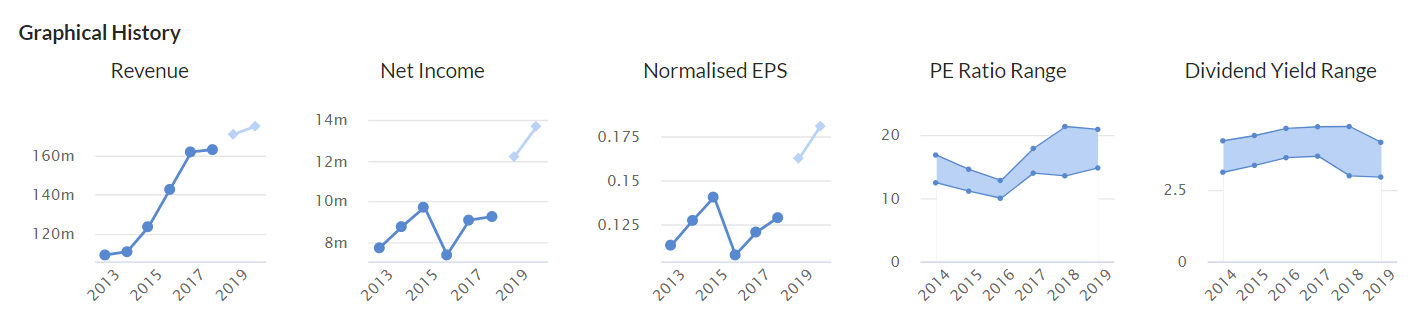

Hence it's the outlook comments for H2 and the full year which really matter, and in this case they're saying performance is heading to be in line with full year expectations. There's always the risk something could go wrong in H2 of course. In this case, I'd say that's a fairly low risk. It's not like this is a software or contracts company, relying on large lumpy orders. Demand seems fairly predictable, evidenced by a fairly stable level of profits, in graph 2 below;

Forecasts show a decent growth in profits this year. As you can see in graph 4 above, the PER band has increased in the last 3 years - i.e. this share has had a re-rating upwards. That's possibly because it has proven more resilient, able to increase profits, whereas a few years ago I think a lot of investors saw it as a dying business, to be replaced with kindles.

The other interesting point, with declining sectors generally, is that financially strong companies can do very well buying up assets of weak competitors, thus prolonging, or even increasing profitability. A good example of that has been newspaper publisher Reach (LON:RCH) (formerly Trinity Mirror), which remains to this day astonishingly profitable. Death is priced in, with its PER being only 2.6 - although that's also because of the huge pension schemes that Reach is burdened with.

Newspapers may be slowly dying out, but it doesn't look as if books are.

H1 figures, with my comments;

Revenue - down 5.3% to £71.3m

Operating profit (before highlighted items) is near enough flat, at £2.7m (vs £2.8m) - as mentioned above, H1 is only about 20% of the full year's profits, hence £100k shortfall in H1 is not significant

Adjustments (called "highlighted items" - are they reasonable? Yes. Note 4 should that the adjustments strip out goodwill amortisation, which is fine by me & is generally accepted as a valid adjustment to arrive at underlying performance of the business. Other adjustments relate to one-off costs re acquisitions, which again is perfectly reasonable.

Balance sheet - IFRS 16 adjustments rear their ugly head - note the £13,052k "Right-to-use assets" that has appeared at the top, in fixed assets. Then a £12,679k "Lease liabilities" item has appeared in long-term ("non-current") liabilities, and a smaller £1,650k "Lease liabilities" has appeared within current liabilities. These are totally pointless entries on the balance sheet, so I just cross them out.

The idea that balance sheets of companies which lease properties should be comparable with those that own properties, is ridiculous to me. The whole point of leasing properties, is so that you don't have debt, and property assets on your balance sheet, and that you can walk away from the property when the lease expires, if you wish.

Receivables are particularly high, at £86.0m, because this includes £25.36m in "Royalty advances", presumably paid to authors? (see screenshot below). This has gone up a bit from last year, but it's in the same ballpark, so not a concern. I tend to look for large & unusual items, or things that have significantly changed, when reviewing balance sheets.

Note that there's a bad debt provision of £1,682k. This reinforces my worries about the book selling sector. There must be a heightened risk that BMY's customers (distributors, book shops & websites, presumably) might go belly-up, leaving a bad debt.

