Good morning from Roland and Graham!

Today's report is now finished (10.20)

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Graham's section

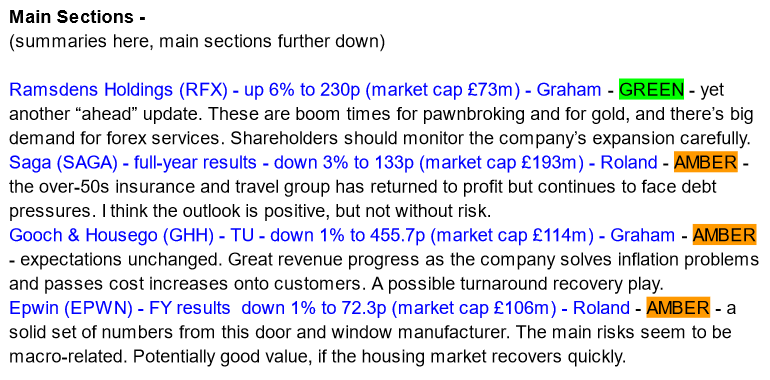

Ramsdens Holdings (LON:RFX)

- Share price: 230p (+6%)

- Market cap: £73m

It’s an “ahead of expectations” update from Ramsdens at the end of H1 (the period ending in March)..

It has turned the production of good news for its shareholders into something of a habit:

FY September 2023 PBT is now expected to be “not less than £9.5m (FY22: £8.3m)”.

Every Ramsdens service appears to have done well in H1:

Jewellery retail gross profits up 20% year-on-year

Foreign exchange service up 40% year-on-year (though still below pre-Covid levels) as international travel trends continue to improve.

Pawnbroking loan book up 13% in six months to £9.7m, a new record high.

Previous metal volumes purchased up 20%.

It can’t hurt that the price of gold has been very firm, especially since the start of 2023. That’s a tailwind not just for precious metal purchasing but also for the amounts that can safely be loaned through pawnbroking.

Ramsdens is expanding into the South-East and can now be found in places like Basildon and Croydon. I do wonder about the wisdom of expanding into these areas and competing head-on with H & T (LON:HAT) - there are three H&T stores in the middle of Croydon, for example. Will Ramsdens be able to make a living there from foreign exchange alone?

At least the pace of the expansion hasn’t been too aggressive - six new stores opened in H1 - and so hopefully Ramsdens will be able to see if it’s working before they continue..

CEO comment:

We are successfully executing against our long-held strategic priorities. We are focused on driving organic growth by delivering ongoing continuous improvements to our operations, expanding the store estate - for which we have a strong pipeline of potential new stores - and investing in our online offering. In addition, we are continuing to seek and appraise attractive consolidation opportunities in what remains a highly fragmented market."

Estimates - their broker upgrades the FY 2023 adjusted PBT estimate from £8.9m to £9.6m, and their corresponding FY 2024 estimate from £9.3m to £10.1m.

My view

I’m going to give this stock the thumbs up.

It’s obviously not without risk, and previous boom periods have seen successful pawnbrokers overextend themselves and then get into difficulty. So I don’t think this is a “buy-and-forget” type of stock (there aren’t many of these).

Instead, it’s a “buy-and-monitor” type of stock - are their new stores performing well? And if they make an acquisition, that will need to be carefully studied.

But I’m a big fan of their core business and it’s performing wonderfully for now, so I have to take a positive view here.

Gooch & Housego (LON:GHH)

- Share price: 455.7p (-1%)

- Market cap: £114m

This manufacturer of laser components and systems releases an update for H1 (to March 2023). Full-year expectations are unchanged.

Let’s quickly review some of the key issues facing the company, which fell into unprofitability last year (FY September 2022).

Firstly, the order book became bloated.

Thankfully it appears to be under control now and stands at £124m, providing “good coverage for our expected second half revenues”. Historic orders needed to be fulfilled before the company could pass inflationary cost increases onto customers.

Revenue has grown strongly to £71m (H1 last year: £54m), “supported by favourable exchange rate movements and the effects of price increases to offset cost input inflation”. So the company is solving the inflation problem.

In addition to cost inflation in the supply chain, salaries have had to increase.

