Good morning, it's Paul here.

Yesterday saw a sharp downturn in US markets. The S&P 500 is down 7.5% in the last week. The catalyst seems to have been an escalation of the US-China trade war, and China devaluing its currency. How this affects UK small caps? Who knows!

My view is that the avalanche of takeover bids, is the more interesting story, and a good reason to remain invested in UK shares.

Please see the header for the companies I intend writing about today. Plus of course I always read the subscriber comments below, and if anyone makes a good case for why a particular company's results/trading update looks interesting, then I follow up on those when time permits.

Estimated completion time today is about [edited, as VCP took me longer than expected]: 7pm-ish, and I'll sign off once there will be no more updates. Hopefully the above manages expectations, especially for newer subscribers who haven't quite got the hang of the erratic way that I work.

Jack Wills

The Telegraph reports that struggling fashion chain Jack Wills has gone into a pre-pack administration, and been bought out by guess who - yes, Mike Ashley of course! It's a small deal, at £12.75m.

Someone from Warwick Business School is quoted as making the very good point, that Sports Direct doesn't seem to have the skill set to manage all these different brands. On the other hand, Ashley has proven the doubters wrong in the past, so it will be interesting to see how Sports Direct's bizarre headlong expansion pans out.

Warpaint London (LON:W7L)

Share price: 56.5p (down c.27% today, at 11:59)

No. shares: 76.7m

Market cap: £43.3m

Trading update (profit warning)

Warpaint London plc (AIM: W7L), the specialist supplier of colour cosmetics and owner of the W7 and Technic brands, provides a trading update for the current financial year. [Paul: year ending 31 Dec 2019]

A 27% drop in share price makes this look like a profit warning.

To bring me up to speed, am just re-reading my notes here on 21 May 2019, after the last trading update at the AGM. In summary, it reported "challenging" trading in the UK, better overseas sales, and concluded with "cautious optimism". Positives were mainly: a reasonable PER, good dividend yield, and strong balance sheet.

Remember there had previously been a profit warning in Oct 2018.

Today's update -

The Board anticipates that Group sales for the financial year to 31 December 2019 will be approximately £50 million.

That is c.5% below the broker consensus revenues shown on the StockReport here.

Here comes the profit warning;

However, a number of factors including the geographic mix of sales, adverse exchange rate movements and the Group's investment in its strategy for future growth, particularly in the US, are having an impact on profitability in the current financial year.

Consequently, the Company's board currently expects adjusted profit before tax for the year ending 31 December 2019 (excluding amortisation in connection with acquisitions, share incentive scheme costs and exceptional items, which the board expects to total approximately £2.8 million) will be in the range of £6 million to £7 million.

My first impression is that £6-7m adjusted profit is plenty for a company that is now valued at only £43m mkt cap. Maybe the share price has overshot on the downside?

Forecasts - I can't find anything new today, but a note from Hardman dated 24 April 2019, forecasts adj PBT of £9.0m. Therefore the £6-7m range profit guidance given today is a 22-33% downward revision. The 27% drop in share price therefore looks entirely logical.

By my rough calculations, 2019 now looks to be heading for something like 6-7p adj EPS.

Balance sheet - the first thing to check when a company warns on profits, is whether it threatens solvency (e.g. if bank covenants might be breached). I've checked the last accounts, and the balance sheet as at 31 Dec 2018 is strong.

NAV: £41.0m, NTAV: £24.5m

Current ratio: very strong, at 4.80

In plain English, what this means is that the fixed assets, inventories, and the receivables book, combined are all owned outright by shareholders. As opposed to the more normal situation, where assets are part-funded with some bank debt.

The little bank debt it had at 31 Dec 2018, was more than covered by cash.

Inventories & receivables both look rather too high, but despite that, it still had net cash of £1.3m. So nothing at all to worry about, re solvency.

Dividends - the second thing to check after a profit warning, is whether the dividends are under threat. In this case, 5.0p divis are forecast for 2019. Given, that EPS now looks to only modestly above that (my estimate above of 6-7p), then I imagine there is a strong possibility that the dividend could be reduced.

The strong balance sheet means that the company should remain on the dividend list, but I would imagine the divis might be cut back from say 5.0p to perhaps 3-4p? It's a policy decision though, so that's up to the company. Anyone particularly interested in this could check back in previous results statements, searching (CTRL+F) for the words "dividend policy". Actually, it's so easy to do, I've just done that, and the last Annual Report just describes it as "progressive".

Last year the company paid out 4.4p divis, versus 9.1p of adj EPS, so a payout ratio of 0.48.

If the same payout ratio were to pertain in 2019, then that suggests divis of about 3p to 3.5p. That would be a divi yield of over 5%, if buying today - still very good.