There is information on customer concentration & credit risk in the Annual Report, so I've done some digging, looking at the 2019 Annual Report, which is here. It amazes me how few investors actually read Annual Reports. They are full of useful information. The trouble is, it's heavy going to plough through one - 3-4 hours I find. Yet surely when we're risking thousands of pounds on a share, that is time well spent? Not reading Annual Reports is almost reckless. NB. There's an element of "note to self" in this!

The good news, is that we don't have to read an entire Annual Report. I tend to download them from a company's website, and then use CTRL+F search function in the pdf document, to identify key things. So in this case of Bloomsbury, I searched for "concentration", meaning customer concentration, and this came up;

The Group determines its concentration of credit risk based on the individual characteristics of its customers and publicly available knowledge of specific circumstances affecting those customers. The Group defines counterparties as having similar characteristics if they are related entities. [page 125, 2019 Annual Report)

That's fairly boring, this bit is more interesting;

The Group has a significant concentration of credit risk due to its use of third-party distributors.

Credit limits for the final customers are set by the distributors based on a combination of payment history and third-party credit references. Credit limits are reviewed on a regular basis in conjunction with debt ageing and collection history. The distributors belong to established international groups whose business includes a number of publishing interests and clients.

The Group’s risk is limited as significant amounts outstanding through the UK distributors are secured by credit insurance, and in the US credit risk for significant amounts outstanding through distributors rests with the distributor.

The balances with the US distributor make up 95% (2018: 94%) of the North America trade receivable balance. In the United Kingdom balances with the distributors make up 85% (2018: 88%) of the United Kingdom trade receivable balance.

That's very interesting. I didn't know that BMY sells through distributors in the UK, and it seems just one distributor in the USA. Therefore investors really need to find out who the US distributor is, and examine their finances, as it doesn't sound as if that debt (about £13m in Feb 2019) is insured.

The UK distributors are covered by credit insurance, which is good, but what is a "significant" amount? I'd want to know roughly what part of the £34.6m UK trade receivables as at Feb 2019 are insured, and what aren't - which presents risk of bad debts.

Provision for returns - the other thing that I've highlighted in note 7 above, is that a "Provision for returns" of £7.83m last year, has vanished this year. That's a big number, so I need to find out more about that. Doing a CTRL+F search for that, throws up this explanation, which looks fine to me;

As part of the adoption of IFRS 15 the provision for returns has been reclassified as sales returns liability within trade and other payables.

Therefore £7.83m of the increase in receivables is simply down to reclassifying this into a different part of the balance sheet. Adjusting that out, underlying receivables have gone up by less than 1%, so I'm happy with that.

This is all a bit long-winded, but I'm trying to explain the things I look for when reviewing balance sheets, and how to find out the answers to queries. So hopefully that's of use to people who are not terribly au fait with analysing accounts.

Overall strength of balance sheet - here are my usual tests;

NAV is £143.2m. I always write off all intangible assets, which are £45.3m goodwill, and £21.0m Other, which gives us;

NTAV of £76.9m - that's a solid asset base for this size of company, so a tick in the box here.

Working capital - current assets total £137.3m (including £20.1m cash). Current liabilities total £79.7m , less the (to my mind) spurious lease liabilities figure of £1.65m, gives us £78.1m current liabilities. Divide current assets by current liabilities, and we get a current ratio of 1.76. For this type of business, I have a rule of thumb that anything above 1.3 is good, so 1,76 looks very healthy to me.

Long-term liabilities - I check this to make sure there isn't a ton of debt, and/or pension deficit. This looks fine, as of the £15.4m long-term liabilities, it's nearly all down to the spurious lease liabilities figure of £12.7m.

Pension deficit - note there is a £217k pension deficit, so it's worth checking to make sure that isn't an iceberg figure. CTRL+F for "pension" throws up 4 occasions that it appears in today's results announcement. That doesn't provide any relevant figures, so I'll check back to the last Annual Report. Note 23 shows that the pension scheme is very small - only £540k assets, and £661k liabilities. Therefore the pension deficit is immaterial, and can be safely ignored.

