Good morning, it's Paul here with the SCVR for Tuesday. Let's hope we have a bit more news than yesterday!

Portmeirion (LON:PMP) (I hold) interview - in case you didn't see the link that I put up here on Friday evening, here it is again - this is my Q&A audio interview with the newish (from Sept 2019) CEO of Portmeirion, a pottery, candles, and kitchenwares group headquartered in Stoke-on-Trent. He has refreshed the group's strategy, with a greater focus on expansion, in particular online. An equity fundraising carried out earlier this year means the group is fully financed to push ahead with its marketing, and range expansion. At around 400p, I think the shares look interesting, with a longer term view, although I'm not expecting it to shoot the lights out in the short term. Like a lot of things that were hit by covid/lockdown, recovery is a gradual process, and takes time.

Timings - I've got 3 quite big sections up, and am taking a break for lunch now. Will do some more work this afternoon.

Agenda - this is what has caught my eye, from today's results & trading updates;

Castings (LON:CGS) - Trading update

Rbg Holdings (LON:RBGP) - Trading & market guidance update

Restaurant (LON:RTN) - Interim Results

Smartspace Software (LON:SMRT) - Final Results FY20, and Interim Results FY 21

.

10pm curfew - there are press reports today that Tories might rebel in enough numbers to force the Govt to retreat on the 10pm curfew, which has hurt bars & restaurants. I think it's another example of policy being made on the hoof, with seemingly nobody thinking through the unintended consequences of such policies. I could have told them, if the Govt had asked me, that kicking out all the bars at 10pm, would have led to less social distancing, as people congregate outside bars, and pile into supermarkets to buy take-out booze, and head back to each others' houses, parks, beaches, to carry on drinking.

If we do see this daft policy repealed, then it could give a much-needed boost to the bars & restaurants. From what I've seen, most of which have tried very hard to implement as much social distancing as they can. And let's hope table service in pubs is here to stay permanently, I love it!

Boohoo (LON:BOO) (I hold) - just to surprise & delight all my readers, a comment on BooHoo! Drapers Record is reporting that failed Labour leadership candidate, Liz Kendall, has written to BOO shareholders suggesting that they oust the management team. BOO shareholders might want to consider this, if they have their brains replaced by cauliflowers! Why on earth would shareholders want to get rid of the management team that has delivered such spectacular growth & shareholder value? Particularly as the supply chain issue has already been dealt with comprehensively? Still, anything goes, when politicians want so score some points and appear relevant to voters. She's not even prompt on this issue, which has been rumbling away/flaring up, for about 2 years now, and has been addressed. Still, as I demonstrated earlier this year, every time the share price falls on background noise like this, it presents long-term, and new shareholders with an attractive buying opportunity.

.

Castings (LON:CGS)

338p (up 1%) - mkt cap £148m

This is an iron castings & machining group. I seem to recall that turbocharger housings for commercial vehicles are key products. It's a pity that the trading update doesn't give a brief summary of what the company does, which most companies tend to do, and I think is best practice. There are several thousand companies listed in the UK, so how are investors meant to remember what each one does, especially the smaller ones like this?

As with so many companies reporting to us at the moment, a gradual recovery from covid/lockdown disruption is underway;

We reported in August 2020 that demand from the commercial vehicle sector had increased to over 60% of pre-Covid output levels. Forward schedules at that time were suggesting a further increase to approximately 85% and it is pleasing to report that the monthly demand is now at this level.

In other words, the most recent trading is still running 15% down on last year, and of course the YTD average will be worse than that.

Outlook -

Future schedules currently suggest output levels moving back towards pre-Covid levels during the third quarter [Paul: Oct-Dec 2020] of the financial year.

However, there remains uncertainty regarding the impact of Brexit and the pandemic and therefore whether this forecast demand increase will materialise and how sustainable it might be.

As we learn to cope with covid, Brexit is resurging as an issue. If no deal (or partial deal) does happen, then the two areas most at risk of disruption are food (30-40% tariffs) and vehicles (10% tariffs). Everything else has insignificant tariffs, although disruption could come in the form of non-tariff barriers, or indigestion from paperwork, or physical blockages at the ports. Who knows, we'll just have to see what happens. These things are nearly always resolved or fudged in an all-night sitting, on the deadline - that's just how the EU works.

