Good morning, this is the placeholder for Tuesday morning. It's Paul here.

Many thanks for the positive comments about my video review of the AIM admission document for Loungers (LON:LGRS) - hopefully this might encourage subscribers here to delve into these large documents, which can seem quite daunting. I tend to get about half way through reading them (if that!) normally, and then abandon them on any flat surface in my office. Never to be completed.

To properly read an admission document is quite a big time & effort though. I'd estimate that to properly read, and think about the LGRS AIM admission document probably took me about 5 hours of quality time - i.e. time when there's nothing else going on - so it has to be outside market hours, TV switched off, and nobody else in the vicinity making any noise. In practice then, unless you're superhuman, the only time to properly immerse yourself in an admission document is at weekends, and only if you're a hermit, or an insomaniac!

No wonder that, very often, many of us make quite significant investments, without having properly read the admission document, or not having read any of it.

I finished off reading the rest of the LGRS admission document yesterday afternoon. So I'm aiming to record Part 2 of the video at some point in the next few days. That seemed a better use of my time than reporting on Kier, or Fulcrum, which were on my to do list, but seemed things where I didn't have any value add.

See you in the morning!

7-8am quick comments

Cloudcall (LON:CALL)

(I hold a long position in this share)

Contract win - "significant new contract with a major U.S. staffing firm".

Contract value is for a minimum of £1.1m over 3 years, so almost £400k p.a.

That's say £367k next full year FY 12/2020, which is 2.4% of £15.3m forecast revenues. So not material in terms of revenues, but being a high gross margin business, there's a leveraged impact on the bottom line from new business. Revenues are mostly recurring, and customer churn is low.

Buried in this announcement is an upbeat-sounding trading update;

This major contract win continues what has been a strong start to 2019 for new contract bookings and net new user growth, particularly in the US where we are seeing more traction from our new integrated SMS and IM products.

My opinion - this company has disappointed in the past, but has I believe reached a tipping point where things are starting to work.

This was one of my small cap ideas at the recent Mello London conference - see page 8 of my presentation slides here.

After a few false starts in recent years, I think this share could re-rate nicely if sales momentum continues. I see good upside here. Strongly growing SaaS businesses tend to be highly rated, especially in the US. £26m market cap at circa 100p per share, looks cheap to me.

AO World (LON:AO.)

Results for FY 03/2020

Still loss-making, but that's due to losses in Europe offsetting decent profits in the UK.

Gushing commentary from the exuberant founder, who returned to run the business - as seems to happen quite often with entrepreneurial-type businesses.

Targeting run-rate profitability in Europe in FY 03/2021 (i.e. next financial year). If it achieves this, then the £519m market cap (at 110p per share current price) might begin to make sense.

My opinion - I remain negative on this - it's not a good business model, selling low margin electrical products online. People just search for the best deals, meaning AO will always be facing margin pressure.

After 8am comments

Gooch & Housego (LON:GHH)

Share price: 1030p (down 24% today, at 12:26)

No. shares: 24.96m

Market cap: £257.1m

Gooch & Housego PLC (AIM:GHH) ("Gooch & Housego", "G&H", the "Company" or the "Group"), the specialist manufacturer of optical components and systems, today announces its interim results for the six months ended 31 March 2019.

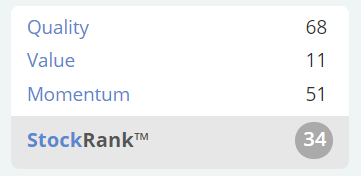

I'm not terribly familiar with this share, having last written about it here in 2014. I recall that it's always seemed a good quality, but rather expensive share. That's reflected in last night's (pre profit warning today) StockRank;

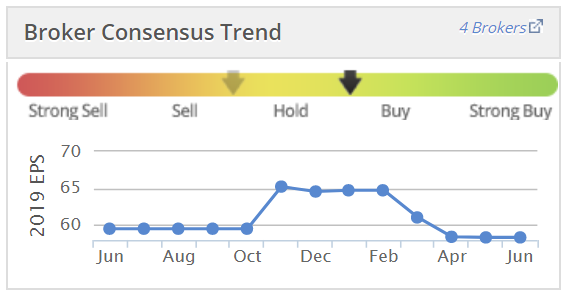

Also I note that the broker consensus forecast has been reducing in recent months - a precursor of trouble ahead sometimes. So it's important to keep an eye on this chart for all positions one holds;

Graham wrote a piece here on 20 Feb 2019, when the company warned on profits. He picked up on the H2 weighting, and correctly highlighted the risk of another profit warning to come, so kudos to Graham!

