Good morning, it's Paul here with the SCVR for Tuesday.

Timings - a bit late today, but should be done by 3pm.

Today's report is now finished.

Please see the header for company announcements I'll be looking at.

Jack has kindly sent me a section on Air Partner (LON:AIR), which I've copied in below. Thanks Jack! Always good to have a contribution from you.

Tekmar (LON:TGP)

Share price: 120p (up 4% today)

No. shares: 51.3m

Market cap: £61.6m

(I have a long position in this)

Tekmar Group (AIM: TGP), a leading technology provider of subsea protection systems for the global offshore energy markets, announces the following trading update ahead of the Group's results for the year ended 31 March 2020 ("FY20" or the "Period"),

We're not seeing many positive updates like this at the moment - it's in line with expectations for FY 03/2020, together with a positive outlook statement.

- Revenues - up over 40% - despite Covid-related problems. All the more impressive given that Q4 (Jan-Mar 2020) is seasonally important to profits

- Order book at year end was up 39% on prior year, at c.£10m

- Net cash of £2.1m at year end

- Received a £3m loan via Barclays, under Govt's CBIL scheme - good to see this paying out

- Liquidity - well placed, given above cash headroom

- All sites continuing to operate, with only 8% of staff furloughed

- Temporary freeze on capex, recruitment, and pay rises, to conserve cash

- Outlook - demand for offshore wind remains strong

.

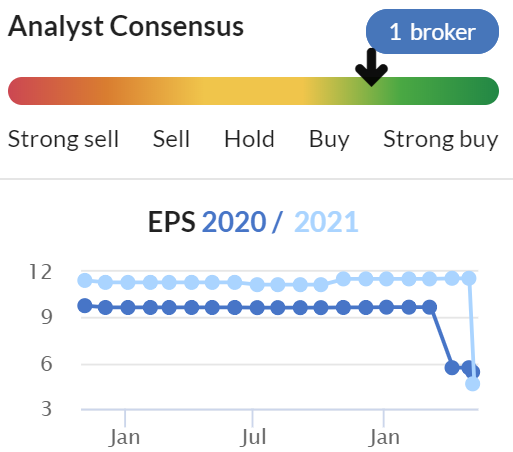

There is a catch though - the company warned on profits in Feb 2020, and broker forecast was considerably lowered. Hence it has only achieved the reduced forecast number. It's always worth checking this! See below;

.

.

Valuation - this is a rare case where I can actually use broker forecasts! Or rather, I could if there were any broker notes available, which I cannot find on Research Tree or elsewhere for Tekmar.

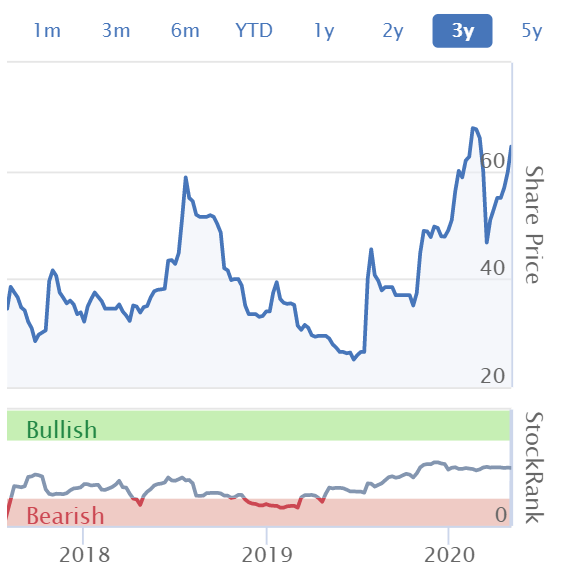

Going by the Stockopedia numbers (Thomson Reuters data) they have 5.41p EPS forecast for FY 03/2020, and we know the company is in line with that. At 120p per share, that's a historic PER of 22.2 - not exactly a bargain. I can live with that PER, because the order book is up a lot, and outlook promising. The company seems to have excellent niche products, in a thriving sector, hence why I like this share, and own a few.

The forecast for FY 03/2021 shows a fall in earnings, to 4.63p, which is now looking too cautious. It's very difficult with broker forecasts at the moment, because so many are out-of-date, prepared pre-covid, and with company guidance often withdrawn, brokers don't seem to want to stick their necks out with updated, more cautious forecasts. Strange, isn't that their job?! In this case however, broker forecast looks sensibly cautious, maybe too cautious now?