This is all educated guesswork of course, management might decide to maintain last year's divis, or cut them completely, or something in between, we don't know which yet. Although the strong balance sheet should give them the scope to continue paying fairly good divis.

My opinion - this share is looking good on value, but it was looking good on value a few months ago too, when the share price was almost double the current level.

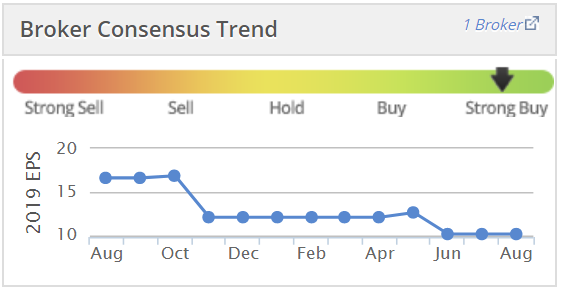

What concerns me is that earnings forecasts are on a seemingly relentless downward slope. Note that consensus forecast has dropped a lot, and this graph will soon update to 6-7p EPS, so another drop is coming;

I feel that the company's announcements do not adequately explain what is going wrong at the company. Why is profit guidance dropping every few months? There must be something underlying this.

To buy into a falling share, I have to be clear about what's gone wrong, and what management is doing to fix it. A good example of this, is Revolution Bars (LON:RBG) (in which I hold a long position) - where new management has set out & is executing a very detailed, commonsense plan to turnaround disappointing performance. Hence why I am happy to hold, and buy more of that one. It seems to me that the plan makes sense, and should succeed, given time. The problems are fixable - revamping tired sites, and getting in better site managers. Plus improving all other operational aspects of the business, and cutting costs where needed. All good stuff.

I can't say the same with Warpaint. Management has not explained why performance is deteriorating (although still very decently profitable, it should be emphasised). Nor have they set out what is being done to improve performance. For that reason, I can't muster the conviction to buy into this share, even though the valuation looks cheap, and is supported by a strong balance sheet.

The key here would be to properly research the products, and the competitive landscape. That might help determine if the products are any good or not, which is the key to future performance.

On balance then, I'm feeling neutral to mildly positive (on valuation grounds only) about Warpaint. But I wouldn't buy any without doing detailed research about the products - online reviews and social media would be a good place to start.

It would be interesting to meet management too, to have the business explained to us. I wonder if they ever do meetings with investors? Could be a good initiative.

Victoria (LON:VCP)

Share price: 525p (unchanged today, at 12:59)

No. shares: 125.4m

Market cap: £658.4m

Victoria PLC, (LSE: VCP) the international designers, manufacturers and distributors of innovative flooring, is pleased to announce it has acquired the business and certain assets of high-quality Spanish ceramic flooring manufacturer, Iberoalcorense, S.L ("Ibero") (www.iberoceramica.com) (the "Acquisition").

This is no longer a small cap, but we've followed Victoria here for years, so it remains of interest.

I normally don't mention acquisitions, unless they're important-looking. This one is very small, looks to be about £9m initial payment (3 times EBITDA), with a further c.£6m due if targets are hit. So small beer for an acquisitive group with a market cap of £658m.

It's always worth reading all RNSs for companies of interest, because sometimes there can be other points of interest buried in an announcement about something trivial. Occasionally, a trading update might be included.

Net debt - In this case, Victoria comments on its overall net debt situation, which has been controversial in the past, saying;

On completion, Victoria's net debt to EBITDA ratio1* will not increase.

As previously stated, the Board believes leverage is at a comfortable level - especially given the Group's high level of cash generation - and within Victoria's stated acceptable level of debt.

*1 as measured in line with our bank facility covenants

This bit is also interesting, and quite reassuring (particularly on overseas earnings, given current sterling weakness);

We have been successful at negotiating a very attractive price for Ibero with the initial consideration being less than 3x the last 12 months EBITDA and, including the maximum earn-out payment, it will still be under 5x EBITDA - before considering the benefits of the expected synergies.

These payments will be funded entirely from Victoria's current cash balances and will not require any further borrowings.

Post-completion, nearly 75% of Victoria's earnings will come from outside the UK - continuing our transformation into an international flooring business.

Outlook - again, sounds reassuring;

It has been 12 months since our last acquisition, Ceramica Saloni, which has now been fully integrated within our Keraben operation and is contributing strongly to our performance with the realisation of material synergies.

Our strategy of achieving scale through acquisitions and using that scale to extract operational synergies continues to deliver value for the Group.With a strong management team in place in Spain, we look forward to developing the Ibero business as part of Victoria."

My opinion - I feel that management sailed too close to the wind, taking on more debt than some investors were comfortable with. There was also an aborted attempt to raise bond financing in late 2018, which frightened the horses. However, that's all in the past now, and the share price has been recovering this year, as the dust has settled. Also, I think taking a 12 month break from acquisitions, to allow cashflow to reduce debt, makes a lot of sense.