Being in the automotive sector, Castings must be more at risk of disruption than many other UK companies. That said, its bulletproof balance sheet means that there's no solvency risk, whatever the outcome of Brexit. We got through the closure of large parts of the economy for several months, so we'll get through Brexit too.

Speaking of cash, Castings didn't need to conserve cash, as it has plenty, but it has done anyway;

In the light of the pandemic, the board has focussed on cash preservation during the six-month period; the balance sheet remains strong with cash levels of £35 million as at 30 September 2020.

Cash is material to the valuation of the company, given that the market cap is £148m. £35m cash is nearly 24% of the market cap.

Balance sheet - I've looked again at the last reported balance sheet, as at 31 March 2020, and it's phenomenal. NAV was £131.7m, and there are no intangibles, so that's all real. Moreover, the cash pile is more than enough to pay off all creditors - short and long term. What this means is that when you buy shares in Castings, you're not only buying the future profits of the company in perpetuity, but you're also getting a load of surplus assets thrown in for free.

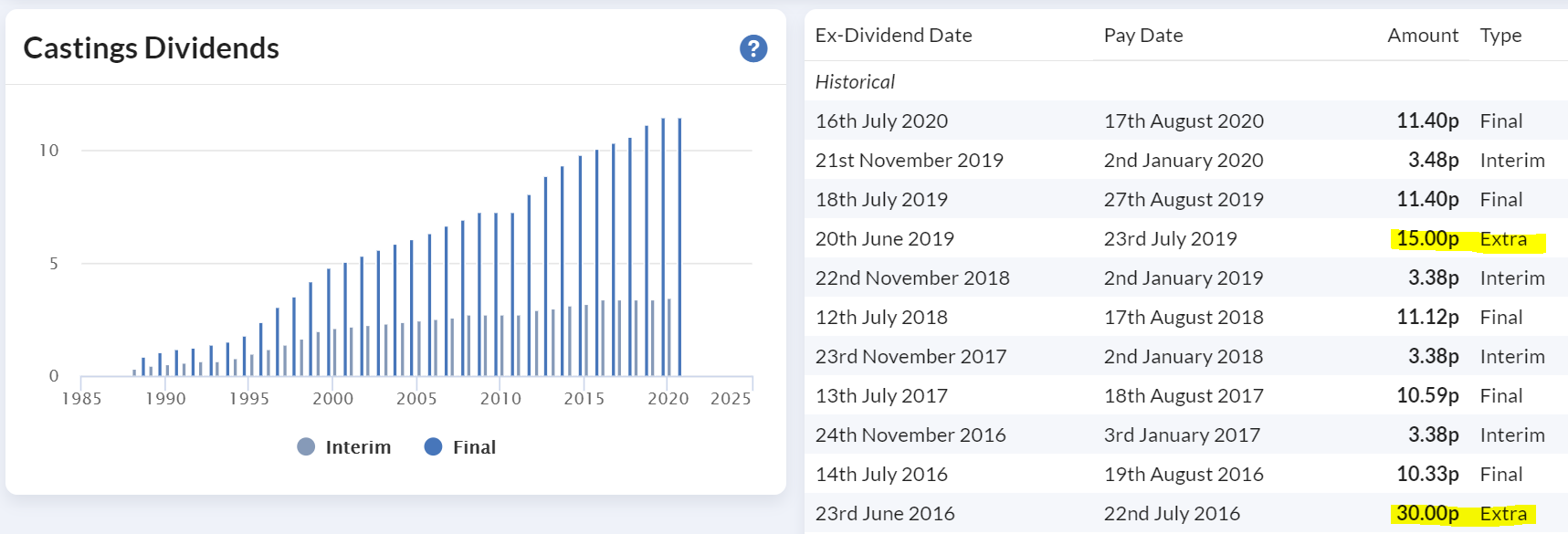

Dividends are another pleasant spin-off usually, from companies with very strong balance sheets. I don't know what's likely to happen with divis this year, but in future years, Castings should have the capacity to continue paying generous divis. Looking at the Stockopedia page for divis, it looks like Castings has paid a couple of special divis along the way, and could easily do so again, given its balance sheet excess strength.

.

.

Sale of site - has raised £1.95m recently.

Results - interims (Apr-Sept 2020) are due out on 13 Nov 2020.

My opinion - it doesn't take a genius to work out that results for FY 03/2021 are going to be poor, due to the lost sales from covid/lockdown. However, business seems to be gradually returning to normal. Brexit could cause some disruption, but it's not in anyone's interests to have extended blockages to trade. Castings is so strongly financed, that it should be able to sail through any disruption with no lasting damage.