Overall then, I'm happy this is a strong balance sheet. Although receivables, and the concentration risk, is the main issue, that would need more thoroughly checking out. That's the area I would focus on, if talking to management, as there could be some risk there of a nasty hit from bad debts, were a large, uninsured customer to go bust. That's got to be a heightened risk in the books sector.

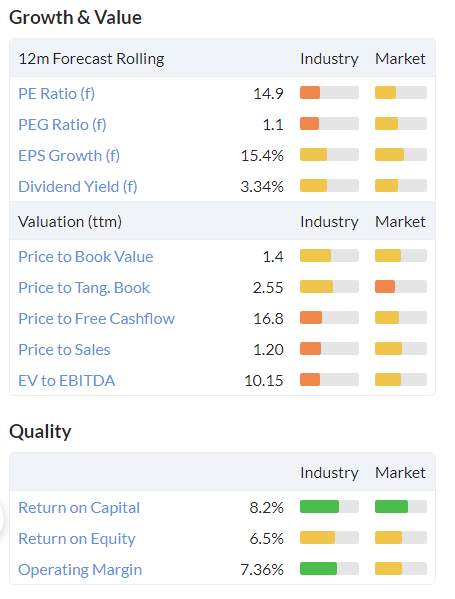

Valuation - as mentioned before, this stock has re-rated upwards, and is not looking cheap any more;

.

Hence it's a sea of yellowy-amber, not green as it used to be before the share re-rated upwards.

My opinion - I've not read the narrative, because I'm not interested in buying any shares at this level. The figures, combined with an in line outlook for the full year, tell me that it's probably priced about right around the 250p level. Nice, but that's not a reason to buy, in my view. I'm only interested in buying things that are cheap, and/or which I think are going to thrash forecasts. In these uncertain times, things need to be really compelling for me to want to buy.

Shareholders here must be feeling quite smug, rightly so, in that a fairly boring value share has performed well, whilst the exciting growth stocks are crashing back down to earth one by one! It's interesting the way the market swings from favouring growth, to favouring value, every few years.

Stockopedia remains firmly bullish on it. Look how the StockRank (now integrated into the little share price chart on the StockReport - a terrific new feature I think) shows that BMY has had a consistently high StockRank for the last 5 years.

Can it go any higher? I don't know! There might be some chartists who decide to buy on the upward breakout. But can it really attain an even higher PER than 15? I'd say there's probably limited upside from here, and it would need out-performance against forecasts to take the share price sustainably higher.

Probably the key issue is to look at the H2 book releases, and decide if you think they are strong enough to beat forecasts. I see there's a new Harry Potter book, which has been the mainstay (along with cookery books) of BMY for years now.

.

.

.

Sorry, I got a bit bogged down in BMY, so will try to speed up a bit.

Eckoh (LON:ECK)

Share price: 50p (up c.4% today, at 11:51)

No. shares: 254.1m

Market cap: £127.1m

Eckoh, the global provider of secure payment products and customer contact solutions, announces a trading update for the six months ended 30 September 2019...

A bullish sounding update, but it's only in line with expectations, so in itself should not be share price-sensitive;

The Board is pleased to announce that trading for the six-month period was in line with expectations. It has been a very strong first half to the year with excellent levels of contracted business and double-digit revenue growth in both the UK and US.

This bit sounds concerning, is this a profit warning for H2?;

As announced on 1 July 2019, we secured a contract extension with a Fortune 100 telecommunications company for our agent desktop tool Coral. The contract is worth a minimum of $3.8m, and of this, $2.1m will be recognised in this six-month period. Consequently, while the Company expects revenue growth to continue in the second half, the first half is expected to have a greater weighting this financial year.

What do they mean by that? My interpretation is that they're saying H2 (revenues) should be above H2 last year, but below H1 this year. Is that how you read it?

I need to check that the broker forecasts show an H1 weighting already. Good, there's a new note available on Research Tree, from a high quality broker. This basically says that the forecasts are already 90% visible for FY 03/2020, and that the analyst is very confident the company should meet this forecast. That's good enough for me.

Valuation - Eckoh is set to achieve 1.4p adj EPS for this year, FY 03/2020. That puts the share on a PER of nearly 36 times - expensive, but this share always seems to be expensive.