I've had several meetings with Geoff Wilding (Chairman) in recent years, and rate him highly. It's a clever strategy, to have identified a sector with lots of small, privately-owned businesses, with typically excessive inventories, and excess costs. Applying more modern management techniques (e.g. focusing on best selling lines, and freeing up working capital through efficiency gains, etc) has helped make a lot of the acquisitions partially self-funding.

Although in more recent years, I think too much debt was taken on. The Chairman refutes this, so we just agreed to disagree on that point when I last met him. My feeling is that more headroom needs to be factored in, to allow for what might happen to profits & cashflow in the next recession. However, see below, as the situation has now changed very much for the better.

Refinancing - I've only just seen the recent RNSs, stating that the company has successfully refinanced, with the issuance of E330m 5.25% fixed rate bonds with expiry some time in 2024.

I've put in a request for a call with Victoria, so I can talk all this through with the Chairman. Will add any additional thoughts here, if we speak.

Telecon today with Geoff Wilding

The Chairman kindly rang me to respond to my email queries. It's all on the public record, so there's nothing here that can't be published.

Q1. Recent bond issuance - what are the covenants, and why did you raise bond funding?

A1. They are covenant light, therefore much more secure than bank lending. Main reasons for raising bond funding;

- Depth of bond market is huge. So this could be the first of more deals

- Long-term money - secure for 5 years, so frees up management to run the business, instead of thinking about financing

- Covenant lite, so safer & more secure than bank debt. If anything were to go wrong, business continues as normal

Cost is about 125 bps above previous bank funding, well worth it. Also it's fixed rate at 5.25% - certainty.

Q2. With my queries answered, and being happy with the situation, I just asked him if there were any other points he wanted to get across.

A2. A few more points;

Exceptional costs - see last Annual Report - there are no material exceptional costs expected in the current year, FY 03/2020. Also no growth capex needed. So free cashflow should "go through the roof" this year.

Dividends - not paying divis - policy is explained in last Annual Report. I asked if shareholders were demanding divis? Generally not, as two thirds of register (excl. Chairman's c.20%) are USA-owned organisations that prioritise growth over divis. "If you're after dividends, don't buy shares in Victoria!"

Director purchase - £4.9m purchase in Oct 2018 was he says, the largest open market purchase by a listed company Director since the early 1990s. Although note that it was a good bit smaller than previous higher priced sales!

Trading update - take a look at most recent one in mid July, which reported LFL revenue gains, and an operating margin up over 100bps on prior year. (I've not checked this, but assume it's correct).

I wrapped up by thanking him, and apologising for my somewhat alarmist comments previously, when the bond issue frightened me and the whole market, to be fair. The Chairman replied by saying that at least I'm prepared to pick up the phone, have meetings, and change my mind when the facts change - unlike some other commentators, who stick to a wrong opinion & refuse to have a dialogue with the company.

He also quipped that, "I may not always agree with what you write Paul, but it's never boring!"

Q3. I just thought of some follow-on questions, so asked, now the group is so much larger, is it a struggle to manage?

A3. No, because it's only 10 business units, which each have a very strong management team (average 27 years working in the sector). Plus Victoria has a strong CEO overseeing everything.

Q4. What happens in the next recession? Would the debt not then become a problem, if profits/cashflow collapse.

A4. People misunderstand our cost structure. Only c.8% is fixed costs. 50% are variable costs (raw materials), and the rest is semi-variable (e.g. wages, marketing). Therefore, we can weather a downturn better than people expect. Look back at 2008-9, when turnover actually increased, in the worst recession in 70 years.

My (revised) opinion - Geoff Wilding is incredibly persuasive, and I always come away with a really positive impression (which can be dangerous)! That said, everything he says makes complete sense, and has stood the test of time - i.e. his reassurances in the past have been proven correct with subsequent facts & performance.

Having completed the recent bond refinancing, I think risk:reward has dramatically improved here. The main impediment to me previously wanting to own shares, was the risk inherent in substantial bank debt. Moving that over to low risk bond funding, is very positive indeed, in my view.

The current valuation looks about right to me. However, when you factor in future acquisitions, then profitability should increase considerably. It reminds me of a bigger version of Judges Scientific (LON:JDG) or Tracsis (LON:TRCS) - an acquisitive group that is buying cheaply, using a disciplined process, to increase earnings strongly. Victoria also brings considerable benefits from adding perhaps somewhat sleepy, family-owned businesses into the group - making them more efficient.

With 75% of earnings outside the UK, Brexit issues shouldn't be too much of a worry.

Overall, I like what I see here, and am adding it to my watchlist.

