Good morning, it's Paul here with the placeholder for Tuesday's SCVR, for you to leave your comments on the RNS from 7 am.

Please see the header for company results and trading updates that I'll be looking at today. Quite a lot, 10 companies, so it's doubtful I'll have time/energy to do any reader requests, sorry about that.

Estimated timing - I've started early at 7am, so there should be plenty of material up by official finish time of 1pm. I'll leave a note here if I need more time to cover everything, which is looking likely, due to lots of trading updates & results being published today.

Update at 13:00 - I've done 5 companies so far, and will add some more later this afternoon, after lunch.

Update at 17:40 - today's report is now finished.

.

Mello Virtual

David Stredder and his team have been busily working on an online version of the UK’s highest quality & friendliest investor show, Mello.

It’s on 10-11 July, so quite soon. Tickets are amazingly cheap, so I’ve already bought mine here. As usual, there will be some brilliant speakers, and decent quality companies giving presentations.

I’ll miss holding court in the bar afterwards, but never mind!

.

Company webinars

I must admit that I’m finding it wonderful to “attend” meetings online. Last week there was another really useful company webinar, from Warpaint (W7L). Thanks to Equity Development for arranging that. It gives a nice flavour for what management are like, and how they interact. W7L management made a good impression on me, with open/honest answers to the questions, and a good presentation. It doesn’t matter if there are minor technical glitches, as this stuff is all quite new at the moment.

If I find any webinar useful, then I'll publish a link here. Also, I encourage readers to post comments including links to useful webinars.

Here's the recording of the W7L webinar;

.

That's all I've got in pre-prepared stuff, as I used up most of it yesterday.

Vianet (LON:VNET)

Share price: 94.5p (up 8.6% today, at 08:52)

No. shares: 28.95m

Market cap: £27.4m

Vianet Group plc (AIM: VNET), the international provider of actionable data and business insight through devices connected to its Internet of Things platform ("IOT")

I'm just reading my notes here on 2 June 2020, when I briefly covered its results for FY 03/2020. The current trading update was positive.

Today's update confirms that trading is OK;

"Thanks to our proactive response to management of C19, the Group's performance in the first two months of the financial year has been very encouraging, with losses comfortably lower than anticipated.

That's alright as far as it goes, but if you're expecting dire figures, and they're better than expected, they might still be pretty awful! I'd have preferred some hard numbers, compared with last year. That would be more meaningful.

Pubs division (Brulines) - majority of pub clients will start re-opening from 4 July. Clients seeking increased data, to help with re-opening. Giving customers 30% discount on weekly support services until 31 Oct 2020, when pricing will return to normal. So this will be a hit to revenues & profit, but hopefully one-off in nature.

Smart Shield - I hadn't heard of this before, but VNET has jumped on the bandwagon, offering anti-covid cleaning services. Too early to determine demand, but has received first orders.

Smart machines (vending machines) - strong momentum, new customers including Tchibo & Lavazza. Encouraging pipeline. Trend towards contact payment (instead of cash) is helping.

These strong trends will continue to gain momentum post lockdown,...

Outlook - bear in mind that VNET has a long history of over-promising about growth, whilst delivering only very modest growth, hence I would take the following with a pinch of salt;

"Whilst we recognise that the C19 situation is still unpredictable and uncertain, we remain confident that the Group is in a very good position to resume its strong earnings growth, continue the solid momentum that was building into FY2021 and deliver on the exciting growth opportunities that we see ahead of us."

My opinion - neutral. The main (probably only) attraction of this share were the generous divis. This year's impact from covid is likely to have damaged its balance sheet somewhat, which combined with companies probably being more prudent in future, means that investors may have to forget about divis for a year or two.

Pubs re-opening is likely to give some positive newsflow for a while, but that needs to be seen in the context that pub numbers are likely to continue falling, maybe at an accelerated pace?

There is some interesting growth potential, but there always has been. I've learned from experience that growth at Vianet happens at glacial speed, so the shareholder list tends to be a revolving door of people buying into the growth potential, then gradually losing interest as nothing much happens for several years.

It's not a bad company, and is profitable. I just don't see enough growth potential to get me excited enough to want to own this share.

.

.

