Good morning from Paul & Graham.

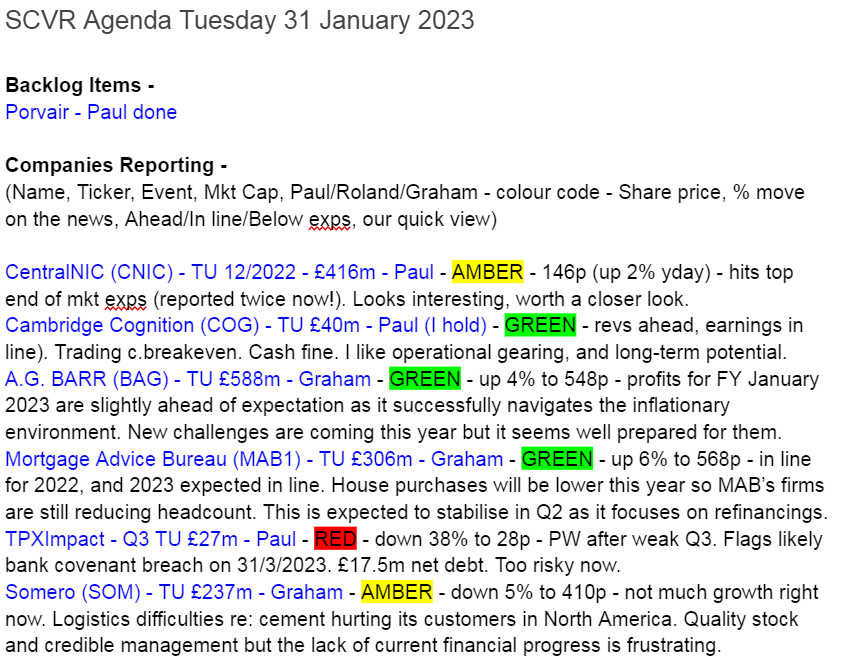

It's the last day of Dry January today, so I'm looking forward to celebrating a friend's birthday at the weekend. In the meantime, we've got lots of companies to report on, so I got up early today to try to catch up on 2 stragglers from yesterday - Porvair (LON:PRV) and CentralNic (LON:CNIC) [CNIC now done].

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

It's another huge list of announcements today. We'll not be able to cover all of these, but will try to report on the most interesting (above or below exps take priority). If updates are just in line with exps, then they're lower priority & might not be covered. Please do add your own comments on any companies, it's a team effort, especially on busy days! -

Paul’s Section:

CentralNic (LON:CNIC)

145p - mkt cap £416m

CentralNic Group plc (AIM: CNIC), the global internet platform company that generates recurring revenues selling online presence and marketing services, is pleased to announce its trading update for the full year 2022.

Continued positive trading momentum, with record revenue and EBITDA for 2022

These guidance numbers look impressive - it’s another ahead of expectations update on EBITDA -

The Company now expects to report record gross revenue of c.USD 728 million, and net revenue and Adjusted EBITDA1 of at least USD 177 million and USD 85 million respectively for the financial year 2022.

These represent increases of c.77%, c.33% and c.84% respectively versus the prior year, ahead of the recently upgraded market consensus2 for 2022.

Adjusted for acquisitions and FX, year-on-year organic growth3 for 2022 was c.60%. This outperformance has been driven largely by the growth of the Online Marketing segment, reflecting increased demand for our privacy-safe online customer acquisition services, and the resulting economies of scale and consequent operating leverage.

2 Analyst consensus of revenue and adjusted EBITDA for the financial year ending 31 December 2022 as of 29 January 2023 and last updated on 6 January 2023 is USD 708.5m (analyst range of USD 701m to USD 715m) and USD 82.7m (analyst range of USD 80m to USD 85.1m) respectively.

Bravo for the footnote! It makes things so much better for investors/commentators when companies spell out what the guidance actually is, instead of sending us on a wild goose chase trying to discover what the forecasts are.

In this case, the footnote shows that the company has hit the top end of the analysts’ range at c.$85m EBITDA.

This is not actually much different to the ahead of expectations update which I covered here on 12 Dec 2022, when it said “at least in line with the upper end of market expectations” for EBITDA, which at the time was $80.0 - $84.1m. So this does look a case of double-announcing in Dec 2022, and again in Jan 2023, the same slight beat against forecasts! Hence probably why the share price barely moved on yesterday’s news.

Next question, is EBITDA a meaningful number?