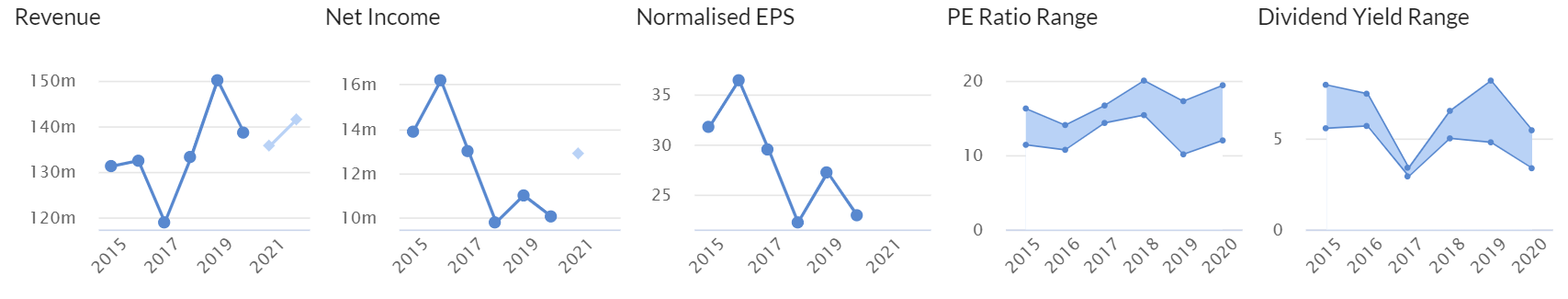

The crucial question then - are Castings shares a bargain? Not really, is my view - because as you can see from the graphs below, profitability was already in decline before covid. So it's a mature business. Add to that, the threats from covid/Brexit/electrification of vehicles, and I'm not sure I'd particularly want to own this share, unless the PER was well into single digits. Although the amazing balance sheet does mean that the company could in theory do a large acquisition, in order to diversify. That might give the shares a boost in future, possibly? I'd like to see an acquisition making products for a different sector, and serving global markets, rather than potentially problematic European markets - which in any case are likely to be showing little growth any time soon.

I'll keep CGS on my watchlist, as it's the type of thing I'd be keen to buy, if it plunges on Brexit disruption later this year, or early next year. But I cannot see the point in paying full price now.

.

.

Rbg Holdings (LON:RBGP)

66p (up 8%) - mkt cap £56.4m

Trading & market guidance update

I'm not familiar with this share.

RBG Holdings plc (AIM: RBGP), the professional services group, today publishes an update on trading, alongside the reinstatement of guidance for the expected financial performance of the Group for the full year to 31 December 2020.

Since interims were published;

... the Group's law firm, Rosenblatt Limited ("RBL") has continued to trade well with case value and volumes remaining significantly ahead year-on-year.

At the interims, it was reported that two other divisions had been performing below plan: newly formed litigation finance business, LionFish, and Convex Capital (M&A advisory). Today we are told that;

- Convex has earned a deal fee of £1.2m, and

- LionFish has realised £1.1m from its litigation financing book

The trouble with this information, is that there's no context. Is the £1.1m realised good, or not so good? We're not told. Also, what are LionFish's overheads? Is it trading profitably or not? Again, no information is given.

Guidance - is reinstated, but only for revenues, not profitability, which again is of limited use;

... improved visibility of the financial performance of the Group for the year as a whole. Accordingly, the Board is in a position to reinstate guidance for the year to 31 December 2020. Based on management's current forecasts, the Board now expects Group revenue and realised gains to be between £24 million and £26 million (2019: £23.7 million).

Covid uncertainty means it hasn't decided what (if anything) to pay for the interim divi.

My opinion - the company has thrown a few snippets of information to us, but not enough for me to come to any firm view.

Rummaging through old broker notes on Research Tree (forecasts were withdrawn a while ago), suggests that the core Rosenblatt business might be performing about in line with H1, where group revenues were £12m, and a profit of £1.45m was made. Given that H2 should have new revenues from LionFish and Convex, of £2.3m, then it looks as if the core business has roughly stood still. But profit could be higher, given that LionFish and Convex contributed little to H1. I haven't got any up-to-date forecasts, so cannot value this share.

