Good morning! It's Paul here.

I'll start Tuesday's article with an interesting announcement from after-hours on Monday:

Taptica International (LON:TAP)

Taptica (AIM: TAP), a global leader in advertising technologies for performance-based mobile marketing and brand advertising...

This is an Israeli-based tech company. I avoid all of these, as it seems to me there can sometimes be something wrong with them, lurking under the surface.

Taptica's CEO seems to have been found guilty of lying;

Hagai Tal, CEO of the Company, has today been found liable for certain statements made in relation to the sale of Plimus Inc, a company of which he was both a shareholder and chief executive officer at its time of sale in August 2011. The plaintiffs in the case are entitled to restitution for breaches of certain representations and warranties.

From what I can make out, this does not seem to have any financial impact on Taptica itself.

He has resigned as CEO of Taptica. His LinkedIn profile indicates that he was CEO of Taptica from Jan 2014 until yesterday. So the problem with Plimus pre-dates his involvement in Taptica by over 3 years.

As Monday's RNS states, the legal action against him was disclosed in Taptica's Admission Document. I wonder how many investors actually spotted it though? It just shows, those Admission Documents really are important, and need to be scrutinised closely, as that's often the only time that important negative information will be disclosed. Especially in the notes near the back of the Admission Document, as many people will have given up reading it by that late stage!

Details of the claim were disclosed in the Company's admission document on page 85 (section 7.9 of Part IV), which is available on the Company's website.

Let's have a look then! This is what section 7.9 says;

7.9 In September 2012, Great Hill Equity Partners IV LP, Great Hill Investors LLC, Fremont Holdco, Inc and Bluesnap Inc (formerly Plimus Inc), (collectively “Great Hill”), filed a complaint in the Court of Chancery of the State of Delaware against SIG Growth Equity Fund I LLP, SIG Growth Equity

Management LLC, Hagai Tal and others (collectively the “Defendants”) arising out of the acquisition by Great Hill in August 2011 of Plimus Inc (“Plimus”), a provider of mobile and internet payment solutions. Great Hill filed a further amended complaint in April 2014.

The Defendants include the principal selling shareholders of Plimus and certain members of its management team at the time of the sale to Great Hill. Hagai Tal was both a selling shareholder (owning approximately 8% of the company) and the chief executive officer of Plimus at the relevant time.

In its complaint (as amended) Great Hill alleges that the Defendants deliberately and fraudulently concealed material facts regarding Plimus's relationships with its payment processors and its compliance with various credit card regulations and seek judgment either that the transaction be rescinded and the US$115 million consideration be returned to Great Hill together with interest, or that damages and costs be assessed and awarded by the court.

The Defendants deny any liability and intend to vigorously defend themselves against the claim. However, there can be no guarantee that, should the claim proceed to trial, their defence would be successful.

Any judgment against Mr Tal could have an adverse effect on the Company, its reputation and its relationships with its customers.

My opinion - clearly then, this is quite serious for the (now former) CEO. It may not have any direct financial impact on Taptica, but indirectly it reflects very badly. If the CEO has acted in this way, then how can we believe anything else he's since said?

Lots of investors (myself included) are suspicious of Israeli tech companies. This type of announcement just reinforces that we're right to be suspicious.

The company no doubt will be on damage control duties from now on. Indeed, it has put out a trading update to accompany the bombshell news of its CEO departure, as follows;

Since announcing its interim results in September 2018, the Company has continued to perform well and execute on its strategy to deliver higher-margin revenue. As a result, the Company expects to report EBITDA growth in line with market expectations, demonstrating a higher-than-expected EBITDA margin, and revenue below expectations due to the forgoing of some lower-margin sales. Cash generation within the business is also as expected.

There are 2 ways of looking at this. Some investors are likely to want out in the morning, so I expect the share price to drop sharply early on. I expect the PR & broker have probably been ringing round the major shareholders today, to try to reassure them that this is all historic, and no reflection on Taptica.

The other way to see it, is that this share is already incredibly cheap, and that any drop on this news could be a buying opportunity, if you believe that there's nothing wrong with Taptica.

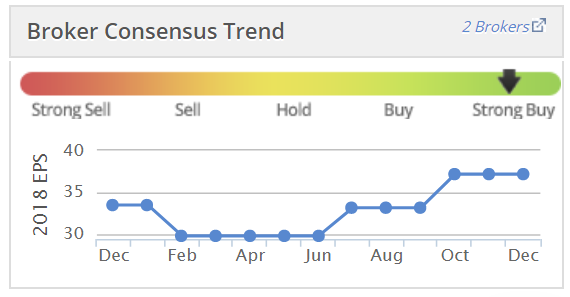

Recent trading updates have been good, and the broker forecasts have been rising too;

Personally, I'll just be watching from a safe distance - I don't want to get involved in this.