Sometimes it is, sometimes it isn’t, depending on how much is being capitalised, the size and type of costs that are going through the finance costs line on the P&L, etc.

The good news here, as I discovered when rummaging through the accounts here on 12 Dec 2022, is that CNIC does not seem to capitalise much into intangibles. So the EBITDA figure does indeed look credible.

My main reservation with CNIC’s finances, is that it’s taken on too much debt, which we’ve discussed before here. The balance sheet is very weak, with negative NTAV.

Net debt - however, the latest numbers on net debt actually look fine -

Cash increased to c.USD 95m as at 31 December 2022 from c.USD 56m as at 31 December 2021, whilst Net Debt4 decreased to c.USD 57m as at 31 December 2022 from c.USD 81m as at 31 December 2021. Adjusted operating cash conversion continued to be in excess of 100%.

So is debt such a worry now? Not really, no. Although when I see large gross cash, and large gross debt, I do worry that the cash might be a window-dressed, or seasonal spike, which could dissipate once the reporting date has passed. So I’d like to see CNIC use its cash pile to pay down some of the gross debt. It should (as all companies should) disclose average daily net cash/debt, to provide us with a more reliable number that reflects reality, which might be similar to the balance sheet snapshots, we don't know.

The balance sheet at Sept 2022 showed a deficit on NTAV of $(156)m, so not ideal, but it is a capital-light business model, with very little in fixed assets.

Diary date - results for FY 12/2022 are due out on 27 Feb 2023, along with an InvestorMeetCompany webinar on the same day at 13:00.

Board changes are announced, with a new CFO becoming a proper Director, so they must be happy with his performance to date.

My opinion - CNIC has a high StockRank of 89, and modest valuation metrics - a forward PER of only 8.8. Although it doesn’t have balance sheet strength, which is the missing bit for me.

That said, the previous worries on net debt don’t seem valid any more.

CNIC has demonstrated stunning growth, and high levels of profit now do look genuine. The big question is whether this profitability is sustainable or not? If you think it is, then the shares would be good value. I don’t know enough about it, so have to declare myself neutral for now, but as mentioned before, leaning more towards a positive view.

Some of the reader comments yesterday did call into question whether profits are sustainable, which concerns me somewhat, or whether it's a temporarily lucrative cigar butt type of business? the low PER suggests the market might think that currently. We’ve seen before with companies in this sector, that profits can suddenly disappear, then they reinvent themselves doing something different.

I think big Director selling is always something to look out for, when unsure about a business model. In this case all the recent Director buying at CNIC has been from one individual, offset by a couple of large sells from other Directors, so nothing conclusive either way here.

Definitely worthy of doing further digging on this one, I’d say. Or tempting to just buy a few as a punt maybe? I'm tempted!

Cambridge Cognition Holdings (LON:COG) (I hold)

115p (up 1% at 08:38) - mkt cap £40m

I want to do this first because I hold a small position personally, and obviously want to check on my investment, before moving on to everything else.

Cambridge Cognition Holdings plc (AIM: COG), which develops and markets digital solutions to assess brain health, is pleased to announce a trading update for the year ended 31 December 2022.

Strong revenue growth (ahead of mkt exps), up 25% to £12.6m

(H1 revenues were £5.9m, so H2 is £6.7m)

Contracted order book up slightly Y-on-Y to £17.6m (but down from £18.6m in June 2022)

High visibility for 2023, with c.60% revenues already secured (hence little worry about profit warnings)

Trading around breakeven, with £0.2m PAT quoted (H1 was a whisker above breakeven PAT, so better in H2). FY 12/2021 PAT was higher, at £450k (being PBT £253k, plus tax credit of £197k)

Cash position healthy at £8.3m (up from £6.8m a year earlier), so no risk of dilution (unless money raised for more acquisitions)

Reminds us that 2 small acquisitions done, to broaden product/skills - no material effect on 2022 numbers. Note that trading losses from acquisitions mean that a move into the red is expected for 2023 (Dowgate forecasts £(1.0)m loss at adj PBT level).

Large & growing market.

Outlook -

With Cambridge Cognition's gold-standard cognitive assessments, Winterlight's leading vocal biomarker technology, and Clinpal's end-to-end virtual platform, the combined Company is well positioned for further considerable growth.