Demand sounds robust:

New orders for the Group's products from our semiconductor, data communications and next generation industrial laser markets have continued to be strong… whilst there is evidence that some of the Group's customers in certain industrial and medical laser sub markets are overstocked we expect this position to rectify itself in the second half of the financial year due to underlying end market demand.

Net debt is £19m.

Forecasts - finnCap are forecasting adjusted PBT of £9.3m in the current financial year, rising to £11.8m in FY September 2024. They see only c. £2m of adjustments to these figures in each year.

So the P/E multiple is at a reasonable level, even if you want to use unadjusted PBT numbers.

My view - I’ve always found this company interesting, but it has sadly never proven its quality as an investment proposition.

At its current level, it arguably offers some turnaround possibilities. The price to sales ratio is less than 1x and if it hits its targets over the next 18 months then the stock looks attractively priced.

I’ll stay neutral because I just don’t think it has enough quality for me to have the confidence to take a more positive stance. But readers may find more here than I do.

Roland’s Section

Saga (LON:SAGA)

- Share price: 137p (pre-market)

- Market cap: £192m

Preliminary results for the year ended 31 January 2023

Saga aims to become The Superbrand for over-50s and is undergoing a turnaround under the chairmanship of Roger De Haan, a member of the company’s founding family.

Today’s full-year results appear to show a strong recovery in underlying profit, but in fact only one part of the group’s business – insurance broking – actually generated a profit last year.

This situation is set to improve in 2023/24, with the travel and cruise businesses returning to full profitability. However, the accounts suggest that the group’s leverage situation remains potentially challenging, despite improving trading.

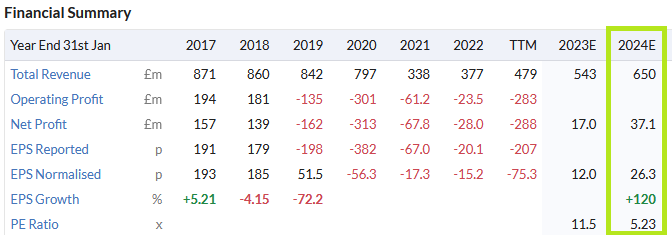

Financial summary

Saga’s headline numbers show a welcome return to profit and a (slight) reduction in net debt. Underlying earnings appear to be in line with Stockopedia’s consensus estimate of 12p per share.

Revenue: +54% to £581.1m

Underlying pre-tax profit/(loss): £21.5m (FY22: (£6.7m))

Statutory pre-tax loss: £254.2m (FY22: (£23.5m))

Underlying earnings per share: 11.9p (FY22: (11.1p))

Available operating cash flow: -28% to £54.9m

Net debt: -2% to £711.7m

Leverage ratio: 7.5x (FY22: 11.7x)

The large statutory pre-tax loss relates to a goodwill impairment charge on the group’s insurance business included in the half-year results. No further impairments have been reported today, so I don’t think we need to worry about this.

Going concern risk? Saga’s leverage still remains extremely high and the company’s going concern notes flag up the ongoing risks.

The group has a £150m bond repayment due in May 2024. The comments in today’s going concern statement suggest to me that funding this redemption could be difficult, if the sale of the insurance underwriting business hasn't been completed by then.

As there’s “no certainty” of an insurance sale, Saga has now agreed a £50m loan facility with chairman Roger De Haan. If needed, this will be used to help fund the bond repayment next year.

On the basis of this new loan facility, the accounts have been prepared on a going concern basis. I think this situation will probably be managed successfully, but I don’t think equity investors should ignore the potential risk of further dilution if trading doesn't improve as hoped.

Operating performance

Cruise: Saga says that its ocean cruise operations generated a pre-tax loss of £0.7m last year, but returned to profitability during the second half, with a profit of £6.2m. A full-year profit is expected for the current year.

Load factor (the percentage of tickets sold) and daily revenue figures are showing a clear trend of recovery:

2021/22: 62% / £299

2022/23: 75% / £318

2023/24 (to date): 72% / £339 - “on track” for target profitability

The company’s river cruise business generated a pre-tax loss of £5.1m last year. However, bookings are said to be 23% ahead of the same point 12 months ago and management expects a return to profitability this year.

Travel: this business generated a loss of £4.1m on revenue of £108m in 2022/23. Bookings at the end of March were 32% ahead of the same point last year, helped by new product offerings such as private jet tours. This business is also expected to return to profitability in 2023/24.