D4T4

Share price: 223p (down 4% today, at 09:24)

No. shares: 40.26m

Market cap: £89.8m

D4t4 Solutions Plc (AIM: D4T4, "the Group", "D4t4"), the data solutions provider, today announces its Audited final results for the year ended 31 March 2020.

Results are down on prior year (both revenue and profit), which is blamed on transtitioning from one-off licence sales, to a higher quality recurring revenues SaaS model.

High profit margin - it achieved £5.05m adj PBT (down 16% on LY) on revenues of £21.75m (down 14% on LY), which is a profit margin of a very high 23.2%

Adj fully diluted EPS is 11.19p (down 19% on LY) - PER is 19.9 times - seems a lot, considering profits fell, and would have had little impact of covid in the FY 03/2020 figures. Although the big question is whether a PER of 20 is expensive, or could be seen as cheap, if you think interest rates are likely to be near zero forever.

Dividends - as Graham mentioned recently, this is an interesting indicator of how confident & solvent companies are. There's a 1.9p final dividend proposed here, down on 2.3p LY.

Balance sheet - receivables looks very high, at £10.1m. The commentary says this was due to "particularly strong sales" in Q4. that's fairly normal for software companies, but is an amber flag, that I would want to check the next interim results to see receivables have indeed turned into cash. Excessive receivables can be a precursor to accounting problems, in my experience, so I watch this area carefully.

In all other respects, the balance sheet looks excellent. There's a £12.8m cash pile.

Net current assets look lovely, at 2.64. Anything over about 1.5 is strong, in my eyes.

This company is very financially secure, so shareholders don't have to worry about solvency at all, even in a period of bad trading, which could be absorbed by a balance sheet this strong.

Outlook - rather long-winded, so I'll summarise the main points;

- Uncertain outlook this year, due to covid

- Low customer churn, and strong recurring revenues, mitigate covid impact

- Mixed impact on different customer sectors

- D4T4 operates in a sweet spot, of digital transformation

- Sales pipeline, for "major new contracts" remains strong, most should be signed this year, FY 03/2021

- Some contracts deferred or slower to close, but not being cancelled

- Transition to SaaS continuing - this year will be key

- Strong cash reserves & no debt (confirmed by me above)

- Upbeat final comments;

Taking these factors into account, including some very positive initiatives with our existing strategic partners and the excellent progress with product development, the Board remains upbeat about the future prospects for the business through 2020/21 and beyond. ..

2020 has started promisingly and in line with the Board's expectations, with strong levels of both existing and new client activity.

Overall that sounds positive to me.

My opinion - I've got a positive impression of this company.

It operates in a growth area, has a strong balance sheet, pays (small) divis, and over time revenue/profit should get less lumpy as the SaaS transition continues.

Overall, the company gets a thumbs up from me, although I'd say the share price of 230p probably looks about right at the moment, rather than cheap or expensive.

.

.

Solid State (LON:SOLI)

Share price: 555p (down 3.5% today, at 10:16)

No. shares: 8.54m

Market cap: £47.4m

Solid State plc (AIM: SOLI), the AIM listed manufacturer of computing, power and communications products, and value added distributor of electronic components, announces its Final Results for the 12 months to 31 March 2020.

Here are my notes from the 8 June trading update. The business was performing well, but there were signs of a softening in the order pipeline.

There is a results presentation, open to everyone, on InvestorMeetCompany at 16:30 today.

Results out today look good - with adj diluted EPS up 29% to 46.3p - a PER of 12.0

Outlook - hesitant again, for the current year, so it's fairly clear the company is signalling profits likely to fall in FY 03/2021, as I would expect given the ravages of covid/lockdown on the economy;

Although the Group is seeing and expecting some slowdown in order intake during this financial year, its diverse sector exposure and strong open order book will provide some resilience.

Bear in mind that a lot of its growth has come from acquisitions.

Order intake has softened in Q1 of FY 03/2021;

Entering the year with the strong open order book has meant trading in the first quarter has been broadly in-line with prior year and ahead of management expectations.

While we have been able to maintain a good open order book the Q1 order intake is down just under 15% compared to prior year, as a result of COVID-19.

Balance sheet - looks good to me, quite strong, hence there shouldn't be any solvency concerns.

Cashflow statement - looks good. Has generated plenty of cashflow (helped a bit by favourable working capital movements). This was used mainly to reduce debt by an impressive £5.3m, and also pay well-covered divis costing £1.15m.

