Hi, it's Paul here. I've just got back from a long weekend in Amsterdam, so am not yet operating at full mental capacity.

We're seeing rather dramatic volatility in the US markets, with a sharp correction underway. I'm sure members will want to discuss this here, as well as our usual small caps stuff. So please post away.

Hi, Graham here!

Paul needs a break after his trip to Amsterdam.

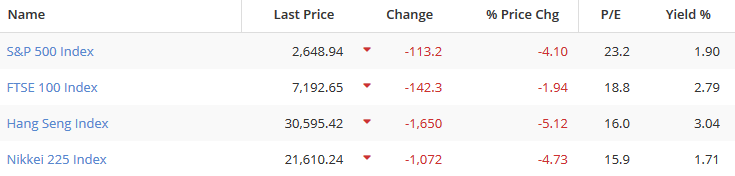

Let's see what's happening in the markets:

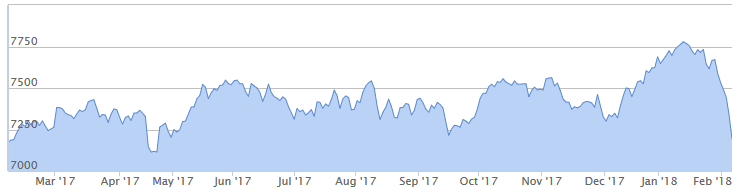

Following on from the FTSE's weak performance on Monday, which preceded Wall Street's biggest one-day drop ever (in terms of the number of points), the UK market is now firmly back within last year's range:

As you can see, we are still quite far from making any long-term lows. All that's been lost is the gradual progress higher achieved last year.

Most people (including myself) view the US as being the most overly extended market, so the correction should be the most dramatic over there.

Technical "support" for the FTSE is coming up soon at 7100. Below there, not much until 6500-6600:

Investment-related companies are some of the biggest fallers today:

What's going on?

Last week, the US posted rising average hourly earnings, firming up the belief that the federal reserve would raise interest rates another three or four times this year to stave off inflation.

Expectations of rising rates had seen the 10-year US bond yield on the march higher for the past few months:

The bond markets are much larger than the equity markets. If acceptable yields can be achieved in the bond market, such as 2.7% from a US 10-Year T-Note, then conservative investors would be much happier over there rather than in high-risk, overvalued equity markets.

Some people think that T-Note needs to hit 4% to be a serious drag on equities, but merely getting close to 3% was sufficient to create yesterday's huge sell-off.

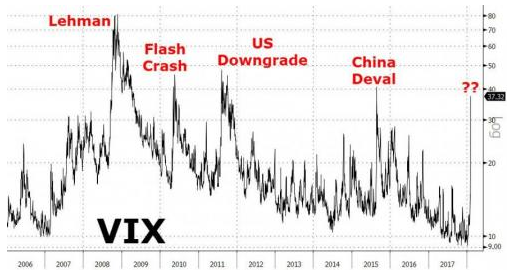

Depending on how you measure it, we just had the second longest bull run of the last 100 years. Investors may have been lulled into a false sense of security by extraordinarily calm conditions in equities, where even a 3% pull-back refused to happen.

That sense of calm has been utterly wiped away, and with it probably some of the trading accounts of those people who jumped on the VIX (volatility index) momentum trade. VIX has been so calm for so long that betting against it became an easy money-maker, until it wasn't:

(Source: ZeroHedge)

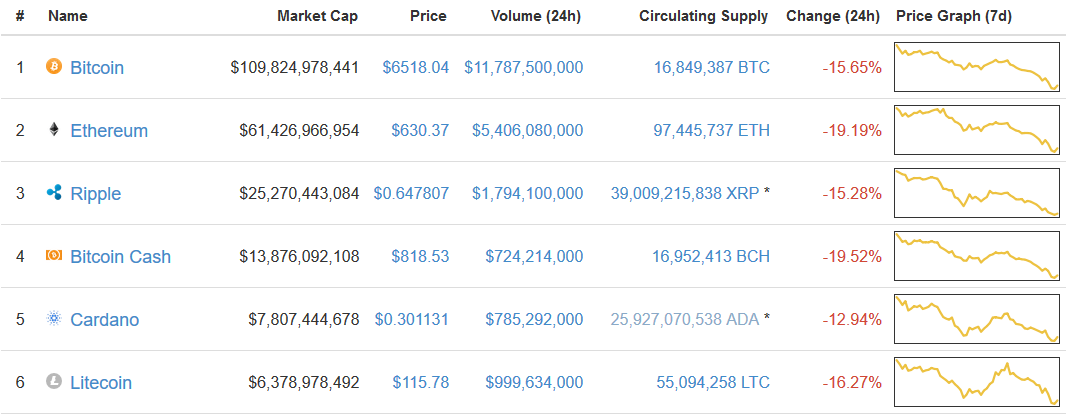

Crypto-currencies have also collapsed again, and personally I wonder if this might be the death knell for many of the minor currencies, if not the space as a whole:

(Source: coinmarketcap.com)

What to do?

Hopefully, your overall portfolio management strategy has incorporated the risk of a correction/crash in equities.

Equities are a volatile long-term investment, even if you are diversified, so they can be painful in the short-term.

Some people have been holding increased amounts of cash, on the basis that markets were overvalued and may provide a better buying opportunity after a correction.

Holding cash in the long-term is of course a losing strategy compared to equities. However, it can be appropriate to hold cash in some portfolios in varying amounts.

I'm 25% in cash and will probably maintain my plan to continue gradually buying equities in the coming months, with my eagerness to buy increasing the lower the markets fall.

As always, but particularly in times like this, it's important to keep a watchlist or at least to regularly check up on stocks you want to buy, to see if they have fallen to a level you are happy with.

Also, you can keep an eye on the stocks which have fallen the most each day, to see if there are unusual and perhaps unnecessary downward movements in stocks you might be interested in. Stockopedia offers a customisable Top Fallers facility.

If you don't have any cash, and if you want to de-risk and sell out, then I suppose that can make sense too. It doesn't really fit into the value-investing philosophy to sell things because of and after a market correction, but I know that lots of people do this when they fear a bear market has started.

Another option is to put some short positions on. This is a risky, dangerous practice if not done correctly, and has a negative long-term outcome. However, for investors who find the volatility too much to bear, then hedging by selling short the FTSE or some other market is an option.

In my own case, I did attempt to put a small short trade on $TSLA last night. I unfortunately couldn't do it, for technical reasons beyond my control, but I think that might have been a nice complement to my long portfolio.

Whatever you do, don't panic!

6pm update: The FTSE has closed nearly 200 points lower at 7141, near that 7100 support level from 2017 which I mentioned earlier.

New York's Dow Jones opened much lower (nearly 600 points) but has recovered and all three US indices are now up by small amounts.

I don't try to make a living off short-term movements. However, I would suggest that the volatility over the past few days is likely to wake up investors, particularly in the US but also in Europe, to the risk in their equity portfolios, which they may have grown complacent about.

So I would expect the tone in the market to be more bearish and more anxious from here. We will not be reading any more stories about people becoming millionaires by shorting the volatility index for a while (external link).

Having said all of that, this is the SCVR and like most of you, I am keen to get back to stock-picking soon.

Thanks for dropping by.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.