I've looked back at the last reported balance sheet, and it's not great. NTAV is about £8.0m, but the problem with the litigation funding business, is that activity soaks up working capital on quite a large scale, which needs funding from somewhere. The total litigation financing book was £3.8m at 30 June 2020. So realising £1.1m is useful, but not game-changing.

Overall, I don't invest in legal services business, because of the conflict between fee earning partners, and equity holders. Also, I don't invest in litigation funding businesses, as profits & cashflows diverge too much. Look at all the kerfuffle there was with Burford Capital (LON:BUR) a few years ago.

So, this one is not for me. As you can see below, the share price has not performed well since it floated in 2018.

.

Restaurant (LON:RTN)

57.5p (up 5%) - mkt cap £336m

There's another announcement here, for bondholders.

Interim results for the 26 weeks ended 28 June 2020 (H1)

Decisive response to COVID-19 pandemic resulting in a higher quality, diversified estate; very encouraging trading since reopening

As at 20th September 2020, The Restaurant Group plc operated over 350 restaurants and pub restaurants throughout the UK. Its principal trading brands are Wagamama, Frankie & Benny's and Brunning & Price. It also operates a multi-brand Concessions business which trades principally in UK airports. In addition the Wagamama business has six restaurants in the US operating under a Joint Venture and over 50 franchise restaurants operating across a number of territories.

I wonder how much of that "very encouraging trading since reopening" is down to the Govt EOTHO scheme, a widespread success - although they're now saying it might have encouraged the spread of covid, but I haven't seen any figures to back up that assertion. With a (semi) reliable contract tracing app only having been launched in the last week or so by the NHS, do the authorities even know what's going on, let alone how to manage it? This epidemic has certainly highlighted how we're simply not geared up to manage unexpected crises. It's made me realise how limited the powers of Govt & civil service really are - it takes months to get any effective action going, and even then they don't have the resources to effectively police decisions. I suppose the same discussions & moans are going on in many other countries.

Current trading is more important than the historic figures, and looks impressive;

· Trading performance post-lockdown (for the 11 weeks from July 4th to 20th September 2020) with c.90% of the retained estate now open has been very encouraging:

- Wagamama: Like-for-like ("LFL") sales growth of 11%, outperformance of 5% versus the market

- Leisure: LFL sales growth of 4%, broadly in line with the market1, representing strongest trading performance in over five years

- Pubs: LFL sales growth of 14%, exceptional outperformance of 20% versus the market2

- Concessions: Disciplined reopening programme focused on EBITDA delivery. LFL sales decline of 58%3, 15% ahead of passenger volumes

I'd want to see more granularity of those figures - i.e. showing before, during, and after EOTHO scheme, which will undoubtedly have greatly improved the figures in August. What the underlying, sustainable level of trading is, we really don't yet know.

Leases - a key positive point here is that RTN did a CVA on its leisure business, which ditched a lot of problem, loss-making sites. That said, the remaining lease liabilities are still huge. Although of course that doesn't matter for sites which are trading profitably. It's only lease liabilities on loss-making sites which are a problem - something that IFRS 16 has failed to provide enough information about. Annoyingly, the CVA kicked in on the day after the H1 period end;

In the second half of 2020, there will be an exceptional credit of £117.5m relating to the extinguishing of the lease liabilities in the CVA, which was effective on the 29 June 2020 and so is a post-balance sheet event. Had this been reflected in H1, the net write down of fixed assets would have been c£21m