My opinion - these figures look quite good actually, and the valuation seems undemanding.

The issue is all about future earnings, as with many/most companies right now, we don't know how bad 2020 is going to be, nor what level of recovery there might be in 2021 and beyond. Hence I think it's generally sensible to regard 2019 earnings as the peak, hence only be willing to pay a fairly low multiple for peak earnings.

Is a PER of 12 times (probably) peak earnings cheap enough? Not for me it isn't. I'd rather wait and see how current year results pan out, and look at it again once the outlook is clearer. Mind you, I'm really not looking to open new positions at the moment, because I feel worried about the short term economic outlook.

Both brokers that cover SOLI do not have current forecasts for FY 03/2021, hence we cannot currently rely on forecast PER and divi yields shown on the StockReport, which are likely to be too optimistic. This point is important to keep in mind for all companies at the moment.

.

.

Driver (LON:DRV)

Share price: 57.5p (unchanged at 11:23)

No. shares: 52.2m

Market cap: £30.0m

This is a small consultancy business

The highlights section looks positive, with H1 underlying PBT up 64% to £1.25m

Driver has done a results webinar today, I'll put up a link to the recording, when it becomes available (from BRR Media) - if anyone spots this, please do put up a comment here, with the link.

The Chairman summarises H1;

"Driver have had a good first half year to 31 March 2020 with only limited impact on performance from Covid-19 related issues. There were strong results in the Europe & Americas (EuAm) and Asia Pacific (APAC) regions offset by a weaker performance in the Middle East (ME) region"

Action taken re covid -

- Home-working for employees

- No interim divi

- Postponed non-essential capex & discretionary spending

- Drawn down £3m RCF in full to sit on cash pile as a contingency reserve

- Board salaries reduced by 20% from 1/4/2020 for foreseeable future [good, I like this]

- Pay cuts for under-utilised staff, and "small number" furloughed

- HSBC has relaxed covenants & extended borrowing facilities by £4m

- Stress tests confirm company has adequate liquidity for >12 months (hence going concern basis is OK)

That all sounds sensible & reassuring.

Outlook -

... I am pleased to report that the Group's current net cash balance stands at £5.5m.

In more normal times, Driver is conditioned to operating with relatively low forward revenue visibility and, as a consequence of the Covid-19 pandemic there is heightened uncertainty over client behaviours and their impact on our business.

However, with current trading holding up well and with recently increased debt facilities the directors believe that the Group is well placed to trade through this current uncertain market environment and to take advantage of the opportunities afforded as a consequence of the disruption of Covid-19 in the Group's target market.

Balance sheet - receivables stands out as very high, at £21.8m. Are there any potential bad debts in that total, I wonder? It would be worthwhile to ask the question.

Overall, this balance sheet is strong. NAV of £20.1m, less £3.0m intangibles (all goodwill), leaves NTAV at a healthy £17.1m - this is good, for the size of company.

Therefore, I don't see any solvency risk here, providing the receivables book doesn't contain any big potential bad debts, that's the main risk here.

My opinion - if you want to invest in a small consultancy business, then this looks fairly decent. The strong balance sheet is particularly important at the moment, as I doubt it needs to do a placing, so hopefully no dilution for existing shareholders.

It could possibly become a takeover target at some stage? I seem to recall there was a flurry of takeovers at good prices in this sector a while ago.

The uncertain outlook is obviously a risk that H2 might slow down & result in a profit warning.

.

.

Cambridge Cognition Holdings (LON:COG)

Share price: 43.5p (up 14% today, at 12:03)

No. shares: 31.2m

Market cap: £13.6m

This is a very small, illiquid share, so I'll keep this brief.

Cambridge Cognition Holdings plc (AIM: COG), which develops and markets digital solutions to assess brain health...

This reads very well;

... pleased to announce further contract wins in the first half of 2020, taking the order intake to £4.9m for the year to date, compared with £2.6m for the first half of 2019. [Paul: up 88% - impressive]

To date in 2020, the Company has signed contracts for four large orders of over £500k and ten for between £50k and £500k, as well as taking many smaller orders. The contracted order book for the company is now at £7.5m compared to £5.7m at 31 December 2019.

