Good morning, it's Paul here.

Estimated timings today - late morning start time, should be finished by mid to late afternoon.

Synnovia (LON:SYN)

Share price: 122.5p (up 40% today, at 10:57)

No. shares: 39.0m

Market cap: £47.8m

This small group was previously called Plastics Capital.

There's an agreed takeover bid announced today, at 125p in cash. That's a healthy 42.9% premium to the share price on the "last practicable date". This phrase is used 29 times in the announcement. At the end, in the definitions section, we are told that the last practicable date is yesterday. They could have saved a lot of ink.

The bidder is a Californian investment group, so here's another example of American investors finding UK listed companies attractive bid targets, due to the weak pound no doubt.

This looks a done deal, with 57.7% of shares already lined up to support the bid.

In my view this looks a fair price. Synnovia was going nowhere as a listed company, in my view. Cash generation was poor, hence it was not able to generate enough cashflow to both pay divis and fund acquisitions. I agree with the announcement today, that the group would be better off being privately owned, rather than being an illiquid listed company.

Well done to shareholders, this is a good deal, at a fair price.

Xaar (LON:XAR)

Share price: 64p (down 27% today, at 11:16)

No. shares: 78.2m

Market cap: £50.0m

Trading update (profit warning)

Bad news from this advanced printheads maker;

Revenue in the first half year to 30 June 2019 was £22.5 million, as previously announced, including the impact of a £4.3 million revenue reversal relating to Xaar 1201 Thin Film printhead inventory being returned to the business.

As part of the interim results process, a review of the Group's holding of Xaar 1201 printhead inventory and near term prospects for sale has taken place which has resulted in a reassessment of realisable value. We now consider it prudent to make a provision of £5.7 million which will be reflected in our first half results.

Trading in H2 is also set to be poor;

Trading for the remainder of the year is expected to be weaker than previously anticipated. This is principally due to lower sales volumes of Xaar 1201 and Xaar 2001 printheads as a result of slower than expected new printer installs by OEMs and credit and sales channel issues on Xaar 1201. As a result, the Board now expects sales in the second half of the year to be similar to those in the first half.

Forecasts - there is a one-page update note available on Research Tree, but it says that forecasts won't be revised until the interim results are available at the end of Sept.

Looking at the existing (now outdated) forecast for FY 12/2019, it pencilled in revenues of £63.3m, and an adjusted pre-tax loss of -£10.6m.

Revenues are now set to be a lower, at c.£45m (H1 revenues of £22.5m times two). Who knows where that would leave losses? Allowing for the £5.7m inventories provision, plus operational gearing in reverse, Xaar must be heading for a loss of perhaps £20m or more in 2019, at a rough guess?

Net cash - at 30 June 2019 was £21.6m, which suggests there is some breathing space for maybe another year of survival?

Interim results - delayed from 10 Sept to 26 Sept.

My opinion - this situation is looking worrying. Is there a viable business here any more? I'd say the jury is out. As regards solvency, it had a very strong balance sheet when last reported at 31 Dec 2018. Therefore I think management has some time to fix things - further restructuring, and maybe a disposal of some or all of the group?

With no earnings now, it's very difficult to value this share.

Solid State (LON:SOLI)

Share price: 485p (up 13% today, at 11:39)

No. shares: 8.5m

Market cap: £41.2m

Solid State plc (AIM: SOLI), the AIM listed manufacturer of computing, power and communications products, and value added distributor of electronic components...

As the +13% share price movement today suggests, this update is a positive one (relating to FY 03/2020);

... is pleased to announce a positive trading update.

As a result of a strong start to the year, the Board is confident that profits for the year ending 31 March 2020 will be significantly ahead of expectations.

Revenue for the year is expected to be in line with current consensus forecasts, albeit the Directors consider there may be opportunities to generate further incremental sales later in the year...

Trading in the first four months of the year has been very strong and is well ahead of budget.

Generally, revenues across the Group have been in line with management's expectations however there has been an acceleration of certain project work into H1 that had been expected in H2 which will benefit reported revenue and profits in H1.

It's usually the other way around with many companies, of work slipping from H1 into H2, so it's great to see a company that is achieving positive timing.

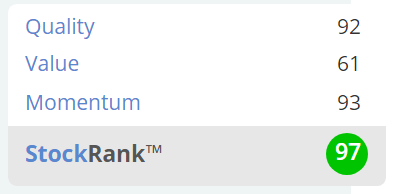

As revenues are in line, but profits are "well ahead" of budget, then clearly margins have improved, as explained;

Forecasts - there's an update note out today. Forecast EPS for FY 03/2020 has been increased by nearly 14%, to 41.5p (LY adj EPS was 35.9p). This gives a PER of 11.7

My opinion - given that the group is performing well (this is one in a series of forecast upgrades), and that it has a decent balance sheet with not much debt, then I think this share still looks good value, even after today's share price rise.

Weak sterling should be a significant benefit for export sales.

I'm not sure that this sector is something I'd want to invest in, as the share price tends to go through good patches, then slips back down again. This reflects the project nature of some work - i.e. lack of recurring revenues.

Still, whatever those concerns, the group seems to be humming along nicely.

Stockopedia likes it;

Michelmersh Brick Holdings (LON:MBH)

Share price: 92.5p (up 6% today, at 12:26)

No. shares: 92.5m

Market cap: £85.6m

Michelmersh Brick Holdings Plc (AIM:MBH), the specialist brick manufacturer, is pleased to report its half year results for the six months ended 30 June 2019.