The valuation hinges on the company achieving strong growth, with 1.8p adj EPS forecast for next year. If achieved, that would bring down the PER to nearly 28 times - still quite expensive, but justifiable because 1.4p to 1.8p is 28% growth. That's a PEG of 1, which is reasonable.

Plus of course we often forget that when you buy a share, you're not just buying this year, and next year's earnings. You're actually buying all earnings in perpetuity. Therefore companies with strong growth and a clear runway to many years' more growth, might look expensive, but occasionally can actually be good value, taking a very long term view.

Net cash - has shot up, to £10.9m at 30 Sept 2019 (was £3.4m a year earlier). Has it done a fundraising (or sold a subsidiary maybe)to boost the coffers? I can't see any fundraising announcements on the RNS. Double-checking the average share count on our StockReport, the only significant increase in the share count seems to be back in 2016. So it looks as if the cash pile might have shot up due to up-front cash for contract wins, such as the large contracts ($7.4m and $3.8m) mentioned in the narrative today.

My opinion - obviously this share doesn't appeal on a valuation basis, as it looks pricey.

However, I sit up and pay attention when software/tech companies start winning big contracts, in large addressable markets. These large contracts can then act as reference sites to use as part of the selling process to win other new customers. If high margin sales start to snowball, and providing Eckoh can cope with the growth, then this could get interesting.

For that reason, I'm going to put Eckoh down on my notepad as something that's worthy of a closer look.

UK companies succeeding in the USA are rare, as mentioned yesterday for some other company. Hence, ECK winning big US contracts, could put it on the radar for a takeover bid maybe?

Stockopedia likes it too;

.

.

Franchise Brands (LON:FRAN)

Here's a quick plug for the next Mello Investor Show, in Chiswick again.

These are brilliant events, with easily the most intelligent & friendly investors attending, and always interesting companies to talk to (not spivvy resource sector rubbish, like other shows!)

Franchise Brands plc (AIM: FRAN), a multi brand franchisor, is pleased to announce that it will be attending as one of the exhibitor companies at the Mello London 2019 investor conference taking place on Tuesday 12th and Wednesday 13th November 2019 at the Clayton Hotel Chiswick, Chiswick High Road, London, W4 5RY.

Stephen Hemsley, Executive Chairman of Franchise Brands plc, will be presenting to delegates on Wednesday 13th November 2019.

For further information on the Mello London conference, please visit the event website https://melloevents.com/.

I think I'm correct in saying that Stockopedia will be there, so come along and have a chat with the team!

I'll be there too, either propping up the bar with David Hornsby, or hanging around chatting to people on the Stockopedia stand. I'm not doing any talks this year, as there's no point, I've got nothing to say other than, "Everything's crap at the moment, and hardly any of my shares have done what I thought they would do". Which isn't much use to anyone!

Graham will be doing a SCVR live, as well as writing it down too for people who can't get to Mello. He's got some other talks too, I think.

.

.

Dods (LON:DODS)

Share price: 6.38p

No. shares: 555.9m

Market cap: £35.5m

Dods, a leading technology company specialising in data, code, business intelligence and media, announces its unaudited interim results for the half year ended 30 September 2019. The Group continues to enhance its business credentials as a leading provider of Augmented Intelligence2 by embedding its services into client workflows, further enabled by the acquisition of Meritgroup Limited ("Merit") on 18 July 2019.

I've no idea what any of that means. So this is another description the company gave of its activities, from a previous RNS, which actually makes sense, unlike the drivel above;

.

The acquisition of Merit for £22.4m was a relatively big transaction , funded by a placing at 6.5p (at a horrible 23% discount).

Graham looked at this company here in May 2017, when it appeared to be undergoing a decent turn around. That hasn't worked out, as the share price has halved since then.