In the last 5 years, annual revenues have been between £5-7m. Therefore the order book numbers above are quite significant, although it depends on what period they are delivered over - e.g. if these are multi-year contracts, that wouldn't be as positive as contracts to be delivered in the next year alone.

More details are in the RNS about product development.

However...

Until all clinical trial sites are open again, we remain cautious around the extent to which these increased order levels will have a favourable impact on recognised revenues this year.

However, as a number of clients have already indicated that they are now restarting trials that had been paused, the current prospects are encouraging.

Hedging their bets there a bit!

Directorspeak - some nice nuggets in this bit, although I don't know how the current CEO ranks in terms of delivering what he promises. The company hasn't done at all well on that front historically, but the newish CEO might be different hopefully?

"These order wins are pleasing to see and confirm that the strategy we set last year is succeeding.

"We are seeing unprecedented demand for the breadth of solutions we are able to offer clients: CANTAB™ cognitive assessments, electronic Clinical Outcomes Assessment solutions, digital solutions and also our new voice-based assessments for cognition. What is particularly pleasing is that many companies are ordering more than one solution, increasing sales per client.

"We are looking forward to delivering these new orders in the second half of the year and securing further orders from our strong order pipeline."

My opinion - there have been repeated false dawns here before, in the 7 years it has been listed on AIM.

I met the company a few years ago, and saw the product, and I've always thought it has an interesting niche. If sales can be scaled up, then we could see a highly operationally geared move into profit.

Overall, I think there might be speculative potential here. It sounds more than just hot air. The strategy was revised, to be more commercially focused, and a strongly rising order book suggests that it might be working. Clearly not for widows & orphans, given the track record.

Here is the long term chart since it listed;

.

Naked Wines (LON:WINE)

We had an interesting discussion here recently about this online wine club.

Here's the link for its results webinar recording. I shall check it out later.

I'm taking a break for lunch now, but will add some more sections later this afternoon.

Staffline (LON:STAF)

Share price: 37.8p (down <1% today, at 14:57)

No. shares: 68.9m

Market cap: £26.0m

Staffline Group plc, the recruitment and training group, today announces its audited preliminary results for the year ended 31 December 2019.

I reported here yesterday on the revised agreed banking facilities. I'm guessing that, with bank facilities newly confirmed, the auditors have now signed off the 2019 accounts, hence them being published today.

There's not a lot of point in poring over the 2019 accounts.

Revenue of £1,076.7m, down 3.9%. This number is inflated by pass-through revenue, being the wages paid to temps. Hence gross profit is a more realistic figure for STAF's real world revenues, at £86.5m.

The business is effectively trading around breakeven on an underlying basis, but there are lots of exceptionals, due to a series of accounting problems & mishaps. After taking account of those problems, the reported PBT is a loss of £(48.1m).

Going Concern - these disclosures are very important. As I concluded yesterday, the group is benefiting hugely from deferring its VAT payments, up to £45.7m. The crunch is coming in March 2021, with the company yesterday indicating that at present, i.e. remedial actions, it would not have enough cash/headroom by March 2021.

This is a really important point to emphasise. Many companies are building up large balance sheet liabilities, which are not included within disclosed net debt figures, because net debt is defined as interest-bearing, usually bank debt. Hence it's more important than ever to properly scrutinise every balance sheet, and determine what the total debts are, including backed up rent and tax liabilities, which will have to be paid later this, or early next year.

Note 3 gives more details about the going concern situation, much of which is repetition from yesterday's announcement. I don't like the sound of this bit - which sounds like it gives the bank scope to pull its lending facilities. With security over the receivables book, the bank would be in a good position to pull the rug out if it wanted to;

The amended revolving credit facility and receivables financing facility now include a cross-default clause that is triggered if there is a withdrawal, or reduction in the facility size and/or advance rate, of the £25.0m uncommitted (non-recourse) invoice discounting facility. The Group has a 28-day cure period in relation to the cross-default clause.

We're not given a full enough explanation of this to work out if it's dangerous or not for shareholders.

Material uncertainty - this confirms my previous comments, that STAF is definitely not yet out of the woods, and hence has to be seen as remaining financially distressed, until it does another equity fundraising.