These figures look good, and with a positive outlook too.

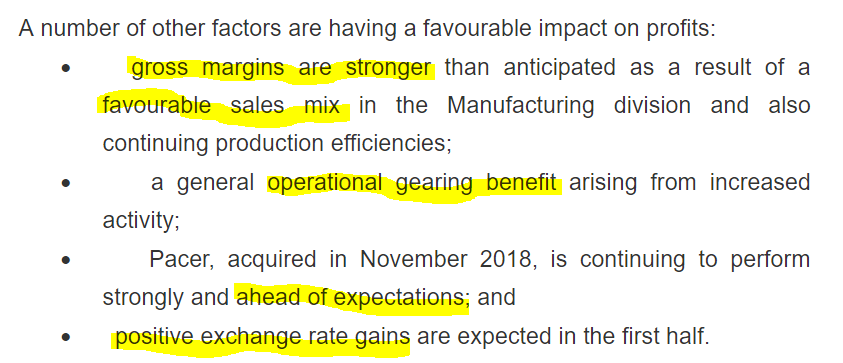

Take your pick from the highlights below -

Note the yellow highlighter I've added above. Adjusted EPS growth is lower at +8.3%, than underlying profit growth of +18.3%. This suggests that either the tax charge is much higher (as EPS is post-tax), and/or that the share count might have risen. Yes, there was a placing of 5.56m shares at 90p in Feb 2019 to fund an acquisition in Belgium.

The adjustments to profit look reasonable to me.

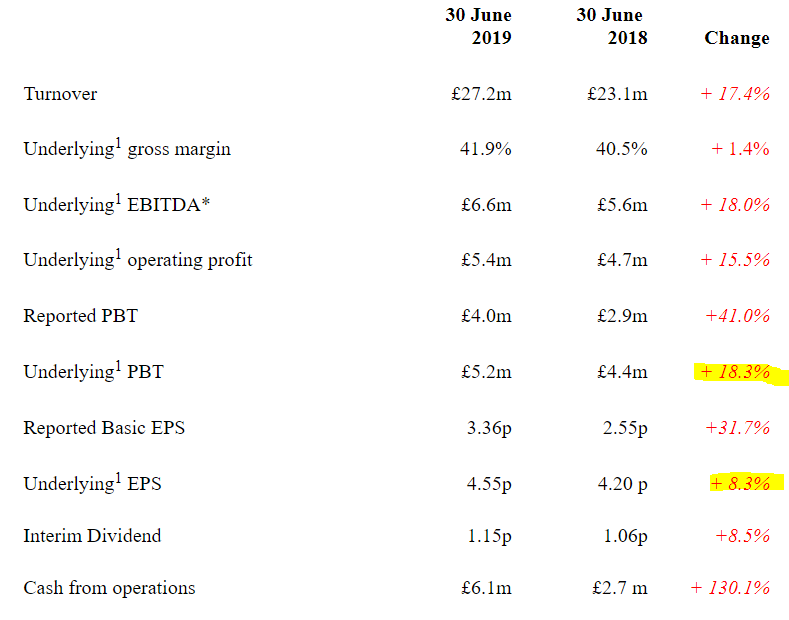

Outlook - sounds good -

Following a very strong first half in 2019, and with a robust order book, Michelmersh can look forward to steady trading for the remainder of the year. Stocks across the industry remain at historically low levels and the volume of imported products are increasing.

The Group's performance in the first half of 2019 has continued into the second half and, with the positive backdrop to our markets, the Board expects to exceed market expectations for the full year.

There's more commentary on the sector, which I won't repeat here.

Balance sheet - looks good to me. There's some debt, but substantial property assets too, so not a concern.

There doesn't seem to be a pension fund, which is good news for shareholders.

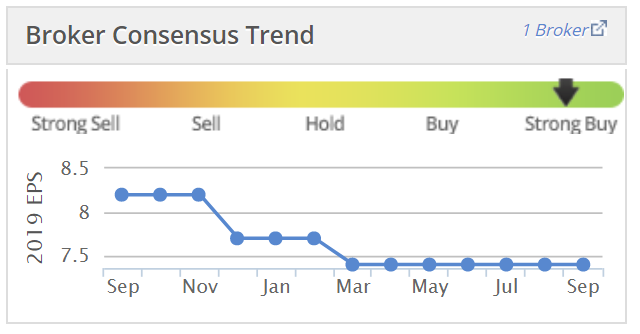

Forecasts - unfortunately, I can't find any forecasts, updated or not.

The usual Stockopedia graph shows falling forecast EPS. So maybe today's beat against softer forecast isn't quite as good as it looks?!

At a guess, I'd say the group might be heading for perhaps 8-9p full year EPS, which would value it on a PER of 10-11 - which looks good value in a low interest rate environment.

The dividend yield is just under 4%, which again is pretty decent.

My opinion - the Help To Buy scheme may be propping up housebuilders profitability, but even once it's withdrawn, that shouldn't affect the actual number of new houses being built. Therefore I imagine Michelmersh should continue to see decent demand.

Weaker sterling should make it more competitive versus more expensive imports, in the UK market.

Overall, this gets a thumbs up from me. It looks a decent company, at a reasonable valuation. It's also reassuring that management seems to have made a successful acquisition - with more to come maybe?

(I'm taking a break for lunch now. Will add a couple more sections later this afternoon)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.