Insurance broking: Saga’s insurance broking business generated a pre-tax profit of £67.7m last year (2021/22: £66.6m).

The total number of in-force policies fell by 3% to 1.7m, despite a recovery in travel insurance sales, which doubled.

Customer retention across home and motor was good, at 83.8%. This seems to suggest that Saga’s brand and/or pricing remain attractive in the over-50s market.

The decline in policy numbers seems to be linked to a decline in new business sales, where 7% fewer policies were sold.

Saga isn’t the only UK insurer to report a slowdown in new business last year - it looks like this may be a consequence of the new regulations requiring insurers to charge new customers the same prices as renewal customers. I guess this will even out over time, perhaps with a lasting reduction in switching and improvement in retention.

Insurance underwriting: last year was tough for UK motor insurers, with escalating claims costs driven by a return to normal driving post-Covid (higher claims frequencies) and a massive increase in repair costs and used vehicle prices.

Saga’s underwriting business reported a pre-tax profit of £19.1m thanks to reserve releases from the previous year of £25.1m. However, these numbers tell us that the group’s underwriting for the year was loss making.

The company says its continuing to “apply material price increases to the motor book”, reflecting continued inflation.

Saga hopes to sell this business to raise cash and repay debt, as I discussed above. Today’s results confirm this process remains ongoing.

My view

Saga’s insurance broking business remains the profit engine of the group. Its brand clearly has some value.

Alongside this, I do think it’s reasonable to expect a significant recovery in profitability from travel and cruise operations this year.

The company’s over-50s customer bases are more affluent than average and much less likely than most other demographics to be affected by cost-of-living pressures, in my view.

I have some concerns about the group’s debt position, but I think that this will probably be resolved without requiring further equity fundraising.

The shares look cheap on a forecast P/E of 5 for the year ahead. But given the financial pressures on the group, I would say the shares are priced about right for now.

Epwin (LON:EPWN)

- Share price: 72p (-1% at 09.00)

- Market cap: £106m

Final results for year ending 31 December 2022

"We have begun the new financial year well. Whilst cognisant of the macroeconomic and market headwinds, the Group remains confident of delivering a further year of strategic and operational progress in 2023, supported by the strength of the medium and long-term drivers of our markets."

Epwin makes doors and windows for residential property, so I think the group’s trading is of interest as a general barometer for the wider economy.

Today’s results cover the last calendar year, so are somewhat backward looking. But the numbers do seem to indicate stable levels of trading, despite some pressure on costs and new-build demand.

Financial summary

Epwin’s headline figures for last year appear to be fairly stable:

Revenue: +8% to 355.8m

Pre-tax profit: -7.8% to £11.9m

Adjusted earnings per share: -2.3% to 8.95p

Dividend: +8.5% to 4.45p

Net debt ex. leases: +90% to £17.9m

Net debt/EBITDA leverage: 0.6x (2021: 0.4x)

Operating margin: 4.8% (2021: 5.4%)

Debt levels look comfortable enough to me - last year’s increase was linked to £17.8m of acquisition payments. Without this, debt would presumably have fallen.

Shareholders get a dividend increase, giving a yield of 6% at current levels. This payout should be covered comfortably by free cash flow, before acquisitions.

Current year trading & outlook: Epwin says that trading so far in 2023 is in line with the Board’s expectations. Revenue so far this year is said to be ahead of the same period last year.

However, the company says that “signs of a slowdown in the housing market” could contribute to a slowdown in both RMI (repair, maintenance and improvement) and new-build markets in 2023.

Epwin says its scale and diverse customer base should provide some resilience against this, but acknowledges the uncertainty.

According to Stockopedia, broker forecasts suggest a modest level of earnings growth this year, compared to 2022.

If these estimates are correct and the UK avoids a severe recession, the shares might be attractively valued at this level:

My view

I share Epwin’s view that the medium and long-term demand for the RMI market should remain positive. Epwin reminds us of the “poorly maintained and ageing” state of much of the UK’s housing stock.

I’m attracted to Epwin’s scale and respectable profitability, but I’m also mindful that this is a competitive sector where companies often lack defensive advantages.

On balance, I think the shares are fairly valued and Epwin looks in decent shape. The main downside risks seem to be macro-related. This is an area where investors need to form their own view. On balance, I’m neutral here.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.