... the Directors consider that the outlook presents significant challenges in terms of sales volumes over the coming months. The unprecedented and ever-changing impact of COVID-19, uncertainties specifically related to post-Brexit transition arrangements, well documented issues within the non-food sectors (including retail, manufacturing and automotive) and a slowdown in new contracts and apprenticeship starts are all impacting on sales volumes.

Whilst the Directors have instigated measures to manage liquidity (described below), these circumstances create material uncertainties over future trading results and cash flows.

...the Group's liquidity forecast (considering its available financing facilities) for this period is sufficient to cover the Group's and the Company's commitments during that period with the exception of a portion of the deferred VAT falling due on or before 31 March 2021, which represents a material uncertainty in relation to the Group's liquidity, although the Directors are working on options to mitigate this liquidity risk.

Not good at all.

Balance sheet - at end 2019, NAV was £75.8m. Deduct intangibles of £128.9m, and NTAV is heavily negative, at £(53.1m). At some point I think the group will have to do another equity fundraising, in order to fix this large hole in the balance sheet. It did an equity fundraising in 2019, so those funds are included within this. Another big fundraising is obviously required, which would likely lead to a doubling or tripling (maybe more) of the share count.

My opinion - there's loads more stuff in the results announcement. You could spend the whole day going through it all.

I've seen enough to make me not want to spend any more time on this. It's been a mess for a while now, and the company clearly needs to raise substantially more equity between now and March 2021 cashflow crunch time.

Therefore, for me this share is too risky, hence uninvestable.

.

Quick sections now;

Walker Greenbank (LON:WGB)

(I'm long)

Market cap £28.3m, at 39.9p per share

FY 01/2020 results show revenues down slightly to £111.5m, with adj EPS down 14% to 9.26p - a PER of just 4.3

Pension deficit - is a nasty drain on cash, with recovery contributions of £1.7 to £1.9m p.a. Hopefully this can be renegotiated.

Going Concern - short and sweet! The group has enough liquidity to continue trading for the foreseeable future. That's strong.

Balance Sheet - looks strong, with NTAV of £35.0m. Although there's a lot of capital tied up in receivables & inventories.

Divis - nothing for now, will be reinstated when conditions allow. Fair enough.

Outlook - the most important bit of every announcement these days.

Significant impact from covid. Trade is improving now, but below last year. First 5 months (to 30 June 2020), sales are 35% below last year. That's pretty bad. Slowly improving trend since April. No full year guidance.

Forecasts - how on earth are we able to value the shares, when there is no full year guidance, and no broker forecasts? It's ridiculous. The trouble is, we don't have enough information to be able to construct our own accurate forecasts. I'll have a stab at something rough & ready:

Revenues assume full year down 20% on FY 01/2020, gives £89.2m revenues for FY 01/2021

Gross profit margin of 61.1% feeds through to gross profit of £54.5, down £13.6m on last year.

Assuming no cost cutting, that would reduce the £6.4m profit before tax (PBT) to a £(7.2m) loss before tax.

Given the furlough schemes, and other possible cost cutting, then I would have thought the company could shave several million off its costs this year.

Therefore, my best guess is that we're probably looking at a loss of around £3-4m this year - that's not a disaster, and the balance sheet is strong enough to be able to absorb a knock of that size.

My opinion - I'm reassured by my very rough figures above. Combined with the confident going concern statement, I think there's very little insolvency risk here. So why is the market cap of £28.3m so low? That strikes me as an unnecessarily gloomy valuation, giving good upside if the business can return to profits next year, FY 01/2022.

The back catalogue of fabric prints, has considerable value, as is shown by the (somewhat erratic) licensing revenues.

This share look cheap to me. I already hold some, just a small position. It's rather illiquid, so I'm happy to keep this as a small position in my portfolio.

.

Trakm8 Holdings (LON:TRAK)

Market cap £7.9m, at 15.7p per share (up 21% today)

This telematics company seemed to have a lot of potential a few years ago, but it's flopped in recent years.

FY 03/2020 results are out today. Revenues up 2% to £19.6m, and it almost got to breakeven, with a £(0.2m) adjusted loss before tax (improved from a £(1.5m) adjusted loss prior year).

Net debt of £5.6m rules it out for me.

Outlook - no guidance for the year.

My opinion - it's just not a very good business in my view. Insurance telematics is a waste of time, because the only people who would tolerate their own car spying on them, are 18 year olds who cannot get conventional insurance. Then after 1 year of trouble-free motoring, they get conventional insurance & rip out the telematics box.