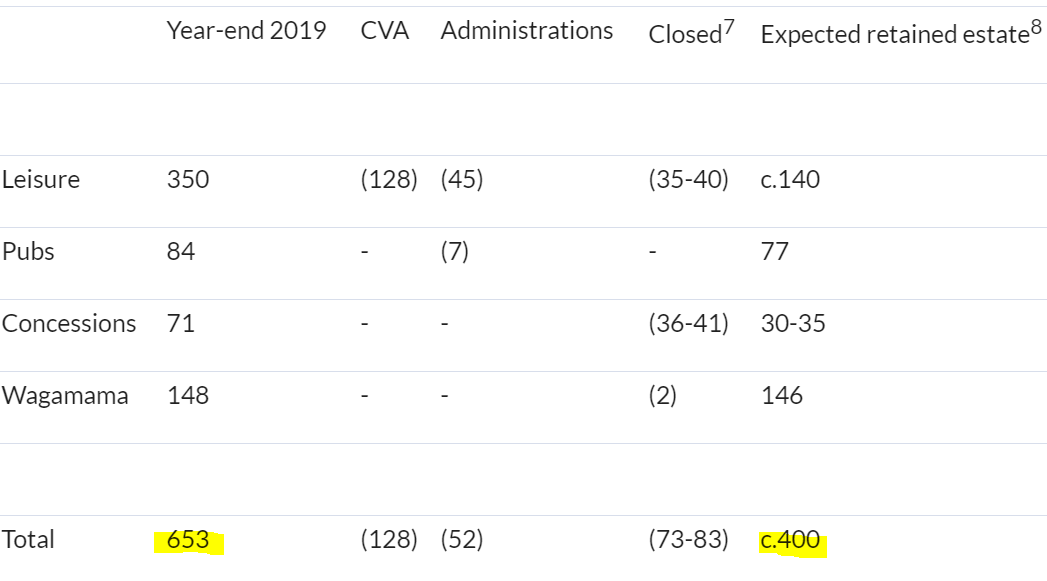

That still leaves behind a lot of leases, but the loss-making sites seem to have been weeded out through the CVA if leisure (the weak brands of Frankie & Benny's and Chiquito), and also note how the problem concessions (in airports, etc) have also been exited. There's a useful summary table below, showing how the group has reduced from 653 sites to c.400, and remember that the ones closed, are the loss-making sites, clearly a good thing to have got rid of those;

.

Balance sheet - is it financially stable?

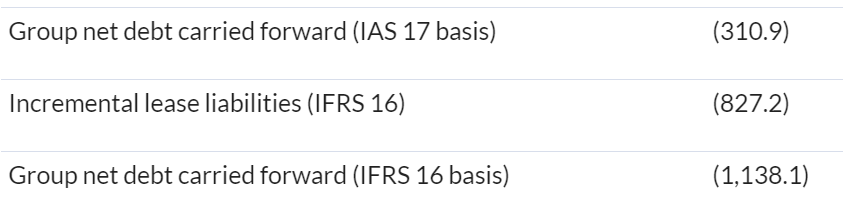

Net debt looks scary, even if we deduct the £117.5m lease liabilities which were extinguished the day after these figures in the CVA;

.

.

Outlook - this is very useful information in how to value the business post-covid;

For illustrative purposes only, the restructured Group as it stands today would be capable of delivering annualised EBITDA of between £110m to £125m (on an IAS 17 basis) if its retained estate9 were to achieve 2019 sales levels.

Back to the balance sheet - The £310.9m net debt, before lease liabilities, is 2.6x EBITDA (mid point of above range), which is quite high. Moreover, we need to remember that everything has changed now. In the new world, we now know that retail/hospitality/travel sectors, cannot rely on having reliable, predictable revenues. The unthinkable has happened - that they could be forced to shut down completely, for months at a time, due to a virus. Therefore, this means that it is no longer safe for companies in these sectors to operate with significant borrowings. Their business models were not safe after all, so they need to operate in future with cash, not debt. And/or, restructure their leases so that they don't have to pay rents if they're forced to close.

I would have considered £310.9m net debt too high, even if we hadn't had a pandemic. But after/during one, I find this an unacceptabl risky level of debt. That's a deal-breaker for me, so I think RTN shares are too risky, due to excessive debt.

NAV: £224.6m, less £601.7m intangibles, gives a very weak NTAV of negative £(377.1)m. Why does this matter? It means there's a high risk of RTN needing to do another equity fundraising, hence dilution to existing holders if they don't participate in the next fundraising. Also it means the ability of RTN to pay divis is very limited, even if the business is able to trade sustainably well in future. If covid gets worse again, then RTN is in a weak position to withstand another prolonged period of losses, were one to arise.

My opinion - the business should survive, because lenders don't want to pull the plug on fundamentally sound businesses like this. Hence covenants are usually waived, and being financially weak can be useful when negotiating with landlords. However, it's not comfortable owning the equity in a business like this, which is in a tough sector, and has a very weak balance sheet.