My opinion - this looks fine to me. The strong revenue growth is key, because it’s high gross margin (80% last year), so combine that with good revenue growth, and it’s giving us lovely operational gearing. Why is COG only trading at breakeven then? Because it’s been run on a shoestring in the past, and is now reinvesting additional gross profit into additional overheads to drive growth - so we have to trust that management is spending the money wisely. The CEO Matthew Stork has impressed me to date, with much improved financial performance & commercial focus since he came on board. I can tolerate the expected £1m loss in 2023.

COG has expertise & decades of key data, in a niche area that would be difficult to replicate. So high barriers to entry, which is proven by the 80% gross margin.

Cash is fine, so I’m not worried about dilution risk. Also, there’s still a fair bit of interest in the company in the stock market, with a market cap of £40m, so I don’t see delisting as a risk. Nigel Wray is the biggest, long-term holder, at 14.5%. So nobody completely dominates the company.

Overall, as a long-term holder, I’m happy with everything. I don’t really want the company run for short-term profit, when it has big market opportunities to go after. As long as it doesn't become a major loss-maker, then that's fine by me. The big potential upside is from the business scaling up, and being valued on a rich growth multiple in future bull markets, not on eking out a small profit, and putting it on a PER of 10-20.

This gets a tick on my portfolio sheet, and I’ll go back to sleep for another 6 months. Thumbs up from me as a long-term investment. Short term? Probably priced about right for now, but as market conditions become more bullish, then it might re-rate upwards with other growth companies, possibly?

The story here is good I think, and with no cash burn to worry about, and good visibility of high margin revenues, then we’re not having to take silly risks to enjoy the potential upside. i.e. risk:reward seems quite good to me, but that depends on what the future holds, which is currently unknown, as with every share.

Note that COG comes up on the Altman Z-score shorting screen. I would ignore this, as a false alarm, but it's important to always check this warning flag. The historic performance justified concern, but it's now fine, with plenty of cash, and capable of profits (but making a policy decision to operate at breakeven, by modestly reinvesting profits for expansion - which could be an excuse, but it's not here) -

Tpximpact Holdings (LON:TPX)

29p (down 36% at 09:17) - mkt cap £27m

Formerly called Panoply, then changed its name. Shares looked promising a while back, but it’s been a disaster since peaking at c.300p in May 2021, now down 90% from that high.

I covered its last profit warning here on 30 Sep 2022 in a fair bit of detail, with a strange disclosure of the founders admitting they didn’t have the right skill sets, and planning to step back into lesser roles. Very unusual indeed. Good visibility meant they indicated a better H2 was in the offing, so I toyed with the idea of this possibly being a recovery share, whilst flagging the balance sheet risk of an £18m bank loan, and negative NTAV.

Unfortunately recovery was not to be. More bombshells today -

TPXimpact Holdings PLC (AIM: TPX), the technology-enabled services company focused on digital transformation, announces its Q3 trading update for the three months ended 31 December 2022.

Trading below expectations. Full-year guidance revised.

Loads of detail is provided - way too much actually. I almost missed a lot of the detail, as if you scroll down, it turns out the top bit is only a summary.

Key points -

Q3 disappointing trading, but good order intake.

Net bank debt £17.5m at end Dec 2022 (and within bank covenants).

Key point re risk - “Unlikely to satisfy its debt covenants at 31 March 2023”, so in talks with bankers to seek a waiver. This obviously greatly increases risk. Although banks are usually supportive, unless they think a business is a total basket case. Plus of course this also greatly increases the risk of an emergency equity fundraise, which might be part of a refinancing package.

Revised guidance FY 3/2023 - revenue £80m (previously £90m), and adj EBITDA margin 2-3% (previously c.8%), so it’s a whacking great miss. Dowgate reckons this is just above breakeven at adj PBT level, at £0.2m (many thanks to them for an update note on Research Tree).

Guidance for FY 3/2024 - it’s only starting the budgeting process for FY 3/2024, which is madness - there should already be a budget in place, given that this financial year starts in just 2 months. This tells me there isn’t proper financial control here.

It’s hoping to get 10-15% LFL revenue growth in FY 3/2024, and has £56m of committed revenue visibility, which does reassure somewhat.

My opinion - I think this is now too risky for me. It could go either way, it’s a coin toss now - a strong recovery in share price, or a disastrous continuation of more bad news, with possible dilution, delisting, or even insolvency.

It wouldn’t matter if TPX had cash in the bank, but it’s got £17.5m net debt, not a good thing when performance has dipped to only breakeven (at PBT level).