My opinion - I like this company a lot, it ticks a lot of the boxes for me - niche products in demand, decent profit margins, sound balance sheet, positive outlook despite covid. Imagine what it could be doing in more normal circumstances?

I reviewed the admission document in some detail here on 18 Feb 2020, when the company warned on profits due to covid disruption in China. That should no longer be an issue, hopefully.

Lack of liquidity in this share is a big problem. I had an order in to buy 10,000 shares after the profit warning, but my broker could only get 5,000 after trying all day. That does make me think, what is the point of it having a listing, if there's so little liquidity in the share? This so frequently happens with small cap floats - the brokers are lazy & greedy, and want to earn big fees with as little effort as possible. Hence the shares are sold in large lumps to institutions. Hence when trading in the shares starts, nothing happens? There can be negligible trades for years, in some smaller caps, for this reason. It's hopeless! All floats need to fragment the shareholdings as much as possible, in order to create an active aftermarket. Otherwise a listing is pointless.

Some companies solve this by getting management out there, going to investor events, doing presentations & webinars online, making sure broker research is widely available on Research Tree, etc, in order to stimulate some interest from private investors, and thereby gradually improve liquidity. This is all such basic stuff, I find it astonishing that I'm still having to implore the city, and companies, to take these basic, obvious steps, to make the most of their expensive stock market listing.

It's the lack of liquidity in this share which means I won't be increasing my position size, despite the reassuring update today. If there is a serious resurgence in covid in future, then I want to be able to sell most of my stuff easily, if needs be. At least having the option would be good. Hence I would rather have say 20 or 30 shares like Tekmar, and small position sizes, rather than buying lots, and being unable to sell. I've got enough of that type of position already! Also, I'm trying to broaden out into having some mid caps too, where the liquidity is marvellous of course. Being stuck in a load of totally illiquid micro caps can be horrible in a market crisis, as you're trapped & cannot get out often.

.

This section written by Jack Brumby:

Air Partner (LON:AIR)

- Share price: 48.75p (up 25.97% today, at 11:46)

- No. shares: 53.5m

- Market cap: £20.7m

Last time I looked at Air Partner (LON:AIR) , its shares were rangebound at around 100p. Today they are up some 25% up to c49p… Clearly I am a little out of the loop here.

As I understand it, Air Partner secures chartered airplanes for customers and provides other related services. I quite like the way this update starts:

This is the third update released during the COVID-19 pandemic and we anticipate communicating to shareholders approximately every four to six weeks during the crisis.

That’s a nice touch - clearly shareholders have been spooked by the lockdown, as you might imagine for an airplane broker and safety consultant.

Current trading

It turns out that the mass parking of airplane fleets is good news for chartered services. AIR says:

The Group has had a strong start to the financial year, with the unaudited accounts for February, March and April showing expected underlying profit before tax of £6m. April was a record month, predominantly driven by unusually high levels of activity in Freight and Group Charter. However, as expected, activity in Private Jets and Safety & Security remains notably lower than in previous years, although Redline has recently secured two new security contract wins.

Going into a little more detail, AIR says that Group Charter has been kept busy with COVID-related repatriation and evacuation work. The group is also flying agricultural workers into the UK from elsewhere in Europe - I didn’t realise this was happening - and there has been increased demand for “corporate shuttles” from UK and US customers that want to transport employees in a more controlled manner.

Freight has similarly been strong, with the group flying emergency shipments of protective personal equipment (PPE). Given all the chatter about PPE shortages and continued grounding of fleets, I could see this demand continuing in the short term.

The group’s Private Jets division continues to be weak, though, with people cutting out non-essential air travel. Safety and Security has also seen much reduced demand.

Cost management and cash

On this point, AIR comments:

At the end of April, the Group has normalised cash in the bank of £13m, excluding significant customer deposits and JetCard cash. The Group has access to a total debt facility of £14.5m, comprising of a £1.5m overdraft and a £13m revolving credit facility (RCF), which is drawn down by £11.5m as at 1 May 2020. The RCF is due to expire in February 2023.

This seems to me on the face of it a strong position for a £20m market cap company, but I admit I am not up to speed with just how AIR operates. Other air travel companies have very high operating costs as a result of maintaining their fleets. If AIR has a more capital-light, outsourced business model then it might be better placed than most to survive and even, as we see, take advantage of heightened demand during lockdown.