Interim results - these have clearly disappointed, with the share price down 24% today, albeit on low volume (only £150k-worth of trades printed so far today). Although there can be background orders being worked which don't print until later.

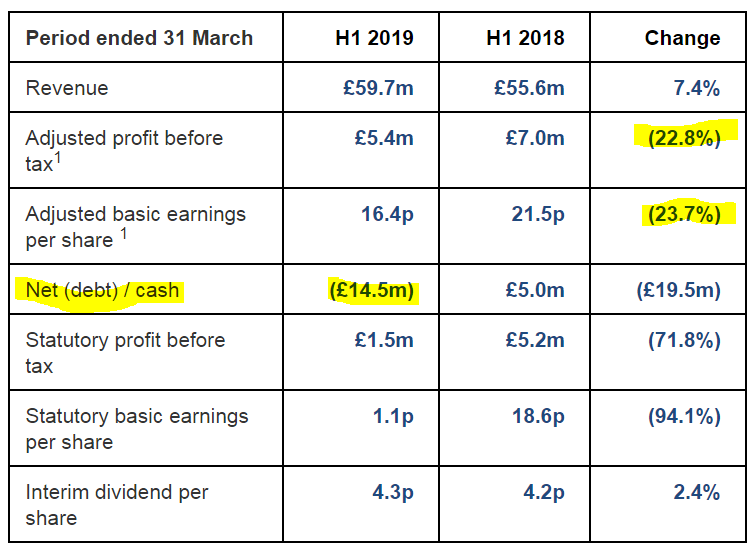

Key numbers;

Note profit well down on H1 LY, and a sharp deterioration in the cash position (probably from an acquisition).

Commentary key points;

- challenging industrial laser market, due to cyclical downturn and continued US/ China trade dispute

- Industrial laser orders have increased since our last update, but we are now assuming that industrial laser business will not return to 'normal' levels in FY 2019 and instead we only supply known / high certainty orders. This segment is 50% of revenues.

- We anticipate non- industrial laser business will perform in line with our expectations

- Expectations reduced - Given revised industrial laser outlook, Board's expectations for the Group's adjusted PBT for FY 2019 now reduced by circa £3.5- 4.0 million

- Order book up 10% at £93.2m (Q2 improved on Q1)

- Cost reductions being implemented

To save me crunching the numbers, I'm delighted to report that Research Tree has updated numbers from Finncap, with a nice one page summary of the situation.

Revised forecasts - a hefty reduction today, in the full year broker forecasts;

FY 09/2019: EPS reduced 22% to 45.3p - PER of 22.7

FY 09/2019: EPS reduced 19% to 53.8p - PER of 19.1

That really doesn't look cheap, does it? And I've calculated those PERs based on today's sharply lower share price.

Outlook - mostly repeats comments already mentioned above, adding;

... That said, significant technological innovation in 5G, folding phones and the greater use of industrial lasers in manufacturing, coupled with our market leading position means supply of critical components to industrial lasers will be an important source of growth for G&H into the foreseeable future.

During FY 2019 we have prepared for significant capacity growth in fibre optics generally and hi- reliability fibre couplers specifically, as they undergo a multi-year growth phase.

We remain confident in the potential of the industrial laser sector and our other target markets to provide attractive long term growth.

Balance sheet - the current ratio is very strong, at 2.60. This includes £15.6m in cash.

Long-term creditors includes £30.0m borrowings, which seems rather inefficient (why hold cash, and debt?)

NAV: £106.9m, less £62.1m intangibles, gives:

NTAV: £44.8m

That's fine overall I think. No solvency issues here.

Cashflow statement - looks as it should. In H2 last year, the group increased borrowings by £17.3m in order to finance acquisitions totalling £24.0m last year.

Paying modest divis.

My opinion - this situation is a straightforward one. If you think this is a great business, that will recover from a temporary slowdown in business, then this might be a good entry point.

If you think that the problems are more serious, then it's best avoided.

Personally I don't have the knowledge to make that judgement, so it would really just be a punt were I to get involved here. Bearing that in mind, I'd want a price considerably lower, to tempt me in, than a current year PER of 22.7 - that doesn't give any margin of safety for anything else that might go wrong.

All done for today. Sorry I didn't get round to looking at VP.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.