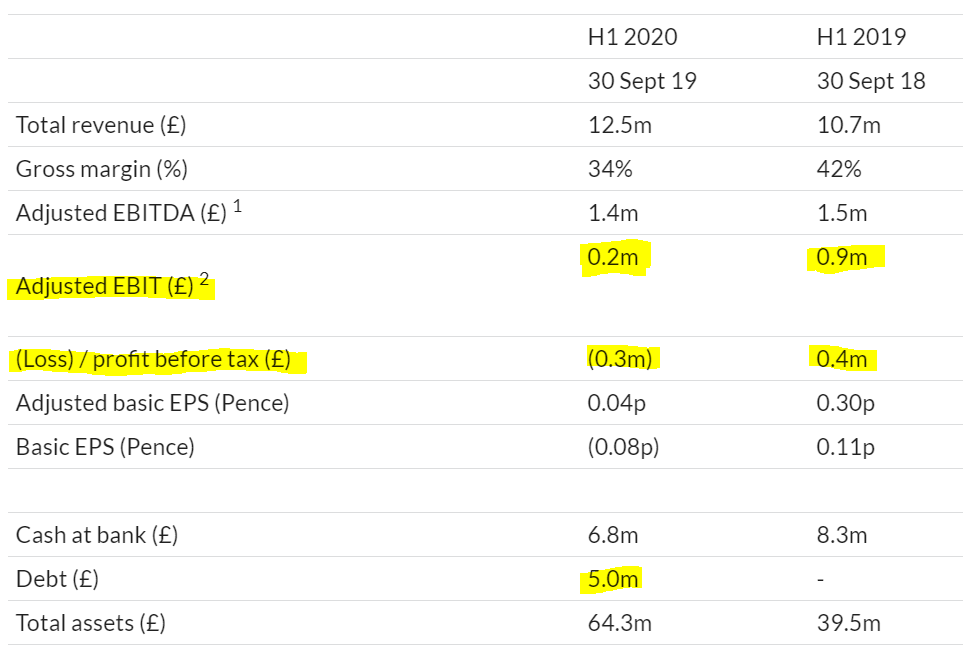

Despite Merit contributing 2.5 months to H1 results, profit has fallen a lot, even tipping into losses at the statutory level. That doesn't look good;

.

.

Note that £5.0m debt has appeared too, and the cash pile has dropped, although it's still larger than debt. Why have both cash (not earning interest) and debt (costing interest)? Often it's because the year end cash balance might be window-dressed to look good, and/or at a seasonal peak.

CFO has resigned, as disclosed on 2 Sep 2019. That's a potential red flag. I don't know the circumstances, but a CFO clearing off shortly after a major acquisition, is bound to raise questions. The broker has just been changed too - again, why?

Outlook comments sound like a possibly H2 profit warning?

The results for the period have been in line with the Board's expectations and following completion of the Merit acquisition, the Group will benefit from an 8-month contribution from Merit in the current financial year.

The Group continues to be cash generative and has strengthened and diversified its capabilities. Due to the uncertainties in the political and economic environment, and with an approaching general election in the UK, the Board remains cautious about the outlook for the second half of the year.

"The Group continues to deliver quality products and services in a challenging environment. The addition of Merit has enabled us to diversify and increase our recurring revenue base. Notwithstanding the current cautious outlook, the Board views the Group's medium to long-term prospects with confidence

That all sounds a bit wobbly to me, at least in the short term.

Reading the narrative, there seem to be a lot of changes going on - personnel, IT, a big acquisition. All of which is a little unnerving, and looks to add to the risk of a profit warning.

Balance sheet - not very good. NTAV is negative, at -£1.9m.

Cashflow statement - also not very good. Post-tax cash generation was only £216k in H1 this year, and was £697k last FY. Maybe that might increase once the Merit acquisition is bedded in, but these numbers are an unimpressive starting point.

The big cashflow numbers are £17.1m outflow for purchasing Merit, funded by £13.0m share issuance, and £5.0m in a new bank loan, mentioned above.

More management speak - I know that Graham loves management speak (not!). So he'll enjoy this (taken from a previous RNS on 28 June 2019, relating to the Merit acquisition);

"The acquisition of Merit is the first step on our journey to becoming a significant augmented intelligence business where the combination of machine learning, artificial intelligence and human application meet to inform actionable business outcomes (we call this AI2).

There is a clear strategic fit and industrial logic in purchasing Merit which is a highly skilled, competent and educated business with over 15 years of domain expertise in data engineering. Merit is at the forefront of innovation and technology and has developed significant resident knowledge allowing them to help power some of the world's leading Business Intelligence solutions...

Isn't that brilliant! Personally I can't distinguish whether it's pure genius, or meaningless waffle - maybe you can?

Merit acquisition - it made £9.2m revenue, and profit before tax of £1.2m in FY 12/2018, so this looks like it should nicely boost DODS full year numbers.