Anexo (LON:ANX)

Share price: 193.5p (up 9% today, at 16:11)

No. shares: 110.0m

Market cap: £212.9m

Anexo Group plc (AIM: ANX), the specialist integrated credit hire and legal services provider, today provides the following Trading Update in respect of the year ending 31 December 2019 ('FY-2019').

This is a reader request. My heart sank when I realised that it's in a sector that I absolutely loath. Still, I've started, so I'll finish.

This company listed on AIM in June 2018. This is my first look at it, so I'll start with some background comments. Here is the Admission Document for anyone who wants to read it. I'll do a quick 10 minute skim, to get a flavour for the business...

... much later: OK, a 10 minute scan took rather longer than 10 minutes (!)

AIM Admission Document. These are the main points I noted down;

- Placing of 25m new shares at 100p, by Arden - company to receive £8.6m net of fees

- £15m from placing proceeds is going to selling shareholders - slightly confusing - but c.£5m of that is circular - coming back into the company to pay off Director loans. Therefore total net (cash) proceeds to the company looks like it was c. £13.6m

- Run by lawyers & accountants

- Provides replacement vehicles & legal services to "impecunious" (i.e. skint!) no-fault party in accidents. So it's an ambulance-chasing type of business.

- Does not work for insurers, it works in conflict with them (this was how Accident Exchange worked, and that was a complete disaster for investors - so how is this different?)

- Charges excessive car hire rates, typically 2-3 times the GTA rates agreed with insurers - this strikes me as profiteering - is that sustainable, I wonder?

- Average car hire period is 69 days, and an almost unbelievably high charge of £11.2k!

- Cases are settled at average of 54% of that £11.2k, by negotiation, so £5.8k (still wildly excessive, and this type of business therefore pushes up insurance premiums for all of us)

- Insurers don't pay until taken to court

- Anexo typically has 10 barristers per day pursuing cases

- Cases rarely settled before issuing proceedings - again this seems exactly the same as Accident Exchange's failed business model, so I'm curious to find out why this does seem to be working for Anexo

- IPO funds will allow it to be more aggressive in pursuing claims - i.e. offering less settlement discount to insurers

- 99% success rate claimed, due to "quality vetting process"

- Directors & connected people will own 77.3% of the company after IPO - plenty of skin in the game, maybe too much even?

- Risks section on pages 31-36 is worth reading. My main concern is the regulatory threat. Insurers must be lobbying Govt to end this highly profitable racket?!

- Section B - accounts - very high operating profit margin - is this sustainable?

- Massive trade receivables, being money the company is in the process of extracting from insurance companies

- Little fixed assets, only £1.5m

- Strong balance sheet, with little debt relative to profits

- Balance sheet has grown very strongly, organically (i.e. with no fresh shares issued) between 2015-17

If my points above seem to be dripping with disdain, then good, that was my intention. What a horrible business model. The way I see it, the company seems to be generating excessive profits, from taking advantage of a legal process which allows them to charge far more than seems reasonable, for car hire.

But, if that doesn't bother you, then let's see how current trading is going.

Trading update -

- "Considerable improvement" in financing facilities has been achieved

- Cost savings also achieved with its fleet insurance provider

- Better targeting of most valuable & profitable claims

- Increased levels of case settlements & cash collection - record month in July

Resulting in;

Taking these matters together, the Board now confirms that profit before tax will significantly exceed current market expectations of £20.0 million.

Great news for shareholders.

My opinion - you've probably already gathered what I think of this.

I cannot see any difference between the business model here, and what Accident Exchange used to do years ago (a listed ambulance-chaser that eventually delisted for peanuts). What killed off Accident Exchange, after several years of apparent success & big profits, was that they couldn't turn the debtors into cash. Litigation dragged on & on, as insurers deliberately held up payments, and eventually it overwhelmed ACE. Its cashflow was constricted, as all the paper profits ended up in an ever-growing mountain of debtors.

It could be that Anexo is operating more efficiently, and is somehow able to collect in the receivables better than ACE did?

Since my bad experience with ACE (I lost quite a lot personally on the shares), I always steer clear of any business where the customers have to be forced to pay the invoice, and really don't want to. That can be a big can of worms at some point.

So for me, this is not something I would want to own, at any price.

The absolutely key question is whether the debtors can be reliably turned into cash, and how that pans out & changes over time. At the moment these seems to be some cash generation, but the cashflow mainly seems to be swallowed up in rising receivables. That needs careful monitoring. It could all turn out fine, who knows, but for me once bitten, twice shy, with this business model.

I'll sign off there, as I have a restaurant booking for 18:30.

I might come back and have a look at GATC, BOO, WGB, ZTF, but it depends how many beers I have with dinner. To make things easier, if I do manage to muster up the energy to write some more, then I'll put it in the placeholder article for tomorrow. That way our OCD readers won't have to keep checking this article to see if anything more has been added ;-)

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.