Why get involved?

.

System1 (LON:SYS1)

Market cap: £12.5m, at 98.5p per share (up 4% today)

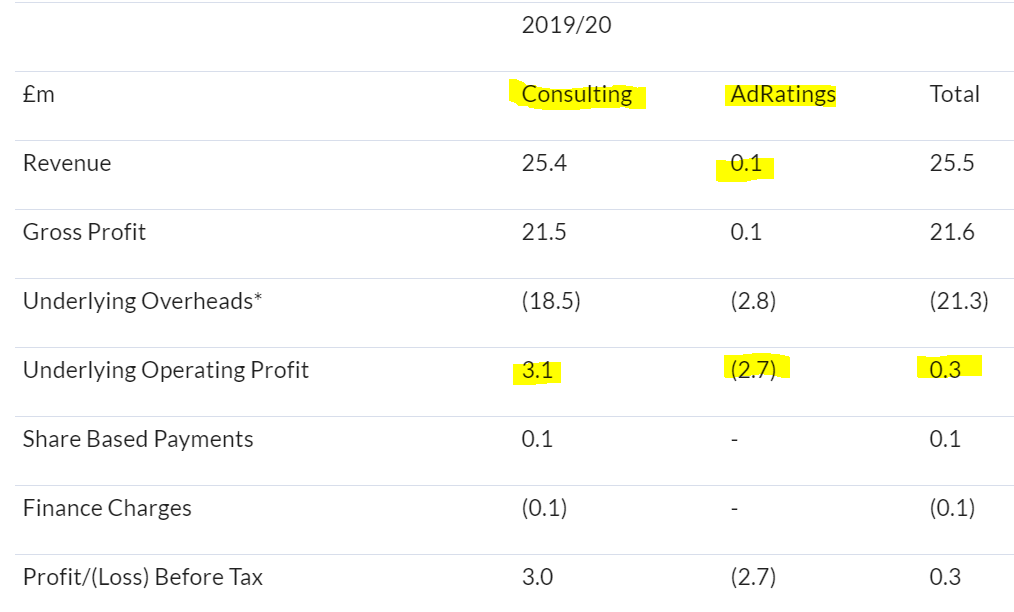

It splits out the core business results, from its loss-making startup, called AdRatings. I do wonder if AdRatings' losses are now too large for the overall group? AdRatings hardly generates any revenues, but burns up nearly all the profit made by the core business;

.

.

Of course, if AdRatings does work, then the upside on a £12.5m mkt cap could be interesting.

Outlook & current trading - a mixed bag here;

In the Trading Update issued on 27th April we said that given the impact of the Covid-19 pandemic it was difficult to provide financial guidance for the 2020/21 year, and this remains the case.

In the two months to end May, Revenue and Gross Profit were 36% and 38% respectively below the same period of last year.

Over these months the business as a whole incurred a Pre-Tax loss of some £0.7m as we pursued our short-term objectives of continuing to develop our new automated product set, while conserving cash by shrinking the cost base to offset lower sales.

Cash net of debt facilities ended May at £3.9m compared with £4.1m at 31 March.

In June, the sales pipeline has shown early signs of recovering towards pre-pandemic levels, and our cost base was in line with our targets.

Balance Sheet - looks OK to me. No solvency issues, and the company has flexible overheads, so could reduce costs relatively easily.

My opinion - something about this company intrigues me. However, when companies left right & centre are slashing non-essential costs, then I feel this is probably not the right time to be buying shares in this sector.

.

Touchstar (LON:TST)

(I'm long)

Market cap: £4.7m, at 55p per share (up 20% today)

AGM Statement. Here are my notes from first thing this morning, when I had a quick skim;

- Momentum has continued

- Strong interim result for H1 expected

- Greatly improved cashflow

- Order book >£500k at end June 2020

- £150k CBIL borrowing, plus unutilised £300k bank facility available

- No guidance due to uncertainty

My opinion - I'm quite pleased with that. It's a tiny business, but with interesting products. It looks solvent. I'm not sure why the stock market ascribes it such a lowly valuation, when there's interesting potential here. Am happy to continue holding.

Well, I'm surprised I got to the end of that list of 10 companies!

See you tomorrow.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.