It’s the lack of financial control over the budget that worries me the most, and that won’t impress the bank one bit, in my experience. Also previous guidance of a recovery in H2 hasn’t happened, which undermines the credibility of the fresh guidance today. I'm not keen on situations where bad news keeps getting worse.

It sounds like there are significant operational problems too, with shortages of suitably experienced staff mentioned.

This was on my spreadsheet as a speculative idea for 2023, but the facts have changed, so I’ll take the loss and close this position on my spreadsheet (as I would do in real life, if I held). As individuals with usually smallish positions, we have the luxury of being able to sell. Whereas the institutions don't have that option, and as Nigel Wray once replied to my question, "How do you get out of a micro cap that goes wrong", his reply being, "I don't, I just go down with the ship!"

Graham’s Section:

A G Barr (LON:BAG)

Share price: 527p (pre-market)

Market cap: £590m

This drinks company gives us a full-year update for FY January 2023. It is slightly ahead of expectations.

Revenues for the year are up 17% to £315m, or up 15% on a like-for-like basis (adjusting for slightly different year lengths, and the small acquisition Barr made recently. I discussed the acquisition here).

All divisions of the group contributed to the strong performance.

On inflation:

As anticipated, the inflationary backdrop across the UK continued across the second half of our financial year. We have remained focused on supporting our employees, customers and consumers alongside taking positive action to mitigate the inflationary cost pressures.

They evidently did enough to offset inflation, given that profits are coming in ahead of expectations. Well done to management for that.

Cash position: little information given, but it will be “robust” despite the acquisitions made. As I noted in December, the interim results showed cash of £61m, prior to the £20m acquisition of the Boost energy drinks company. There is another £12m of contingent consideration.

Outlook

The outlook statement is in line with expectations, although there will be a few challenges to navigate:

“Continued high inflation” (their words, not mine)

Deposit retention scheme in Scotland from August 2023 (you have to pay 20p when you buy a drink in a container, and you get it back when you return the container to a recycling point).

“Short term dilutive impact from the Boost acquisition” - they are referring to the impact of Boost on Barr’s operating margin. They have previously warned of this, and said that they expect their operating margin to recover in the medium term.

My view

To me, none of the challenges look beyond Barr’s ability to manage. They have already managed inflation very well, and I’d bet on them continuing to do so.

It’s true that the deposit retention scheme is a new challenge: These schemes are being rolled out all over the EU right now.

The way they work is that consumers will have to remember to dispose of their drink containers in a shop or other recycling centre. They can’t simply dispose of them at home, or they will lose their 20p deposit. So there’s an additional hassle which I suppose could turn off a few consumers at the margin. Hopefully not too many.

I included A.G. Barr in my list of top ten ideas for 2023 so it will come as little surprise that I retain a positive view on this company. Since I wrote that article, not much has changed except that we now have an “ahead of expectations” trading update for FY January 2023.

Mortgage Advice Bureau (Holdings) (LON:MAB1)

Share price: 568p (+6%)

Market cap: £324m

This stock was also included in my top ten ideas for value and growth in 2023. Here is its update for the full-year 2022, which is in line with expectations.

Highlights:

Revenues +22% to c. £230m, despite the short-term crisis in the mortgage market which occurred in September.

Organic revenue +10% after adjusting for the acquisition of Fluent Money.

Total number of advisers at year end up by 20% to 2,254 (including advisors at Fluent). No worries about productivity as revenue growing faster than the number of advisors.

We also get some comments on the mess that occurred in Q4, which resulted in recruitment being halted and cutbacks by some of MAB’s member firms (which led to a reduced outlook for 2023).

I think this mess has been cleaned up now. These comments are relevant to many other property-related stocks:

After the Chancellor's Autumn Statement, mortgage rates stabilised and then improved a little towards the year end. The number of mortgages available also started to increase and this trend has strengthened into 2023. Although markets expect further rises in the Bank of England base rate, we expect lending conditions will continue to improve throughout 2023.

Outlook

Current trading is in line with expectations. But there are some useful comments from the company for us to chew on.

Again, I think there is plenty of read-across from here to other property-related stocks and to lenders, as MAB are at the coalface of the mortgage market:

Current activity levels are below the levels seen this time last year. However, towards the very end of this month there have been early signs of increasing lead volumes and written business across the Group, which we anticipate will build steadily as borrowers gain confidence in a more stable macroeconomic and interest rate environment…

Although house purchase transactions will be lower this year, overall we expect a second-half weighted recovery. Re-financing opportunities from MAB's client bank are at a record level for 2023. In the wider market, 1.8 million borrowers' current mortgage deals will expire during 2023, providing further opportunity for MAB.