I can see from the group’s balance sheet that it is quite asset-light, suggesting it does not actually own aircraft.

My view (Jack)

This is certainly worth a closer look.

In all honesty, I need to read up more on just how Air Partner operates and then I can take a better view on how well placed it is to continue operating. Most airplane operators are finding life incredibly difficult right now.

AIR’s share price has been hammered - is this an efficient market reaction or the baby being thrown out with the bathwater? It is possible that investors just ditched anything remotely to do with flying, regardless of business model. If so then there could be an opportunity here. AIR looks to have a more asset-light, flexible business model than other operators. I imagine a few people in the comments are more familiar with it than I am.

Either way, it certainly looks as though Air Partner’s services (unlike so many Passenger Transportation Service companies) are in high demand right now. The forward order book is encouraging for May and June with demand for Freight and Group Charter services remaining high.

Beyond that, visibility is limited for the group. But visibility is limited for everyone, I suppose. I can’t offer a more detailed view right now but I have tagged this one for further research. I might find something that turns me off - at this kind of valuation, there is usually something - but the group’s shares are also pricing in quite a lot of bad news.

If you subtract group cash, the company has a tiny EV of about £7m compared to FY19 revenue of nearly £78m… Air Partner is clearly seeing heightened demand for some of its services and yet this group is priced more cheaply than a lot of airlines with totally suspended operations. Perhaps it is actually negatively correlated to airlines in that the longer fleets are parked, the more demand there will be for AIR? If so, that is an opportunity given that its share price has so far been positively correlated with airlines.

I like the fact that the company is committing to regular communication throughout the lockdown, too. Worth further research to understand just how its operations stand to gain (or suffer) from current conditions.

Thanks Jack, back me (Paul from here onwards)

.

Getbusy (LON:GETB)

Share price: 68.5p (up 12% today)

No. shares: 48.9m

Market cap: £33.5m

GetBusy plc (AIM: GETB), a leading developer of document management and productivity software products, provides an update on trading in advance of this morning's AGM.

Preamble - a friend implored me to look at this earlier this year, which I did here on 3 Mar 2020. Re-reading my notes, my conclusion was positive, thinking that this share looks potentially interesting. Although I wasn't madly keen on the weak balance sheet (even after the recent placing), and did wonder if the company was perhaps trying to do too many things (3 products), on a tight budget? It has strong recurring revenues, and the 2 loss-making divisions could be shut down if they don't make progress, leaving behind a decently profitable core business. That's an attractive set up.

Overall, I like the investment case for GETB, and it's been on my watchlist since. It's topical too, with the trend towards working from home, and that we're in a tech boom in shares again, which feels quite similar to 1998-2000. Hence even small tech stocks can be multi-baggers in the current environment, with valuation being largely ignored. For now anyway, before the inevitable meltdown happens. That said, GETB's valuation looks reasonable at the moment.

Trading update today - this relates to FY 12/2020 to date.

This sounds reassuring;

The new financial year has started well, with double digit revenue growth and a small Adjusted Profit* being generated in the first four months of the year (the "Period").

On a constant currency basis, recurring revenue and total revenue grew by 20% and 15% respectively in the Period. Recurring revenue represented 90% of the Group's total revenue in the Period.

Note that this includes April, which is when the big impact of covid really hit. Therefore to grow revenue 15% in that 4 month period is quite good. Profitability isn't a big issue at this growth stage. As long as it's not haemorrhaging cash, then I'm fine with small growth companies not yet reporting profits. Particularly where there's a lot of potential operational gearing, as there is here.

More detail is given in the RNS.

Covid-19 impact - a bit mixed, here are the main points;

- GETB staff working from home is going well

- Accountants & bookkeepers make up 60% of revenues, so performance depends on health of their clients

- Increased risk of customer churn & reduced number of licenses

- Some clients stretching payment terms & switching from annual to monthly terms (bad for GETB's cashflow, as this would reduce deferred income & cash balances)

- Risk is spread - no customer is over 1% of recurring revenues

- Trade shows cancelled, so some marketing spend diverted to online lead generation

- GETB has stress-tested its cashflows in various scenarios, and believes it is OK to withstand crisis

Outlook - should benefit from long-term trend towards working from home

Reiterates 2020 guidance - very good, how many companies are able to do this?! Although the forecast figures are not particularly great;

We remain confident that revenue and Adjusted Loss* for 2020 will be in line with market expectations of £13.8m and £(0.6)m respectively.