Quartix Holdings (LON:QTX)

Share price: 260p (up 8.3% today)

No. shares: 47.8m

Market cap: £124.3m

Quartix Holdings plc, one of Europe's leading suppliers of subscription-based vehicle tracking systems, software and services, is pleased to provide an update on trading for the 10-month period to 31 October 2018.

It starts off sounding rather exciting;

The Board believes that profit (adjusted EBITDA) is likely to exceed market expectations* for the year to 31 December 2018 by between 10 and 15 per cent...

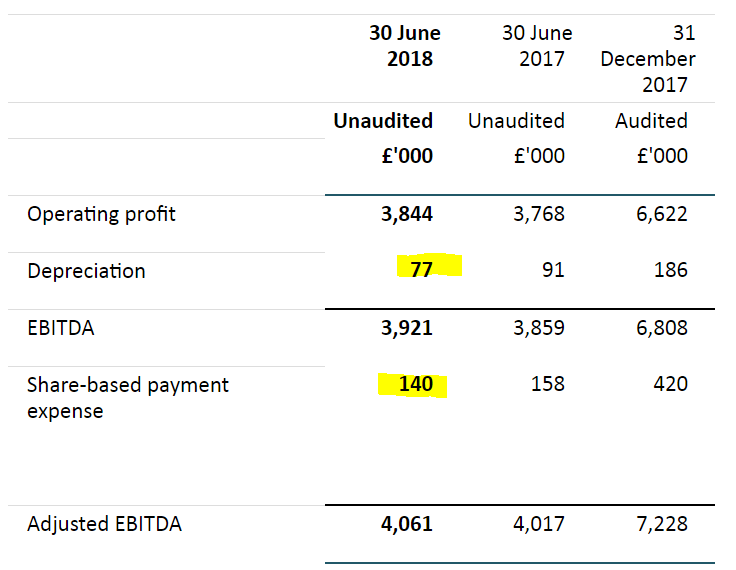

It should be pointed out that adjusted EBITDA is not the same thing as profit! I'm perplexed as to why Quartix refers to adjusted EBITDA? It's often used by technology companies which capitalise a lot of development spend, to present an artificially high impression of profitability. Yet in this case, Quartix doesn't seem to capitalise any development spending. Its figures are completely clean, so quoting EBITDA is an own-goal, in my view.

In the H1 2018 results, profit before tax was £3,858k. Whereas adjusted EBITDA was only slightly higher, at £4,061k. So why quote adjusted EBITDA at all? There's really no need. Here is the reconciliation from the H1 results, to show you what the adjustments are - there is no amortisation at all, it's just share-based payments being adjusted;

Going back to the trading update today, unfortunately the increased profit is largely as a result of accounting changes, so isn't very exciting after all;

This is largely as a result of the Group's adoption of IFRS15 (Revenue from Contracts with Customers), which has increased profit and revenue in 2018 as noted in the trading statement on 2 July 2018.

Looking back at the 2 July 2018 trading update, it did indeed mention IFRS15 as a positive factor, but didn't quantify it. Perhaps today's announcement shows a bigger benefit than people imagined? It strikes me as odd that analysts hadn't already factored this into their forecasts. Maybe nobody had worked out the numbers until now?

Anyway, it's better to have forecasts going up, than down.

Investors very much appreciate it when companies include a footnote, specifying what market expectations are. All companies should do this. Bravo to Quartix & its advisers, this is very helpful;

* The Board believes that consensus market expectations for 2018, prior to this announcement, were as follows: revenue: £24.6m; adjusted EBITDA £7.5m; free cash flow: £5.4m.

Other points;

- Estimates are still dependent on trading in Nov & Dec 2018 (fairly obviously)

- Revenue & free cashflow are expected to be slightly ahead of market expectations

- Strong progress in USA & France, and UK sounds like it's picking up

- Expectations for next year FY 12/2019 are unchanged

- Next trading update will be in mid-January 2019

My opinion - I view this company favourably, because it is highly profitable & cash generative, paying good divis, and with recurring revenues. The balance sheet has net cash.

The only problem is that it looks almost ex-growth on the existing forecasts. Some of that is due to investing in growth in USA. If that works, it could trigger a new wave of growth, and a positive share price re-rating.

I tried to buy some of these shares a while back, but found it hopelessly illiquid, and gave up. The recent share price weakness has brought the valuation down to a level which looks sensible (in the high teens, rather than the twenties, for PER).

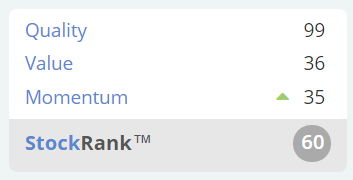

I think this share qualifies as a QARP (quality at reasonable price) - the approach favoured by popular & highly successful investor, Leon Boros. The Stockopedia quality scores are excellent. Note that the momentum score is pulling down the StockRank. However, we can probably anticipate that rising, once new broker forecasts are out;

That was all I had time for in the end. See you tomorrow.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.