Mortgage refinancings are, as I understand it, less profitable than new business from first-time buyers. But they should still provide a steady flow of deals for MAB to advise on.

The headcount at MAB’s member firms will fall in Q1 but they expect this to stabilise in Q2 and then “build gradually” in H2.

My view

Again, there is little reason for me to change my view on this stock since I wrote about it last, as there is no change to expectations.

I half-hoped that advisor numbers might have stabilised already in Q1, but an expected stabilisation in Q2 is no bad thing.

Remember that this company employs the franchise model, so it can be mentioned in the same sentence as the likes of Property Franchise (LON:TPFG) and Belvoir (LON:BLV) (even though MAB is not an estate agent).

The high-quality characteristics keep me interested here:

Somero Enterprises (LON:SOM)

Share price: 400p (-7%)

Market cap: £223m

We have covered this American company many times, most recently in December.

Let’s see the important points from its full-year trading update for 2022. It is below expectations.

Record revenues $134m (last year: $133.3m, so not much of an improvement year-on-year)

The expectation for revenues was a little higher, at $138.8m. The shortfall reflects “the impact, albeit limited, of supply chain shortages in our North America market on our customers’ pace of work.”

Due to the lower than expected sales, adj. EBITDA is $46m, below guidance of $47.7m.

Year-end cash $34m.

As a reminder, this company makes screeding equipment for the construction industry. The typical bear argument against it says that cyclicality in the construction industry is going to hurt it, sooner or later.

North America: this is Somero’s biggest and most important market by far.

H2 2022 saw “a healthy and active underlying non-residential construction market”, though H2 was weaker than H1 and revenues were slightly lower than 2021. There was “inconsistent availability of concrete nationwide”, due to a shortage of cement and drivers.

These challenges persist in early 2023 though “underlying market conditions” are said to remain positive.

Europe: revenues rose 20% to a record high. It seems like there were fewer logistical difficulties. Also, Somero have shifted their international efforts to Europe and Australia (their Chinese venture, as I anticipated, did not work out as they hoped it would).

Australia: revenues rose 40% from a low base.

China: revenues fell 50% versus 2021 and are now close to zero.

Products: the core product offering remains responsible for the lion’s share of revenues, as revenues from newer products targeting new segments “grew modestly on a combined basis from 2021”, and remained small.

Outlook: confident, though there will be investments and costs in the short-term, in order to grow internationally and develop the new products:

With consideration to these factors, the Board expects 2023 will be a highly profitable year with healthy cash generation, revenues that are comparable to 2022, and EBITDA that reflects the planned investment to add strategic resources for future growth.

My view

I can understand that investors might be feeling some mild frustration here.

Adjusted EBITDA is lower than last year, with only mild revenue growth. And for 2023, not much (if any) revenue growth is expected, and adj. EBITDA is unlikely to make progress, either.

How to value an ex-growth company that makes equipment for a cyclical and volatile industry?

Well, I do consider Somero to be a better-quality company than that description would imply. And management have built up lots of credibility over the years, so I do think we can have some faith in their long-term growth initiatives.

Remember the quality metrics on offer here:

At a single-digit earnings multiple, I do think this stock is looking rather cheap currently, given its undoubted quality.

However, I’ll hold back on taking an outright positive view, since despite management’s credibility, I don’t feel able to predict with any certainty that its growth prospects will materialise. There is a risk that results could stagnate for the time being.

But this is a close call for me. It’s definitely worth continuing to research this one, if you are interested in it and have the time to do so. The prospective dividend yield (9%, according to Stocko) also justifies taking a closer look.

Paul's spreadsheets

(please don't publicise the links, these are intended for Stockopedia subscribers only!) - if you find these interesting, may I suggest bookmarking the links.

SCVR summary to quickly show shares we think are good (green). Also note the ahead exps & profit warning tabs (may not be complete - please let me know of anything I've missed, with a reader comment here).

My 2023 watchlists - I'll do a month end up date of this shortly. It's been a good month, as it has I think been for everyone in small caps!

Podcast mystery shares last weekend were: Best Of The Best (LON:BOTB) (I hold), and hVIVO (LON:HVO) (I hold) - as always, please be sure to DYOR, as I'm frequently wrong!! (because I can't predict the future).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.