* Adjusted Profit / (Loss) before Tax is Profit / Loss before share option costs, net capitalised development costs, finance costs that are not related to leases, and non-underlying items.

My opinion - clearly the recession which is hitting us now, is bound to do some damage to GETB, but also creates new opportunities. I remain of the view that this company looks interesting, and I can see why bulls like it. Having previously checked out the figures, I can't see any particular bearish points. A slightly stronger balance sheet would be nice, but not essential given recurring revenues.

I don't see anything in today's update to make me want to rush out and buy this share. It's reassuring rather than strongly bullish, in my view. Overall though, I think GetBusy looks interesting, and readers might want to take a closer look, if you're interested in small growth companies.

.

Johnson Service (LON:JSG)

Share price: 116.5p (down 2% today)

No. shares: 369.8m

Market cap: £430.8m

AGM Statement & Covid-19 Update

Johnson Service Group PLC (the "Company" or the "Group"), a leading UK textile services provider, provides an update on its strong financial and liquidity position and the actions taken in response to COVID-19 since its previous announcement on 20 March 2020.

This used to be a dry cleaning business, but it sold off that part, in order to concentrate on textile hire - e.g. uniforms, and linen/towels, etc for hotels, restaurants, etc. Therefore this must be an awful sector to be in now, and for some time to come. Bear in mind that it got into trouble in the 2008 due to having too much debt, and it looks as if history might be about to repeat, possibly?

The Group is continuing to see a significant amount of disruption across its markets, prompting the Board to implement appropriate mitigating actions...

Workwear business - holding up relatively well. The April figure is key, as that's after lockdown began, so minus 12% strikes me as surprisingly modest fall in revenues. I'm guessing that "trading" means revenues & not profits, in this context;

Organic growth within our Workwear business for the first quarter overall was slightly negative and trading in April was some 12% down.

Hospitality sector - a very different picture here, with the business at close to zero revenues current run rate, not a surprise;

Within HORECA, which serves the Hotel, Restaurant and Catering markets, we have ceased processing at the vast majority of our 18 sites as the demand for linen has significantly reduced from most sections of the hospitality market. Organic growth for the first two months of the year was particularly strong at 9%, however, March saw volumes reduce resulting in a negative organic growth in the month of 27%. In April, revenue fell by some 97% on an organic basis due to the closure of the vast majority of our hospitality customers.

- Furloughed a significant propertion of workers

- Senior staff & Board taken 20% pay cut for 3 months, admin staff taken 10% pay cut

- Capex halted, and discretionary spending

Net debt - not excessive when EBITDA was good, but in current circumstances EBITDA could be running at a loss, I imagine?

Net debt, excluding IFRS 16, at the end of March 2020 was in line with December 2019 at £87.7 million, resulting in a net debt to adjusted EBITDA leverage ratio, calculated in accordance with our bank facilities, of 1.3:1

Govt aid - it is using furlough scheme, and has deferred VAT & payroll taxes

Bank discussions - June 2020 covenant test waived, even though JSG says it should pass.

JSG wants 2021 covenants relaxed, and to draw down £40m accordion facility. Sounds like these have not yet been agreed by the bank.

It is also exploring other options of Govt funding, ie. loan schemes.

Divis being suspended, as you would expect.

The above makes me uneasy, as it sounds as if the bank has not agreed (yet) to the company's requests. This raises the likelihood of the bank possibly requiring JSG to raise some fresh equity before agreeing extended facilities & relaxed 2021 covenants. Or, the Govt schemes could provide the necessary additional liquidity.

No guidance is being given, due to uncertainty.

My opinion - probably the only thing worse than being a restaurant or hotel right now, is being a supplier to restaurants & hotels.

I've been flagging, for years, that JSG has a weak balance sheet, with too much debt. That doesn't matter in the good times, but becomes a problem when recession looms.

Banks are being very supportive in the main, so maybe the risk is not that great? It's just a risk that I would prefer not to take. If JSG would be a multi-bagger on emerging from this crisis, then it might have some appeal. But it strikes me the upside is not particularly exciting (maybe a 50% gain?) for taking quite a large risk. Hence I see risk:reward here as being unfavourable.

All done for today.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.