My opinion - there's nothing appealing in the numbers announced today. H1 profits down, a weakish balance sheet, lack of cashflow, a new £5m loan appearing. It looks extremely illiquid as a share too - number traded today, a big fat zero. So you'd probably have to stomach a hefty bid/offer spread to get involved here. Why bother?

The only reason I can see to buy or hold this share, is if you've done deeper research, and become convinced that it's the best thing since sliced bread walked through the door. Clearly they must have impressed investors to raise £13.0m in the placing earlier this year, so maybe there's a good story here which is not yet evident from the numbers?

.

.

Koovs (LON:KOOV)

Share price: 2.8p (down c.10% today, at 14:50)

No. shares: 401.9m

Market cap: £11.3m

Koovs plc (AIM: KOOV), the Western fashion experts for online Indian consumers, provides an update on its trading performance for the three months to 30 September 2019, being the second quarter of its 2020 financial year ("Q2 2020").

These are the highlights, so don't ask to see the lowlights!

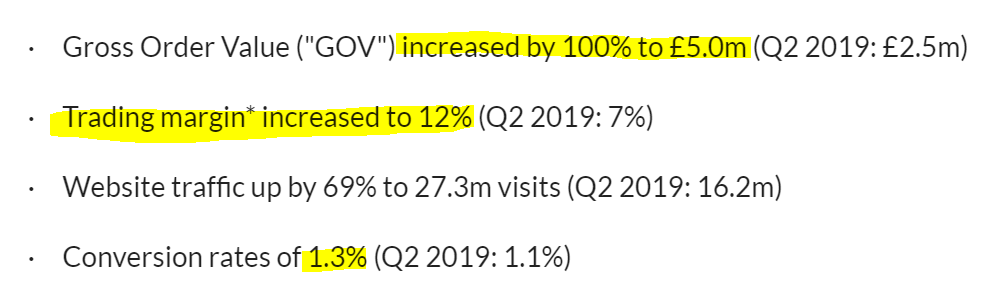

To be fair 100% growth in what they call gross order value, sounds impressive growth. Although looking at last full year's accounts FY 03/2019, GOV was £12.8m (down 13% on FY 03/2018), and this only translated into revenues on the P&L of £6.4m - so half the GOV.

In both the last 2 years, it made a gross loss. So selling the clothes for less than they cost to make.

A highlight in Q2 above, is that the gross margin is now positive, at 12%. That looks like a typo, in that the comparative should say Q2 2018, I think.

What they don't tell us today, is that the gross margin in Q2 has actually dropped from +21% in Q1, as disclosed in a previous RNS, to +12% today.

This is one of the worst business models I've ever seen. Not only does it generate negligible gross profit, but it has colossal overheads of about £13m p.a.. This requires frequent injections of cash to keep it afloat. At the last balance sheet it had burned through over £80m in total, with nothing to show for it.

Fundraising - an urgently needed injection of cash has not come through from an investor called FLFL. This is said to be due to some technical approval having failed in the Indian banking system. Forgive me if I am sceptical about that. More likely is that FLFL has realised that it's throwing good money after bad.

This bit makes it clear that KOOV is weeks away from potentially going bust;

The Company is working with FLFL to secure the committed investment, alongside considering other fundraising options available to the Company, in the event the RBI approval process is not completed within the coming weeks.

The Board has also determined to implement certain cash conservation measures, primarily in relation to reducing stock purchases and marketing spend, with the intention of ensuring there is the maximum time available for the various options available to the Company to be considered.

That's fairly explicit, that Koovs is now very much in the last chance saloon. That said, it's survived previous near-death experiences. Market appetite to refinance failing eCommerce businesses, is probably now a lot more difficult than it was say in the boom year of 2017.

My opinion - Koovs has tried, and dismally failed, for over 5 years now, to crack the Indian eCommerce market. It clearly isn't working. Therefore at some point, difficult though it is, investors just have to accept that it's not worked. The only hope now is for a miracle, and someone with deep pockets to come along and refinance it. That has happened before, so it could happen again, who knows?

Given how close it is to insolvency, the diabolical track record, and clearly broken business model, then this share has to be treated as a complete bargepole job.

.

.

Right, that's me all done for today. Thank you for dropping by, and adding your comments. See you in the morning!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.