On the upside, I very much like the fact that RTN has already done a comprehensive restructuring, ditching the leases of loss-making sites through a CVA, and the jewel in its crown, Wagamama, seems to be an excellent business. Goodness knows why it's so popular, given that a packet of noodles only costs about 30p from Aldi or Lidl, yet Wagamama dress it up with some other ingredients and charge a bomb for it. Great business, and if customers didn't like it, they wouldn't come back, so maybe I should try the food again?! Thinking about it, by the time you've bought all the other ingredients like fresh ginger, soy sauce, spring onions, the meat, sesame oil, etc, you'd probably end up spending much the same, and have to throw out lots of left overs, or eat the same meal for several days.

Tricky one this. Let's summarise;

Bull points - It is a good, and restructured, business. It's trading well, with good LFL sales. Wagamama is a terrific brand, doing well. The rubbish brands have either closed of been scaled right down. Takeaway seems to be doing well.

Bear points - awful balance sheet, with far too much debt. Risk of further shutdowns re covid. Uncertainty over future demand, now EOTHO scheme has ended.

For me personally, the weak balance sheet rules it out. If the company did another equity fundraising to reduce debt to say 1x EBITDA or less, then I'd be interested in becoming a shareholder.

.

.

Smartspace Software (LON:SMRT)

84.5p (up 4%) - mkt cap £23.8m

This is an unusual situation, with the audited accounts for FY 01/2020 being published, on the same day as interim results for H1 to 07/2020. As there have been acquisitions & disposals, I'll only very briefly mention the FY 01/2020 numbers

- Revenue of £5.1m

- Loss after tax (because it includes a tax credit) of £1.9m

- Balance sheet - messy due to disposal pending, but ha positive NTAV of £7.3m

Moving on quickly to the more recent numbers;

SmartSpace Software plc, (AIM:SMRT) the leading provider of 'Integrated Space Management Software' for smart buildings and commercial spaces announces its unaudited interim results for the six months ended 31 July 2020.

Revenues in H1 of £2.3m (of which £1.05m is recurring) - still a tiny business.

Cash position of £1.14m at 31 July 2020, but grew substantially to £5.6m at 30 Sept 2020, once disposal proceeds received. Says that is sufficient for its growth plans, hence should not be any further dilution for shareholders - very good news, I do like a fully funded business model.

Loss-making still, at £(979)k loss after tax in H1

My opinion - I can't take this any further, as the valuation hinges on hopes for future growth, rather than historic numbers.

Reading through the commentary, the software being sold sounds very relevant to today's world, with various covid features for offices - managing visitors, meeting rooms, etc. As the company is so small, it is trying to sell through channel partners, including recently appointed SoftCat.

From the numbers, the main point is that it shouldn't need to raise any more equity for now, given that it has £5.6m in cash after the disposal.

It's up to readers to decide if you think the software the company sells is any good or not, I'm just checking out the numbers. There's not enough for me to go on, to form a view either way, because it's so small, and loss-making.

.

Vp (LON:VP.)

640p (down 1.5%) - mkt cap £257m

Vp plc, the equipment rental specialist, announces the following update on trading since the Annual General Meeting held on 23 July 2020.

Coincidentally, this sounds very similar to what Castings said above;

Group revenues have continued to improve, although the initial impact from the re-opening of existing sites has slowed and the business has become more reliant on new projects starting. Group revenues are now running at circa 85% of pre-Covid levels.

17 branches have been permanently closed, incurring (not quantified) exceptional costs.

Net debt is down, but note that we're not told how much is temporary measures such as stretching taxation creditors;

The Group has continued to demonstrate excellent cash management and net debt has reduced further to £118.7 million at 30 September 2020, which compares with £159.7 million at 31 March 2020, an improvement of £41.0 million. A sustained period of strong cost control, reduced capital expenditure and excellent working capital management has delivered this impressive net debt improvement.

Outlook comments - this is self-explanatory;

Markets are generally stable and infrastructure work, in particular, should be supportive as the likes of the AMP7, HS2 and Hinkley Point programmes start to gain momentum. We do however remain slightly cautious with regard to the short to medium term prospects as we await evidence of a recovery in confidence and the commencement of new projects. In addition we also remain conscious of the fact that the Covid pandemic is yet to be fully under control.

The longer term outlook for the Group remains positive and we are proactively identifying organic growth opportunities, focused particularly within those of our businesses already achieving pre-Covid levels of trading.

My opinion - I don't know how reliable broker forecasts are at the moment, as with so many companies.

So it's difficult to assess how we should be valuing the company, on a PER or dividend yield basis.

I'll review the interim figures when they come out later this year.

.

I'll leave it there for today, as am out of time/energy. See you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.